Grid trading is a popular strategy used by traders in various markets, particularly in forex. It is a method that doesn't require predicting market direction but instead involves placing buy and sell orders at predefined intervals around a set price level. While grid trading can be highly profitable in certain conditions, it also comes with significant risks.

In this article, we'll delve into whether the reward of grid trading justifies the risk, helping you decide if this strategy is suitable for you.

What Is Grid Trading?

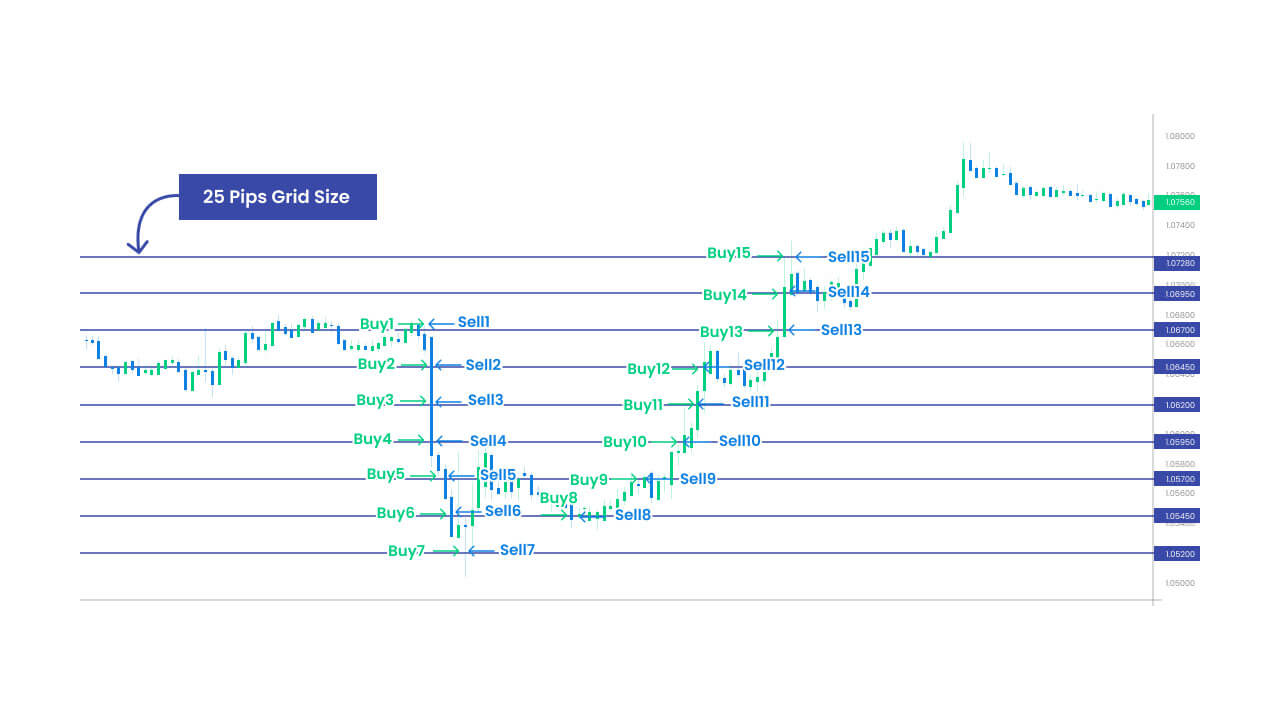

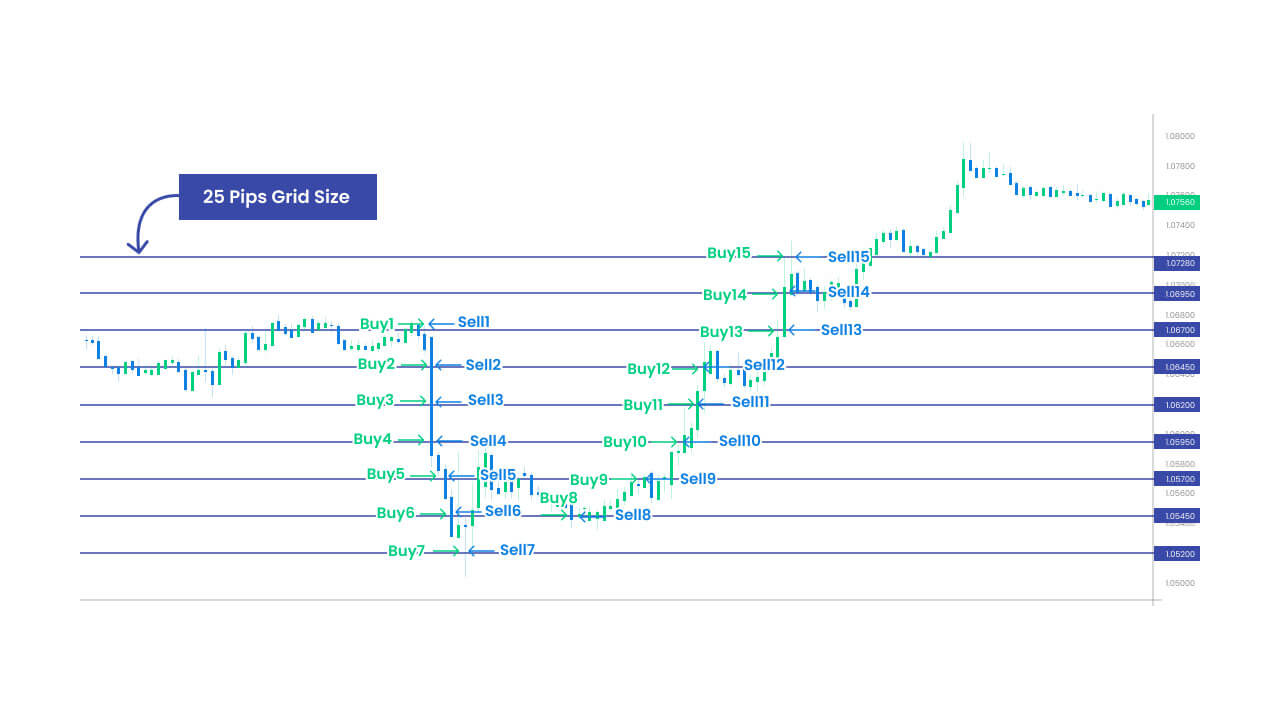

Grid trading is a strategy that involves placing multiple buy and sell orders at regular intervals above and below a set price level, creating a "grid" of orders. As the market moves, the strategy aims to capture profits from price fluctuations.

For example, if a trader sets a grid with a 10-pip interval, they may place buy and sell orders at 10-pip increments. When the market hits a particular price level, the trader's order is triggered, and the position is either opened or closed.

The advantage of grid trading is that it doesn't require the trader to predict market direction. Instead, it takes advantage of the market's natural ebb and flow. This makes it a popular strategy among traders who want to automate their trades and reduce the need for constant market analysis.

How Does Grid Trading Work?

Grid trading typically works in a trending market, but it can also be used in ranging markets. The key principle is to open buy and sell orders at regular intervals around the current market price, without needing to forecast the direction of the price movement.

For example:

A trader places a buy order at a certain price level and a sell order at the same price level.

As the market moves, the orders are triggered when the price reaches the predefined levels, creating a series of open positions.

If the market moves in one direction, the trader can close profitable positions while leaving other positions open for potential future profits.

One of the unique aspects of grid trading is that it can be automated using trading bots or algorithms, allowing traders to set up their grids and let them run without much manual intervention.

The Potential Rewards of Grid Trading

Grid trading can yield significant profits if executed correctly, especially in volatile or sideways markets. The primary advantage of the strategy is that it doesn't rely on market predictions. By setting up a grid of orders, a trader can take advantage of price fluctuations, regardless of whether the market is trending up or down.

Profit from Market Movements: By capturing small profits from multiple trades as the market moves, grid trading can accumulate significant returns over time.

Works in Sideways Markets: In markets that don't show a clear upward or downward trend, grid trading can still be profitable by catching both upward and downward movements.

Automation and Time-Saving: One of the main benefits of grid trading is that it can be automated. Traders can set up a grid and let the system run, saving time and reducing the need for constant monitoring.

The ability to automate grid trading can also eliminate the emotional element of trading. Since the strategy doesn't require market predictions or decision-making, it allows traders to stick to their plan and avoid impulse decisions based on market noise.

The Risks of Grid Trading

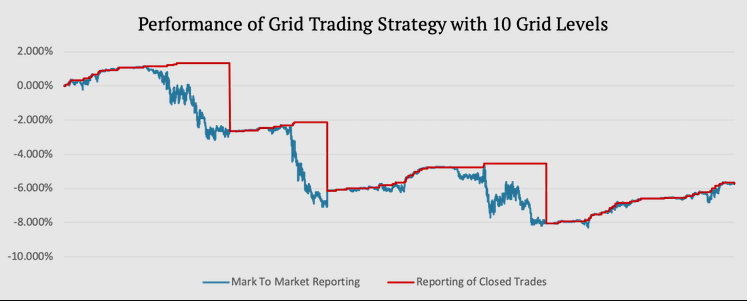

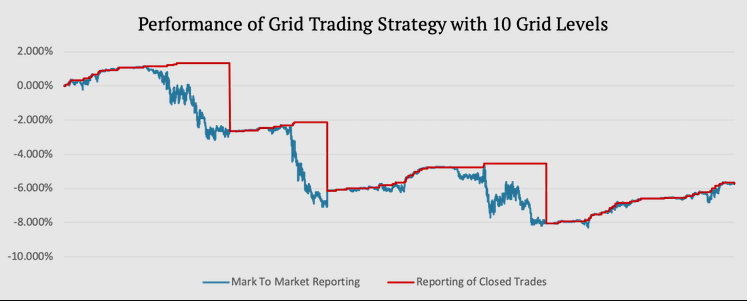

While the potential rewards are appealing, grid trading is not without its risks. One of the main risks lies in the use of leverage, which can magnify both gains and losses. If the market moves against the trader's positions, it could trigger large drawdowns, especially if the trader has not set proper risk management parameters.

High Risk of Large Losses: If the market moves in one direction for an extended period, the trader may be left with a series of losing positions. Without proper risk management, this can lead to substantial losses.

Leverage Risk: Grid trading often involves using leverage to open multiple positions simultaneously. While leverage can increase profits, it also increases the potential for significant losses.

Overexposure: With many open positions, traders risk overexposing their account to a single market. If the market suddenly moves dramatically in one direction, it could wipe out the trader's account balance.

Risk management becomes crucial when using grid trading. Proper stop-loss orders, position sizing, and regular monitoring are essential to avoid disastrous losses.

When Is Grid Trading Most Effective?

Grid trading works best in specific market conditions, such as when the market is in a range or is exhibiting low volatility. It is less effective in strongly trending markets, where the price moves consistently in one direction. In these conditions, a trader's positions may accumulate losses if the market does not reverse as anticipated.

The strategy can also be more effective when the trader has a clear understanding of the market's potential movements and can adjust the grid size accordingly. For example, a tighter grid may be used in low-volatility environments, while a wider grid may be better suited for more volatile conditions.

Is Grid Trading Suitable for Every Trader?

Grid trading is not for everyone. While it can be profitable, it requires a solid understanding of risk management, the ability to stay calm during periods of drawdown, and a willingness to accept that there may be times when the strategy leads to losses.

It is crucial for traders to use grid trading with caution, ensuring they only risk what they can afford to lose. It is recommended to start with a demo account to practice and understand how grid trading works before applying it with real capital.

Final Thoughts

The answer to whether the reward of grid trading is worth the risk depends on several factors, including the trader's experience, risk tolerance, and market conditions. While grid trading offers the potential for significant rewards, the risks are equally substantial. It is a strategy that can yield impressive returns, but only if the trader is disciplined, uses effective risk management, and applies it in the right market environment.

Ultimately, grid trading requires a balance of patience, discipline, and risk awareness. For traders willing to invest the time and effort to understand the strategy fully and manage the risks, the reward can certainly be worth the risk.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.