When looking for suitable stocks, investors usually focus on the profitability of the company. This is because only if the company's profitability is stable can the stock price rise steadily, which in turn attracts investors' attention and market pursuit. To assess a company's profitability, investors often look at its profit margins. And when it comes to a slightly more precise indicator, it is the gross profit margin. Now let's take a closer look at the gross margin formula and tips on how to use it.

What does gross margin mean?

It refers to the proportion of the total revenue that is left after subtracting the direct costs of the enterprise after the sale of goods or the provision of services. It is a very important indicator of a business's operating efficiency and can help a business assess the profitability of its products or services and the effectiveness of accounting for costs.

In traditional terms, the money a company earns from doing business minus the costs it must pay to do business is what is left as gross profit. Divide the gross profit by the company's costs to get the gross profit margin. The higher a company's gross profit margin, the more efficiently it will make money.

If you compare a company to a cistern, then revenue is the inlet and expenses are the outlet. And the gross profit margin represents the combined inlet efficiency when both the inlet and outlet are started at the same time. This efficiency is put into the company's money-making efficiency.

Gross profit margin of the company Even now that the pool is empty, the water will soon be filled. This kind of money-making efficiency of the company is what the majority of investors are looking for in a money company. And for those companies with low gross profit margins, even if the water in the pool is now more water and day-to-day operations are a little careless, the water in the pool may also become less.

Generally speaking, avoiding the particularly low-gross profit enterprise will reduce the probability of investors choosing the wrong company, while the high-gross profit enterprise is often a bull-stock-infested place. Higher gross profit margins indicate that a company's products command a high premium, such as Maotai, which could reach a gross profit margin of 76% in 2021.

However, the gross profit margin cannot fully reflect the business situation and needs to be combined with other indicators to carry out a comprehensive analysis. For example, the higher the net interest rate used in conjunction to analyze profitability, the stronger the two ratios reflect the enterprise's profitability. Generally speaking, the higher the gross profit margin reflects the company's ability to operate the core business, the stronger the enterprise is. The higher net profit margin represents the appropriate operating costs of ATC and shows the efficiency of management.

If the gross profit margin is high but the net profit margin is low, it means that the company has the ability to operate its core business, but it does not control the cost properly, which may be a problem of management and operation. For example, high salary or rental expenses can be improved to enhance profitability by improving the management style. If you only analyze the net profit margin, you will overlook the leading position of the company in the business.

If the gross profit margin is low but the net profit margin is high, this is the result of the company making profits in non-core businesses. Gross profit is the basis of profitability; without a large enough gross profit, it is not able to form a net profit. In the case of low gross profit margins, it can create a high net profit. This may be because the business sold fixed assets or short-term financial instruments to profit, making it difficult to sustain profitability. If the investor does not analyze the gross profit margin, he or she will not be able to detect the lack of profitability of the operation.

To summarize, gross profit margin is an important indicator of a company's operating efficiency, reflecting the level of profit earned from the sale of goods or the provision of services. Comparing it with the net profit margin in the same industry will show the profitability of the enterprise, and the two ratios need to be analyzed together, or else we will not be able to know the whole picture of the enterprise's operation or management.

Difference between gross and net margins

| Comparison Program |

Gross profit margin |

Net margin |

| Definition |

Calculates profit margin as % of sales. |

Net profit as a revenue percentage. |

| Calculation formula |

(Revenue - Costs) / Revenue * 100% |

Net Profit/SSales Revenue * 100% |

| Considerations |

Direct costs only, excluding other expenses |

Includes all costs, like overheads. |

| Description |

Measurement of core business profitability |

Measures overall profitability |

| Field of application |

Analyzes operations and product profit. |

Evaluate profitability and efficiency. |

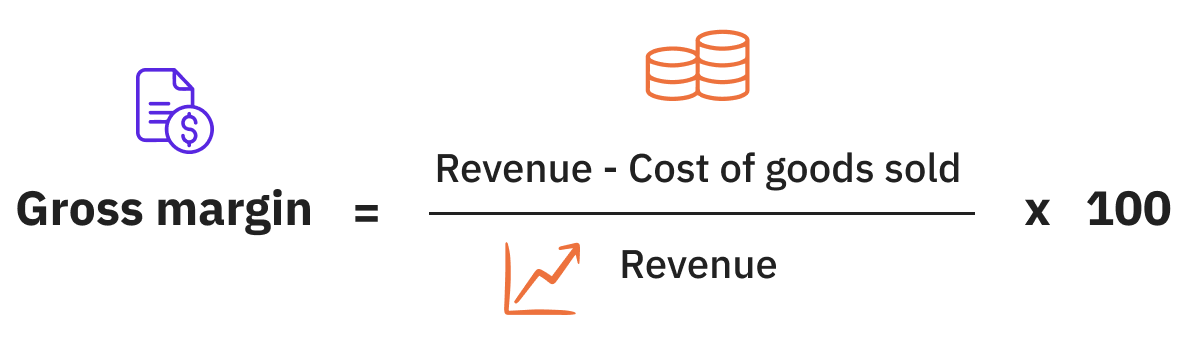

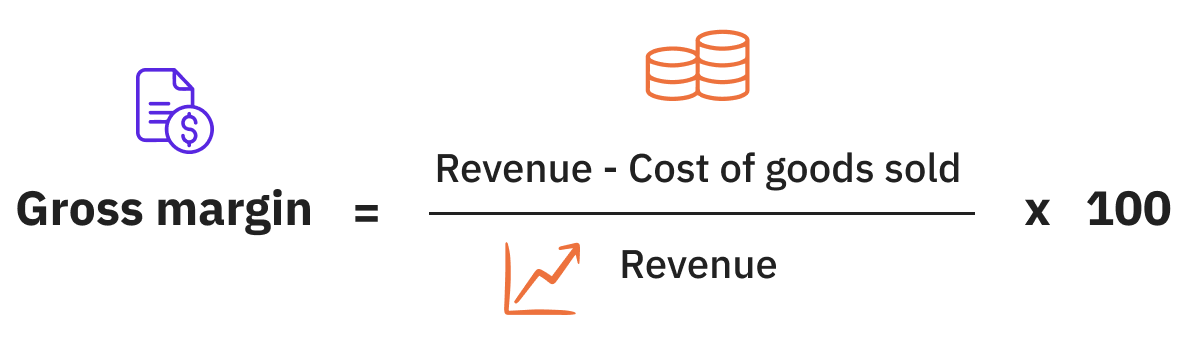

Gross Profit Margin Calculation Formula

It is an important indicator to measure the profitability of an enterprise. Calculation formula: Gross Profit Margin = (Sales Revenue - Cost of Sales) ÷ Sales Revenue x 100%

Among them, sales revenue is the total income obtained by the enterprise through the sale of products or the provision of services. The cost of sales refers to the direct costs associated with sales, including the cost of raw materials, direct labor costs, and manufacturing overhead. It generally excludes labor costs, so gross profit margins usually exclude labor costs as well.

Labor costs are usually considered overhead because they are necessary in the process of selling a product or providing a service but are not directly related to the quantity of a specific product sold or the extent to which a service is provided. As a result, labor costs are usually considered in the calculation of metrics such as net margin.

Gross profit margins are calculated and usually expressed as a percentage, reflecting the profit earned by a business as a proportion of sales revenue for each dollar of product sold or service provided. A higher gross profit margin usually indicates that a business has greater profitability and operational efficiency.

Suppose a company sells $10 million of products in a year, and the cost of goods sold is $6 million. Then the company's gross profit is: Gross profit = sales revenue minus cost of goods sold = $10 minus $6 = $4 million. Using the data for gross profit and sales revenue, you can calculate the company's gross profit margin: (gross profit ÷ sales revenue) × 100% = (400 ÷ 1.000) × 100% = 40%.

Therefore, the company's gross profit margin is 40%. This means that the company earns a gross profit of $4.000 for every $10.000 of product sold.

Is it better to have a larger or smaller gross profit margin?

The general rule is that the higher the gross profit margin, the more profitable the company is. So investors will take it as an important indicator to assess the value of the enterprise and investment risk. An enterprise with a high gross profit margin is more able to attract investors' attention and investment and improve the enterprise's financing channels and financing efficiency. That is to say, people generally believe that the bigger the gross profit margin, the better, while the lower the margin, the worse.

Because a high gross profit margin usually means that the selling price of this product or service is higher than the cost, the profitability of the enterprise is stronger, and it can be easier to bear various expenses and investments to improve the flow of capital and cash flow of the enterprise. At the same time, it means that the quality and value of the product or service are very high, the enterprise is more competitive in the market, can attract more customers, and this market share will improve the enterprise's market position and brand value.

And low gross margin enterprise may mean that there is not enough cost control; you need to take measures to reduce your costs to improve efficiency and effectiveness. For example, improve the production process, optimize the supply chain to reduce the cost of raw materials, and so on.

But in reality, things are not that simple. It is important to note that it is a relative indicator, and gross profit margins will vary between industries and enterprises. To see whether the gross profit margin is high or low, the first is for companies to make a comparison according to their own gross profit margin in the past, and the second is to make a comparison with the gross profit margin of the same industry.

In other words, investors should not only focus on the absolute number of gross profit margins but also pay attention to their change over the years. For example, Apple's gross profit margins in the past three years were 37.82%, 38.23%, and 41.78%, a steady increase in gross profit margins to illustrate the high competitiveness of the enterprise's products.

Another example is the same cell phone industry, whose 2021 gross profit margin is only 17.75%, less than half of Apple. Although Xiaomi's revenue and other aspects of the growth rate are very fast, Apple's products are more competitive.

But here we also have to tell you, even if you compare with companies in the same industry. But there are very few companies that sell exactly the same products. Therefore, differences in company strategy, company size, and so on will all become variables. Therefore, such a comparison is not objective enough.

For example, in the case of manufacturing and services, there is a fundamental difference in gross profit margins. The service industry usually has a higher gross profit margin because it usually sells services rather than products. So the cost of personnel is a cost of goods sold, not a cost of goods sold. In other words, the non-manufacturing sector is not a good place to take a look at gross profit margins.

Another example is the gross profit margin, which can be judged very clearly relative to traditional business. In many of the more emerging industries, such as Internet companies, it is not good to judge their gross profit margin. Because mom is in the vegetable business, the selling price is the cost, and the selling price is the income. Both are first subtracted, and then a division is the gross profit margin.

What Internet companies do is flow business. Theoretically, all the expenses incurred by the Internet company in order to obtain traffic should be counted as costs, such as renting servers, operating websites, and raising programmers to maintain the system.

But in addition to spending money on operations, Internet companies have to go out and buy some traffic from time to time. And after spending money to buy traffic, certain Internet companies often include the cost of this outlay in their marketing or promotion expenses. This makes the gross profit margin for the Internet company quite high.

More honest companies will put all the overhead into costs so that the calculated gross profit margin is relatively low. And know how to profit whitewash business will be different expenses to different financial accounts below, the more obvious will be honestly placed in the cost, and those more hidden will be put directly into the cost. So the gross profit margins calculated in this way are relatively high.

Because so many companies will use a variety of expense utilization strategies to reduce costs, the gross profit margin will be able to increase. It's like a pool where less water flowing out of the outlet equates to more efficient overall water intake.

That's why it's a good idea for investors to understand, when reading a company's income statement, the company's principles for recognizing revenue and operating costs. Only if it is a direct cost incurred to produce products and services can we arrive at a more accurate gross profit margin.

In conclusion, the stability and level of gross profit margin allow investors to assess the profitability of a company's core business. And its level directly affects the enterprise's financial position, market position, cost control, and investment decisions, so enterprise management must pay attention to and optimize the indicators.

Tips for using gross margins

| Tips |

Description. |

| Industry Comparison |

Compare gross profit margins with industry peers for competitiveness. |

| Trend Analysis |

Analyze historical gross profit margin data for operational stability. |

| Cost Combination |

Combine cost data to find improvement points to increase profitability. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.