Chinese people generally like to save money, especially the middle-aged and elderly groups, due to their stable income and lower daily expenses. In contrast, young people have limited ability to save due to high mortgage and car loan expenses. In order to attract deposits, banks have gradually withdrawn from high-interest-rate deposit solicitation businesses, such as Jumbo certificates of deposit. Instead, it now serves as a relatively stable investment option, attracting many investors seeking higher returns. Now, let's take an in-depth look at jumbo certificates of deposit, their advantages and risks, and find the best way to achieve your financial goals.

What does a Jumbo certificate of deposit mean?

What does a Jumbo certificate of deposit mean?

It is a kind of time deposit certificate issued by banks, usually with higher interest rates and longer deposit periods, suitable for investors who have more idle funds, do not need short-term capital turnover, and seek high interest rate returns. This type of investment product is not only safe and reliable but also meets the needs of investors for long-term fund management, making it an ideal tool for storing and increasing the value of funds.

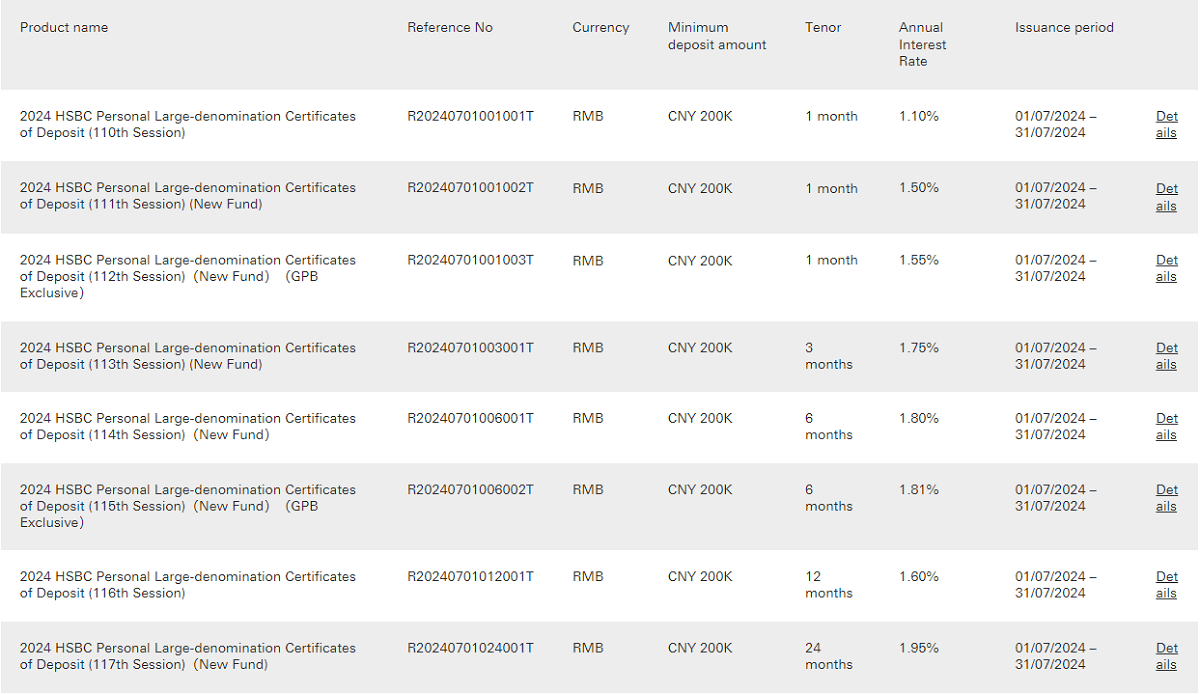

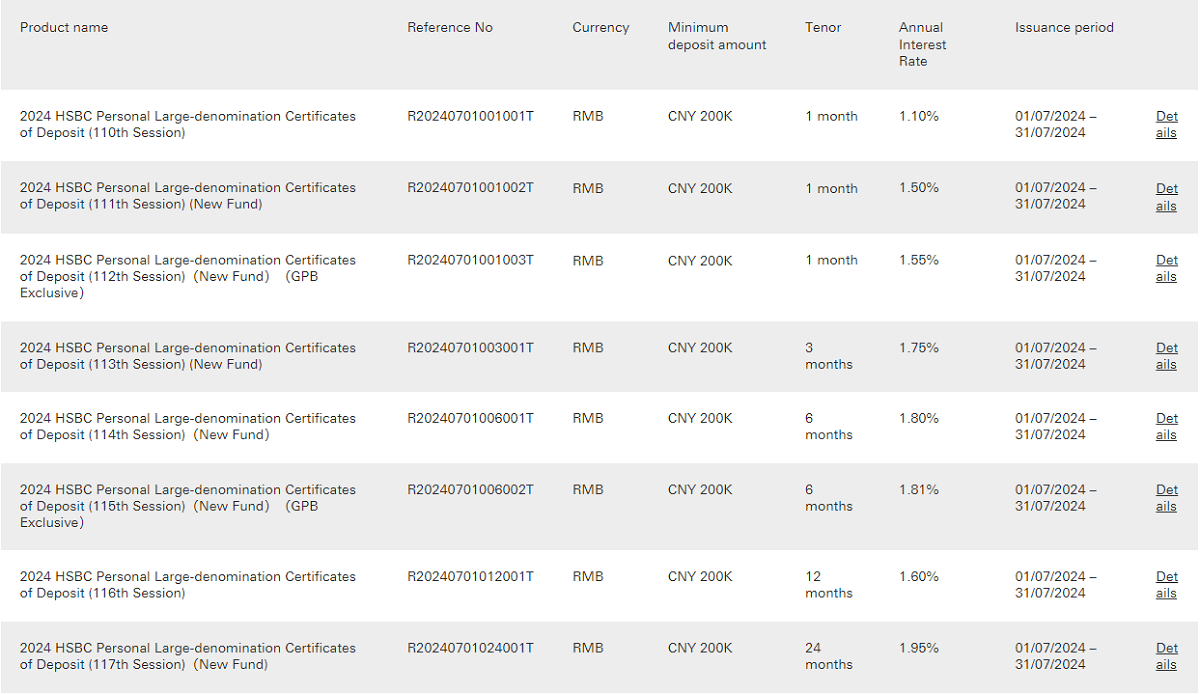

These certificates of deposit are products designed by banks and other depository financial institutions specifically for non-financial institution investors, the issuance of which requires the approval of the central bank, and the deposit threshold is high, usually starting at an amount of 200.000 yuan or more. And for institutional investors, a starting amount of 10 million yuan is required.

It usually offers relatively high interest rates, typically around 20% to 50% higher than ordinary time deposits, and some small and medium-sized banks can even exceed that by more than 50%. These rates usually do not exceed 55% of the prime rate, and the exact rate may be adjusted according to market conditions.

For example, the Agricultural Bank of China currently offers three-year Jumbo certificates of deposit at an annualized interest rate of 2.35%, compared with 1.95% for time deposits of the same maturity, which is 0.4 percentage points higher, and this higher interest rate provides investors with a more attractive income option.

In particular, before the marketization of interest rates, Jumbo state-owned banks had introduced Jumbo certificates of deposit with higher interest rates, which attracted many investors. With the advancement of interest rate marketization, its interest rate has declined in recent years, but it is still higher than the interest rate level of ordinary savings accounts.

It also usually enjoys the protection of deposit insurance, which ensures that investors can obtain 100% protection for the safety of their funds if the deposit amount does not exceed 500.000 yuan. This insurance coverage is usually set by the state, providing investors with an extra layer of security and peace of mind that they can invest in this type of high-interest, long-term deposit product.

Moreover, Jumbo certificates of deposit have a fixed maturity period, and investors can choose from a variety of standard maturities as needed. The types of maturity are very diverse, and investors can choose a deposit period that suits their needs, ranging from as short as one month to as long as five years. This flexibility makes it ideal for managing and storing jumbo sums of money, meeting investors' needs for long-term fund management, and investment planning.

It also offers a variety of interest-bearing options that investors can choose from according to their needs and investment objectives, including one-time repayment of capital at maturity, monthly, quarterly, or yearly repayment of capital at maturity. This flexibility and selectivity enable investors to carry out effective fund management and investment planning in accordance with market conditions and personal capital needs.

Jumbo certificates of deposit have the flexibility of transferability during their validity period, and holders can transfer them to others and determine the transfer price through mutual negotiation, so they have a certain degree of market liquidity. This transferability makes it attractive to investors, as it enables them to liquidate the funds quickly when they need them without having to wait for the maturity of the certificates of deposit. In addition, not only does it offer transfer flexibility, it can also be used as collateral.

However, it should be noted that Jumbo certificates of deposit usually do not support early withdrawal at any time. If investors need to withdraw the funds early before the end of the deposit period, they may face a higher penalty or interest loss. Meanwhile, some banks may charge additional handling fees for early withdrawal, increasing the cost of early withdrawal.

In addition, certain banks require a certain minimum amount for early withdrawals to operate. Therefore, investors need to carefully weigh the benefits and costs when considering early withdrawal in order to avoid unnecessary financial losses and to ensure that the funds are used in a maximally effective manner.

Jumbo certificates of deposit are usually managed and transacted through an electronic platform, thus facilitating investors' deposit management and operation. However, when choosing this investment option, investors should also pay attention to the security and liquidity of their funds and ensure that they choose a reputable issuer to safeguard their funds and achieve flexible utilization.

To summarize, Jumbo certificates of deposit, as a high-yield and highly liquid investment option, not only meet the demand for the management of Jumbo sums of money but also provide market participants with more investment choices and ways of operating funds. For investors and financial institutions, its launch has important market significance and practical value.

The difference between Jumbo certificates of deposit and large deposits

| Characteristics |

Jumbo Certificates of Deposit |

Large deposits |

| Definition |

High-interest lump-sum deposit product. |

Large deposits in basic bank accounts. |

| Interest Rate |

Often offers higher rates than regular deposits. |

Subject to bank deposit rates. |

| Characteristics |

Term deposits cannot be withdrawn early. |

Withdrawable at any time and highly flexible. |

| Mobility |

Longer deposit period with restricted withdrawals. |

Can be withdrawn at any time, high liquidity. |

| Applicable to |

Ideal for large sums committed long-term. |

Ideal for managing large funds with flexibility. |

Jumbo certificates of deposit are transferable and pledgeable.

As a high-value certificate of deposit, Jumbo certificates of deposit are transferable and pledgeable. Holders can resell them to other investors during the validity period of the certificates of deposit in order to realize them in advance or adjust their investment strategies. At the same time, it can also be used as collateral to secure a loan or to enhance a credit line, which allows the holder to access funds or improve his or her financial position when needed while enjoying a relatively low interest rate on the loan.

The fact that Jumbo certificates of deposit are transferable means that holders can resell them to other investors during the term of the certificate in order to liquidate them early or adjust their investment strategies. For example, Auntie Cheung holds a Jumbo certificate of deposit of $1 million with a maturity of three years and an annualized interest rate of 4.125%. If she needs the funds urgently, early withdrawal will be calculated at the call rate, resulting in a substantial loss of interest. In contrast, transferring the certificate of deposit may result in a small loss of interest, but she will still be able to earn a higher return, thus meeting her financial needs.

For the transferee, such a transaction is usually a good deal. To illustrate, suppose Auntie Cheung transfers a certificate of deposit to Uncle Chiu, who will receive the original investment principal and interest, totaling $1072500. After Uncle Chiu continues to hold the certificate of deposit for one year, the bank will repay the capital and interest in a lump sum as agreed, and its expected yield can be as high as 4.779%, far exceeding the level of interest rates for new certificates of deposit of the same maturity.

This highlights its attractiveness and yield advantage in investment. Through the transfer, investors have the flexibility to liquidate the funds when they need them and have the opportunity to earn a higher rate of return, exceeding the interest rate of new certificates of deposit of the same maturity. This flexibility and potentially high returns make it an important asset choice for investment portfolios.

A pledge of Jumbo certificates of deposit is a way to use their holdings as collateral to apply for a loan or other credit facility from a bank. By using certificates of deposit as collateral, investors can utilize their assets to obtain additional liquidity or financing services, which usually enjoy lower interest rates on loans and access to needed funds while keeping the certificates of deposit held.

As a pledge, it can be used to secure a loan or line of credit, which allows the holder to borrow money or upgrade their credit rating when needed. By using the certificate of deposit as collateral, the holder is able to take advantage of its security and stability to obtain more favorable loan terms, often enjoying lower loan interest rates and higher borrowing limits while maintaining a holding interest in the certificate of deposit.

Banks usually determine the amount of loan that can be offered based on factors such as its face value, maturity, and interest rate. Generally, the loan amount is a certain percentage of its face value. This arrangement allows the certificate of deposit to serve as reliable collateral and helps the holder obtain more flexible financing terms.

Moreover, such pledged loans usually enjoy lower interest rates because the use of Jumbo certificates of deposit as collateral effectively reduces banks' risks. Through this arrangement, holders of certificates of deposit are able to obtain funds at a lower cost, while the bank is able to ensure the security of the loan. This mutually beneficial arrangement is favorable to both the borrower, who needs additional funds, and the bank, which seeks a safer way to invest.

At the same time, the term of the loan usually does not exceed its maturity period. This arrangement helps the bank effectively control the risk of the loan while ensuring that the loan is repaid on time when the certificate of deposit matures. This loan arrangement that matches the maturity period of the certificate of deposit not only safeguards the soundness of the loan but also provides the borrower with a smart money management option.

In addition, the loan can be repaid in a variety of ways, including lump sum repayment of principal and interest or repayment by installments. These specific repayment methods usually depend on the negotiation between the borrower and the bank and the specific terms of the loan contract. Choosing the right repayment method can be based on the borrower's financial situation and repayment ability to ensure that the loan can be returned on time and maximize benefits.

In order to complete the specific operational process of pledging Jumbo certificates of deposit, first of all, the holder needs to make an application for a pledge loan to the bank and submit Jumbo certificates of deposit and relevant financial information. The bank will evaluate the certificate of deposit to determine the amount of loan that can be provided and the specific conditions of the loan.

Next, both parties will sign a pledge loan contract after the evaluation is approved, and the bank will register the pledge. Once the contract is signed and approved by the bank, the bank will release the loan funds to the holder so that he can obtain liquidity when needed without having to terminate the certificate of deposit early.

To summarize, compared with time deposits, which are more familiar to the general public, Jumbo certificates of deposit allow holders to transfer them to other investors or use them as collateral when they need the funds, which gives investors more flexibility in disposing of their assets without having to wait for the maturity of the certificates of deposit. Its higher liquidity makes it highly flexible and safe for investment and fund management.

What are the risks of Jumbo certificates of deposit?

As you can see from the above text, Jumbo certificates of deposit have very obvious advantages, such as transferability and flexibility as collateral. At the same time, it is also relatively low-risk. However, it should be noted that investors still need to pay attention to the risk of interest rate fluctuations that may be brought about by changes in the market, as well as factors such as early withdrawal fees or handling charges that they may face.

Generally speaking, it is not recommended for ordinary savers to deposit Jumbo certificates of deposit, mainly because of several reasons: a high threshold, poor security, declining yields, and liquidity risk. Simply put, its high threshold makes it unsuitable for the average family, and there are risks in placing most of your savings in one bank: the amount of money involved, the high fees required for early withdrawal, and the long transfer time.

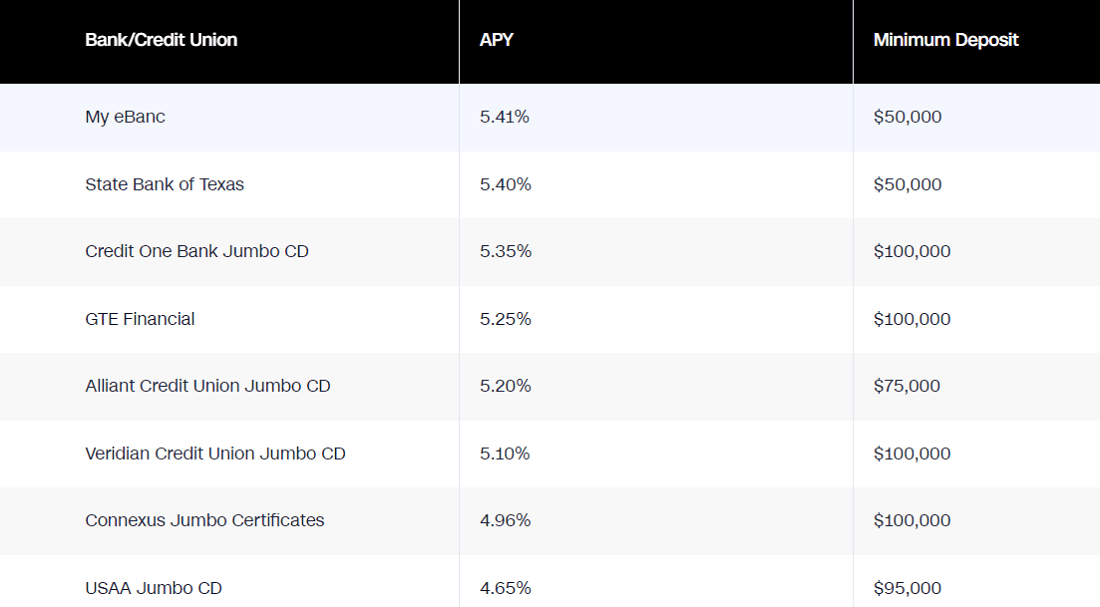

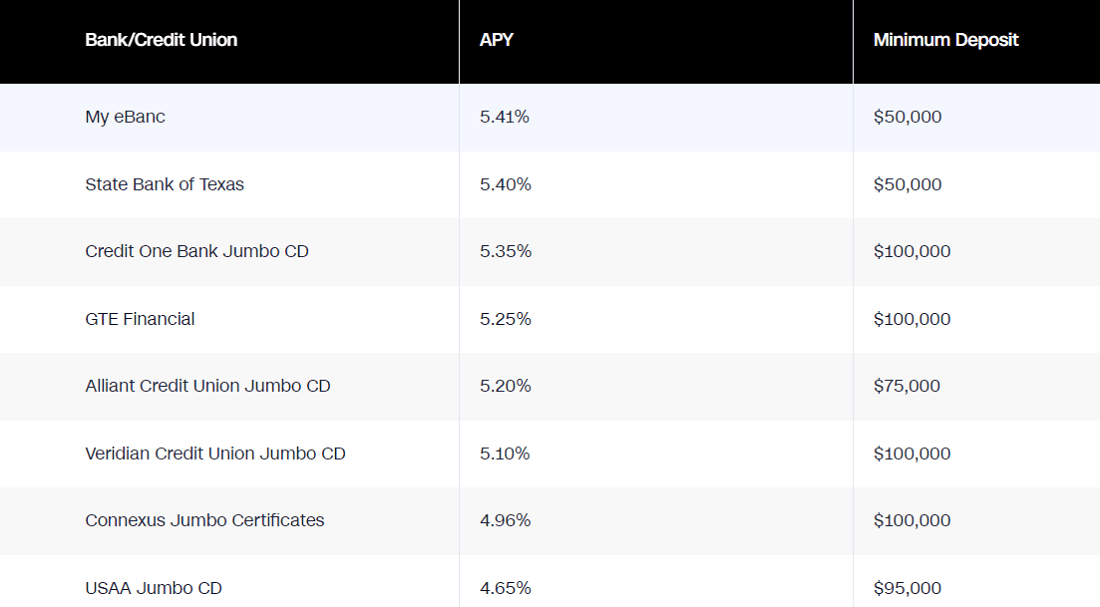

Firstly, depositing a Jumbo certificate of deposit usually requires a high starting amount, which is beyond the investment capacity of most ordinary savers. In China, it usually starts at RMB 200.000. In the United States, the minimum deposit is 100.000 dollars. This is beyond the investment capacity of most ordinary savers and is therefore only suitable for those who have more money.

However, despite its security, its higher yield comes with a corresponding risk. Generally speaking, the higher the interest rate, the longer the term required for the product, which increases the risk of investment. Investors should carefully weigh the pros and cons when choosing a product to ensure that it meets their personal financial goals and risk tolerance.

In addition, if investors need to make early withdrawals, they may face the risk of losing interest on early withdrawals, as banks usually calculate interest at a lower interest rate for demand deposits, resulting in a significant reduction in actual returns. At the same time, early withdrawal may also entail certain risks and costs, including possible early withdrawal fees and the inability to obtain the expected interest return.

Liquidity risk refers to the fact that, despite its transferability, it may not be able to be liquidated quickly or can only be sold at a lower price when funds are urgently needed. Despite its transferability, liquidity risk needs to be considered and managed by investors in their fund management and investment strategies.

It also has a certain amount of interest rate risk. This refers to the fact that investors holding Jumbo fixed-rate certificates of deposit may miss out on higher returns if market interest rates rise. This means that the interest rate on their deposits will remain unchanged, and they will not be able to enjoy the higher returns from rising market interest rates, resulting in a loss of opportunity cost.

Although it is generally issued by more reputable banks, it is still important to be aware of the potential credit risk. And if the bank issuing the Jumbo certificates of deposit encounters financial problems or becomes insolvent, it will not be able to repay the principal and interest on the certificates of deposit on schedule. In this case, investors may face the risk of losing their funds.

In addition, if investors choose to use them as collateral for a mortgage loan, they also need to take into account the creditworthiness of the issuing bank. This is to ensure that the loan service can be enjoyed normally during the loan period and that the borrowed money can be repaid on time to avoid potential risks caused by the bank's financial problems.

In summary, despite the advantages of Jumbo certificates of deposit, there are obvious limitations and risks, and they are not suitable for all depositors. Therefore, depositors should weigh the pros and cons and consider their own financial situation and risk tolerance when choosing an investment option. It is therefore particularly important to rationally assess the risks and take appropriate risk management measures.

Advantages and Risks of Jumbo Certificates of Deposit

| Advantages |

Risks |

| Higher interest rates and stable returns. |

No early withdrawal, inflexible funds. |

| Helps to increase the value of funds. |

Interest rate fluctuations affect returns. |

| Suitable for long-term capital planning. |

Risk of interest rate fluctuation during the period. |

| Protect against inflation risk. |

Interest rate fluctuation affects actual return. |

| Suitable for individuals or organizations with large idle funds. |

Not suitable for people with high liquidity requirement. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does a Jumbo certificate of deposit mean?

What does a Jumbo certificate of deposit mean?