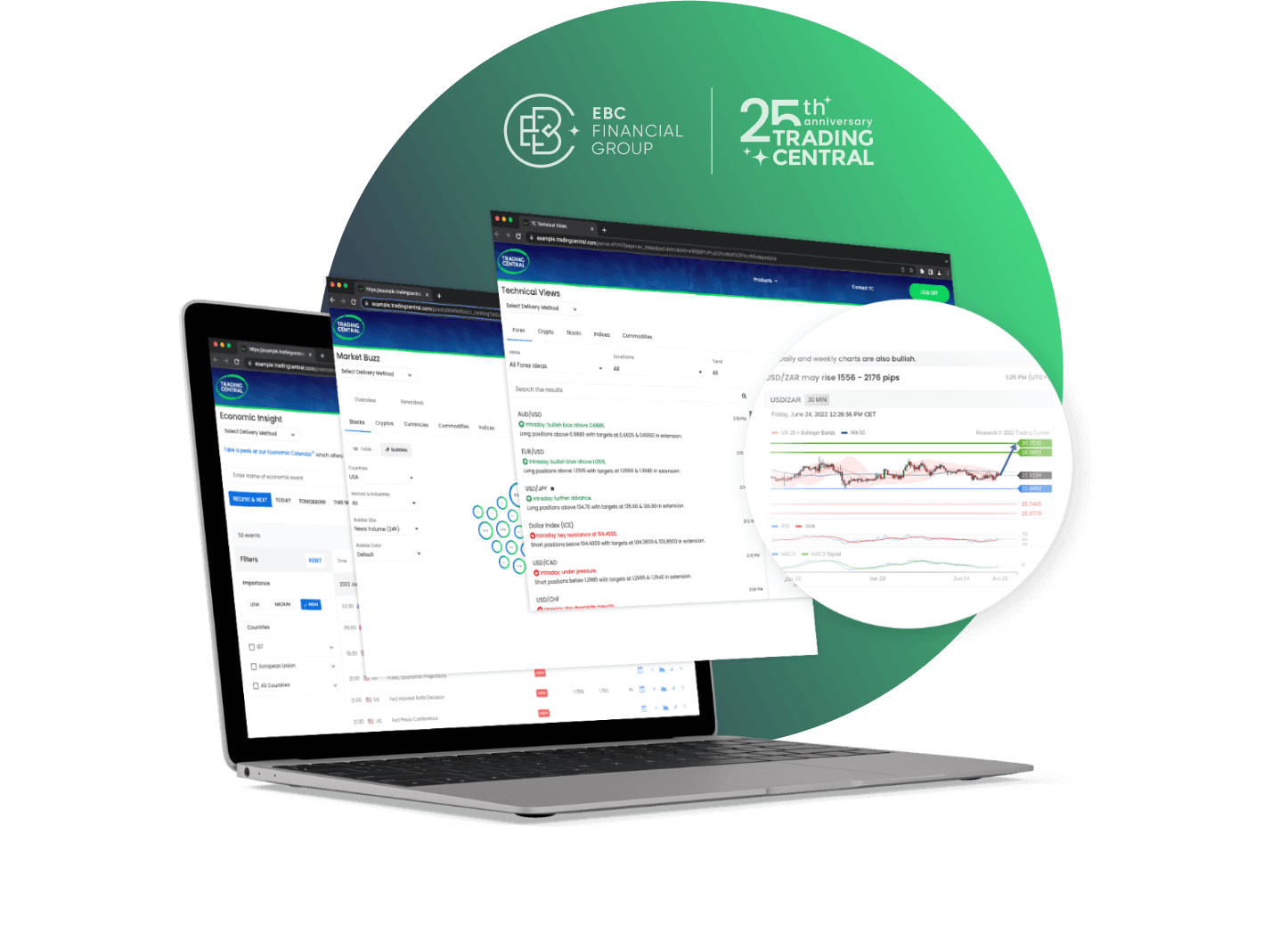

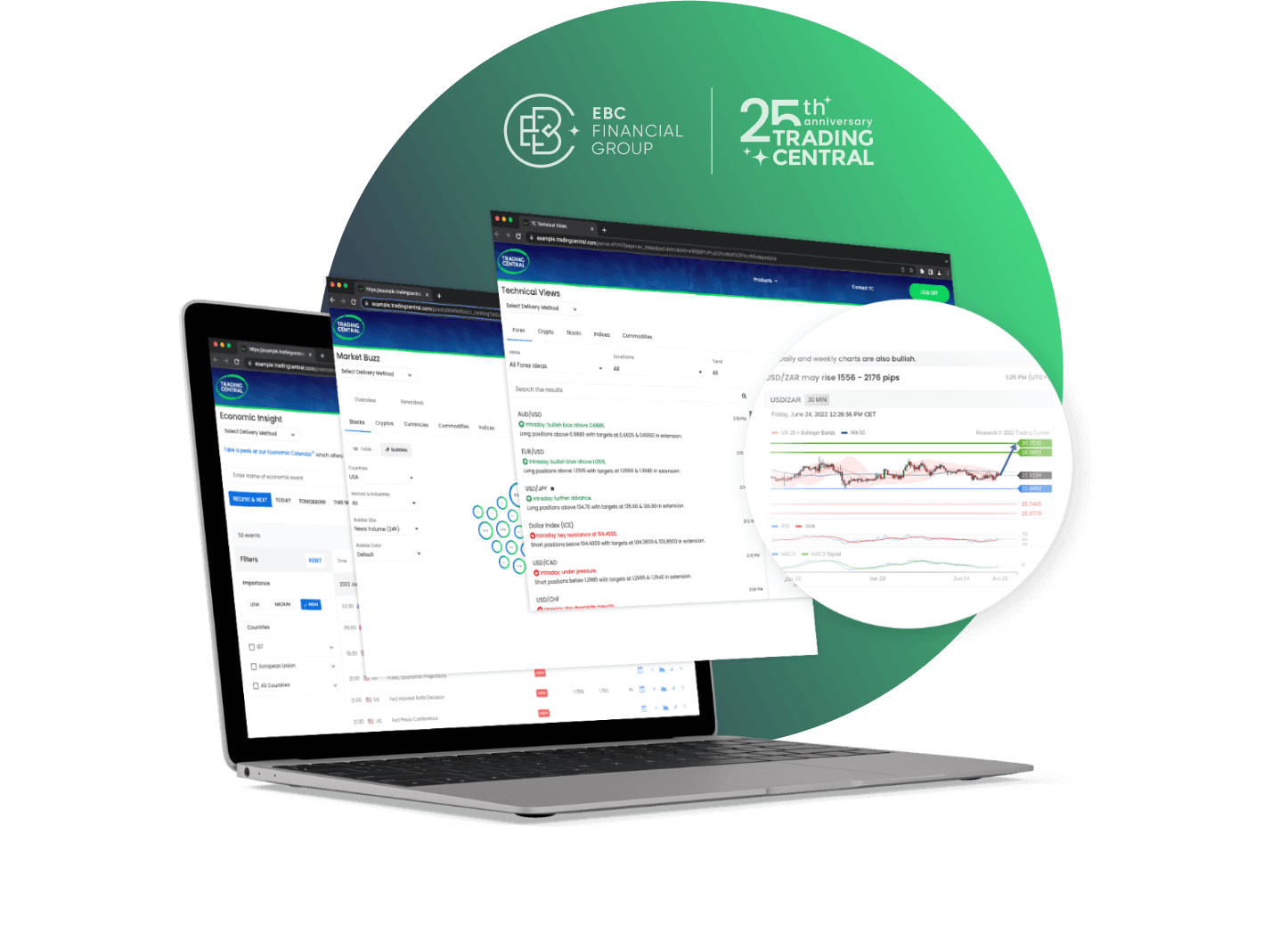

Market Analysis

Technical Insights:

Provide preferred directions and target levels for each charts based on technical analysis result.

Adaptive K-line Charts

Support 16 decision-related K-line patterns.

Adaptive Divergence Convergence (ADC) Indicator:

Includes long/short entry and exit signals, fast/slow price indicators, initial/smoothed signal lines, and fast/slow oscillators.

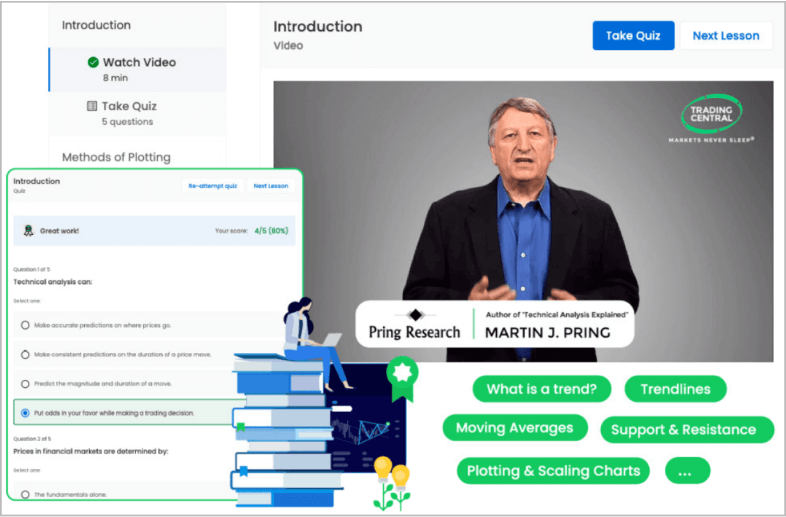

Flexible Learning Mode:

Schedule your learning at your own pace with a wealth of content and tools to easily master investment techniques.

Broad Content Coverage:

From beginner to advanced levels, comprehensive course content caters to users of various skill levels, systematically improving investment skills.

Interactive Learning Experience

Features tools like a glossary and self assessments to help you track your progress, deepen your understanding, and improve retention.