The world of finance is changing at breakneck speed, and at the heart of this transformation is fintech—short for financial technology. Fintech stocks have become a hot topic among traders, and for good reason. These companies are reshaping how we bank, pay, borrow, and even invest, making them some of the most exciting players in the stock market today. But what exactly are fintech stocks, and why are they generating so much buzz?

What Are Fintech Stocks

At its core, fintech is about using technology to enhance the financial services industry. This includes anything from digital wallets and mobile banking apps to complex software that helps banks make lending decisions. When it comes to investing, fintech stocks are shares of companies that provide or develop these kinds of technological solutions for the financial sector.

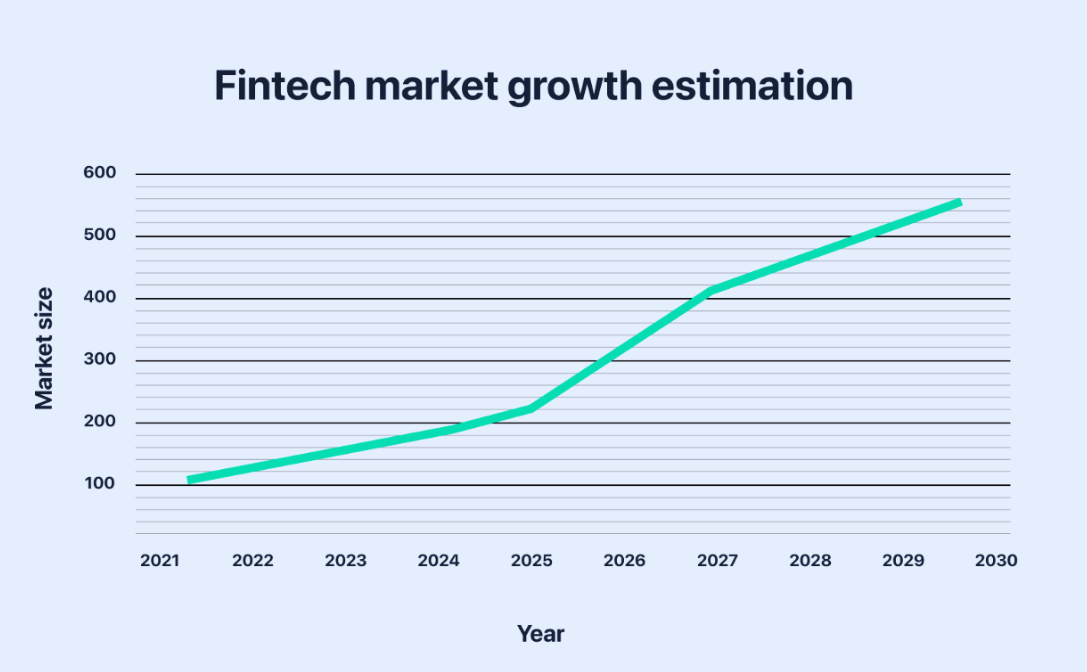

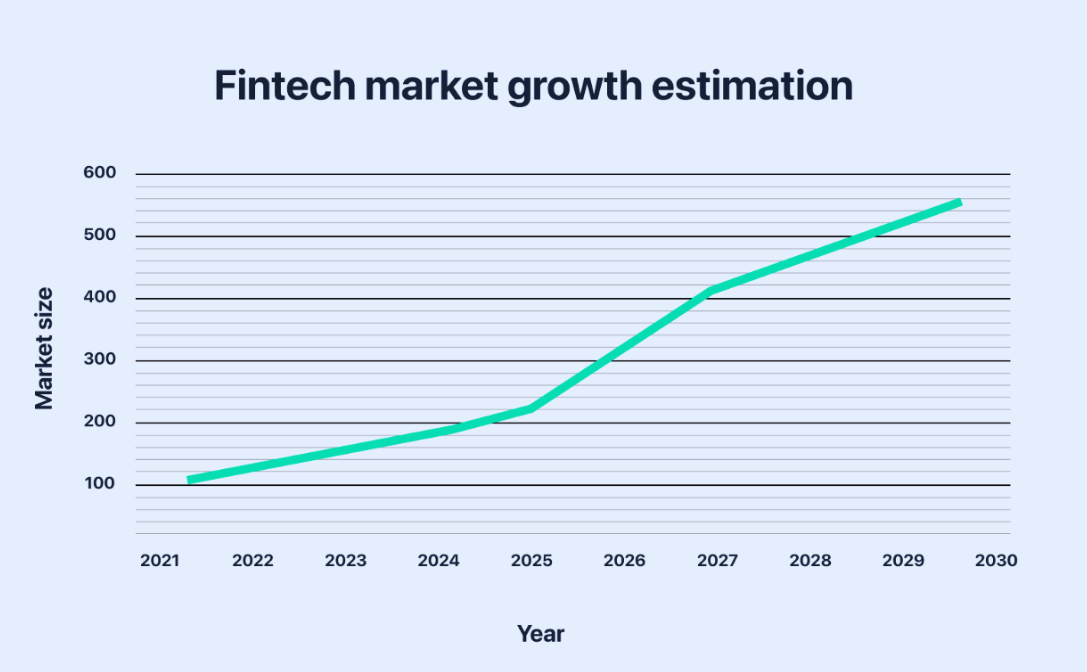

The fintech industry has experienced rapid growth over the past decade. As consumers and businesses increasingly demand faster, more secure, and more convenient financial services, companies in this space have been quick to deliver. The rise of smartphones and the global trend towards digitalisation have further fuelled this growth, and there are now fintech companies in nearly every part of the world offering services that once required traditional banking institutions.

For traders, fintech stocks represent an exciting opportunity. The reason for this is twofold: first, many fintech companies have been growing at an impressive pace, generating huge returns for early traders. Second, the potential for further innovation and disruption is still enormous. With advancements in artificial intelligence, blockchain, and even digital currencies, fintech could be set to redefine how we think about money and banking.

Top Fintech Stocks to Watch in 2025

If you're considering investing in fintech stocks, you'll want to know which companies are leading the way. Let's take a look at some of the top fintech players you should keep an eye on in 2025.

PayPal, as one of the pioneers in online payments, has long been a household name in the world of digital payments. Its platform continues to evolve, adding new features like buy-now-pay-later services and cryptocurrency trading. Despite facing increased competition, PayPal's strong user base and solid revenue growth make it a top contender in the fintech space.

Square, now known as Block, is another heavyweight in fintech. Its point-of-sale systems and business solutions have made it a favourite among small to medium-sized enterprises (SMEs). The company has expanded its portfolio with its blockchain-based payment solutions and a growing interest in cryptocurrency, which could provide big upside in the coming years.

Adyen, a Dutch payment company, is a global player offering businesses a seamless way to accept payments across different platforms and channels. Its strong international presence and ability to scale have made it one of the go-to choices for e-commerce giants and large-scale retailers. With increasing demand for multi-currency, cross-border payments, Adyen is well-positioned for growth.

But it's not just the established names that are worth watching. Emerging fintech companies are also catching the attention of traders. Companies like Revolut, Stripe, and Plaid are changing the landscape of digital banking and payments with innovative solutions that address specific niches within the financial sector. As more consumers and businesses shift towards these services, these companies have the potential to see explosive growth.

The performance of these stocks is often driven by several factors. Strong revenue growth, increasing user adoption, and market expansion are key metrics traders typically look at. However, fintech stocks are also heavily influenced by broader economic conditions, technological advancements, and regulatory changes, which can create significant price fluctuations in the short term.

Key Trends Shaping the Fintech Industry

To understand where fintech stocks are headed, it's crucial to know which trends are shaping the industry. These trends not only give insight into how fintech companies are evolving but also help traders predict where the next big opportunities lie.

Digital Payments & Mobile Banking: Perhaps the most significant trend is the rapid shift towards digital payments. With the rise of mobile apps and contactless payments, traditional payment methods such as cash and cheques are becoming less common. Mobile banking apps are also growing in popularity, allowing customers to conduct a range of financial activities from their phones, such as transferring funds, paying bills, and managing investments.

Blockchain, Cryptocurrency & DeFi: Blockchain technology underpins cryptocurrencies like Bitcoin and Ethereum, but its potential stretches far beyond just digital currency. Blockchain's decentralised nature makes it an attractive solution for creating transparent, secure, and tamper-proof financial systems. As cryptocurrency and decentralised finance (DeFi) continue to evolve, many fintech companies are integrating blockchain to offer more efficient and secure financial services.

Artificial Intelligence (AI) & Machine Learning: AI is another key area that's transforming the fintech landscape. From automated investment advice (robo-advisors) to credit scoring algorithms, AI is helping fintech companies optimise everything from customer service to fraud detection. The increasing sophistication of machine learning algorithms is also allowing companies to personalise their offerings, making them more tailored and appealing to individual customers.

These trends are not only revolutionising how consumers interact with their money but also creating massive opportunities for fintech companies. As these technologies mature, we can expect them to become even more integrated into financial services, driving further demand for fintech solutions.

Final Thoughts

Fintech stocks are at the forefront of financial innovation, offering exciting opportunities for traders. As digital payments, blockchain, and AI continue to transform the industry, the potential for growth remains strong. However, with rapid change comes risks—from regulatory challenges to market competition. Success in this space requires careful research, a focus on long-term trends, and an understanding of the evolving financial landscape. For those willing to navigate the risks, fintech stocks could be a rewarding addition to their investment portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.