With the improvement of investment and financial awareness, more and more people are starting to pay attention to conservative investment methods, and savings bonds are one of them. Compared to high-risk investments such as stocks and forex, it is generally recognized as a relatively safe choice. Recently, there have been scenes of people queuing up to buy them and selling them out in half an hour, vividly demonstrating the extent of their popularity. In this article, we will talk about savings bonds, which have a balance of safety and return, to understand the specific reasons for their popularity.

What is Savings Bonds?

It refers to a type of bond issued by the government to attract the savings of individual investors and provide long-term financial support for the government. It is primarily aimed at individual investors, and the government hopes that by issuing these bonds, it will encourage individual savings and provide a relatively stable and safe investment option for the average investor. Such Treasury bonds issued to the general public can be purchased through banks, government agencies, or other financial institutions.

Treasury bonds are bonds issued by the national government and are often regarded as one of the safest investment choices because of their extremely high credit quality and stable interest returns. Savings treasury bonds, on the other hand, are a special form of treasury bond that are issued to individual investors to encourage personal savings and investment.

Savings treasury bonds usually have a low risk profile and usually have some principal and interest protection features, meaning that the principal amount an investor purchases will be guaranteed at maturity and will earn a certain amount of interest income. This form of treasury bond is usually considered a relatively safe investment option for investors who are looking for stable returns.

The savings bond is a safer investment product for the general public. Because it is a Treasury bond, it is also issued by the national government. Therefore, the multiplier is strong, and it can be considered the safest form of investment. Compared with ordinary people's daily choice of fixed deposits, it is more secure. After all, one is guaranteed by a commercial bank, and the other is endorsed by the state.

Savings bonds are relatively low-risk while also offering stable returns. Investors can earn a fixed interest income by holding these bonds, making them an attractive option for those seeking a stable income. It also has good liquidity. Investors can sell or transfer them to other investors to liquidate their money when needed.

It is important to note that this better liquidity is also only relative. Unlike other treasury bonds, it is specifically targeted at small and medium-sized investors. That is to say, it will not be issued to institutional investors, and the use of the real-name system, which can only be held or redeemed by individuals, cannot be transferred to others; that is, it does not have liquidity. However, it can be redeemed in advance and can also be used as collateral for loans at the original purchasing bank.

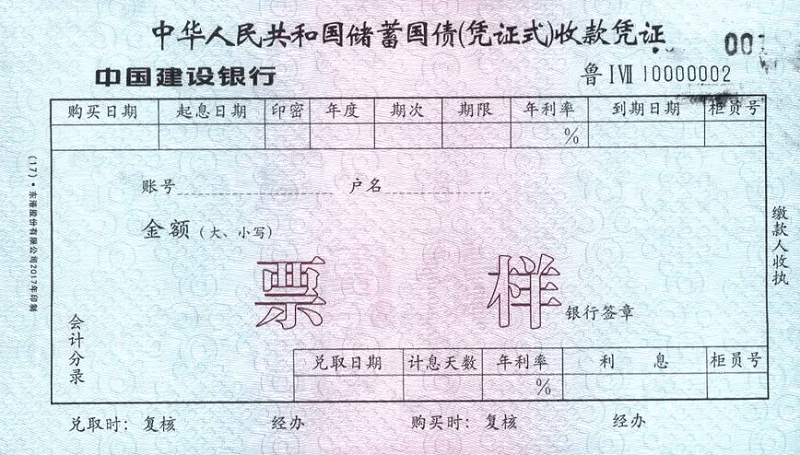

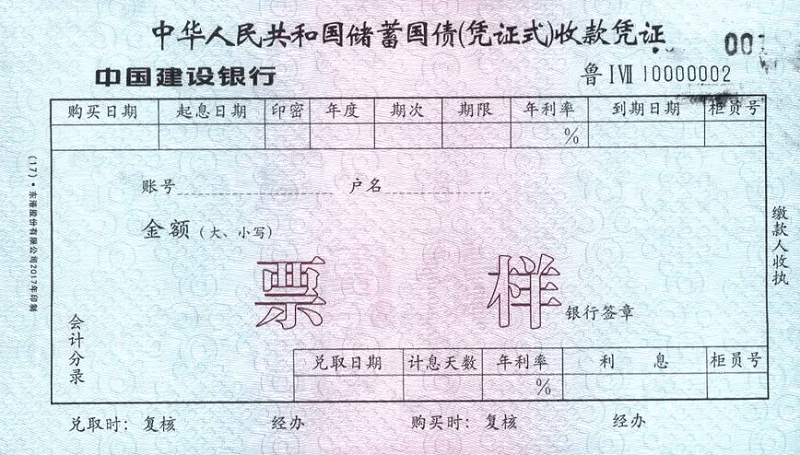

There are two types of savings bonds: one is a voucher type, and the other is an electronic type. Their basic characteristics are similar; both are issued to encourage personal savings and investment, with lower risk and a certain degree of liquidity. The difference lies in the form of issuance and investment methods. The voucher type is issued in the form of physical vouchers, while the electronic type is issued in electronic form.

Certificated Treasury bonds can be bought at a bank counter with money or a card, and after the purchase, there will be a paper certificate similar to a deposit slip. This receipt is equivalent to an IOU, and investors need to keep it safe. The voucher will indicate the denomination of the bond, interest rate, maturity date, and other information. At maturity, you can use it to go to the designated bank or financial institution for redemption procedures. You can receive the principal and interest in one go.

Electronic treasury bonds need to open an electronic treasury bond account first and then be purchased through mobile banking or online banking without paper vouchers. After purchase, its investment record will be stored electronically in a specific bond account. At maturity, the principal and interest can be collected through specified means, such as bank transfers.

In China, savings bonds usually enjoy certain tax incentives. For example, tax exemptions or tax breaks allow investors to earn higher net returns. For example, the Chinese government stipulates that interest income earned by individuals investing in savings bonds is exempt from personal income tax. This means that investors do not need to pay individual income tax on interest income earned from holding savings bonds and can be exempted from tax or partially exempted from tax.

Under certain circumstances, investors may be entitled to pre-tax deductions when purchasing savings-type Treasury bonds. According to China's tax law, some specific types of treasury bond investments may be considered eligible pre-tax deductions, and investors can deduct the corresponding amount from their taxable income when purchasing treasury bonds to reduce their tax payments.

Overall, savings treasury bonds are usually favored by investors as a safe and sound investment. It provides a relatively low-risk investment option for individual investors and a stable and reliable financing channel for the government.

What is the difference between certificated and electronic savings bonds?

|

Characterization

|

Voucher Type

|

Electronic

|

|

Form

|

Paper Voucher |

Stored digitally in an account |

|

Holding method

|

Physical paper vouchers |

Bonds in digital form |

Savings Bond Interest Rate

This is based on national government policies and market conditions and usually varies according to the specific characteristics of the bond and the level of interest rates at the time of issuance. The interest rate on savings bonds may be fixed or variable, depending on the type of bond and the issuance regulations.

In general, interest rates on savings bonds are relatively stable and are usually slightly higher than rates on other types of bonds because they are usually geared toward individual investors, whom the government hopes to attract by offering higher interest rates to fund their savings. Of course, this interest rate is also affected by market interest rates, inflation, monetary policy, and other factors, so it may change over time.

For example, the first batch of certificated savings treasury bonds issued by the Chinese government on March 10. 2024. were all fixed-rate. Savings-type Treasury bonds with a maturity of 3 years have an annual interest rate of 2.38%. The 5-year savings treasury bonds have a coupon rate of 2.5% per year. Compared to last year, the savings bond interest rate has dropped by 0.25 percentage points. But even so, it would still be a bit higher than the prevailing time deposit rate.

Although the interest rate on savings bonds is fixed at the time of issuance, that doesn't mean that the interest rate on the final proceeds will be the same as that of the issuance. Basically, it all depends on its interest accrual rules. For example, the interest accrual rules for savings bonds like the current issue are to repay the principal and interest in one lump sum at maturity, and no interest will be added for late payments.

In cases of early withdrawal, interest will be accrued on a slot basis according to the actual holding period. That is to say, if you want to redeem the bond before the holding period is up, the interest rate will change. The interest rate varies according to the length of the holding period. Therefore, although the savings bond interest rate is basically fixed, the actual yield rate is not necessarily fixed but will fluctuate.

For example, if you hold a savings bond that is five years old, according to the rules of interest accrual, the interest rate for a holding period of six months less than one year is 0.35%, for one year less than two years is 0.85%, for two years less than three years is 1.87%, for three years less than four years is 2.32%, and for four years less than five years is 2.43%. Only those who actually hold them for five years to maturity can get a 2.5% interest rate return.

Meanwhile, depending on the type of savings bond issued, the interest payment method is also different. For example, for the same five-year savings bonds, the voucher type will pay off the principal and interest in one lump sum upon maturity. The electronic type, on the other hand, pays interest every year and basically every half a year. You don't have to wait five years to get the principal and interest in one lump sum, but instead you get a fixed interest return every six months.

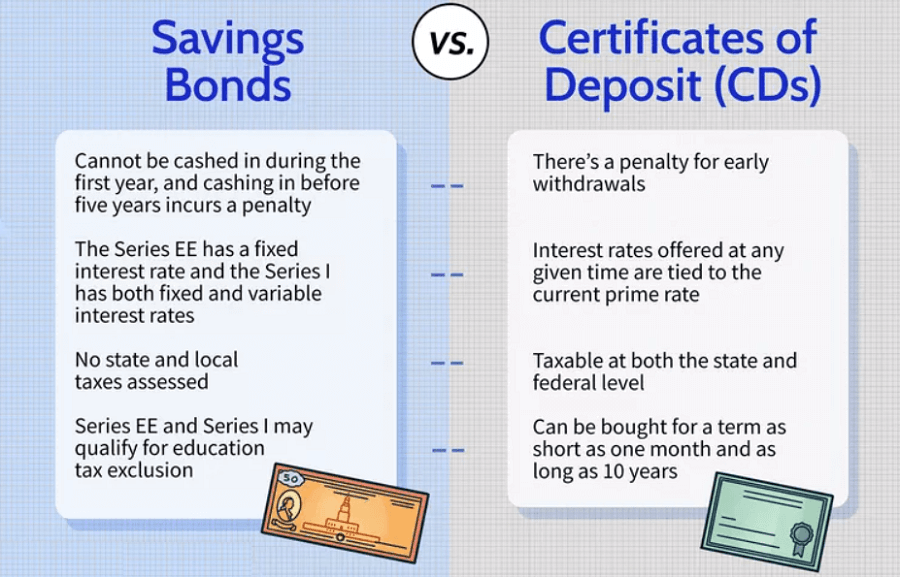

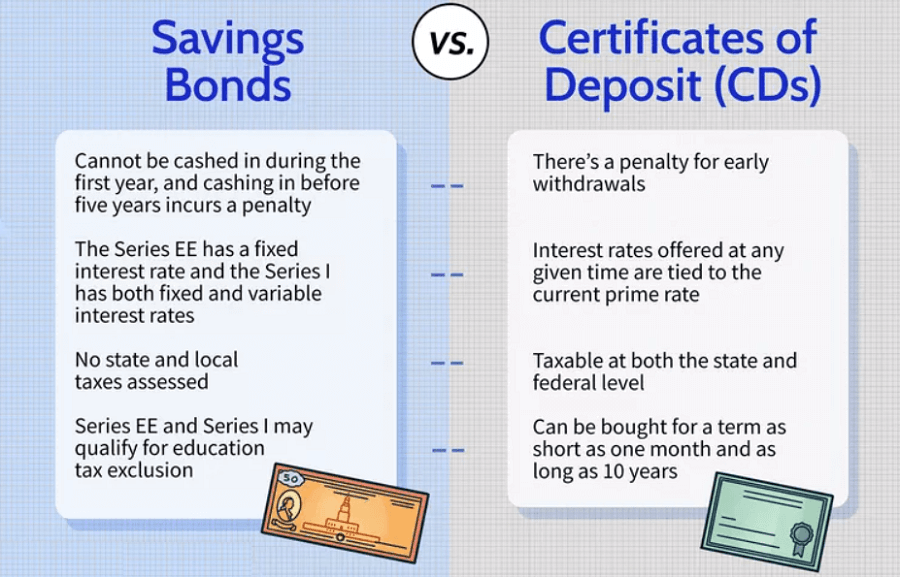

But no matter what type of savings bond it is, the way it accrues interest is simple. That is, the interest does not accumulate on the principal, and each interest payment is based on the initial principal. On the other hand, according to the U.S. Treasury Department's Treasury Bonds Direct website, I Savings Bonds not only pay interest on a monthly basis but also automatically accrue interest from the previous six months to the principal every six months to calculate compound interest.

Therefore, investors should pay attention to the level of interest rates announced at the time of bond issuance before purchasing savings bonds and understand clearly the specific interest rate payment methods and interest rate adjustment rules of the bonds. Only by truly understanding these can you know what the investment returns are and make more reasonable investment decisions.

The Difference Between Savings Bonds and Time Deposits

In China, when ordinary people have some idle money in hand, they usually choose to deposit their money in order to get a fixed income. But nowadays, savings-treasury bonds are also sought after by many people. The 15 billion savings treasury bonds issued on March 10. 2024. were snapped up in half an hour. This shows that, compared with fixed deposits, savings bonds must have more advantages.

Of course, this can be seen from the interest rate of savings bonds. Compared to the interest rate of fixed deposits, the interest rate of savings bonds is generally slightly higher. At the same time, compared to time deposits, which are endorsed by commercial banks, savings bonds are guaranteed by the national credit rating, which is the highest credit rating. In other words, you don't have to worry about whether or not you'll be able to pay your principal and interest rate at maturity after you buy it; it's that safe.

In addition to this, compared to bank time deposits, they can also be deposited after a certain period of time, giving you the ability to cash out early. And because it is able to pay the corresponding interest according to the holding period, you do not have to, and fixed deposits like early withdrawal will not have interest.

This graded interest characteristic means that after the holding time of more than a year after the early withdrawal, there will also be a certain amount of income. Moreover, this return will be substantially higher than that of fixed deposits. According to the rules of savings-type treasury bonds, interest is graded, so if there is free money in hand, you can buy savings-type treasury bonds, which will be better than saving time deposits. Because savings bonds can have a balance between yield and liquidity,.

Of course, in addition to these advantages, compared with fixed deposits, it also has a few disadvantages. That is, savings bonds cannot handle part of the early redemption; that is to say, if you want the early redemption of savings bonds, you have to cash all of them, resulting in a lot of interest loss. Time deposits, on the other hand, will have a one-time partial early withdrawal feature. And with the rest of the deposit, you can continue to enjoy the original annual interest rate.

For example, there is a time deposit of 100.000 dollars for a period of 3 years. If there is a sudden need for money, say $30.000. it is possible to withdraw $30.000 of the $100.000 deposit early. The $70.000 deposit that has not been withdrawn early will continue to enjoy a 3% annual interest rate. And the same 3-year $100.000 if it is a savings bond. A year later, we suddenly need 30.000 yuan, but we can not just withdraw 30.000 yuan early, but only the entire 100.000 yuan early.

Of course, this issue is also very well hijacked. To address the shortcomings of savings-type treasury bonds that cannot be partially redeemed in advance, it is possible to purchase larger amounts of money in installments. Knowing that the starting point for the purchase of savings bonds is $1.000. it is easy to purchase large amounts of money in separate installments. Of course, there is no need to break down the amount too small for ease of management.

For example, the same $100.000 savings bond does not have to be purchased entirely at once. Instead, it can be purchased in three installments, and the amounts can be $50.000. $30.000. and $20.000. respectively. In this way, when you are in urgent need of money, you can redeem different amounts of savings bonds in advance according to the size of the amount, thus balancing profitability and liquidity.

Overall, whether an investor chooses savings bonds or time deposits depends on his or her risk appetite, liquidity needs, and current market conditions. If an investor prefers conservative investment and wants to reduce risk, then savings bonds may be a more suitable choice, as they are generally considered safer investment instruments with higher credit quality and stable interest returns.

Early Payment Rules for Savings Bonds

|

Characteristics

|

Early payment rules

|

|

Payment Terms

|

Request early redemption based on specified conditions or terms. |

|

Payment Fee

|

Early encashment fees or interest penalties may apply. |

|

Application for redemption

|

A written application must be made to the issuer or designated financial institution. |

How to Buy Savings and Treasury Bonds

As an investment and financial product facing ordinary people, it is also very convenient to purchase. For example, you can go to the counter of the issuing bank to buy certificated savings-type Treasury bonds. Electronic savings bonds are even more convenient; as long as you log in to the mobile banking app, you will be able to buy them.

Of course, before purchasing, investors also need to understand the market situation of Treasury bonds in their countries, including the different types of Treasury bonds available, interest rates, maturity dates, and other information. Then choose a suitable Treasury bond product according to your investment objectives and needs. Different countries may have different types of Treasury bonds, including long-term, short-term, fixed-rate, floating-rate, and so on.

The other thing you need to be aware of if you buy electronic savings-type Treasury bonds is that you need to have a bond account. This can be done at a bank, or you can open an investment account with a Securities firm or broker. Anyway, as long as you can make sure that the account supports the transaction of purchasing Treasury bonds, you are good to go.

Once you have an account, you can buy them directly, and certain governments may allow the purchase of Treasury bonds directly from their official website or bond issuer, such as the United States. In China, on the other hand, you can go to a bank to buy them. Of course, it is important to know which banks issue these bonds. Nowadays, there are 40 banks in China where you can buy savings treasury bonds, so basically, you can't go wrong with China, agriculture, industry, and construction to find a bigger bank, and it will have a higher quota, making it easier to buy.

Once purchased, the number and details of treasury bonds held will be reflected in the investment account. You can manage your holdings according to the maturity date of the bond and the interest rate yield, including checking interest payments and whether to renew your holdings after maturity. If it is in certificated form, you need to keep it carefully. Although it is possible to lose it, it is more troublesome after all.

Savings treasury bonds are highly favored by investors as a safe and sound investment option, and their safety, stability, and higher interest rate returns make them an ideal choice for ordinary investors. Finally, before finalizing your purchase, it is advisable to read the relevant terms and conditions carefully and make an informed decision based on your investment objectives and risk tolerance.

Are savings bonds risky?

|

Risk Type

|

Brief Description.

|

|

Interest rate risk

|

Treasury returns may be less attractive if market interest rates rise. |

|

Inflation Risk

|

Purchasing power may decline if inflation is higher than Treasury rates. |

|

Early redemption limits

|

Early redemptions may face additional fees or interest losses. |

|

Liquidity Risk

|

Investors might face difficulty selling bonds or may sell at a discount. |

|

Credit default risk

|

Government Treasury bonds usually don't carry credit default risk. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.