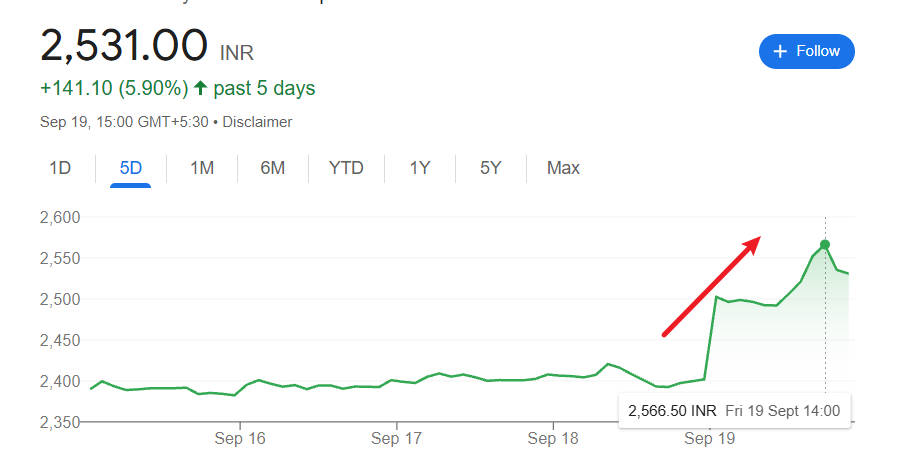

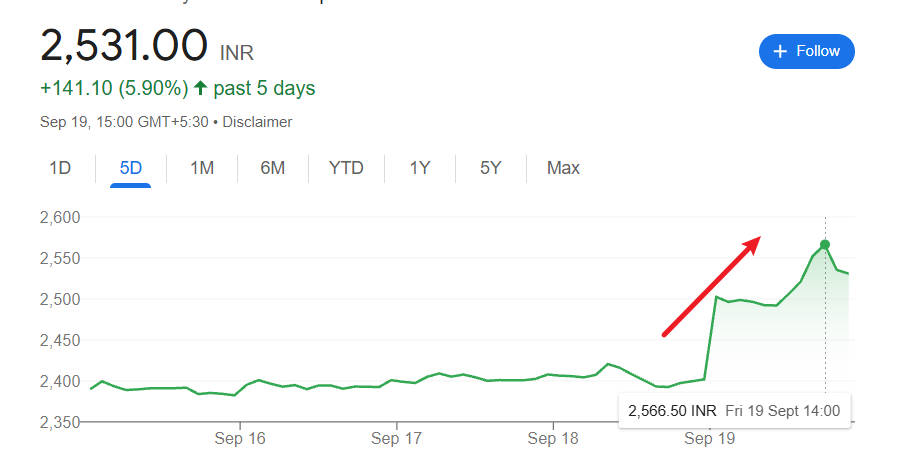

The Adani stock price has received a sharp lift following a landmark ruling by India's market regulator.

On 18 September 2025. the Securities and Exchange Board of India (SEBI) dismissed allegations by Hindenburg Research that Adani Group engaged in stock price manipulation and non-disclosure of related-party transactions.

Within hours of the announcement, shares across the Adani Group surged:

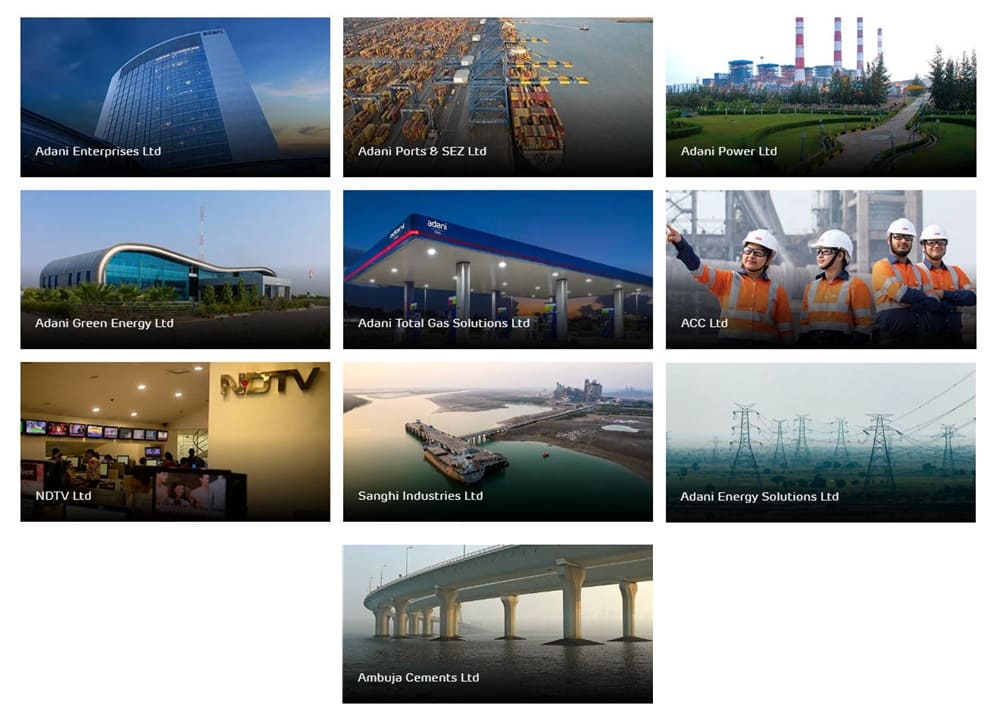

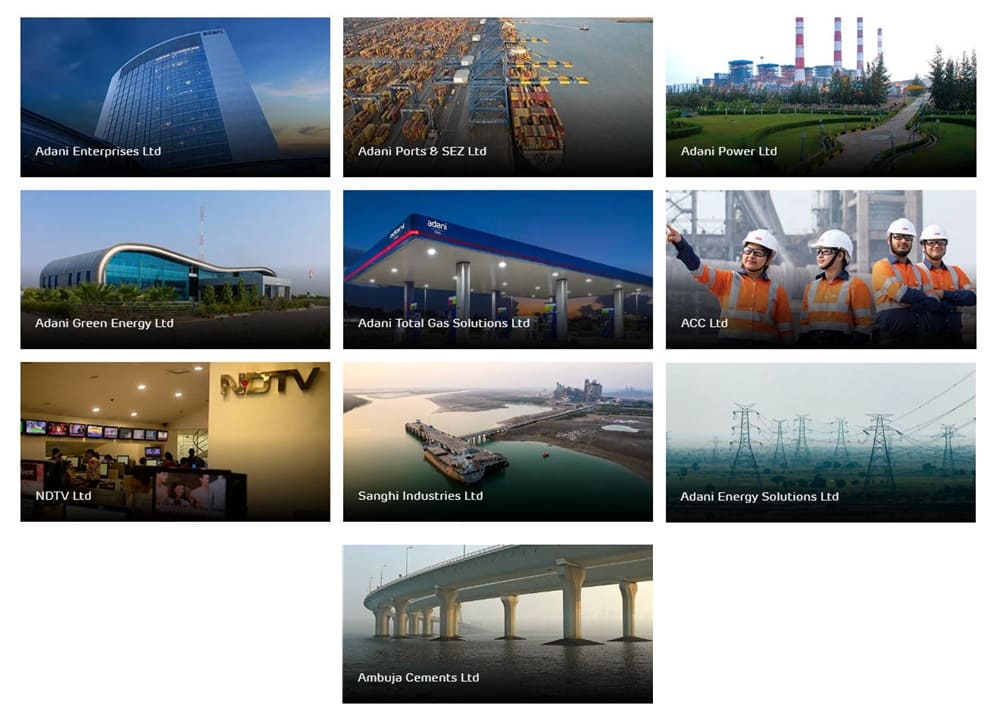

Adani Enterprises (ADEL) climbed over 4% in early trading.

Adani Power and Adani Total Gas were among the leaders, with rises of around 7–9%.

Other group firms—including Adani Green Energy and Adani Ports & SEZ—also saw gains of 3–6%.

The move comes after a prolonged period of uncertainty for Adani stocks; the initial Hindenburg report in January 2023 had prompted a massive sell-off, erasing roughly US$150 billion in group market value.

What SEBI Found — and Didn't

SEBI, in its final orders, found that:

1) The transactions cited by Hindenburg did not meet the legal definition of "related-party transactions" under the law applicable at the time.

2) There was no violation of disclosure norms or any manipulation that would breach regulatory standards.

3) All proceedings (at least those linked to the Hindenburg allegations) have been dropped, with no penalties imposed.

Gautam Adani welcomed the decision, calling it a "resounding victory" and reaffirming the company's commitment to transparency and integrity. At the same time, he expressed sympathy for investors who had lost money amid the turmoil.

Analyst Views and Valuation Implications

While the regulatory overhang may have been lifted, analysts caution that the path ahead depends heavily on fundamentals and execution. Several observations are noteworthy:

1) Adani Power has drawn particular attention.

Morgan Stanley has initiated coverage with an "Overweight" rating and set a target price of ₹818. suggesting roughly a 30% upside from its recent trading levels.

2) Adani Green Energy shares are now being viewed by some brokers as undervalued.

Jefferies, for example, believes the stock is trading at a significant discount.

3) Other Adani entities are also flagged as having upside potential.

Analysts see scope for revaluation in companies such as Adani Enterprises, Adani Ports, Total Gas and others, especially if growth plans deliver and debt remains manageable.

Risks and Remaining Questions

Even with the recent regulatory clearance, several red flags and issues remain:

1) Debt and Capital Expenditure

Adani Group has large investment plans, including aggressive capacity expansion (especially in power generation), infrastructure, ports, green energy etc. Any cost overruns, delays, or rising interest rates could strain cash flows.

2) Reputation and Investor Trust

While SEBI has dismissed the Hindenburg allegations, the reputational damage has already been done. Restoring confidence—among domestic and international investors—will require consistent transparency, clean audits, and meeting promised operational metrics.

3) Regulatory Jurisdictions Outside India

The "clean chit" pertains to the SEBI investigation. But Adani, and its founder, continue to face scrutiny elsewhere, including potential US legal actions and claims of bribery. These could become a source of risk if brought forward.

4) Valuation Concerns

Some Adani stocks may still be richly priced relative to their earnings or risk profile. For example, if the market's optimism is too high, even small missteps could trigger volatility.

What This Means for the Adani Stock Price

Given the above, the recent regulatory outcome provides a strong near-term boost to the Adani stock price across the group. It removes a major source of uncertainty and may open the door for renewed investment inflows. However:

The potential upside is considerable if growth targets—especially related to capacity expansion, earnings margins, and infrastructure build-outs—are met.

Conversely, failure to deliver, disappointments in international or cross-border exposure, or renewed regulatory surprise could lead to downswings.

Long term investors will likely monitor quarterly earnings, debt levels, and execution on green energy transitions, among other metrics.

Conclusion: Is It Time to Buy?

For those considering whether to enter or add to positions, here are some guiding thoughts:

If you believe that SEBI's dismissal marks a turning point, and that Adani firms will meet their ambitious growth plans with robust governance, then certain Adani stocks (notably Adani Power, Adani Green, Adani Enterprises) may offer attractive medium-to-long-term returns.

If, however, you are risk-averse or concerned about external risk (legal, regulatory, credit), then it may be wise to wait until clearer signals emerge—such as full quarterly results, reduced debt ratios, and successful cost control.

In short, the Adani stock price has likely passed a key hurdle yesterday. What matters now is whether the Group can convert regulatory goodwill into financial performance and sustainable growth. For many investors, that will be the real test.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.