Yes, forex trading is legal in South Africa and trading with an unregulated broker is not illegal. Thus, South Africans can trade the global currency market through locally regulated brokers or trusted international ones.

However, like any investment, forex trading comes with risks, and traders must ensure they work with licensed platforms while following guidelines to avoid scams.

This guide explains forex trading regulations in South Africa, how to select a reliable broker, the steps to begin trading, and advice for responsible trading in 2025.

Is Forex Trading Legal in South Africa? Regulation Status

The South African government recognises forex trading as a legitimate financial activity. For context, foreign exchange has expanded rapidly since the turn of the decade, with retail traders participating via online platforms, mobile apps, and social media trading networks.

South African traders frequently engage in trading major pairs such as USD/ZAR, EUR/USD, and GBP/USD, capitalising on currency fluctuations and exploiting global market prospects.

However, there are specific regulations that traders must follow:

Compliance with Exchange Control Rules: South Africans can send money abroad for trading, but they must adhere to the foreign exchange regulations set by the South African Reserve Bank.

Tax Obligations: Profits from forex trading are taxable under the South African Revenue Service (SARS) and must be declared.

How to Choose a Safe Forex Broker for South African Traders

Selecting the right broker can make a huge difference in your trading experience. Here are some essential factors for South African traders:

1) Regulation

Brokers, whether regulated or unregulated, must adhere to South African legislation, maintain client funds in separate accounts, and ensure pricing transparency.

2) Trading Costs

Evaluate spreads, fees, and overnight charges. Lower costs can significantly boost profitability for active traders.

3) Trading Platform

Look for brokers offering MetaTrader 4 (MT4), MetaTrader 5 (MT5), or a user-friendly web/mobile platform.

4) Leverage Options

While high leverage can increase profits, it also magnifies losses. Brokers like EBC Financial Group usually offer leverage up to 1:500 for professional accounts.

5) Customer Support

Good brokers offer local customer service in English, Afrikaans, and other South African languages.

The Safety Risks of Forex Trading in South Africa

As mentioned above, even though forex is legal, it comes with financial and operational risks:

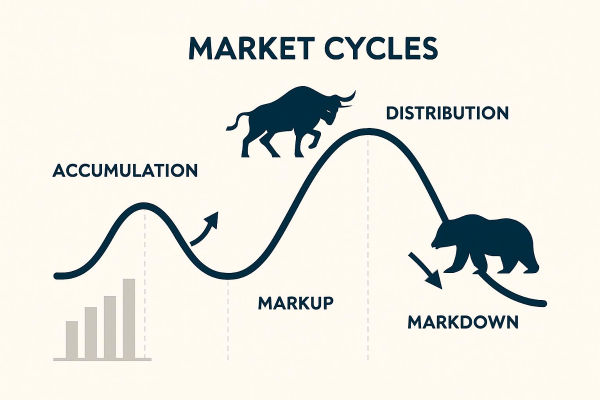

Market Risk: Currency fluctuations can result in losses.

Leverage Risk: Trading on margin increases both potential gains and losses.

Broker Risk: Unregulated brokers may engage in unfair practices or disappear with client funds.

Psychological Risk: Trading based on emotions can result in bad choices and excessive trading

A smart trader controls risk through utilising stop-loss orders and limiting leverage.

Forex Scams in South Africa and How to Avoid Them

Unfortunately, South Africa has seen a rise in forex scams, often promoted through social media. Common scam types include:

Ponzi schemes promising fixed returns

Fake brokers who disappear with deposits

Signal sellers claiming guaranteed profits

How to Stay Safe:

Check registration before depositing

Avoid offers that sound "too good to be true"

Never share your account login details

How to Start Forex Trading in South Africa

Step 1: Learn the Basics

Understand currency pairs, pips, leverage, and lot sizes before depositing money.

Step 2: Choosing a Broker

Verify the broker's license and read reviews from other South African traders.

Step 3: Open a Trading Account

Submit identification documents to comply with Know Your Customer (KYC) rules.

Step 4: Fund Your Account

Most brokers accept EFT, credit/debit cards, or local bank transfers.

Step 5: Practice on a Demo Account

Gain experience without risking real money.

Step 6: Trade Responsibly

Start with small positions and gradually scale up as your skills improve.

Frequently Asked Questions

Q1. Is Forex Trading Legal in South Africa?

A: Yes. Forex trading is legal in South Africa. Traders must use licensed brokers to ensure their funds and trades are protected under South African financial laws.

Q2. Can South Africans Use International Forex Brokers?

A: Yes. South Africans can trade with international brokers. However, ensure it has a strong reputation and is recognised by other top-tier regulatory authorities, such as the FCA.

Q3. Do I Have to Pay Tax on Forex Trading Profits in South Africa?

A: Yes. Profits from forex trading are taxable under the South African Revenue Service (SARS). Depending on your trading activity, earnings may be taxed as Capital Gains Tax (CGT) or Income Tax.

Conclusion

In conclusion, forex trading is legal and regulated in South Africa. However, security relies on selecting a suitable broker, adhering to regulations, and implementing effective risk management.

For beginners, starting small, using a demo account, and continually improving skills is the best way to succeed in 2025.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.