In recent years, many globally renowned companies have chosen to implement a Stock Split. Although this move does not directly change the total market capitalization of the company, it reflects the company's confidence in its future development and has had a significant impact on the liquidity of the stock market and the level of investor participation. Today, we will delve into the concept of a stock split, its purpose, and the various implications it brings.

What does a stock split mean?

What does a stock split mean?

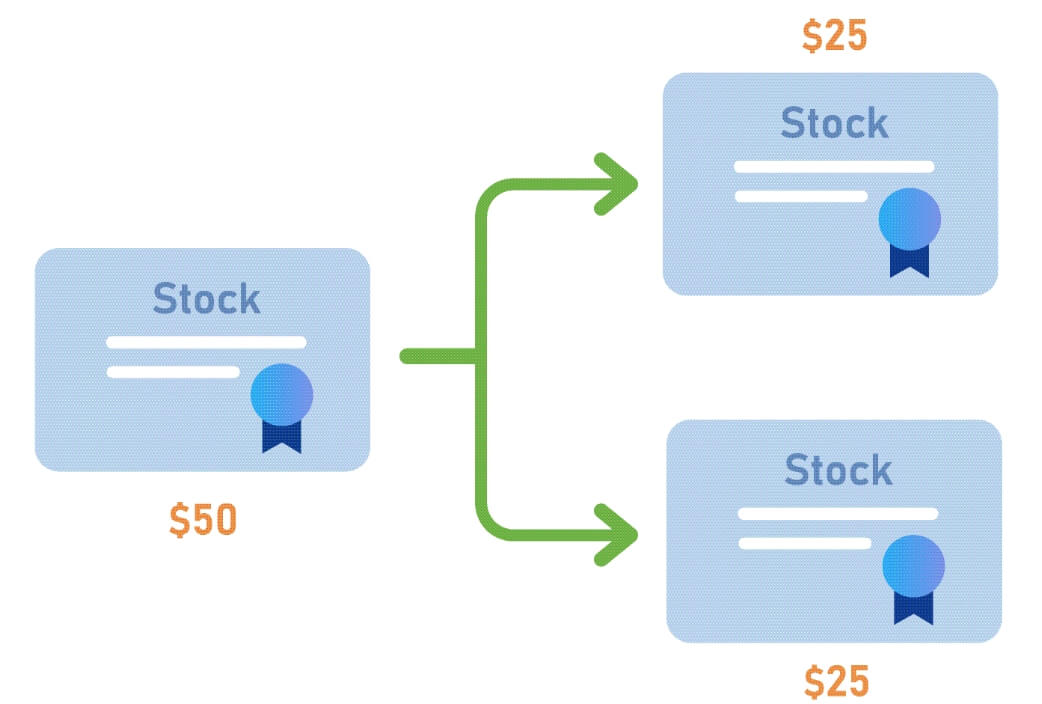

Also known as a stock split, it is a financial operation in which a company splits its existing stock into more shares in a certain ratio while keeping the total market capitalization intact. In short, a stock split is similar to splitting a large bill with a face value of $1.000 into ten smaller notes with a face value of $100.

In this way, a company is able to lower the market price per share, making the stock more affordable, thereby attracting more investors and increasing liquidity. Despite the lower price per share, the total number of shares held by shareholders increases, and the total market capitalization and the value of investors' assets remain the same.

In a stock split, although the par value per share is reduced and the number of shares held by investors increases, the total equity or total market capitalization remains the same. This is because the total equity equals the total market capitalization, i.e., the total number of shares multiplied by the par value per share, and the split only adjusts the ratio between the number of shares and the par value without changing the overall market capitalization of the company.

For example, before the split, the company had 1.000.000 shares with a par value of $10 per share and a total equity of $10.000.000. After a 1 for 2 split, the total number of shares increases to 2.000.000. the par value of each share decreases to $5. and the total equity after the split remains at $10.000.000. This shows that the total equity always remains the same, both before and after the split.

After the stock split, the total assets of the firm and the wealth of the shareholders remain unchanged, although the price per share decreases. This adjustment is mainly to enhance the tradability and attractiveness of the stock. As an example, Tesla conducted a 1:5 stock split in July 2020. splitting each share into 5 shares, reducing the share price to 1/5 of its original price.

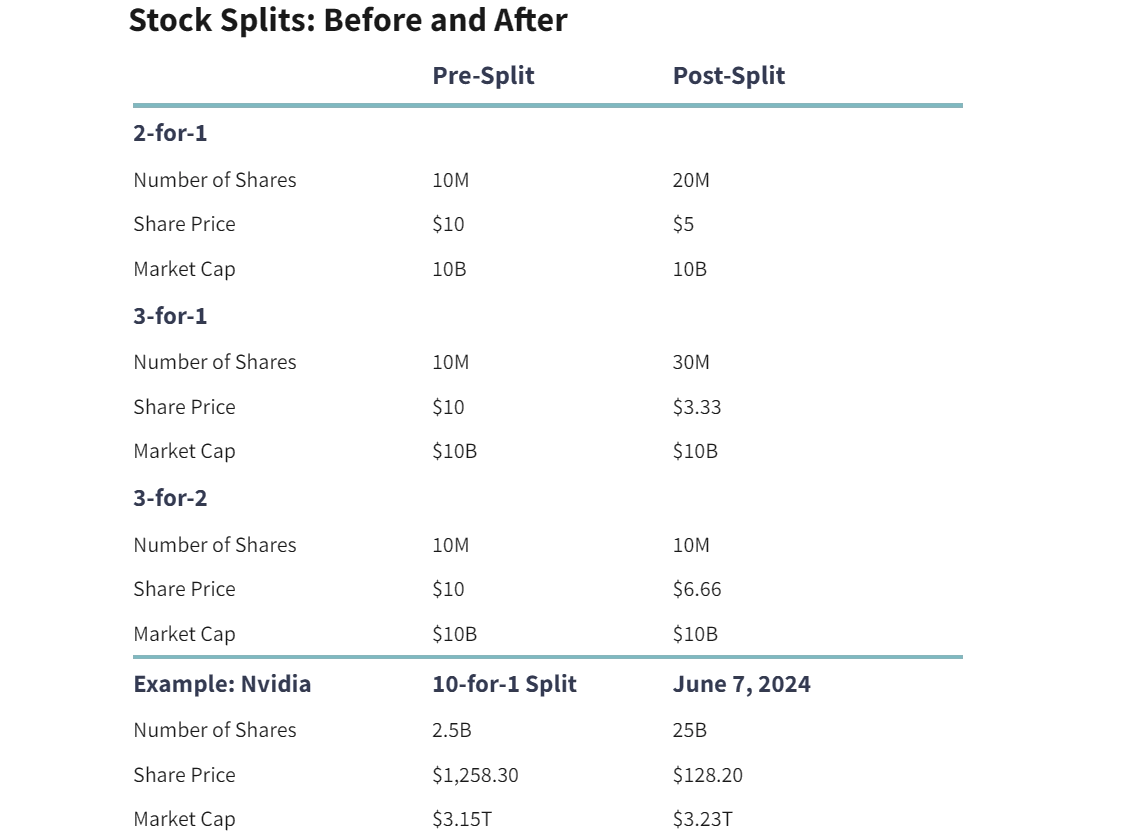

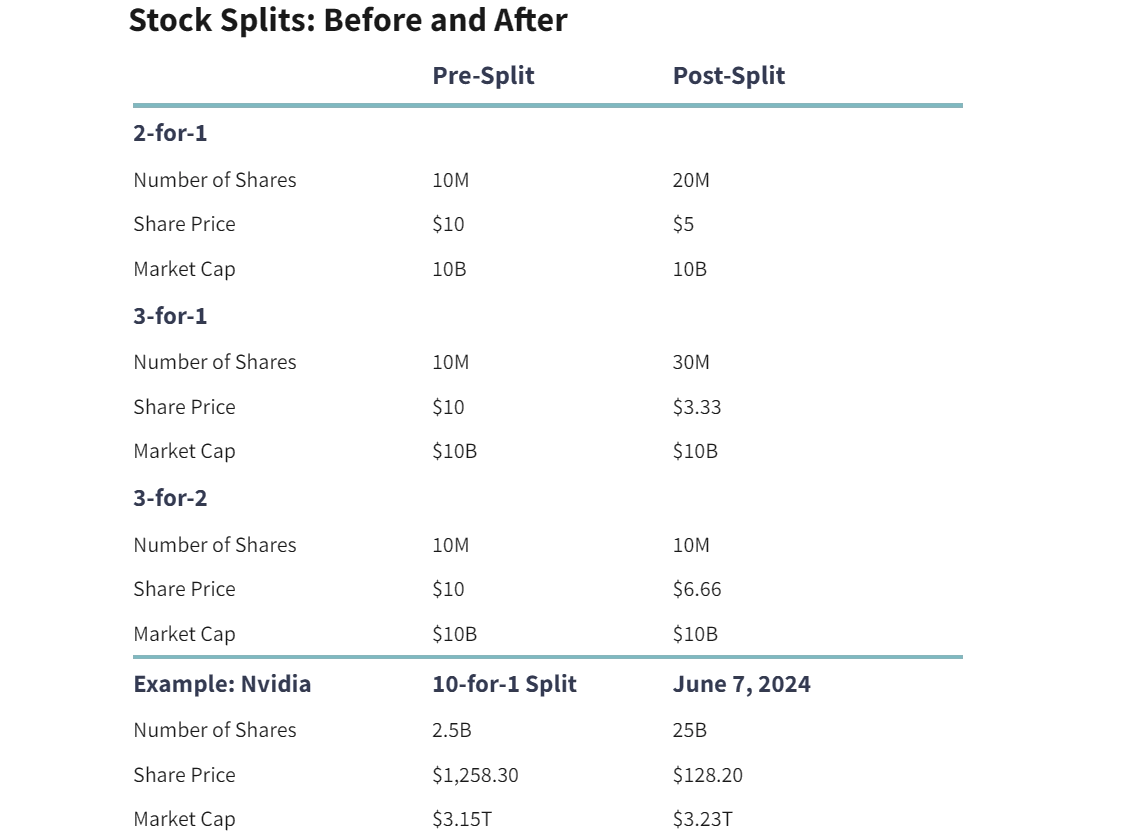

Stock splits are usually done in certain ratios, such as 2:1. 3:1. or 4:1. which indicate that a company is splitting its existing stock into more shares on a pro rata basis. The larger the split ratio, the greater the number of shares after the split, and the price per share will decrease accordingly. However, these changes do not affect the total value to the investor, as the total market capitalization remains the same.

In a 2:1 split, each 1 share of stock becomes 2 shares, and the price per share is reduced to 1/2 of its original value. thus doubling the number of shares. Similarly, in a 3:1 split, each 1 share would become 3 shares, and the price per share would be reduced to 1/3 of its original value.The number of shares would triple. Further, a 4:1 split would cause each 1 share to become 4 shares and the price per share to be reduced to 1/4 of the original price. tripling the number of shares.

For example, assuming a holding of 100 shares, if the company performs a 1-for-2 stock split, it will hold 200 shares, and the price per share will be reduced to $50 from the pre-split price of $100. Similarly, if the company performs a 1-for-3 stock split, 100 shares would become 300 shares, and the price per share would drop from $150 before the split to $50.

To calculate the number of shares after a stock split, multiply the number of shares before the split by the split ratio. For example, if you own 100 shares and do a 1 for 3 split, you will own 300 shares after the split. To calculate the price per share after the split, divide the price per share before the split by the split ratio. For example, if the pre-split price per share is $150 and the split ratio is 1 for 3. the post-split price per share will be $50.

In summary, stock splits alter the market performance of a stock primarily by adjusting the number of shares and the par value per share without directly altering the total owner's equity of the company. Such adjustments can make the stock easier to trade and attract more investors, thus enhancing market liquidity and attractiveness.

Why Stock Splits?

As you can see from the above article, the core idea behind stock splits is that by splitting a large pizza into more slices, the overall price stays the same even though the price of each slice is reduced. So what are the reasons companies choose to split their stock, and what are they trying to achieve by relying on stock splits?

Simply put, the essence of a stock split is to make a company's stock more tradeable and affordable by adjusting the total number of shares and the price per share. This operation is usually done when a company's stock price is high, as a high share price may make it unaffordable for small or retail investors. By splitting, the share price is lowered and the investment threshold is lowered.

For example, a stock priced at 30.000 yen would cost 3.000.000 yen if an investor wanted to buy 100 shares, which may be too expensive for most individual investors. Such a high share price may limit the participation of ordinary investors and reduce their willingness to invest. The share price may be reduced from ¥30.000 to ¥2.000 or ¥1.000 after the split, allowing more investors to purchase shares at a lower cost.

This adjustment not only improves the accessibility of the stock but also attracts more investors to the market and increases the trading activity of the stock. For example, Tesla underwent a 1:5 stock split in 2020. reducing its share price from $1.600 to $320. This move lowered the investment barrier, allowing more small investors to participate in the purchase, which in turn increased the market liquidity of the stock.

In addition, the stock split may attract more investors to the market, thereby increasing the number of shareholders in the company and further enhancing trading activity in the market. Stocks with high liquidity are easier to buy and sell, which helps to increase the market valuation of the stock and makes it possible for the company to access more advanced markets. Stocks with low liquidity may be at risk of being delisted, so companies usually use it to enhance the liquidity and market performance of their stock.

When a company carries out a stock split, it is usually because the share price has risen to a high level and the split reduces the share price to a more tradable range, which indicates that the company is optimistic about its future business prospects and expects the share price to continue to rise, thus boosting market confidence. It also usually occurs when a company's performance is favorable and its share price is rising, reflecting positive expectations of earnings growth and future development, further boosting market sentiment and investment confidence.

While a high share price usually reflects good company performance, a high share price may lead to trading inflexibility, such as high volatility or low trading frequency. Stock splits reduce price volatility, stabilize market movements, and enhance liquidity and trading activity by lowering share prices and making them more tradable.

Moreover, a lower share price can also facilitate a company to make new share offerings. Lower share prices make new issues more attractive, especially when companies need to raise capital for expansion or strategic acquisitions. Through stock splits, companies are able to issue new shares at more competitive prices to fund future expansion and investment.

Some index funds and institutional investors may exclude shares because they are overpriced. By performing a stock split, a company is able to lower the price of its stock to a more attractive level, which increases the likelihood that the stock will be included in more funds and indices. This adjustment makes the price of the split stock more in line with the investment criteria of institutional investors and index funds and therefore attracts the attention and investment of more institutional investors, thus expanding the company's investor base and market influence.

For companies implementing an employee share ownership plan, a lower share price can make it easier for employees to obtain company shares, thus enhancing the incentive effect. A lower share price lowers the threshold for employees to purchase shares, enabling them to participate in the company's share incentive scheme at a more affordable price. This not only helps to increase employee motivation and loyalty but also enhances the company's attractiveness to talented individuals, promoting long-term employee commitment and overall corporate development.

To summarize, the main purpose of a stock split is to lower the share price, increase the liquidity and affordability of the shares, increase market participation, and convey the company's confidence in its future development. Although splits do not directly affect a company's fundamentals, they may sometimes indirectly drive up the stock price by increasing investor motivation.

Impact of Stock Splits

Impact of Stock Splits

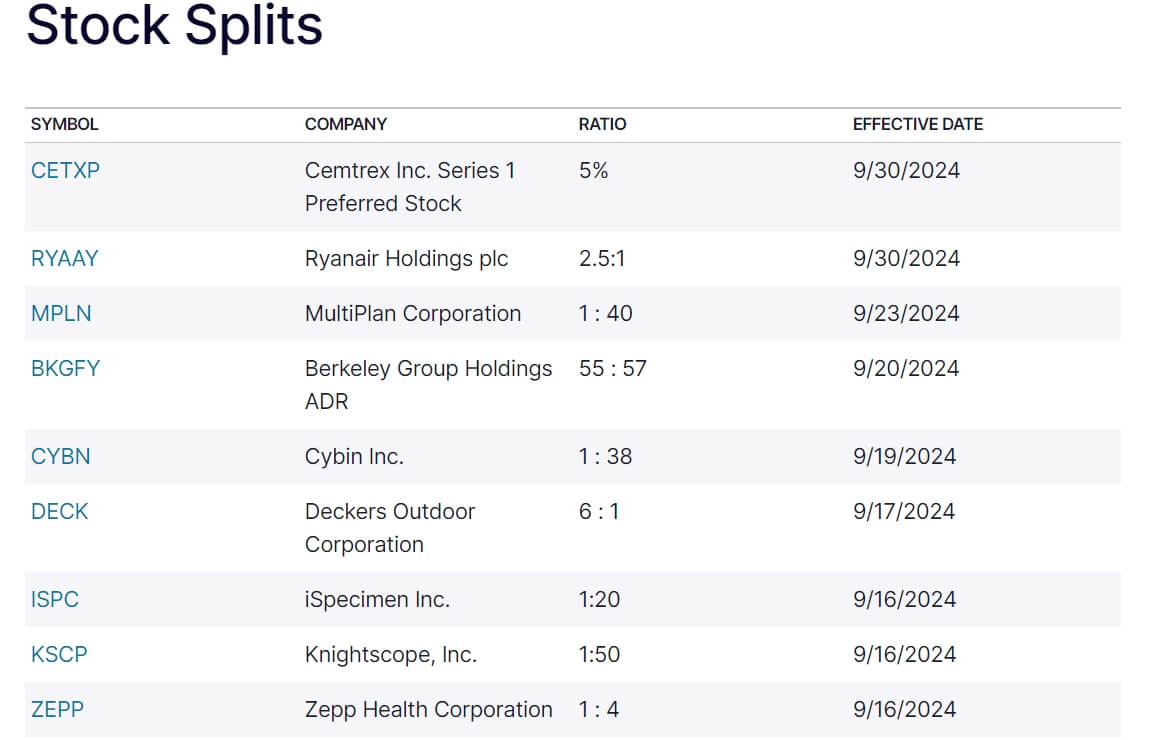

In general, financial markets usually react positively to stock splits. For example, after NBD announced its stock split, the stock price rose 4% at one point during the opening bell. This positive market reaction usually stems from the anticipatory psychology of investors, who generally believe that a stock split will enhance a company's market liquidity and attractiveness, thus driving up the stock price.

In terms of market psychology, the lower unit price of a stock after a stock split may be perceived by many investors as a cheaper stock, creating a greater desire to buy, which in turn drives increased trading volume. Particularly in certain markets, investors tend to be psychologically influenced by Stock Prices and perceive lower share prices as more attractive, making the spun-off shares more likely to be widely purchased.

As for liquidity, after a stock split, more investors are able to participate in trading at a lower price, thus enhancing the liquidity of the stock. Studies have shown that the trading volume of the split stock usually becomes more active and the overall participation in the market increases, which helps the company's stock to remain well liquid in the market.

For investors, the impact of stock splits can also be significant. First, for long-term investors, stock splits provide a more affordable investment opportunity. The lower share price after the split allows investors to invest with less money, especially for fixed investment strategies, and to buy shares with greater frequency, thereby accumulating more shares over time and helping to increase investment returns.

Secondly, it usually attracts more investors to participate in trading, which in turn increases market activity and trading volume. The lower share price after the split makes the stock affordable to more investors, which in turn triggers more buy and sell transactions and boosts the overall trading activity in the market.

And although the stock split itself does not change the intrinsic value of the stock, more trading and investor participation in the market may lead to increased volatility in the stock price. This increased volatility may bring about short-term market instability and have an impact on investors' short-term strategies and market sentiment.

In particular, for short-selling investors, a lower share price following a stock split means a lower price per share but a corresponding increase in the number of shares that need to be borrowed to short the stock. This is because the number of shares a short seller needs to borrow is based on the total number of shares in the split.

Although the stock price is lower, the spin-off does not change the cost structure of shorting, so the shorting investor's costs are not improved by the stock split. The shorting investor cannot profit from the split because the total value of the borrowed shares remains the same; the split simply adjusts the price per share and the volume ratio.

A stock split will not change the company's dividend return, but the dividend received per share will be adjusted in proportion to the split. For example, if a company pays a $1 per share dividend before the split, the dividend per share will be adjusted to $0.50 after a 2-for-1 split and $0.33 after a 3-for-1 split. Despite the decrease in the amount of dividend per share, the number of shares held by the investor increases, thus maintaining the stability of the total dividend income.

The impact of stock splits on options is reflected in the adjustment of option contracts. Specifically, if you hold an option contract that originally covered 100 shares of stock, the number of shares in the contract and the strike price are adjusted accordingly after the split. For example, in the case of a 2:1 split, the option contract will become one that covers 200 shares of stock, while the strike price will be adjusted to $15 from the original $30. Such an adjustment ensures that the total value of the option remains the same before and after the split, even though the price per share and the number of shares in the contract have changed.

Stock splits can have an impact on stock charts, which usually manifests itself in the form of an artifact of a sudden drop in the share price on the stock chart. This is because of the relative reduction in the share price after the split, and the originally high share price will look like a sudden and sharp drop on the chart. To avoid misleading investors, trading platforms usually adjust historical data.

For example, in the case of a 2:1 split, the platform will divide the pre-split share price by 2. This adjusts the historical share price data to ensure that the charts show consistent share price movements, enabling investors to accurately analyze the long-term performance of the stock.

In summary, a stock split is a corporate action that keeps the stock price within an appropriate range, increases market liquidity, and potentially attracts more investors. Split stock prices are easier to buy and sell and may not only have a positive impact on the stock price in the short term but also enhance the tradability of the stock, increase market activity, and favor long-term investor holdings and trading.

The Concept, Purpose and Impact of Stock Splits

| Concept |

Purpose |

Impact |

| Increase shares, decrease price. |

Increase trading volume of shares |

Increase liquidity and lower trading barriers. |

| No change in total market cap. |

Lower the share price to increase affordability. |

Attract investors and boost market activity. |

| Adjust dividend proportionally. |

Keep total dividend payments constant. |

Dividend per share drops; total income stays. |

|

Boost the company's market attractiveness. |

Adjust shares and the strike price in the option. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does a stock split mean?

What does a stock split mean?

Impact of Stock Splits

Impact of Stock Splits