Recent market developments have been dizzying, with every change affecting our lives, from Starbucks' increase in holdings to crude oil's jump. Against this backdrop, we can't ignore the companies that are relevant to our daily lives. For example, Home Depot—the home improvement retail giant we frequent—is not only the first choice of many families for repairs and renovations but also plays an important role in the marketplace. Today, we're going to explore the Home Depot company profile and stock buy reasons to see how this company is performing in the current market environment.

What is The Home Depot?

Home Depot (Home Depot) is a leading large-scale home improvement retailer in the United States that sells building materials, home improvement products, and gardening supplies, as well as provides related services. As one of the largest home improvement retailers in the world, it is known for its extensive product lines and superior customer service.

It was founded in 1978 and is headquartered in Atlanta, GA. The company was co-founded by Bernard Marcus, Arthur Blank, Ron Brill, and Pat Farrah with the idea of creating a large-scale home improvement superstore to promote the ‘DIY’ (Do It Yourself) concept. The idea quickly propelled The Home Depot's growth to become a leader in warehouse-based home building retailers.

Today, the company has a chain of more than 2.200 shops throughout the United States, Canada, Mexico, and China, each of which has a design center staffed by professionally trained associates who provide free home decorating advice and computer-assisted kitchen and bath design services.

With a wide range of products, including building materials, indoor and outdoor lighting products, kitchen and bath products, hardware and electrical products, as well as a variety of furniture and decorative items, the company is committed to providing one-stop furniture remodeling and renovation solutions. As the world's largest home building materials retailer, the company has not only achieved remarkable success in selling its products but has also continued to innovate in its services by providing home installation, repair, and maintenance services to meet the diversified needs of its customers.

The demand for one-stop shopping in the home improvement market has fuelled the rapid rise of warehouse-type home building materials superstores, such as Home Depot, into the mainstream of the market. This model effectively meets consumer demand for comprehensive home improvement solutions by providing a comprehensive selection of products and a convenient shopping experience.

The company adopts a warehouse-supermarket sales model, offering low-priced, full-category home building materials merchandise primarily to DIY consumers and professional contractors. Unlike home furnishing stores in the PRC market, which are primarily rent-collecting stores, Home Depot earns its primary source of profit by purchasing merchandise from suppliers at low prices and selling it at markups, earning the difference between the purchase and sale prices of the merchandise.

Home Depot earns the price difference by purchasing goods from suppliers at low prices and selling them at a markup. This model effectively reduces purchasing costs while increasing sales margins, bringing stable earnings growth to the company. Through this strategy, the company is able to maintain its price advantage in a highly competitive market and drive overall business expansion.

In addition, The Home Depot has aggressively developed private labels such as Husky hand tools and Hampton Bay lighting. These private labels not only offer more competitive pricing but also enhance brand recognition in the marketplace and customer loyalty. Through a differentiated product portfolio, the company is able to enhance profitability and position itself more favorably in the market.

Meanwhile, as the world's largest retailer of home building supplies and hardware, The Home Depot has a clear market positioning advantage. Online shopping is not cost-effective as home building products are usually large, heavy, and costly to transport, such as lumber, cement, and large renovation tools. This allowed it to maintain the advantages of its traditional retail model in the face of challenges from e-commerce companies such as Amazon. Especially during the epidemic, the company's sales grew significantly, benefiting from the combination of a low interest rate environment and people spending more time at home.

In the U.S. home retail market, Home Depot holds a 24.9% market share, making it the dominant player in the industry. According to the National Retail Federation (NRF) in 2017. it ranked fifth in U.S. retail revenues, further proving its significant position and wide reach in the market.

In addition, the company has been recognized by Fortune Magazine as a favorite specialty retailer for many years and was ranked 17th and 43rd on the Fortune 500 in 2007 and 2017. respectively. And it ranked 24th on the 2017 Branzi Top 100 Global Brands, demonstrating the value and reach of its brand on a global scale.

Home Depot's success lies not only in its extensive product line and convenient shopping experience but also in its deep understanding of customer needs and keen grasp of market trends. Through continuous innovation and service optimization, the company has consolidated its leading position in the home building materials retail industry. However, the company is currently facing challenges on multiple fronts, and investors need to keep an eye on the company's future financial performance and market dynamics, especially management's outlook on future home improvement demand.

Home Depot Stock Analysis

Home Depot Stock Analysis

As shown in the chart above, looking at the last five years of stock price action, Home Depot's stock price peaked at $400 at the end of 2021. Since then, the company's stock price has entered a period of sustained decline until it fell to $270. It has only gradually recovered since then, with the stock currently trading at around $374. By comparison, tech giants hit all-time highs during the same period in 2024.

And the underlying reason for Home Depot's weak stock price lies in the declining performance in recent years. The first quarter of 2024 earnings report showed that the company's sales declined 2.3% year-over-year, while operating costs increased by 5%, resulting in a 7% decline in net income.

And while total revenue for the second quarter was up 18.55 percent from the first quarter, net income was up 26.69 percent from the first quarter. However, compared to last year, they declined by 3.01 percent and 11.47 percent, respectively. Based on this performance, which reflects the pressures of the economic environment as well as cautious consumer spending, the company expects sales for FY2024 to decline by about 1 percent and net income by about 1.5 percent compared to the same period last year.

In addition, adjusted earnings per share are expected to be $4.60. down 1.02% from the same period last year, reflecting the challenges the company continues to face in controlling costs and maintaining margins. Despite The Home Depot's efforts to respond to economic pressures and changes in consumer spending, the decline in profitability suggests that the company still needs to make further adjustments and improvements in enhancing operational efficiency and responding to market volatility.

In terms of market conditions, the home improvement market is currently in a downturn, with high interest rates and high home prices dampening consumers' willingness to renovate. Many potential home buyers chose to postpone or abandon their renovation projects due to high interest rates and high property prices, resulting in fewer home renovation projects. In particular, larger projects, such as kitchen and bathroom renovations, have been significantly dampened.

Meanwhile, The Home Depot's recent $18 billion acquisition of SRS Distribution has sparked much discussion in the market. While the acquisition is seen as a necessary step to expand the business and develop larger projects, it also puts pressure on the company's debt, which could affect the share buyback program. Some analysts believe the acquisition will lead to long-term revenue and profit growth, while others are concerned about short-term financial pressures.

Certainly, investors are optimistic about a market recovery and expect that future declines in interest rates will help the homebuilding market gradually return to growth. As the economic environment improves, especially with lower interest rates, consumers' purchasing power is expected to be strengthened, which in turn will drive demand for home furnishings to pick up, leading to an improvement in overall sales. In the long run, the reduction in interest rates is likely to inject new vigor into the home improvement market and bring positive growth expectations for the industry.

However, it may take some time for consumers to feel the substantial impact of lower interest rates in the short term. According to analysts' forecasts, a recovery in home improvement spending may not be evident until 2025. If interest rates decline in the future, it is expected that 2025 may witness some market growth. Nonetheless, the market will continue to face challenges in the short term, and the process of full recovery is likely to be lengthy.

That said, despite Home Depot's dominance in the industry due to its significant market position and strong channel presence, the current economic environment is limiting its growth potential. High home prices and high interest rates have made consumers more cautious in their home improvement spending, inhibiting a rebound in market demand. These economic pressures have made the recovery of the home improvement market more difficult, and even with its strong brand influence and extensive product coverage, it will be difficult to escape the overall market downturn in the short term.

Reasons to Buy Home Depot Stock

Reasons to Buy Home Depot Stock

Despite short-term economic pressures, the company's broad footprint and underlying stability in the home improvement and building materials sectors make Home Depot stock a considerable value in terms of long-term holding. Even during periods of economic volatility or high market uncertainty, the company's core business has been able to maintain steady demand, thus ensuring its reliability as a long-term investment.

It is important to understand that the company focuses primarily on the home improvement and building materials markets, where demand is longstanding and relatively stable. Whether it's plumbing repairs, heating, ventilation, and air conditioning (HVAC) systems, lumber, or other home improvement materials, the demand for these products and services doesn't go away in any economic cycle.

Moreover, Home Depot has two significant mosques. In terms of industry strengths, the company primarily sells large building materials and appliances that are challenging to ship and are less susceptible to the impact of the Internet than lightweight goods. As a result, the company is able to leverage its extensive shop network to offer online ordering and delivery services, making it difficult for Internet companies to compete with it in this area.

This business model not only enhances the company's service capabilities but also strengthens its market position. Through its extensive network of physical shops, it is able to provide efficient online ordering and delivery services, and this distribution advantage has enabled the company to occupy a significant position in the market and maintain a high market share and competitiveness.

Secondly, Home Depot's channel advantage is also very obvious. The company has more than 2.300 shops in the North American market, which provides it with a significant channel advantage. Being a large customer, it is able to get discounts from manufacturers and thus purchase products at lower prices. Additionally, it may be the only option for customers in many regions, which gives it some pricing power.

This advantage allows it to maintain high gross margins, which have stabilized at around 35% over the past five years, significantly higher than Walmart and Target. This demonstrates its strong competitiveness in cost control and pricing, effectively leveraging its channel and scale advantages to maintain a high level of profitability.

Although the company's growth has been slightly less impressive than that of the tech giants, its shares have grown 18-fold since 2010. far outpacing the 11-fold increase in the nasdaq etf (QQQ). This consistent, long-term growth has made Home Depot a preferred underlying for investors, demonstrating strong market competitiveness and profitability.

So far this year, its stock price has grown more than 10 percent, far outperforming the Standard & Poor's 500 Index (S&P 500). This impressive performance shows that the company still has a good ability to resist risk in the current market environment, showing excellent gains over the broader market, further consolidating its image as a stable investment in the minds of investors.

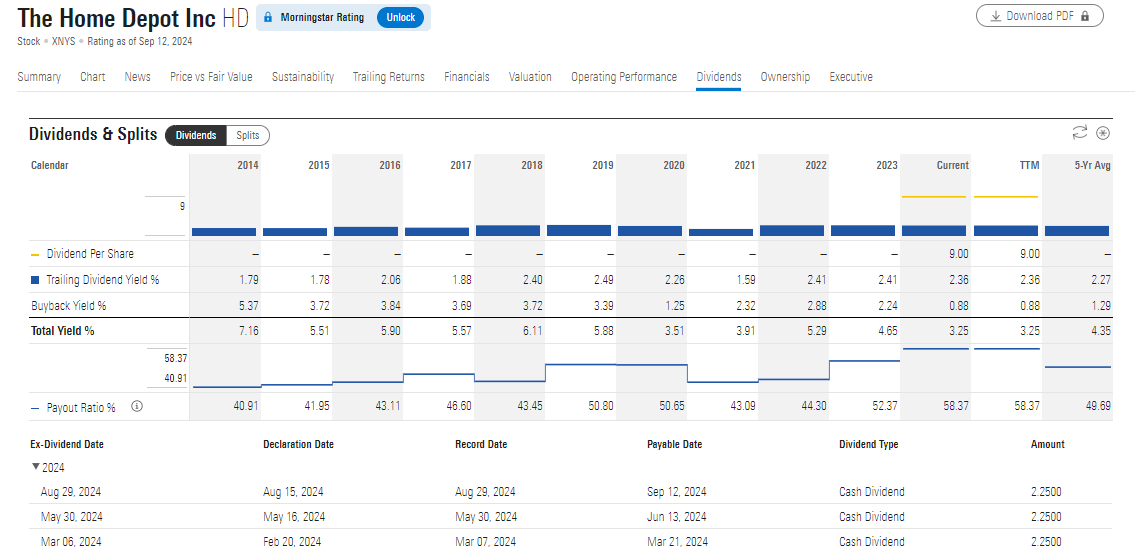

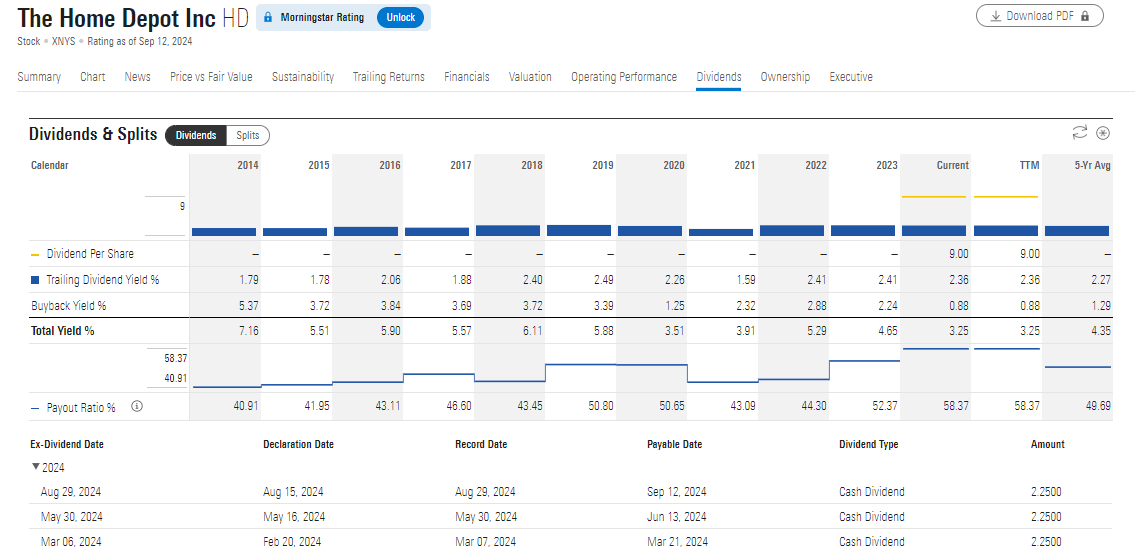

Moreover, Home Depot has maintained a stable dividend policy over the years, with a current dividend yield of 2.36%, making it an important source of income for long-term investors. This means that investors not only benefit from capital appreciation but also enjoy consistent and stable dividend income.

The company not only maintains a stable dividend but also increases it every year, which provides shareholders with a reliable cash return and enhances its attractiveness in the portfolio. In the current market environment, this combination of capital appreciation and income security is particularly favored by investors seeking long-term income stability.

Therefore, it may be a wise choice to include it in your portfolio before the rate cut. Interest rate cuts typically help stimulate the real estate market by driving home sales and renovation demand, and as the largest home improvement and building materials retailer in the U.S., Home Depot is expected to benefit from this trend. As consumers become more willing to purchase and renovate homes, the company's performance may get a boost as a result, further boosting its stock price and profitability.

All in all, Home Depot not only offers excellent growth but also provides investors with a stable dividend yield. With its solid long-term performance and consistently increasing dividends, it has been able to provide shareholders with the dual return of capital appreciation and stable cash flow. Considering its growth potential and dividend return, it is a quality choice for long-term attention and investment.

Home Depot Overview and Share Buy to Reasons

| Company Overview |

Reasons to buy the stock |

| The world's leading home improvement retailer |

Market leadership and stability |

| Founded in 1978 and headquartered in Atlanta, GA. |

Strong market share and extensive shop network |

| Includes building materials and home improvement sales. |

Long-term investment value with expected recovery. |

| 2200+ shops in multiple countries |

Declining rates may offer recovery opportunities. |

| Short-term pressure but stable long-term performance. |

Good dividend return to attract long-term investors |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Home Depot Stock Analysis

Home Depot Stock Analysis Reasons to Buy Home Depot Stock

Reasons to Buy Home Depot Stock