In recent years, with the rapid development of artificial intelligence technology, the global technology stock market has shown strong growth momentum, especially in the chip industry. NVIDIA (NVIDIA), as a leader in AI chips, has an outstanding share price performance and is widely noticed by investors. But in fact, there is another company, and although its market value did not break into the global top ten but also benefited from the concept of artificial intelligence, its share price also realized a sharp rise. Let's take a good look at this company's earnings and stock investment analysis.

Broadcom Company Profile

It is a leading global semiconductor company headquartered in California, the US. The company focuses on semiconductor solutions and infrastructure software development for a wide range of applications in data centers, enterprise networks, home connectivity, telecommunications, and television and is known for its innovations in high-speed communications, network processing, storage, wireless communications, and broadcasting technologies.

As a leading global provider of semiconductors and infrastructure software solutions, Broadcom not only conducts important activities in the field of communications technology but also demonstrates strong innovation and market presence in the areas of artificial intelligence and data centers. Its broad product portfolio covers everything from chips to software, serving various industries such as network communications, storage, industrial, automotive, etc., and is committed to driving the development of the digital era.

Founded in 1991 by Henry Samueli and his student Nicholas Hanweiler at the University of California, Los Angeles, Broadcom focuses on the development and market expansion of broadband communication chips. Relying on its founders' technical background and workaholic management style, the company quickly rose to prominence, not only developing important modern technology but also successfully listing on the stock market, with its share price rapidly soaring.

It is known for its flat management style, with no more than four layers of management structure between the CEO and ordinary employees, which has facilitated rapid growth and business expansion in a concise and efficient manner. The company is known for correctly grasping the direction of technology and markets, rapidly entering new technologies, and rapidly gaining market share, with every decision made after careful market analysis and systematic planning of the overall situation.

Through a series of acquisitions, the company has rapidly expanded its presence in wireless and wired communications, multimedia chips, and storage. These acquisitions have not only strengthened the company's market competitiveness but have also enabled it to more broadly serve all aspects of the global communications market with a wide range of technologies, from the bureau end to the subscriber end.

In 2015. Broadcom made a landmark reverse takeover, acquiring Avago Technologies for $37 billion, setting a new record in M&A history at the time. The acquisition not only further expanded the company's market share but also made it the fifth-largest semiconductor company in the world.

Broadcom's Growth Strategy in Semiconductor and Software Markets

As a global provider of semiconductors and infrastructure software, Broadcom plays an important role in artificial intelligence and data processing. Through its advanced chips and solutions, it provides critical technical support for data centers, cloud computing, and networking equipment, helping enterprises cope with growing data demands and complex computing tasks. In particular, the recently completed acquisition of Vmware has further strengthened its presence in the cloud infrastructure and software markets and accelerated its strategic layout of hardware and software integration.

It is one of the world's largest semiconductor equipment suppliers, with a strong market share in the communications semiconductor sector. Over the years, it has expanded its business through a series of strategic acquisitions, especially in software and high-end technologies, to strengthen its competitiveness in emerging markets such as artificial intelligence, cloud computing, and cybersecurity. Moreover, Broadcom has continued to invest in research and development to drive innovation in semiconductor and software technologies in response to changes in market demand and has established collaborations and strategic partnerships globally.

However, it also faces new challenges and competition as the market changes and technology advances. In recent years, the company's position in certain market segments has been challenged as large technology companies such as Apple, Amazon, and Google have progressively developed customized chips on their own. The trend towards autonomy and the demand for customization by these companies means that how traditional chipmakers can remain competitive in the new competitive environment has become a key issue.

In the future, Broadcom will continue to face rapid changes in the market and the profound impact of technology as cloud computing, the Internet of Things, and 5G technologies become more widespread. The company is expected to find new drivers of growth in emerging areas and continue to play an important role in the semiconductor industry through acquisitions in the software business and the drive for technological innovation.

In short, although Broadcom's market capitalization is not as impressive as that of Indaway, its technological innovation and market expansion in artificial intelligence and big data processing have enabled its shares to show strong growth momentum among technology stocks as well. In the future, with the deepening of artificial intelligence applications and increasing data demand, it is expected to continue to benefit from this fast-growing industry trend and become one of the key objects of investor attention.

Broadcom Financial Report and Analysis

As one of the major beneficiaries of the global AI boom, Broadcom's Ethernet switch chips play an important role in data centers and server cluster equipment, supporting efficient data processing and transmission needs. In particular, its JERCO 3 AI Ethernet switch and Netgnt neural network inference engine products further solidify its leadership in AI infrastructure.

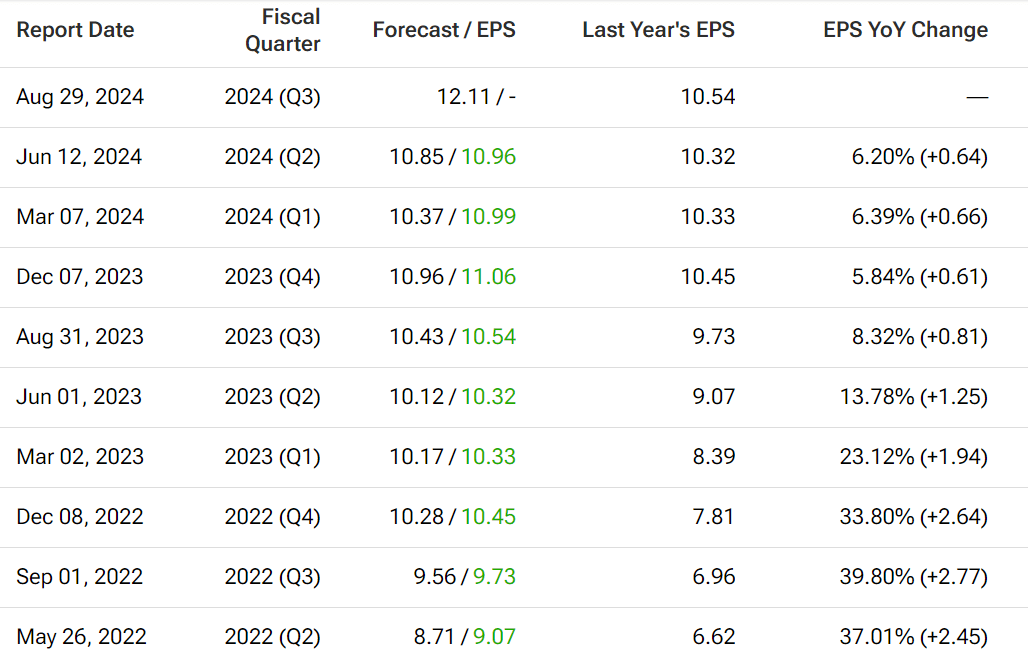

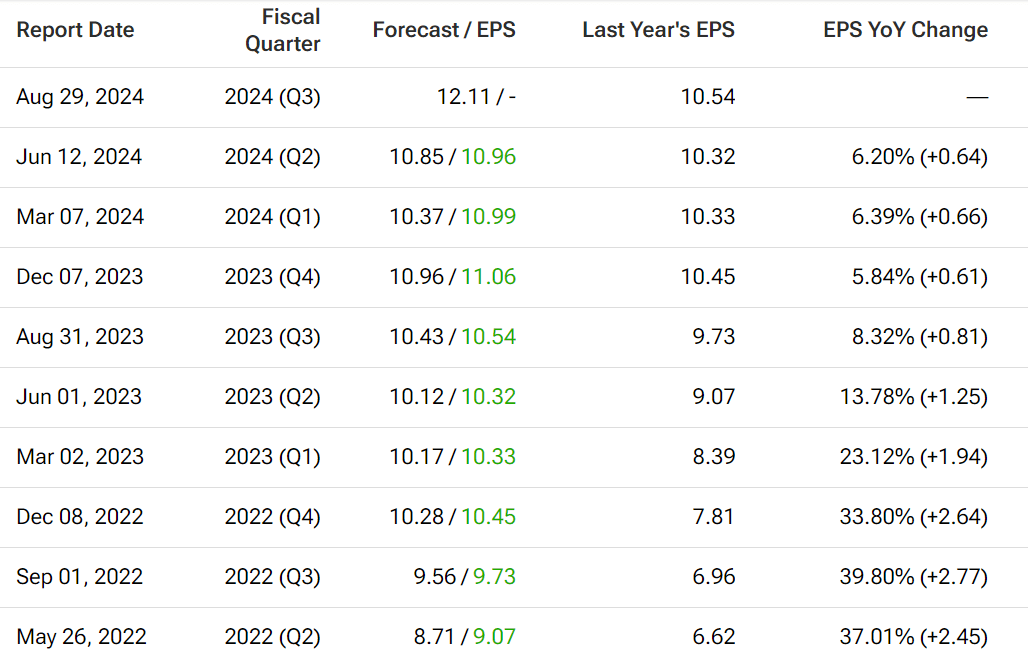

Its success can be seen in its earnings reports, which have exceeded market expectations for nine consecutive quarters. Earnings figures for the first quarter of 2024 (ended February 4) showed revenue of $11.96 billion, up 34.2% year-on-year, beating market expectations of $11.72 billion. Earnings per share came in at $10.99. again beating analysts' expectations of $10.37. showing the company performing well on the back of increased demand for AI-driven net devices and the fruits of its acquisitions.

Broadcom's profitability improved significantly after the VMware acquisition in 2023. Even excluding the impact of the VMware acquisition, it still grew organic revenue by 11%, a significant improvement over the previous quarter's growth rate. The acquisition not only strengthens the company's infrastructure software capabilities but also reinvigorates the company's overall business and further strengthens its leadership position in the semiconductor industry.

2024 Q1 earnings report Broadcom's revenue business is divided into two main divisions: the semiconductor division and the infrastructure software division. Among them, the semiconductor division accounted for 61.8% of the total revenue, mainly through network equipment, broadband server storage, wireless equipment, and other markets to achieve revenue. The infrastructure software division, on the other hand, accounted for 38.2%, including its acquisition of Vmware, which played an active role in improving the company's overall profitability.

Meanwhile, through strategies such as strengthening its AI-related businesses, optimizing operating costs, and shifting to a subscription model, Broadcom expects to continue to achieve double-digit revenue and earnings growth in 2025. It is widely expected to post revenue of $55.55 billion in 2025. while EPS is expected to grow 19.4% to $56.05.

And in its latest earnings report for the second quarter of 2024. its total revenues came in at $12.49 billion, again beating estimates of $12.1 billion and up 4.4% from the previous quarter. Net income of $2.12 billion was up 22.51% from a year ago and 66.48% from the first quarter. Earnings per share, on the other hand, came in at $10.96. beating estimates of $10.80.

In the 2024 Q2 earnings quarter, Broadcom just completed the acquisition of Vmware, which not only boosted the company's strength in software but also strengthened its ability to combine hardware and software. The earnings report showed a significant 153% increase in revenue to $4.6 billion, thanks to the addition of VMware infrastructure software. This significant growth demonstrates the company's success in integrating acquisitions and optimizing its product portfolio, as well as its synergies in semiconductors and software.

In the traditional Semiconductor Solutions division, the latest financial results showed a 4% increase in revenue to $7.4 billion. Meanwhile, revenue from artificial intelligence products reached a record $3.1 billion. In recent times, revenue from the non-AI products business also bottomed out in the second quarter, demonstrating the rebound in market demand and the resilience of Broadcom's diversified product portfolio. These performances reflect not only its competitiveness in technology and markets but also its ability to sustain growth in a changing market environment.

This is because it has a significant presence in artificial intelligence, covering data centers, edge cloud computing, and networking equipment, for which it provides AI gas pedal and processor technologies. With the upgrading of the next-generation internet, its market demand in the field of networking equipment is expected to increase significantly, providing the company with significant room for growth in the future. So despite the company's conservative expectations for full-year revenues, which remain at $50 billion, the market still generally believes that it is expected to outperform as the effects of the Vmware acquisition gradually emerge.

Broadcom's financial results show steadily growing revenues and profits, despite a highly competitive market. By continuing to optimize its operations and product portfolio, the company has managed to maintain good financial health. This demonstrates the success of the company's technological innovations and market strategies, enabling it to maintain a competitive edge in a dynamically changing industry and continue to create value for investors.

Broadcom Stock Investment Analysis

Broadcom Stock Investment Analysis

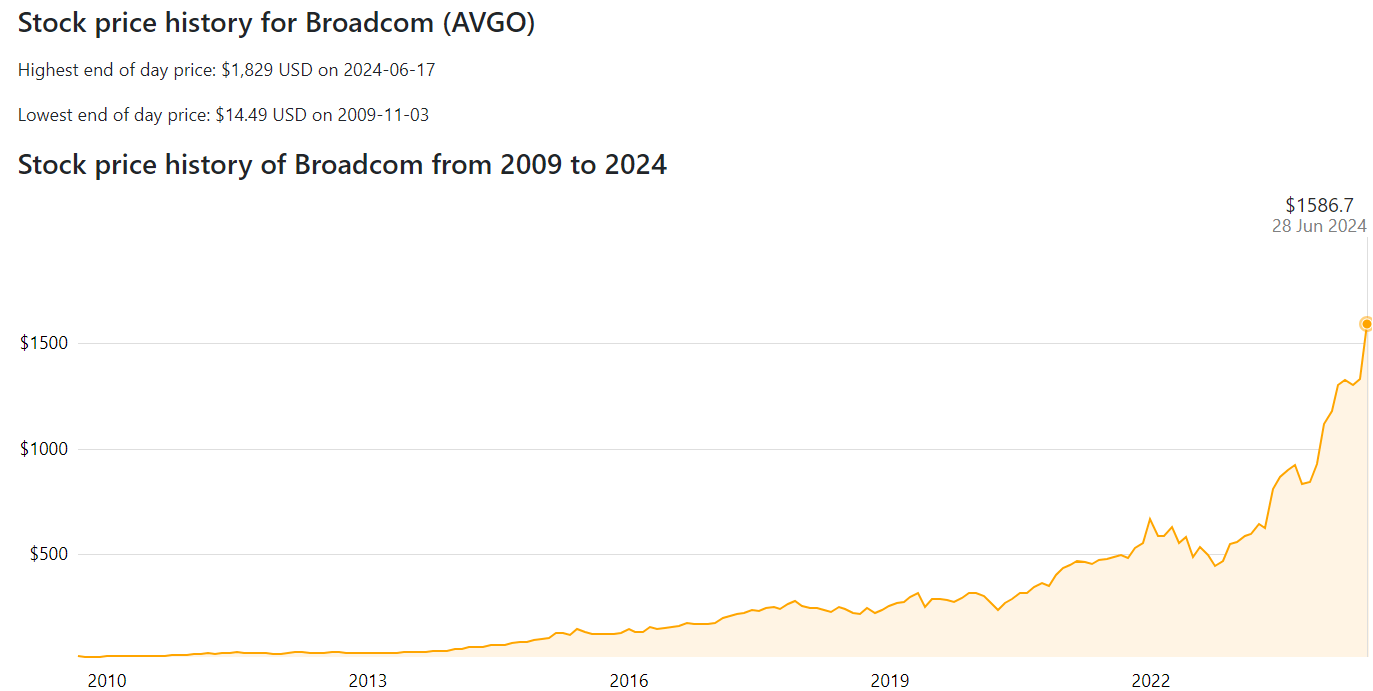

Broadcom stock has long demonstrated strong performance in the market and is widely viewed by investors as an ideal choice for steady growth and high technology content. As a long-established semiconductor company, it has strengthened its position in the market through numerous acquisitions and strategic expansions, particularly its investments in artificial intelligence and cloud computing. The continuous growth of its market capitalization and share price not only reflects its technological innovation and market competitiveness but also attracts the attention and favor of many investors.

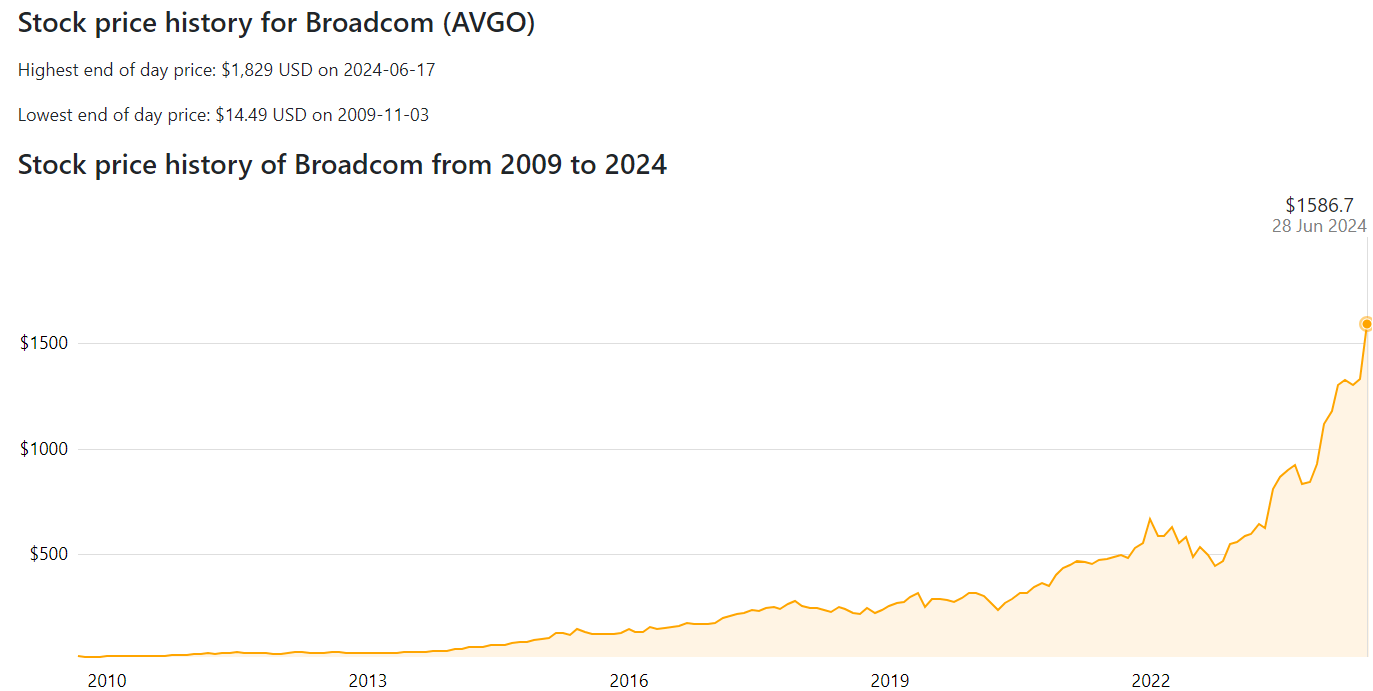

Data show that since 2024. Broadcom's stock (ticker: AVGO) has performed strongly, and its share price has risen by more than 25%, reaching an all-time high of $1.829 on June 17th. Its market capitalization has also reached $640 billion, putting it in ninth place on the U.S. stock market capitalization list. Its announcement on June 13 that it would formally split its shares on July 15 has led to a short-term surge in its stock price.

First of all, despite the constant market volatility, with its technological advantages and strong market share, Broadcom continued to maintain stable profitability. Its stellar earnings performance shows long-term stable cash flow and high profit margins, factors that make it a favorite among investors. Investors are optimistic about the company's long-term growth potential, especially supported by its leadership position in high-tech content areas and continued innovation.

And it is expected to continue to benefit from this trend as the global demand for data processing capabilities continues to grow, particularly in the areas of AI and big data applications. The company has further expanded its presence in the software and services sector through the acquisition of cloud computing and virtualization technology companies such as MicroRay, enhancing its potential for future growth.

Since stock splits typically increase the liquidity and market attractiveness of a stock, Broadcom's stock price has seen a short-term surge since the Stock Split was announced on June 13th. Investors generally expect that its stock price may rise further after the stock split, and its market capitalization is expected to exceed $1.2 trillion or even higher.

This expectation reinforces investors' optimism about its long-term growth potential. Particularly against the backdrop of the company's continued drive for innovation and market expansion in artificial intelligence and semiconductors, investors are confident in its future growth. As a result, Broadcom stock has been able to continue moving higher.

On a technical level, Broadcom stock is also currently in a strong uptrend channel, showing a red fluttering uptrend, which usually indicates positive market sentiment and investor confidence in the company's future performance. A high degree of institutional money control would imply strong ongoing buying interest in the stock from large investment institutions, which could further support the stock's uptrend.

Multiple upward gaps in the stock price usually indicate a strong performance of the stock price, and each gap may become a future support level or rally point. This situation indicates strong buying power from market participants who are willing to buy the stock at a higher price, thus creating a support level. Investors can view these gaps as potential technical support areas that may attract buyers back into the market if Stock Prices pull back.

It is important to note that stock splits usually attract more trading volume and investor attention, which may lead to short-term volatility in the stock price. However, if the company's fundamentals and long-term prospects remain healthy, this volatility may provide a good buying opportunity for long-term investors.

Investors may consider buying low when the stock price pulls back to technical support levels, such as the lower edge of the fourth gap. This strategy helps control risk and find more favorable entry times. It is also key to establish reasonable stop-loss points to protect capital and limit potential losses. A prudent investment strategy can help investors manage investment risk more effectively in the face of market volatility and the impact of events such as stock splits.

However, despite Broadcom's significant technological and market advantages, its business model, which is highly dependent on a few top-tier customers (e.g., Amazon, Google, etc.), poses certain market concentration risks. In addition, uncertainties in the global macroeconomic environment and intensified competition in the industry may also have a negative impact on the company's performance and share price.

So based on the above analysis, long-term investors could see Broadcom demonstrating solid financial performance and potential growth opportunities. However, its current share price has risen considerably, resulting in a high relative valuation, and there may be some risk of short-term volatility. Investors should fully consider market volatility and valuation factors when considering holding or increasing their holdings of the stock to ensure that they are in line with their investment objectives and risk tolerance.

Broadcom's financial report and stock analysis

| Earnings Highlights |

Stock investment analysis |

| Revenue growth is up 4.4% year-on-year. |

Up more than 25%, with a market capitalization of $640 billion, ranked #9 |

| Net profit is up 22.51% year-on-year. |

Long-term growth potential in artificial intelligence and big data processing. |

| Artificial intelligence steady growth |

Market concentration risk and global economic uncertainty impact |

| Semiconductors: stable revenue growth |

Long-term investors monitor market volatility and short-term stock split effects. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Broadcom Stock Investment Analysis

Broadcom Stock Investment Analysis