Best Day Trading Stocks: Top Picks for Active Traders

2025-08-12

Summary:

Summary:

Explore the top 5 US and top 5 Indian stocks ideal for day trading, with key pros and cons to help traders make informed, profitable decisions.

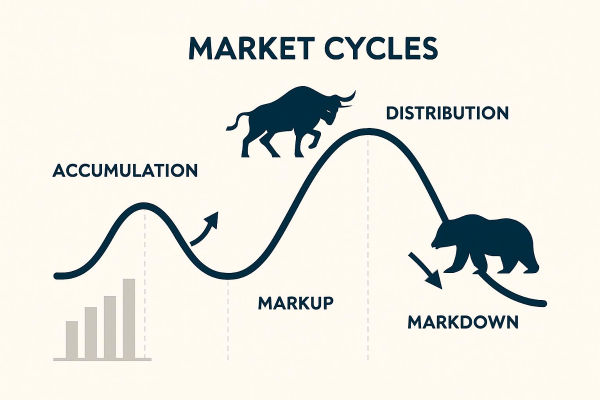

Day trading is a fast-paced trading strategy where positions are opened and closed within a single trading day. For Indian traders active in both domestic and international markets, knowing the best stocks to trade in the US and India is essential. This guide covers the top five stocks from each market for day trading, along with their advantages and potential drawbacks. Understanding these can help you navigate market volatility, manage risk, and optimise your trading strategy.

What Makes a Good Day Trading Stock?

Good day trading stocks generally have:

-

High liquidity: Ensures smooth entry and exit without significant price slippage.

-

Volatility: Provides price movement necessary to capture profits.

Steady trading volume: Frequent trades create consistent opportunities.

Both the US and Indian markets offer highly liquid stocks suitable for day trading, but each has distinct characteristics that traders should consider.

Top 5 US Stocks for Day Trading

1. Apple Inc. (AAPL)

-

Pros: Extremely high liquidity and volume; frequent news events such as product launches; consistent price swings.

Cons: Can be expensive to trade without leverage; large market cap sometimes dampens explosive short-term moves.

2. Tesla Inc. (TSLA)

3. Microsoft Corporation (MSFT)

-

Pros: Stable tech giant with considerable volume; reacts to tech-sector trends and earnings reports nicely.

Cons: Less volatile than smaller stocks, may offer fewer explosive moves for aggressive day traders.

4. NVIDIA Corporation (NVDA)

5. Amazon.com Inc. (AMZN)

-

Pros: Large market capitalisation and substantial trading volume; frequent price changes tied to earnings and economic data.

Cons: Requires careful risk management due to occasional large price swings; expensive without leverage.

Top 5 Indian Stocks for Day Trading

1. Tata Motors Ltd.

-

Pros: High liquidity; frequent price volatility influenced by automotive sector developments; EV segment developments add interest.

Cons: Sensitive to commodity price shocks and global supply chain disruptions impacting stock movement.

2. ICICI Bank Ltd.

-

Pros: Large private-sector bank with solid volume and good volatility; responds to banking sector news and policy changes.

Cons: Regulatory events and RBI decisions can cause sudden, unpredictable moves.

3. Bharti Airtel Ltd.

-

Pros: Telecom sector leader with robust liquidity; telecommunications policy updates can spur intraday price action.

Cons: Subject to regulatory risks and competitive pressures affecting price stability.

4. Tata Steel Ltd.

-

Pros: Commodity-linked stock with price swings tied to global steel and metal markets, creating trade opportunities.

Cons: Highly vulnerable to global commodity price fluctuations and geopolitical developments.

5. Axis Bank Ltd.

-

Pros: Active private bank stock with good volume and volatility; sensitive to interest rate news and financial results.

Cons: Like other banks, risk from sudden regulatory announcements or economic slowdown fears.

Pros and Cons of Day Trading US vs Indian Stocks

| Aspect |

US Stocks |

Indian Stocks |

| Liquidity |

Very high, especially tech giants; smooth execution |

High but can vary; top companies have good liquidity |

| Volatility |

High volatility offers multiple opportunities |

Volatility is influenced by local policy and global commodities |

| Market Hours |

US market hours may require late-night trading for India |

Indian market hours fit the Indian time zone; easier for domestic traders |

| Regulatory Environment |

Stable and transparent; well-regulated |

Some regulatory uncertainty; policy changes impact trading |

| Costs |

Potentially higher capital requirement; leverage available |

Lower capital needed; brokerage fees vary |

| News Impact |

Influenced by US economic data, corporate earnings |

Impacted by domestic economic data, RBI announcements, and global commodity prices |

Key Tips for Day Trading Both Markets

-

Stay Updated: Monitor earnings, economic releases, and sector news in respective markets.

-

Use Technical Tools: Employ chart patterns, moving averages, and indicators to time entries and exits effectively.

-

Manage Risk: Always use stop-loss orders to protect against sudden adverse moves, particularly with volatile stocks.

-

Leverage Selectively: Leverage can boost gains but also increases risk; use cautiously based on experience and capital.

Trade Liquid Stocks Only: Avoid stocks with low volume to prevent slippage and ensure you can exit trades on demand.

Final Thoughts

Day trading US and Indian stocks requires understanding each market's nuances, the stocks' liquidity, volatility, and the prevailing economic and regulatory climate. By focusing on the top stocks suggested above, and balancing pros and cons, traders can position themselves to take advantage of intraday price movements with improved discipline and insight.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.