OpenAI has become one of the most talked-about names in artificial intelligence, powering innovations like ChatGPT, DALL-E, and Sora. As interest in AI surges, many investors are asking: is OpenAI on the stock market, and if not, how can you gain exposure to its rapid growth?

In this article, we explain OpenAI's current status, discuss IPO prospects, and highlight practical alternatives for those looking to invest in the AI revolution.

Is OpenAI on the Stock Market in 2025?

As of April 2025, OpenAI is not listed on any public stock exchange. The company remains privately held and has not announced an official initial public offering (IPO) date. Despite persistent speculation and recent structural changes that could pave the way for a future listing, there is no direct way for retail investors to buy OpenAI shares through traditional brokerage accounts or trading platforms.

OpenAI operates under a unique "capped-profit" model, balancing its mission to benefit humanity with the need to attract investment. While this structure has enabled it to secure billions in funding from strategic partners, it also means public shares are not yet available.

Why Isn't OpenAI Public?

Several factors explain why OpenAI remains private:

Mission and Structure: OpenAI's structure as a public benefit corporation with a capped-profit subsidiary allows it to focus on long-term research and societal impact, not just short-term shareholder returns.

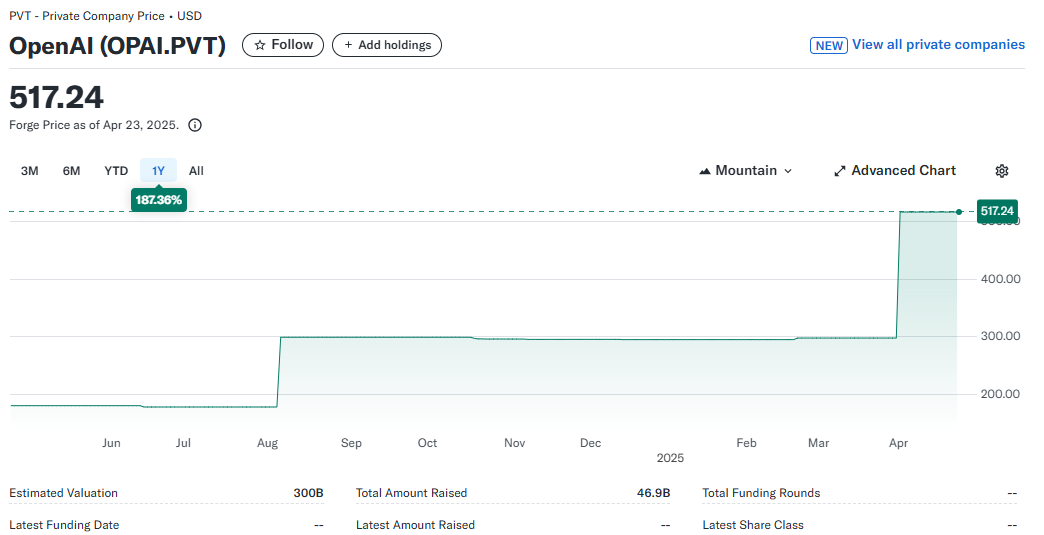

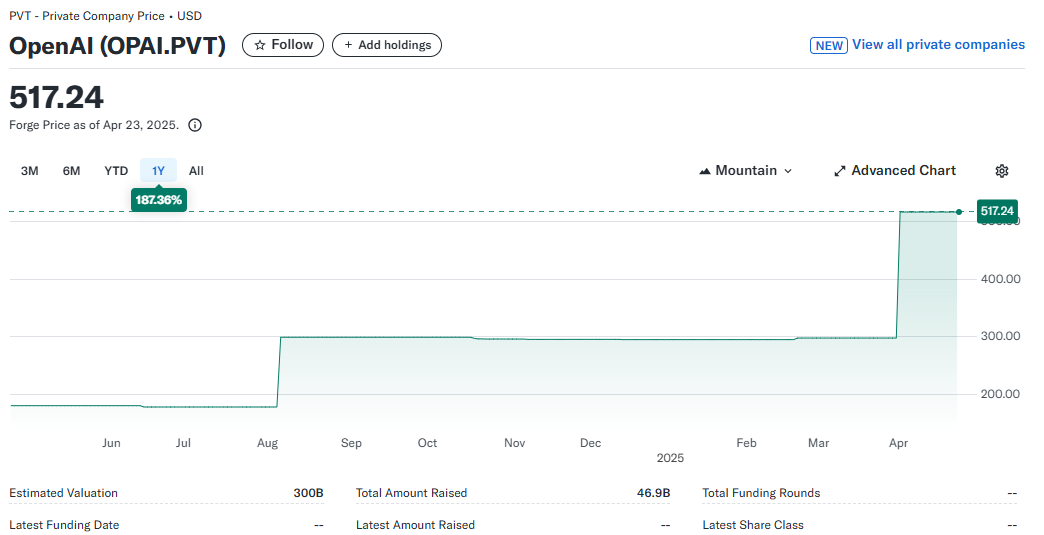

Private Funding Success: The company has raised significant capital privately, including a $40 billion round in early 2025, pushing its valuation to $300 billion—one of the largest in tech history.

Strategic Partnerships: OpenAI's deep relationship with Microsoft, which has invested over $13 billion and provides critical cloud infrastructure, reduces the immediate need for public capital.

Regulatory and Market Timing: The evolving regulatory landscape for AI and volatile market conditions may influence the timing of any potential IPO.

Can You Buy OpenAI Stock Now?

For the vast majority of investors, the answer is no. OpenAI shares are not available on public exchanges such as NASDAQ or NYSE. Only accredited and institutional investors may access OpenAI equity through private funding rounds, special purpose vehicles, or pre-IPO marketplaces. Even then, these transactions are subject to OpenAI's approval and regulatory restrictions, and liquidity is limited.

If you're not an accredited investor, you will need to wait for a potential IPO or seek alternative ways to gain exposure to the AI sector.

How to Gain Exposure to OpenAI's Growth

While you can't buy OpenAI stock directly, there are several alternative ways to gain exposure to its success and the broader AI industry:

1. Invest in OpenAI's Strategic Partners

Microsoft (MSFT):

Microsoft is OpenAI's largest investor and technology partner, integrating OpenAIs models into its Azure cloud platform, Microsoft 365, and other products. By investing in Microsoft shares, you gain indirect exposure to OpenAIs growth and the wider adoption of generative AI.

Other Partners:

Companies like SoftBank, Oracle, and NVIDIA are also involved in major AI infrastructure projects with OpenAI, such as the $500 billion Stargate initiative. These firms are publicly traded and offer additional avenues for AI investment.

2. Consider AI-Focused ETFs and Funds

Several exchange-traded funds (ETFs) and mutual funds focus on artificial intelligence and technology, holding shares in companies leading the AI revolution. Examples include the Global X Robotics & Artificial Intelligence ETF and the iShares Robotics and Artificial Intelligence Multisector ETF. While these funds do not hold OpenAI stock directly, they provide diversified exposure to the sector.

3. Monitor Pre-IPO Marketplaces (For Accredited Investors)

If you are an accredited investor, you may find opportunities to purchase OpenAI shares on private marketplaces such as Hiive, Forge Global, or EquityZen. However, these investments are illiquid, complex, and carry additional risks. Most retail investors will find these routes inaccessible.

4. Follow Industry Competitors

OpenAI is not the only player in AI. Publicly traded companies like Alphabet (Google), Amazon, Meta Platforms, and other tech giants are developing their own AI models and platforms. Investing in these firms can provide exposure to the competitive landscape and ongoing innovation in artificial intelligence.

Will OpenAI Go Public Soon?

There is ongoing speculation about an OpenAI IPO, especially after the company's transition to a Delaware Public Benefit Corporation in January 2024. Reports suggest an IPO could happen within the next two years, but as of April 2025, there are no confirmed plans or timelines.

If OpenAI does go public, investors can expect significant interest and potentially high volatility, given the company's $300 billion valuation and its central role in the AI sector. Until then, investors should monitor news from OpenAI and its partners for any updates on a public listing.

Key Takeaways

OpenAI is not on the stock market in 2025; direct investment is unavailable to the public.

Indirect exposure is possible by investing in Microsoft and other strategic partners, or through AI-focused ETFs.

Accredited investors may access OpenAI shares via private marketplaces, but these are high-risk and illiquid.

An IPO is possible in the coming years, but no official date or details have been announced.

Conclusion

While OpenAI is not yet available on public markets, its influence on the AI industry is undeniable. Investors interested in the company's growth can look to its partners and the broader AI sector for opportunities.

As the landscape evolves, staying informed and considering alternative routes to AI exposure will be key for forward-thinking investors.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.