Many investors shy away from finance-related information, particularly dense financial statements filled with numbers that can be intimidating. Yet, understanding a business's assets, liabilities, operating profits, losses, and cash flow is crucial for making informed investment decisions. Wise investors recognize the importance of analyzing financial statements to identify promising investment opportunities and steer clear of risky enterprises. This article provides an overview of financial statement composition and general techniques for analysis. What are Financial Statements?

What are Financial Statements?

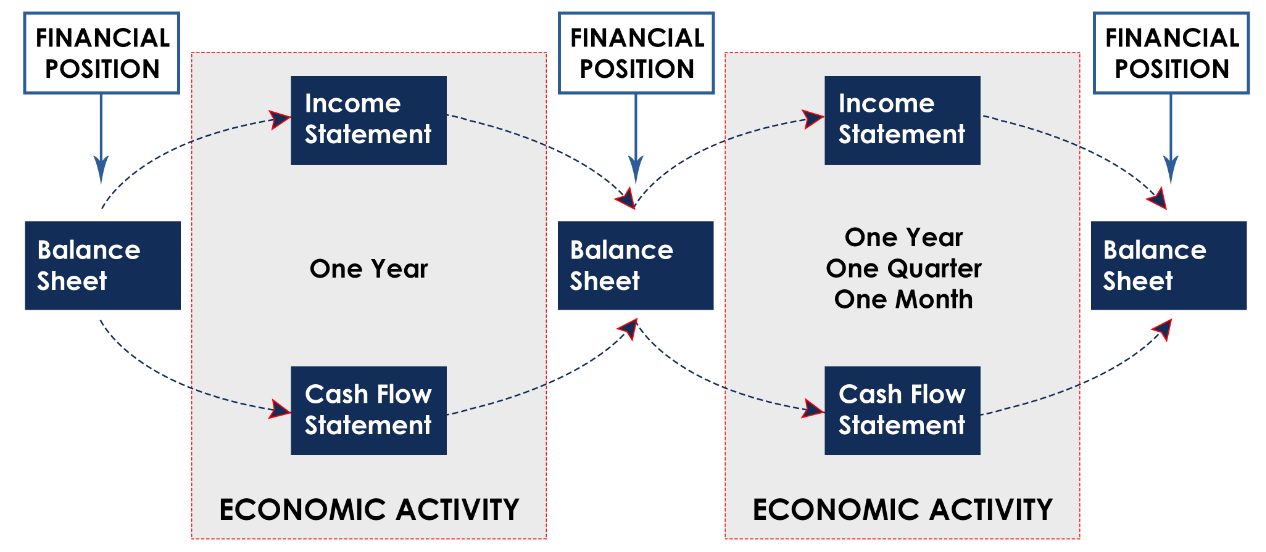

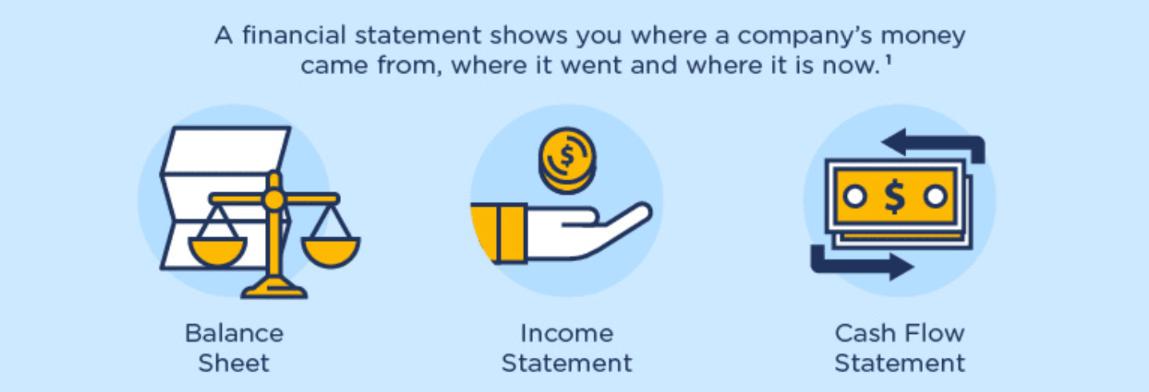

It is a document prepared by a business to reflect its financial position and results of operations over a specific period of time. It provides important information about an enterprise's financial activities, including the status of assets and liabilities, profitability, and cash flow, and provides a basis for investors, management, creditors, and other stakeholders to assess the health of the enterprise and its future development trends.

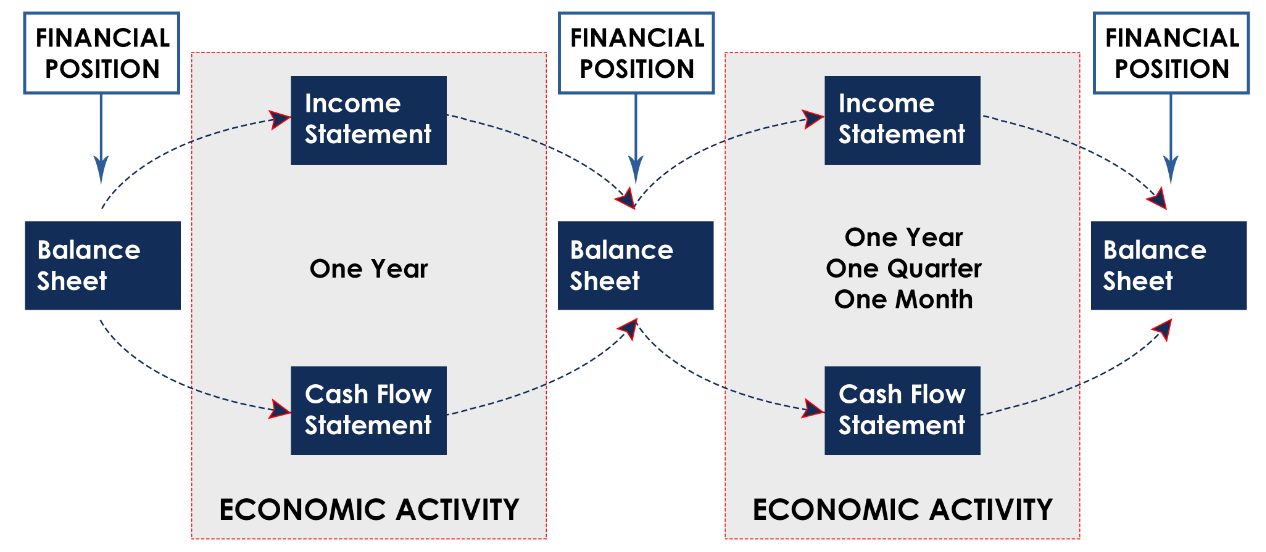

In China, listed companies are required to publish financial reports four times a year, with quarterly reports to be published by the end of April, half-yearly reports by the end of August, three-quarterly reports by the end of October, and last year's annual report by the end of April of the following year. Moreover, last year's annual report must be disclosed earlier than the following year's quarterly report.

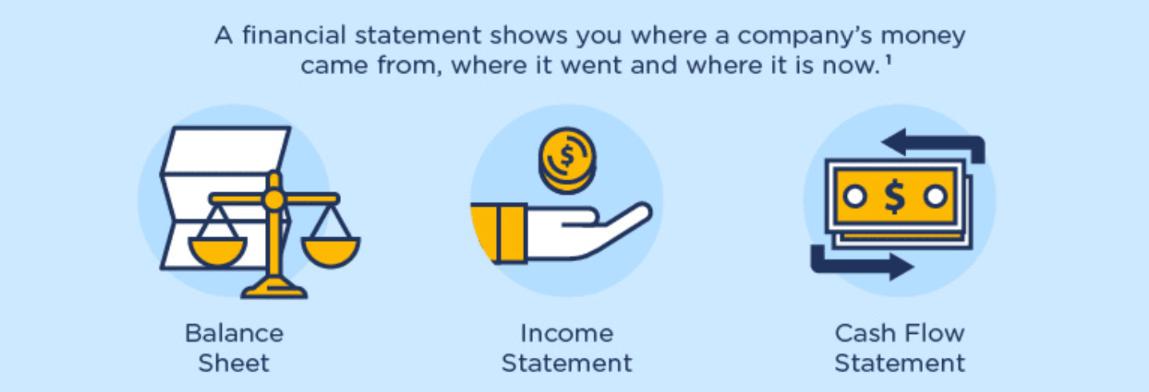

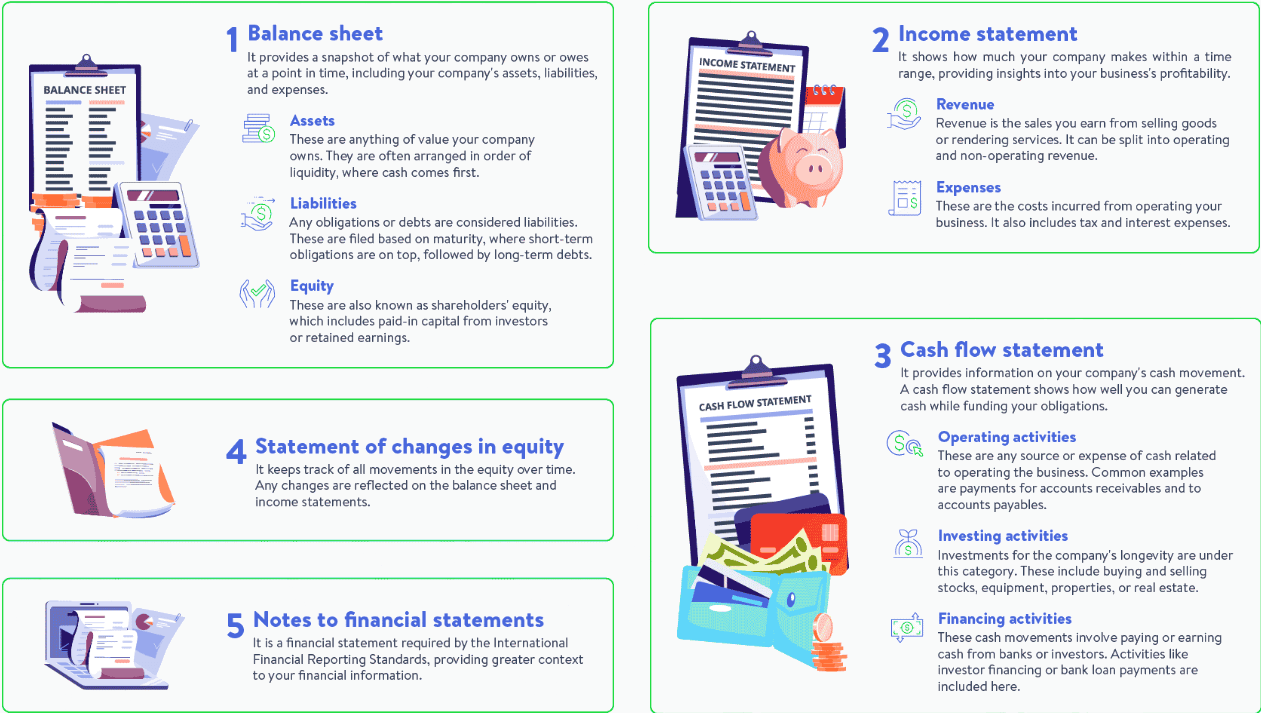

Regarding the scope of the financial report, both the annual report and quarterly report contain at least three statements: the balance sheet, income statement, and cash flow statement, which are commonly known as the three major statements. Each of these statements requires a parent company statement and a consolidated statement. The consolidated statement is a statement that considers the head office and all subsidiaries of the listed company as one entity, so it is also the part that shareholders of the listed company and potential investors focus on.

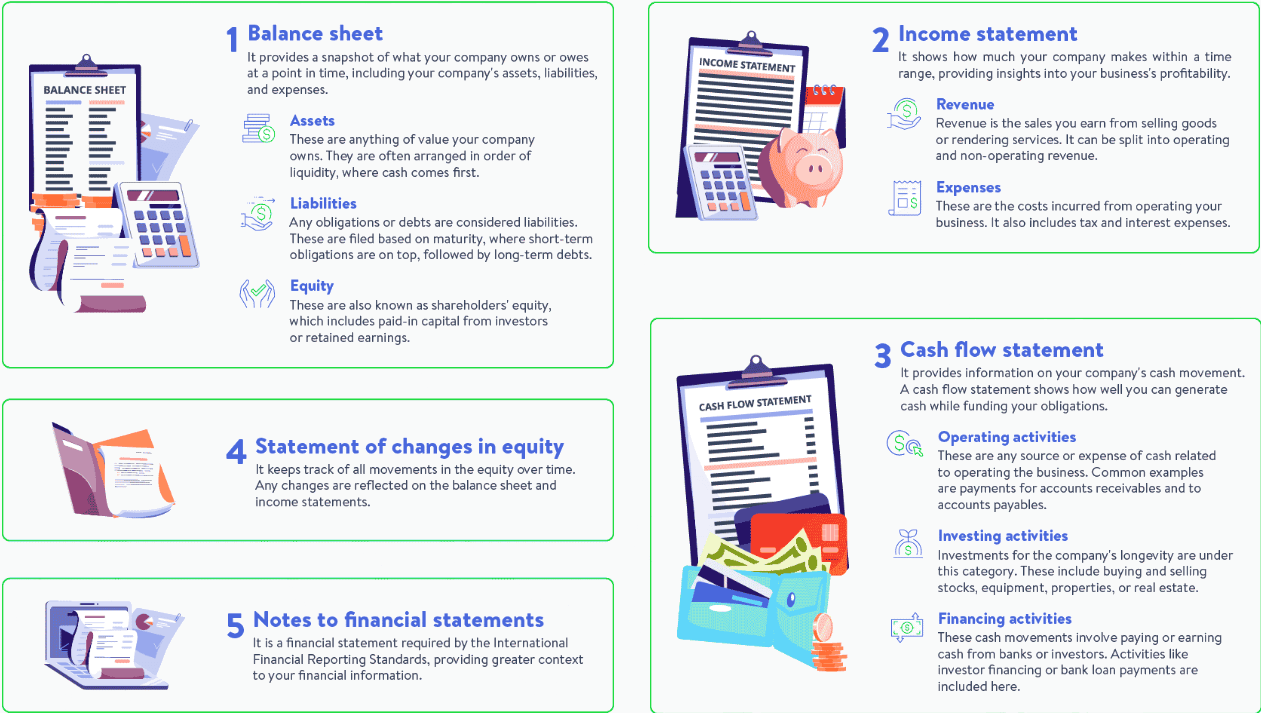

The framework of the balance sheet can be simplified into two main parts. On the right side are liabilities and stockholders' equity, which record the sources of the company's money. On the left are assets, which record where the company's money is going. The money received is liabilities, and the money put in by shareholders is shareholders' equity. Together, this money becomes plant and equipment, financial products, and so on—the company's assets.

The balance sheet follows the first horizontal equation of accounting: assets equal liabilities plus shareholders' equity. Assets are the resources owned by the company or the economic resources to which it has rights externally; liabilities are the debts or obligations assumed by the company externally; and shareholders' equity (net assets) represents the portion of the company's owner's equity in the company's net assets.

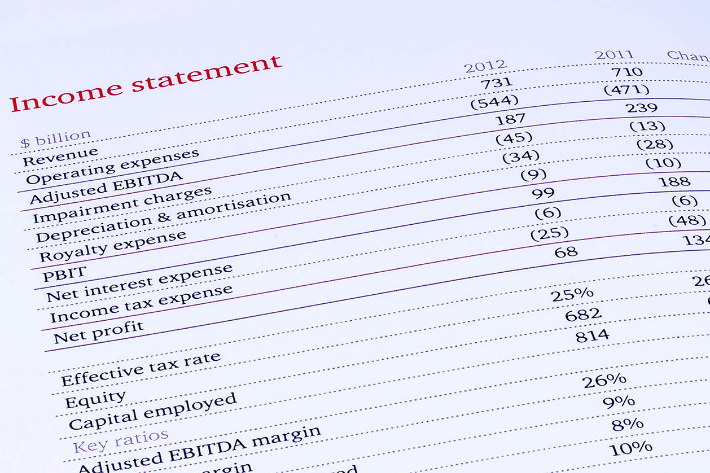

The income statement, also called the profit and loss statement, is framed as a series of additions and subtractions. It shows the revenues and expenses for a certain period of time to calculate the net profit of the company. The income statement is prepared in accordance with the full-accrual basis, also called the accrual basis, which means that revenues and expenses are recorded on the income statement either before or after they actually occur, depending on the business activity that occurs.

For example, Company A pays $1 million for a truck and expects the vehicle to last five years. Under the full-accrual basis of accounting, the $1 million that Company A has now paid out for the vehicle is spread out over the five years as Company A's expenses rather than being fully expensed in the current year.

Precisely because the income statement is on an accrual basis, a company may record revenues and expenses on its income statement that are not actually received or paid, which provides the company with some flexibility but also increases the likelihood of errors or manipulation of the income statement. As a result, the income statement is one of the most manipulative or misleading parts of the financial report.

The cash flow statement is a record of the changes in cash and cash equivalents during the reporting period, and activities involving cash are categorized into three main groups: operating activities, investing activities, and financing activities. In addition, if the enterprise has foreign currency cash inflows and outflows or has foreign subsidiaries, it also needs to exchange rate fluctuations on cash and cash equivalents caused by the impact of a separate list.

These three kinds of financial statements are indispensable because the figures in them are all interrelated, and each kind of financial statement can bring different information for investors. It is important to know that the company's income does not represent the whole picture; only understanding the company's assets and liabilities and cash flow can correctly determine the company's financial position.

For example, ABC Company sells $5.000 of goods to a customer who does not have to pay the money back immediately but can pay it back after 30 days. Although the money is not yet in hand, the value of the goods sold by ABC is recorded directly in the income statement, showing that the company's income will increase by $5.000.

And in the balance sheet, it will be recorded that the $5.000 is in the assets section because the customer will pay it back sooner or later, so the money owed is an asset. And in the cash flow statement, it shows a cash outflow of $5.000 because the accounts that have not yet been collected will reduce the company's cash, leaving the company with less money to carry out its operations.

In addition to these three major statements, there is also a statement of changes in stockholders' equity. It shows the changes in the company's shareholders' equity, including investor contributions, the distribution of surplus profits, and so on. There are also notes to the financial statements, which are used to provide additional information such as the basis of statement preparation, accounting policies, significant accounting estimates, etc.

In the investment field, financial statements are one of the key tools for investors to understand the operating conditions of a company and to assess the value of their investment. Through in-depth analysis of the income statement, balance sheet, and cash flow statement, investors can gain insight into the profitability, financial stability, and future growth potential of a company.

Preparation of Financial Statements

Preparation of Financial Statements

It is an important tool for a company to provide investors and other stakeholders with information about its financial position and performance. It's not only the report card of the company but also the language of the company. The process of preparing financial statements can be used to understand the company's earnings process, flow of funds, and financial health.

Those who share in the fruits of the company's profitability in the stock idea become shareholders, and the wealth of the shareholders is known as shareholders' equity. A company starts off by raising capital, and at that point, the money will only come from two places. One is borrowed from others, and the other is from the shareholders themselves. The money borrowed from others is called liabilities, and the money contributed by the shareholders themselves is called shareholders' equity.

And when the company gets both the money from liabilities and shareholders' equity, in order to make money, it will provide services or produce goods. So the money will be used to buy machinery, plants, equipment, or to keep cash in the company's operations—items called assets. Because assets must all be available for the company's use, assets must equal liabilities plus stockholders' equity.

The liabilities and equity in the right half of the balance sheet are the company's financing channels, representing where the company gets its money. The assets in the left half of the balance sheet are the company's investment pipeline, representing where the company's money goes. Because the money raised by the company must show where it is spent, the amounts on the left and right sides of the balance sheet must be consistent.

Of course, in a specific balance sheet, they are broken down into current assets, fixed assets, current liabilities, fixed liabilities, and shareholders' equity. There are many accounting items inside. In short, the balance sheet is a table that shows how the funds raised by a company have been utilized.

The balance sheet is an important tool to reflect the financial position of a company at a particular point in time. It lists the two major parts of a business, assets and liabilities, in correspondence and calculates net assets, or equity. Net assets represent the equity of the owners of the business, also known as net worth or shareholders' equity.

The net worth of a business is actually the value of the business, as it indicates the value of the remaining assets that would go to the shareholders if the business were to be liquidated at that point in time, i.e., net assets. Thus, the net worth portion of the balance sheet can be used to measure the worth or net worth of the business.

The statement that records whether the company has made money or not is known as the profit and loss statement, also known as the income statement or statement of income. It is a financial statement that reflects the income and expenses of a business over a specific period of time, showing the revenue from sales, costs and expenses, and the net profit or net loss of the business. There are many accounting entries in it, such as sales revenue, cost of sales, overhead, depreciation expense, interest expense, corporate taxes, etc.

A corporation is a company that is owned by all shareholders and is able to pay dividends to each shareholder from the net profits earned, which are the dividends received when investing in stocks. The money left over after the final dividend distribution goes back to the balance sheet under shareholders' equity, allowing the company to keep the money for reinvestment, which is commonly known as retained earnings.

The main purpose of the income statement is to measure the business performance of a company over a specific period of time, from which it can be clearly seen from which sources the company has received its income, as well as the size and structure of these incomes. At the same time, the income statement also lists the various costs and expenses incurred by the business during the period, including the cost of goods sold, administrative expenses, interest expenses, etc.

Ultimately, net profit (or net loss) is the key indicator of the income statement, which represents the level of profitability of the company during the period. As such, the income statement provides a comprehensive assessment of a company's operating performance, directly reflecting where the company makes its money and how much it makes, so net income can be considered a company's "salary" for a given period, i.e., the revenue generated by its operating activities.

Understanding the Components and Important of the Cash Flow Statement

Raising money is recorded on the right half of the balance sheet; investing in business is recorded on the left half of the balance sheet; and starting to make money is recorded on the income statement. The cash flow statement, on the other hand, is the lubricant of this company's operating process, recording cash transactions that are not seen on the other two statements.

A company's operations must involve cash transactions. Cash is paid to buy machinery, cash is received to sell merchandise, and cash is paid for incentives and interest. Direct cash transactions are called cash flows, and whenever a company has cash flows, they are recorded in the statement of cash flows. It consists of three major components: operating cash flow, investing cash flow, and financing cash flow.

The income statement records the revenues and expenses of a company for a specific accounting period, the difference between revenues and costs, or net income. Most income statement items are reflected in the operating cash flow section of the cash flow statement when cash transactions occur. Examples include cash receipts generated from the sale of goods or the provision of services, cash expenses paid to suppliers and employees, and so on.

The left half of the balance sheet primarily records the assets of the business, including current assets and fixed assets, which are used to support the business's operating activities and investments. When a business engages in investment activities, such as purchasing equipment, acquiring other companies, or making long-term investments, these activities generate cash flows.

The cash flows from these investing activities are reflected in the investing cash flows section of the statement of cash flows. Investing cash flows record the cash flows that a business uses to purchase and sell long-term assets and to conduct other investing activities. As a result, the investing line item on the balance sheet is directly related to investing cash flows and reflects the magnitude and impact of the investing activities undertaken by the business during a given period.

The right half of the balance sheet primarily records the liabilities and shareholders' equity of the business, including debt and equity. These liabilities and shareholders' equity are sources of external financing for the enterprise to support its operations and investment activities.

When a business engages in financing activities, such as issuing bonds, borrowing money from banks, or issuing stock, these activities generate cash flows. The cash flows from these financing activities are reflected in the financing cash flows section of the statement of cash flows. Financing cash flows record the cash flows generated by a business from obtaining funds from creditors and shareholders, as well as repaying debt and paying dividends.

The ultimate purpose of the statement of cash flows is to count the ending cash balance and compare it with the beginning cash balance to see the net increase or decrease in the business's cash. If the closing cash balance is higher than the opening cash balance, it means that the business's cash inflows during the period were positive. If the ending cash balance is lower than the beginning cash balance, it means that the business had a negative cash outflow during the period. And the ending balance ends up back in the cash line on the balance sheet, ensuring that the balance sheet is consistent with the cash flow statement.

A cash flow statement is a measure of a company's money flow. It provides a clear picture of a company's cash flow over a period of time through operating, investing, and financing cash flows. As the lifeblood of a company's operations, it is an important part of analyzing whether the company has enough cash to nourish the company's operating processes.

In fact, knowing the process of preparing the financial statements and what exactly constitutes them, I believe that investors will be able to understand the financial health of the company, its ability to manage its funds, and its future growth prospects. However, to quickly digest the information it contains, certain analytical methods are needed.

Financial Statement Analysis

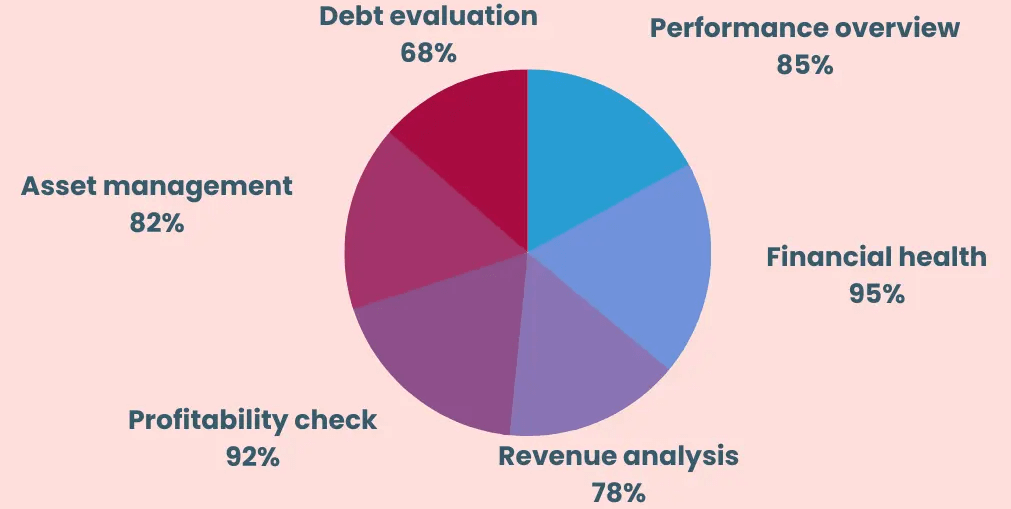

Financial statement analysis is a crucial part of an investor's stock investment. By scrutinizing a company's financial statements, investors can better understand the company's financial condition, profitability, and growth potential so that they can make informed investment decisions.

In a balance sheet, assets represent the resources owned by the company, liabilities represent the money the company owes to others, and stockholders' equity represents the equity of the company's shareholders. The balance sheet allows you to calculate the net worth of the company and thus assess the value and financial soundness of the company.

In the income statement, focus on the company's net profit, where a positive net profit indicates a profit and a negative net profit indicates a loss. By analyzing indicators such as gross profit margin, net profit margin, and earnings growth rate, you can get a more complete picture of the company's profitability and growth potential.

In the statement of cash flows, analyzing cash flows from operating, investing, and financing activities can help assess the company's cash flow position and financing ability. Finally, the statement of changes in shareholders' equity can provide an understanding of the shareholders' investment in the company as well as the company's profit and loss.

And in addition to focusing on the amount of cash flows in the statement of cash flows, attention should also be paid to the quality of cash flows. For example, by analyzing the cash flow from operating activities and free cash flow in the cash flow statement, one can assess the quality of the company's earnings and its cash management ability.

When analyzing financial reports, investors can also compare the financial indicators of the target company with those of other companies in the same industry, so that they can then assess the company's position and competitive advantage in the industry. Comparative indicators include profitability, financial soundness, and market share.

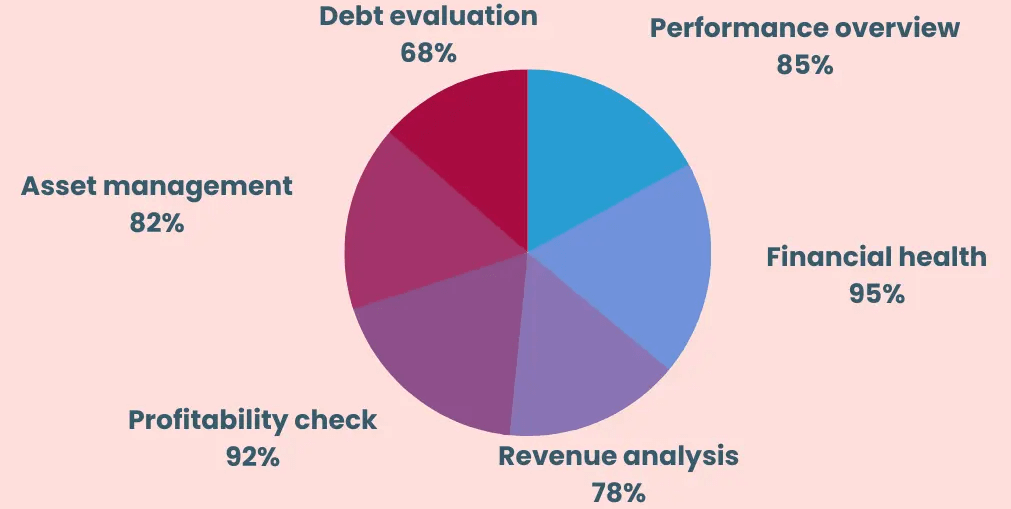

It is also possible to observe changes in the trend of the company's financial report data, such as net profit, operating income, cash flow, etc. This can help investors understand the dynamics of the company's development and long-term trends so that they can better assess the company's potential and risks. Various financial ratios can also be utilized to make an in-depth assessment of the company, including indicators such as profitability, solvency, asset management efficiency, and market valuation.

There are four of these metrics that investors can focus on: return on net assets, gross profit margin, operating income, and net profit before deductions. These ratios can provide more detailed information about a company's financial position and help investors determine whether the listed company they are following is worth following or not.

Return on net assets indicates the return a company can earn per unit of capital invested, while gross profit margin reflects a company's product competitiveness and profitability. Companies that have maintained a return on net assets of more than 10% for three consecutive years and a higher gross profit margin usually have better profitability and market position.

And two indicators, operating income and net profit before deductions, can help assess a company's growth and profitability. Companies that maintain a growth rate of 20% or more for three consecutive years often have good growth prospects.

Then you can also go observe the company's financial expenses, especially the ratio of short-term borrowing to long-term borrowing. Low financial expenses indicate that the company's financial position is relatively sound, which helps to reduce investment risks. And analyze the company's receivables and payables. Companies with higher accounts receivable than accounts payable usually have stronger capital utilization and supply chain advantages, which are conducive to maintaining stable business activities.

Through the above analysis, investors can assess the company's financial position and potential more comprehensively, providing an important reference for investment decisions. However, it should be emphasized that financial statement analysis is only part of the investment decision; investors also need to consider other factors such as industry outlook, management team, etc., in order to achieve long-term investment objectives.

How to read financial statements

|

Context

|

Assets

|

Liabilities

|

Shareholders' Equity

|

| liquidity |

Current Assets Ratio |

Current Liability Ratio |

Equity Ratio |

|

Capital Structure

|

Debt Ratio |

Leverage Ratio |

Equity structure ratio |

|

Solvency

|

Solvency Ratio |

Interest Coverage Multiple |

|

|

Profitability

|

Gross Profit Ratio |

Net Profit Ratio |

Return on equity |

|

Operating Efficiency

|

Accounts Receivable Turnover Ratio |

Inventory Turnover Ratio |

Asset Turnover Ratio |

|

Cash Flow

|

Cash Flow Ratio |

Cash Flow from Operating Activities |

|

|

Growth

|

Sales Growth Rate |

Net Profit Growth Rate |

Equity Growth Rate |

|

Valuation

|

P/E Ratio |

Price to Net Ratio |

dividend yield |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What are Financial Statements?

What are Financial Statements? Preparation of Financial Statements

Preparation of Financial Statements