When it comes to investing, most people are familiar with common stocks—those shares you buy in companies like Apple or Tesla, hoping their value will rise over time. But there's another type of stock that often flies under the radar, yet offers a unique set of benefits: preferred stocks. If you're looking for a way to generate steady income while taking on less risk than common stocks, preferred stocks might just be the golden ticket you've been searching for.

So, what exactly are preferred stocks? Think of them as a hybrid between common stocks and bonds. Like common stocks, they represent ownership in a company, but they also come with features typically associated with bonds, such as fixed dividend payments. These dividends are usually higher than what you'd get from common stocks, and they're paid out before any dividends are distributed to common shareholders. This means that if a company faces financial difficulties, preferred stockholders are higher up the pecking order when it comes to getting paid.

But that's not all. Preferred stocks often come with a fixed dividend rate, which means you can count on a predictable income stream. For traders who crave stability—especially those nearing retirement or looking to balance out a riskier portfolio—this can be a huge advantage. Of course, like any investment, preferred stocks aren't without their risks, but we'll get to that later. For now, let's look at some of the top preferred stocks to consider in 2025.

But that's not all. Preferred stocks often come with a fixed dividend rate, which means you can count on a predictable income stream. For traders who crave stability—especially those nearing retirement or looking to balance out a riskier portfolio—this can be a huge advantage. Of course, like any investment, preferred stocks aren't without their risks, but we'll get to that later. For now, let's look at some of the top preferred stocks to consider in 2025.

Discover the Top Preferred Stocks to Watch in 2025

For those seeking a steady income, preferred stocks are often attractive due to their high dividend yields. Let's take a look at some of the best options for 2025. particularly those offering impressive returns.

Aflac Incorporated (AFL) Aflac, the well-known insurance company, has long been a favourite among dividend traders. Its preferred stocks offer a reliable income, backed by the financial stability of a major insurance player. Aflac's long history of dividend payments makes it a solid choice for anyone looking to add a preferred stock with a dependable yield to their portfolio.

Bank of America (BAC) As one of the largest financial institutions in the world, Bank of America's preferred stocks are another great pick for those seeking high yields. The bank's strong position in the financial sector, along with its long-standing track record, means its preferred stockholders are in a solid position to earn regular payouts. Bank of America preferred stocks are often seen as a safe bet in the world of preferred equity.

Realty Income Corporation (O) Known as "The Monthly Dividend Company," Realty Income Corporation focuses on providing stable and predictable monthly dividends. While it's primarily a real estate investment trust (REIT), its preferred stock offerings are some of the most attractive on the market, with high dividend yields and potential for growth.

Ford Motor Company (F) While Ford may not be a name you immediately associate with preferred stocks, the automotive giant offers some excellent options. Ford's preferred stocks are backed by the stability of a long-established company with a global presence, making them a solid choice for those looking for both yield and stability.

Preferred Shares from Utility Companies (e.g., Duke Energy) Utility companies like Duke Energy, which provide essential services, often offer preferred stocks that come with solid dividend yields and lower volatility compared to stocks in other sectors. Due to the essential nature of their business, these companies tend to be more resilient, making their preferred shares secure option.

Best Sectors for Preferred Stocks: Finance, Utilities, and More

When it comes to preferred stocks, certain sectors tend to be more reliable than others. Here's a look at a few key industries that are often preferred by traders looking for stable, income-producing assets:

Finance: Banks and financial institutions offer a broad range of preferred stocks. These are often attractive because of the stability and reliability of established companies in the financial sector, along with their relatively high dividend yields.

Utilities: Utility companies provide essential services like water, electricity, and gas. Because people rely on these services regardless of economic conditions, utility companies are generally considered low-risk option. Their preferred stocks tend to offer stable, predictable dividends, which can be an appealing feature for cautious invetors.

Real Estate Investment Trusts (REITs): REITs, which own and operate income-generating properties, are another popular choice for preferred stock traders. Many REITs offer high dividends, and their performance is often tied to the real estate market, which can be relatively stable over the long term.

Energy: Companies in the energy sector, particularly those involved in oil and gas, often offer preferred stocks as a way to raise capital. While these stocks can be subject to fluctuations in commodity prices, energy companies with established track records can provide steady dividends.

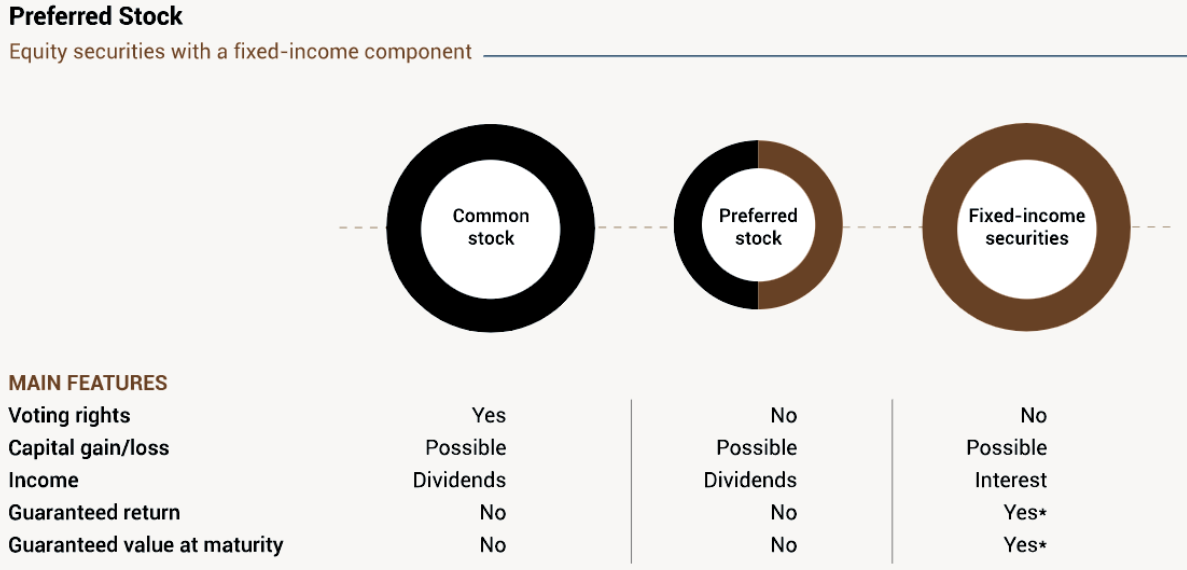

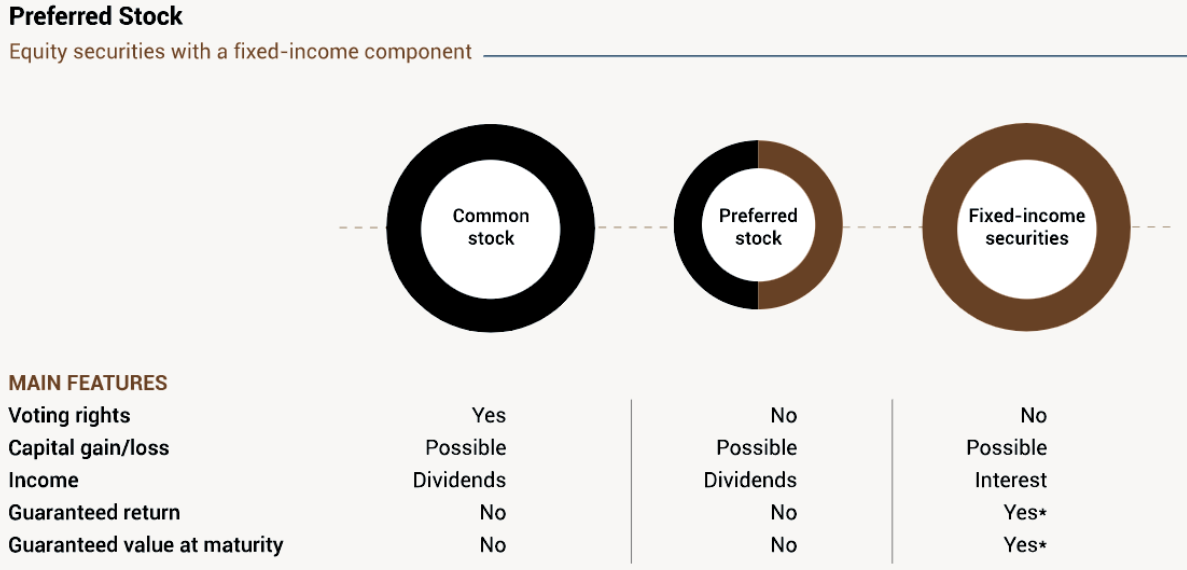

Comparing Preferred Stocks to Common Stocks and Bonds

While the preferred stocks mentioned above are all strong options, it's crucial to understand how they fit into a broader investment strategy. Comparing preferred stocks to common stocks and bonds can help you decide where they might fit in your portfolio and how they align with your financial goals.

Preferred Stocks vs. Common Stocks

Common stocks represent ownership in a company and usually come with voting rights. Shareholders of common stock are entitled to any dividends the company pays, but these dividends are not guaranteed and depend on the company's performance. If the company performs poorly, common stockholders may see little to no dividend payments, and in the worst case, the stock's value can plummet.

In contrast, preferred stocks do not offer voting rights, but they provide a fixed dividend that is paid before dividends for common stockholders. This makes preferred stocks less risky for those seeking consistent income, as the dividend payments are more predictable.

However, preferred stocks typically don't offer the same growth potential as common stocks. If a company performs well, common stockholders are likely to see greater returns as the company's value rises, while preferred stockholders generally do not benefit from price appreciation to the same extent.

Preferred Stocks vs. Bonds

Preferred stocks are often compared to bonds because both provide fixed income through regular payments. However, there are key differences. Bonds are debt instruments issued by companies or governments, and bondholders are creditors, meaning they have priority over stockholders in the event of bankruptcy. Bonds also have a maturity date, at which point the principal is returned to the trader, while preferred stocks do not have a set maturity date.

On the downside, preferred stockholders are not creditors but equity holders, meaning they are paid only after debt obligations (bonds) are met. The advantage, however, is that preferred stocks often offer higher yields than bonds because they carry more risk. Furthermore, preferred stocks don't have a maturity date, meaning they can provide an ongoing income stream as long as the company remains financially stable.

Ultimately, while bonds offer more security in terms of priority in liquidation and fixed maturity, preferred stocks can provide higher returns, making them an attractive option for income-focused traders willing to take on a bit more risk.

Preferred Stock vs Common Stocks vs Bonds

| Aspects |

Preferred Stocks |

Common Stocks |

Bonds |

| Ownership Type |

Equity (no voting rights) |

Equity (voting rights) |

Debt (creditor relationship) |

| Dividend Payments |

Fixed, priority over common stocks |

Variable, based on company performance |

Fixed interest payments |

| Priority in Liquidation |

Paid after debt, before common stockholders |

Paid after preferred stockholders |

Highest priority, paid before stocks |

| Growth Potential |

Limited price appreciation |

High potential for price growth |

No growth, fixed principal and interest |

| Maturity Date |

No maturity date |

No maturity date |

Fixed maturity date |

| Risk Level |

Moderate risk |

High risk |

Low risk |

| Income Stability |

High, regular dividends |

Variable, no guaranteed dividends |

High, regular interest payments |

| Tax Treatment |

Taxed as dividend income |

Taxed as dividend income |

Taxed as interest income |

Final Thoughts

Preferred stocks can be an excellent addition to your investment portfolio, especially if you're looking for reliable income with less volatility than common stocks. By understanding what preferred stocks are, evaluating top performers for 2025. and keeping in mind key factors like dividend yield, issuer credit rating, and sector performance, you can make more informed decisions. As with any investment, it's essential to carefully assess your risk tolerance and investment goals before diving in.

Whether you're new to investing or an experienced trader looking for steady returns, preferred stocks have something to offer—if you choose wisely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

But that's not all. Preferred stocks often come with a fixed dividend rate, which means you can count on a predictable income stream. For traders who crave stability—especially those nearing retirement or looking to balance out a riskier portfolio—this can be a huge advantage. Of course, like any investment, preferred stocks aren't without their risks, but we'll get to that later. For now, let's look at some of the top preferred stocks to consider in 2025.

But that's not all. Preferred stocks often come with a fixed dividend rate, which means you can count on a predictable income stream. For traders who crave stability—especially those nearing retirement or looking to balance out a riskier portfolio—this can be a huge advantage. Of course, like any investment, preferred stocks aren't without their risks, but we'll get to that later. For now, let's look at some of the top preferred stocks to consider in 2025.