Palladium and gold are both precious metals with unique properties and investment considerations. While gold has long been a cornerstone of wealth preservation, palladium has gained attention for its industrial applications and market dynamics.

This article explores the characteristics, uses, and investment aspects of both metals to provide a comprehensive comparison and future price projections.

What Is Palladium and Its Uses

Palladium is a rare, silvery-white metal belonging to the platinum group metals (PGMs). Discovered in 1803 by William Hyde Wollaston, it is known for its exceptional catalytic properties, corrosion resistance, and ability to absorb hydrogen. These attributes make it valuable in various industrial applications.

Key Properties:

Catalytic Efficiency: Palladium is widely used in catalytic converters to reduce harmful vehicle emissions.

Hydrogen Absorption: Its capacity to absorb hydrogen makes it useful in hydrogen purification and storage technologies.

Corrosion Resistance: Palladium resists tarnishing and corrosion, maintaining its lustre over time.

Electrical Conductivity: Its excellent conductivity is beneficial in electronic components.

Uses of Palladium

Automotive Industry: Primarily used in catalytic converters to convert harmful gases into less toxic substances.

Electronics: Utilised in multilayer ceramic capacitors and connectors due to its conductivity.

Jewellery: Valued for its natural white colour and hypoallergenic properties, it is a popular choice for fine jewellery.

Dentistry: Employed in dental alloys for crowns and bridges.

Hydrogen Storage: Used in fuel cells and hydrogen purification systems.

What Is Gold and Its Uses

Gold is a dense, yellow metal treasured for its beauty and rarity for thousands of years. It is highly malleable, corrosion-resistant, and an excellent conductor of electricity.

Key Properties:

Malleability: Gold can be hammered into thin sheets without breaking.

Corrosion Resistance: It does not tarnish or corrode, maintaining its appearance over time.

Electrical Conductivity: Gold's conductivity makes it valuable in electronic applications.

Biocompatibility: Its inert nature allows for safe use in medical implants and dentistry.

Uses of Gold

Jewellery: A primary use, accounting for a significant portion of global demand.

Investment: Held in the form of coins, bars, and ETFs as a store of value.

Electronics: Used in connectors, switches, and other components due to its conductivity.

Dentistry and Medicine: Applied in dental restorations and specific medical treatments.

Aerospace: Utilised satellite components and connectors for their reliability.

Comparing Palladium and Gold

While both are precious metals, palladium and gold differ in several aspects:

1. Abundance and Availability:

Gold: More abundant and mined in huge quantities globally.

Palladium: Rarer, with significant production concentrated in Russia and South Africa. In terms of rarity, palladium is 30 times rarer than gold.

2. Market Size:

Gold: The gold market is significantly larger, valued at approximately $5 trillion, compared to the palladium market's $16 billion

Palladium: A smaller market primarily driven by industrial demand.

3. Price Volatility:

Gold: Generally exhibits lower volatility, making it a stable investment.

Palladium: More volatile due to its industrial demand and supply constraints.

4. Investment Demand:

Gold: Sought after for investment purposes, including ETFs and bullion.

Palladium: Less common in investment portfolios, with limited availability in investment-grade forms.

5. Industrial Demand:

Gold: Used in electronics and dentistry but to a lesser extent.

Palladium: High industrial demand, especially in the automotive sector.

Current Market Trends and Future Forecast

As of April 2025, gold has seen significant gains. For context, gold prices have surged to a record high of $3,506 per ounce, marking a 28% year-to-date increase.

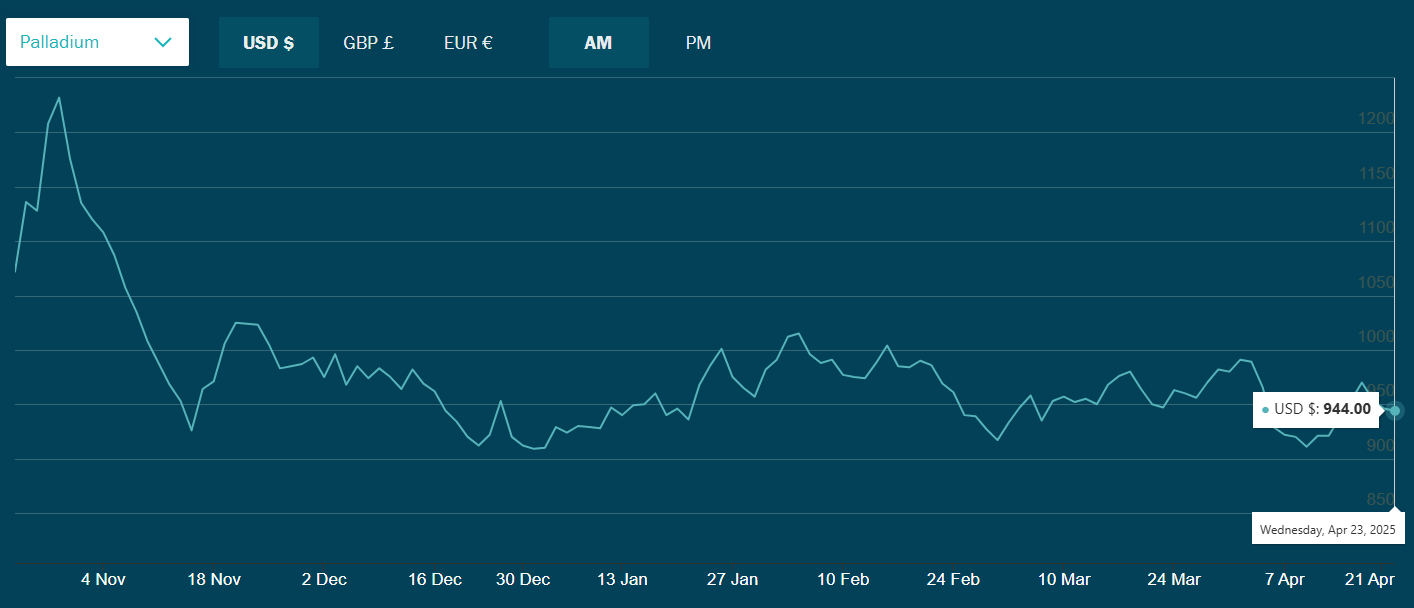

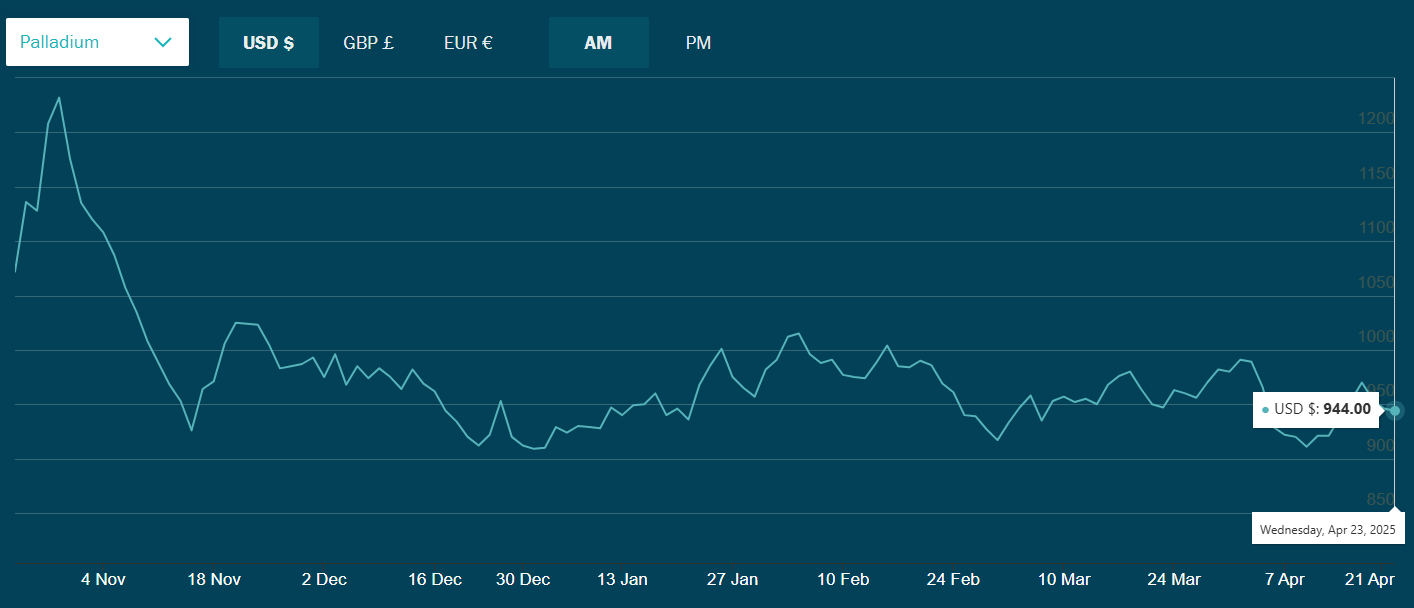

On the other hand, palladium is trading at approximately $923 per ounce, a significant decline from its 2022 peak of $3,002 per ounce. However, year-to-date, the metal has experienced a modest 10.46% increase but remains substantially below historical highs.

Gold Price Projections Beyond 2025:

2026: Goldman Sachs and Citi Research suggest gold could stabilise between $3,600 and $4,000 per ounce, assuming inflation moderates slightly but remains above target.

2027–2028: If economic instability escalates, gold could approach $4,500 per ounce. Aggressive central bank stimulus or currency debasement could even push gold to $5,000.

2030 and Beyond: Under a high-inflation, low-growth (stagflation) environment, gold could climb past $5,500 per ounce. In a more balanced economy with normalised inflation, prices may hover around $4,000, sustained by steady investment and central bank accumulation.

Palladium Price Forecast Beyond 2025:

2026: Mixed analysts. JPMorgan projects palladium stabilising around $1,100 to $1,250 per ounce as ICE vehicle sales slow. Trading Economics forecasts a dip to $950 if EV sales dominate.

2027–2028: Palladium may experience more volatility. If hybrid vehicle demand remains strong, prices could rebound to $1,400. However, in a fully electrified automotive market, prices might retreat to the $800–$1,000 range.

2030 and Beyond: By 2030, many developed nations aim to phase out ICE vehicles. It could place significant downward pressure on palladium unless demand from new industries emerges. Base case projections show prices between $700 and $1,000. In bullish cases — such as a hydrogen fuel cell boom or major supply disruptions —palladium could climb back to $1,500+.

Investment Considerations

Investors should weigh the following when considering palladium and gold:

Gold:

Pros: Stability, liquidity, and long-term value retention.

Cons: Lower potential for rapid price appreciation.

Palladium:

Conclusion

In conclusion, gold and palladium offer compelling but very different long-term investment narratives. Gold remains a time-tested safe haven, likely to continue appreciating steadily in response to inflation, geopolitical instability, and monetary policy shifts. Palladium, by contrast, faces an uncertain road as its primary demand source declines.

However, innovation in hydrogen and electronics and unpredictable supply dynamics may create new opportunities for palladium investors.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.