Investing in the stock market has traditionally been seen as one of the most effective ways to build long-term wealth. While it may seem complex at first, with the right knowledge and strategy, even beginners can confidently participate and succeed.

In this guide, you'll learn how to get started, understand key concepts, avoid common pitfalls, and grow your money through the stock market.

Understanding the Basics of Stock Market Investing

The stock market is a platform where shares of publicly traded companies are bought and sold. When you invest in a stock, you're essentially purchasing a small ownership stake in a company.

If the company performs well, the value of your shares may increase, and you might receive dividends—payments distributed from profits.

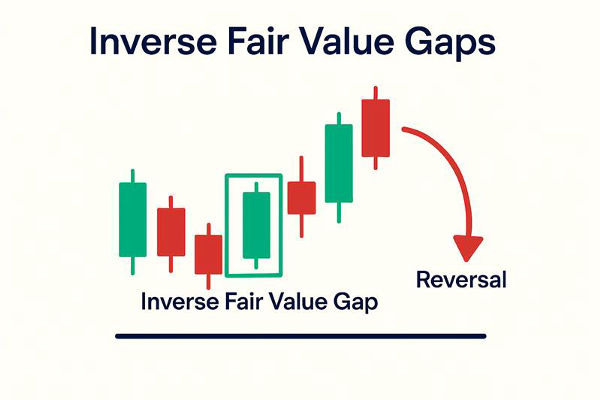

Supply and demand influence the stock market. For example, when there are more buyers than sellers for a stock, the price rises. Conversely, if more want to sell, the price drops. Understanding this dynamic is critical for making sound investment decisions.

Why Invest in the Stock Market?

One of the main reasons people invest in the stock market is the potential for higher returns compared to other forms of savings, such as fixed deposits or savings accounts. Historically, the stock market has outperformed many asset classes over the long term.

It also offers investors the ability to diversify their portfolio, protect against inflation, and participate in the growth of industries and companies they believe in. In contrast to speculative endeavours, long-term stock investment is based on economic expansion and the fundamentals of business.

How to Invest in the Stock Market as a Beginner: Step-by-Step Guide

1) Selecting a Reputable Broker

Starting your stock market journey doesn't require a large amount of money. Many brokers now allow you to open an account with just a small deposit. The first step is choosing a reputable broker that offers a user-friendly platform, transparent fees, and access to the markets you're interested in.

After opening and funding your brokerage account, you can start exploring stock options. Focus on companies you understand and believe in. It's wise to invest in sectors you are familiar with, as this facilitates improved analysis and risk evaluation.

2) Setting Clear Investment Goals

Before making your first stock purchase, take time to define your investment goals. Ask yourself what you hope to achieve—are you saving for retirement, a home, education, or simply building wealth over time?

Having a clear goal will help you determine your risk tolerance, investment horizon, and the types of stocks or funds that suit your needs. For long-term goals, you can afford to take on more risk and ride out market fluctuations. For short-term goals, a conservative approach may be better.

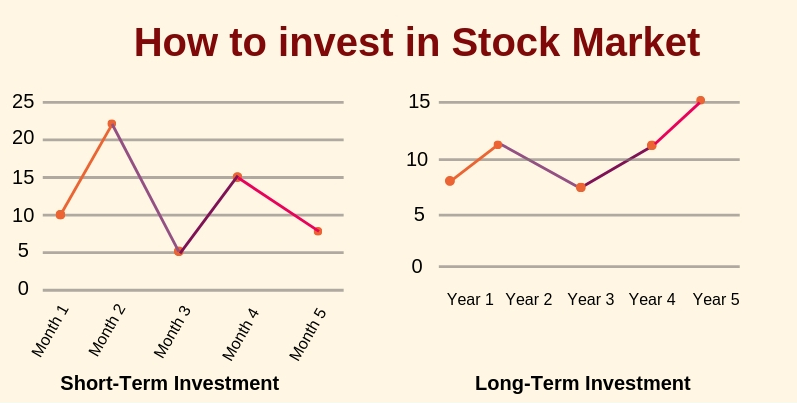

3) Choosing Between Long-Term Investing and Short-Term Trading

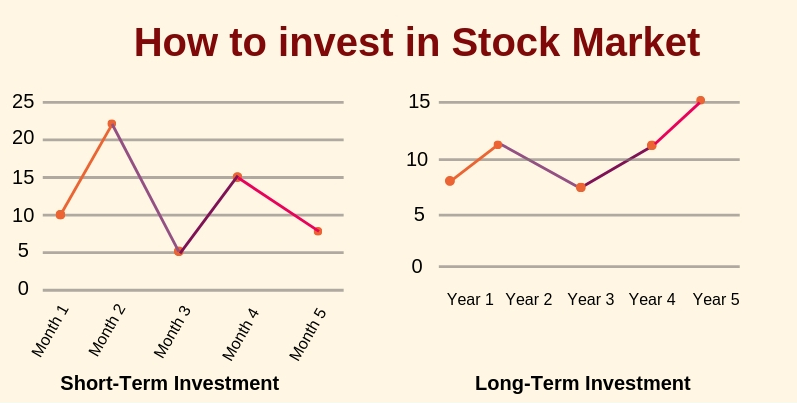

Many beginners confuse investing with trading. Investing typically refers to buying stocks with the intention of holding them for years, benefiting from the company's growth and compounding returns. This strategy is more aligned with wealth-building.

Short-term trading involves buying and selling stocks frequently, often trying to profit from price movements within days or even minutes. While it can be lucrative, it's riskier, requires more knowledge, and results in higher transaction costs.

For most beginners, long-term investing offers a more stable and rewarding path.

4) Researching Stocks Before Investing

Thorough research is vital. Begin by examining a company's financial data, including its revenue, profits, liabilities, and cash flow. Read annual reports and earnings announcements. Pay attention to industry trends, competitors, and regulatory environments.

You should also evaluate management's reputation and long-term vision. Numerous prosperous investors, including Warren Buffett, place significant emphasis on the calibre of the company's management and the competitive advantage of the enterprise.

For your convenience, here's a directory of the stocks we recommend for beginners.

5) Diversification: Don't Put All Your Eggs in One Basket

Diversification means spreading your investments across different companies, sectors, and even asset classes to reduce risk. If one stock or industry underperforms, gains in other areas may offset the losses.

For beginners, it's a good idea to start with a small, diversified portfolio that includes a mix of stocks from different industries such as technology, healthcare, finance, and consumer goods.

You can also consider investing in Exchange-Traded Funds (ETFs), which offer instant diversification by holding multiple stocks in one fund.

6) Understanding Market Risks

While investing offers the potential for high returns, it's not without risks. Market prices vary due to news, earnings updates, economic factors, and investor emotions. Stock prices may rise or fall, and there are no assurances of profits.

Typical risks involve company-specific factors, such as ineffective management or worsening performance, as well as wider threats including economic downturns, inflation, or geopolitical unrest.

However, history shows that over long periods, the stock market tends to recover from downturns and grow. The key is to stay invested and avoid panic-selling during temporary dips.

7) Learning the Importance of Dollar-Cost Averaging

One powerful investing strategy for beginners is dollar-cost averaging. It means investing a fixed amount of money at regular intervals, regardless of the stock's price. Over time, you buy more shares when prices are low and fewer when they're high, reducing the impact of market volatility.

This disciplined approach helps eliminate emotional decision-making and encourages long-term investing. It's useful during uncertain market periods when prices fluctuate frequently.

8) Be Mindful of Taxes and Fees

When you buy and sell stocks, you may be subject to capital gains taxes. The rate depends on how long you hold the investment—short-term gains (held less than a year) are usually taxed at a higher rate than long-term gains.

Brokerage fees also vary. Some brokers charge commission per trade, while others offer commission-free trading but may earn money through spreads or other services. Review the fee structure before committing.

Understanding these costs ensures you're not caught off guard and can factor them into your investment strategy.

9) Nurturing an Investment Mindset

Lastly, successful investing requires the right mindset. Many beginners make avoidable mistakes, such as chasing "hot stocks" based on hype, overtrading, or failing to do proper research.

Therefore, always keep this in mind: Markets will go through ups and downs, but your ability to stay focused and committed will determine your success.

Conclusion

In conclusion, investing in the stock market doesn't have to be overwhelming. By following a step-by-step method, setting clear objectives, and grasping essential principles, anyone can embark on their investment journey with assurance.

Start small, keep learning, stay consistent, and let time work its magic. The sooner you begin, the more you can benefit from compounding and market growth. In the words of Warren Buffett, "The best time to invest was yesterday. The next best time is today."

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.