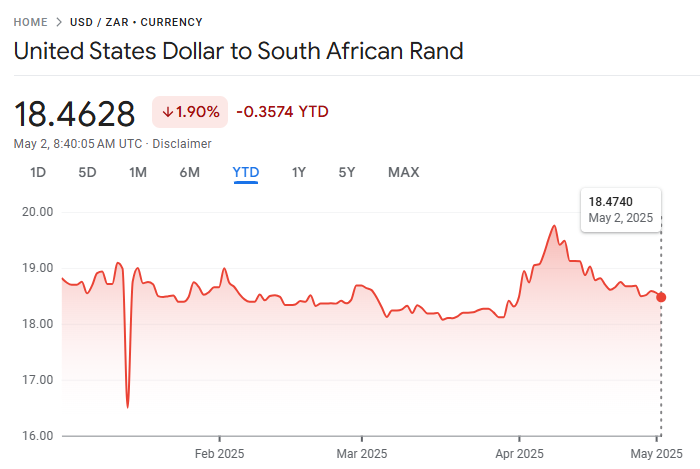

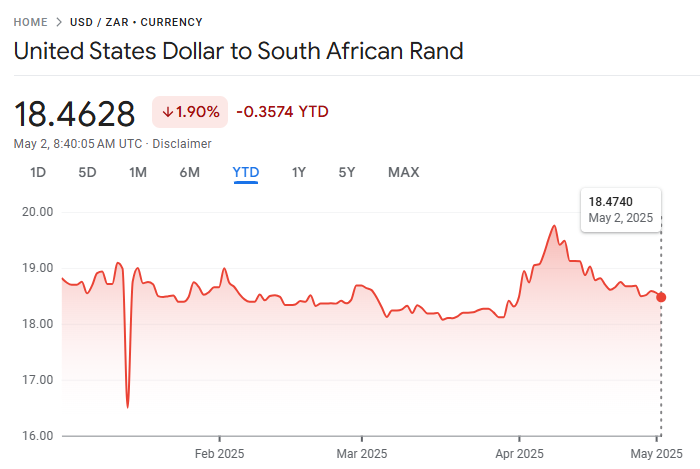

As of May 2025, the USD/ZAR exchange rate remains a focal point for investors, businesses, and travellers. Currently, the USD/ZAR exchange rate is approximately 18.43, reflecting a year marked by significant volatility.

Global economic shifts, domestic fiscal policies, and geopolitical developments have influenced the currency pair's movements.

This article delves into the latest dollar-to-rand forecasts, technical analyses, and expert opinions to provide insights into whether it's an opportune time to buy or sell the pair.

Current USD/ZAR Exchange Rate

The USD/ZAR exchange rate has experienced notable fluctuations in 2025. In April, the pair reached a high of 19.93, primarily driven by global economic uncertainties and domestic challenges.

Conversely, March saw a low of 18.00, influenced by positive market sentiments and policy expectations.

Technical Analysis and Market Sentiment

Technical indicators provide insights into the USD/ZAR pair's potential movements:

Relative Strength Index (RSI): The 14-day RSI stands at 41.97, suggesting a neutral market condition.

Moving Averages: The current rate is below the 50-day Simple Moving Average (SMA) of 18.64 but above the 200-day SMA of 18.35, indicating mixed signals.

Market Sentiment: Approximately 69% of technical indicators signal a bearish outlook, while 31% suggest bullish tendencies.

These analyses highlight the importance of monitoring technical indicators alongside fundamental factors when considering trading decisions.

Economic Indicators Influencing the Rand

1. south africa's Fiscal Policies: The national budget, presented by Finance Minister Enoch Godongwana, emphasized spending cuts and a moderated VAT increase, aiming to stabilize the economy. A well-received budget could strengthen the rand.

2. U.S. Economic Policies: The Federal Reserve's stance on interest rates and economic policies under President Trump's administration influence the dollar's strength, subsequently affecting the USD/ZAR pair.

3. Global Economic Conditions: Emerging market sentiments, commodity prices, and geopolitical events play roles in the rand's performance against the dollar.

Forecasts from Analysts and Institutions

Dollar to Rand Forecast 2025 (Q2-Q4)

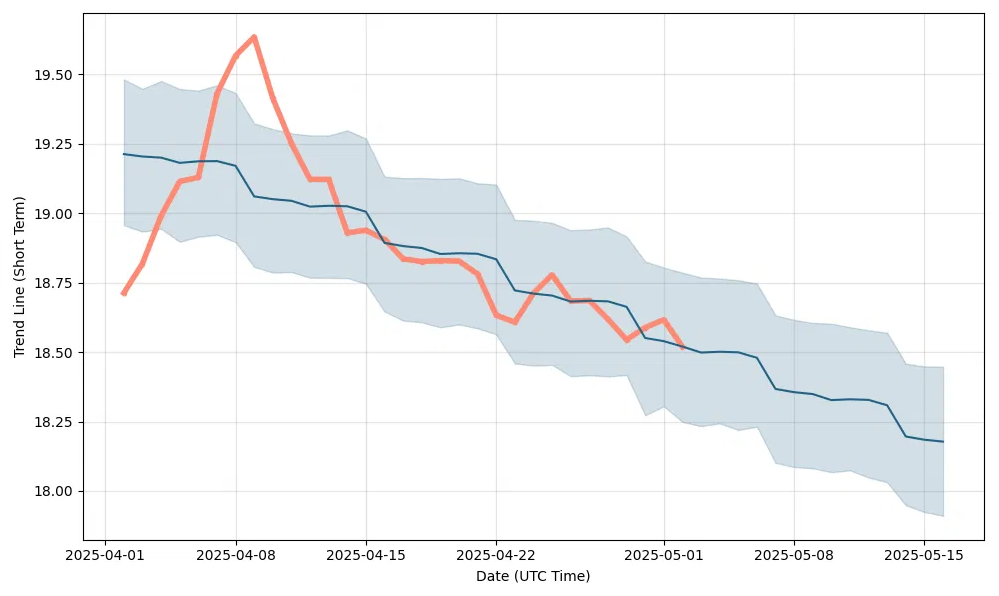

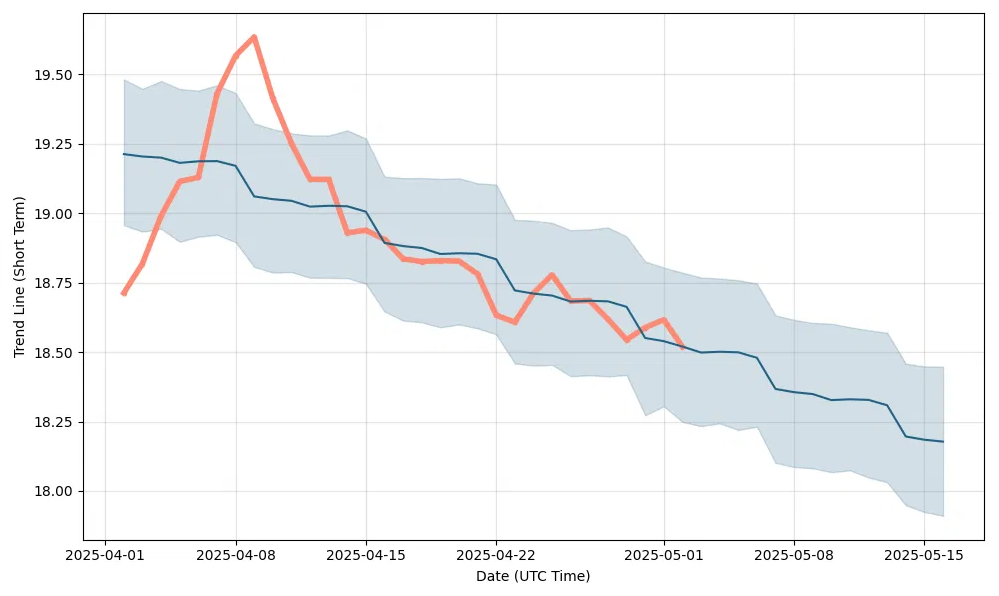

Short-term projections for the USD/ZAR exchange rate vary among analysts:

MidForex anticipates a gradual increase, with rates averaging around 19.16 in May and reaching approximately 19.22 by December 2025.

WalletInvestor forecasts a modest upward trend, predicting the rate to close at 18.43 in May and potentially reaching 19.09 by November 2025.

ExchangeRates.org.uk offers a more optimistic view for the rand, projecting a decline in the USD/ZAR rate to around 17.69 in Q2 and 17.45 in Q3 2025.

These divergent forecasts underscore the uncertainty in the currency markets, influenced by factors such as interest rate differentials, trade balances, and geopolitical events.

Long-Term Outlook (2026–2030)

Looking beyond 2025, projections suggest varying trajectories for the rand:

Traders Union predicts the USD/ZAR rate could reach 23.39 by mid-2026, indicating a potential rand depreciation.

Economist Dawie Roodt foresees a more significant weakening, projecting the rand to hit 25 to the dollar within two years, citing ongoing economic challenges and policy pressures.

These long-term forecasts highlight concerns about South Africa's economic growth, fiscal discipline, and external vulnerabilities.

Should You Buy or Sell the Rand?

The Big Mac Index, a measure of purchasing power parity, suggests that the rand is significantly undervalued. As of 2025, the index indicates the rand should be trading around 8.96 to the dollar, implying a 52% undervaluation.

Even when adjusted for GDP per capita, the rand appears undervalued by approximately 40%, suggesting potential for appreciation if economic fundamentals improve.

Therefore, deciding whether to buy or sell the rand depends on your investment horizon and risk tolerance:

Short-Term Perspective: If you anticipate favourable domestic policies and a weakening U.S. dollar, there may be opportunities for the rand to strengthen, suggesting a buying opportunity.

Long-Term Perspective: Given projections of potential depreciation due to economic challenges, a cautious approach may be warranted, with considerations for hedging against currency risk.

It's essential to stay informed about economic developments, monitor exchange rate trends, and consult financial advisors to make decisions aligned with your financial goals.

Conclusion

In conclusion, the USD/ZAR exchange rate in 2025 will be influenced by a complex interplay of domestic and international factors. While short-term Dollar to Rand forecasts offer varying outlooks, long-term projections suggest potential challenges for the rand.

Investors should remain vigilant, continuously assess economic indicators, and consider diversified strategies to navigate the currency markets effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.