What is a Hammer Candlestick Pattern?

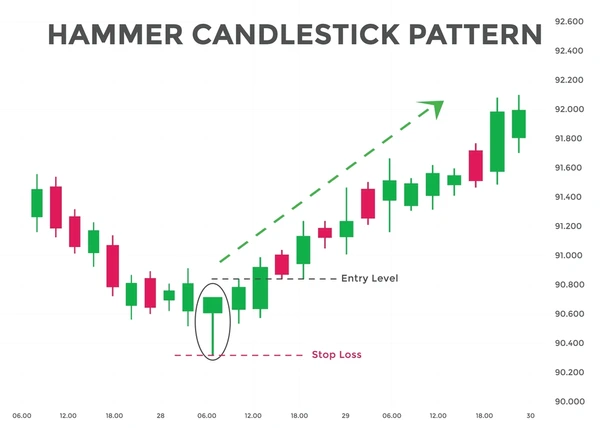

A hammer candlestick pattern is a technical trading pattern that resembles a "T". In this pattern, the price trend of a security falls below its opening price, illustrating a long lower shadow, and then reverses and closes near its opening.

The hammer candlestick is a bullish reversal pattern that signals a possible end to a downtrend and the start of an upward trend.

The hammer candlestick formation is characterized by a small body and a long lower wick, indicating a market session marked by recovery from a steep decline.

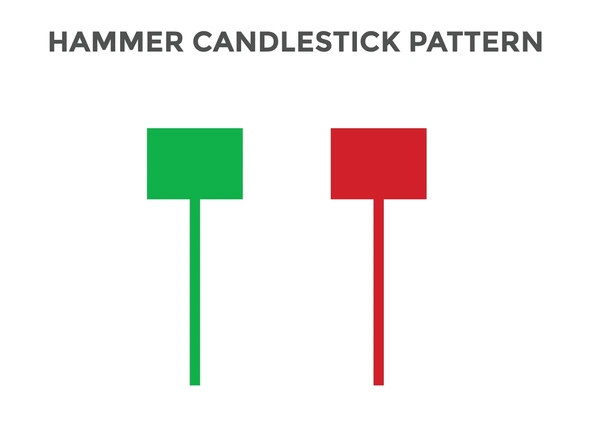

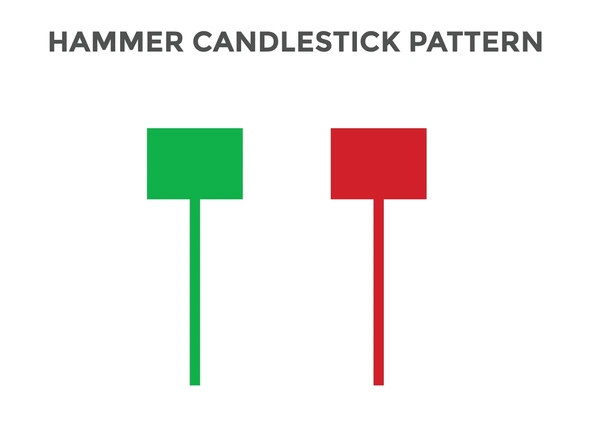

Types of Hammer Candlesticks

Bullish Hammer

A bullish hammer candlestick is a hammer candlestick pattern that occurs during a downtrend and signals a potential bullish reversal. It is considered a powerful reversal signal, indicating that buyers have emerged to bid up prices from the lows. The bullish hammer pattern is often seen as a sign of a potential shift from bearish to bullish momentum.

Bearish Hammer

A bearish hammer, also known as a hanging man, is a hammer candlestick pattern that occurs during an uptrend and signals a potential bearish reversal. Recognizing different variations of hammer candlesticks, such as bearish hammers, is crucial for traders to understand market behavior and make informed decisions.

It is considered a weaker reversal signal compared to the bullish hammer, but still indicates a potential shift from bullish to bearish momentum.

How to Identify a Hammer Candlestick

A hammer candlestick pattern occurs when the market initially drops but recovers to close near the opening price, suggesting buyers have regained control following intense selling. This pattern can be identified by its distinctive shape, with a small body and a long lower wick. The hammer's elongated lower shadow narrates a tug-of-war where sellers push prices down, only for buyers to drive a comeback, ending the session near its commencement.

The Psychology of the Hammer Pattern

The hammer candle is a visual representation of a market's psychology, indicating a shift in sentiment from bearish to bullish. The pattern suggests that buyers have regained control of the market, pushing prices higher despite initial selling pressure.

The hammer pattern can be seen as a sign of a potential trend reversal, as buyers begin to take control of the market.

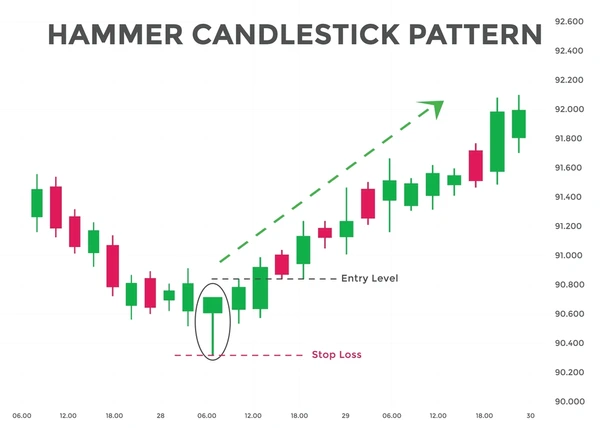

Trading with Hammer Candlesticks

The Hammer Signal

The hammer candles are a bullish reversal signal that occurs when a hammer candlestick pattern is formed during a downtrend.

Traders can use the hammer signal to enter long positions, as it indicates a potential shift from bearish to bullish momentum.

The hammer signal can be used in conjunction with other technical indicators to confirm the reversal.

Risk Management

Risk management is crucial when trading with hammer candlesticks, as the pattern is not foolproof.

Traders should set stop-losses below the hammer's low and target at least a 2:1 reward/risk ratio.

Traders should also consider using other technical indicators to confirm the reversal and manage risk.

Limitations and Considerations

The hammer candlestick pattern is not a guarantee of a trend reversal, and traders should be cautious when using the pattern.

The pattern can be influenced by other market factors, such as volume and other technical indicators.

Traders should consider using the hammer pattern in conjunction with other technical indicators to confirm the reversal.

Hammer Candlestick vs. Other Patterns

The hammer candlestick pattern is often compared to other candlestick patterns, such as the doji and the inverted hammer.

The hammer pattern is distinct from these patterns, as it signals a potential bullish reversal, while the doji pattern reflects market indecision. The inverted hammer candlestick, characterized by a long upper shadow and a small body at the bottom, signals potential market reversals and indicates bearish momentum following an uptrend, contrasting with the regular hammer pattern.

Advanced Strategies

Advanced traders can incorporate the hammer candlestick pattern alongside other technical indicators to develop a more effective trading strategy. This pattern can be used to identify potential trend reversals, allowing traders to enter long positions at optimal points. Additionally, it serves as a useful tool for setting stop-loss levels and defining target profits, helping to manage risk and improve trade outcomes.

Conclusion

The hammer candlestick pattern is a strong reversal signal that can indicate potential market shifts. However, traders should exercise caution, as it is not always a guaranteed indicator of a trend change. By combining the hammer pattern with other technical analysis tools, such as moving averages or volume indicators, traders can refine their strategy and enhance their decision-making process when navigating market fluctuations.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.