The forex market is a global trading platform where investors profit from the spreads between the currencies of different countries. Among the many currency pairs, AUD/USD, as one of the five major currency pairs, attracts a lot of attention from investors due to its unique market position and dynamics. In the following section, we will take a closer look at the AUDUSD currency pair and its trading strategies to help investors better understand and participate in this market.

What is AUDUSD?

AUD/USD is a currency pair used in the foreign exchange market to express the exchange rate between the australian dollar (AUD) and the United States Dollar (USD). As one of the most actively traded currency pairs, AUDUSD is often referred to as ‘AUD/USD’ or ‘AUDUS’. Not only is it widely followed by foreign exchange traders around the world, it is also an important indicator of the performance of the Australian economy and the strength of the US dollar.

In the AUDUSD currency pair, AUD stands for Australian Dollar, which is the official currency of Australia and is widely used in the country's daily transactions and international trade. The value of the Australian dollar is heavily influenced by the country's economy, particularly its dependence on mining and commodity exports.

USD stands for United States Dollar and is the official currency of the United States. Not only is the dollar widely circulated within the United States, it also plays an important role as a global reserve currency. In international trade, financial markets, and foreign exchange transactions, the U.S. dollar occupies a dominant position, becoming the world's most influential currency.

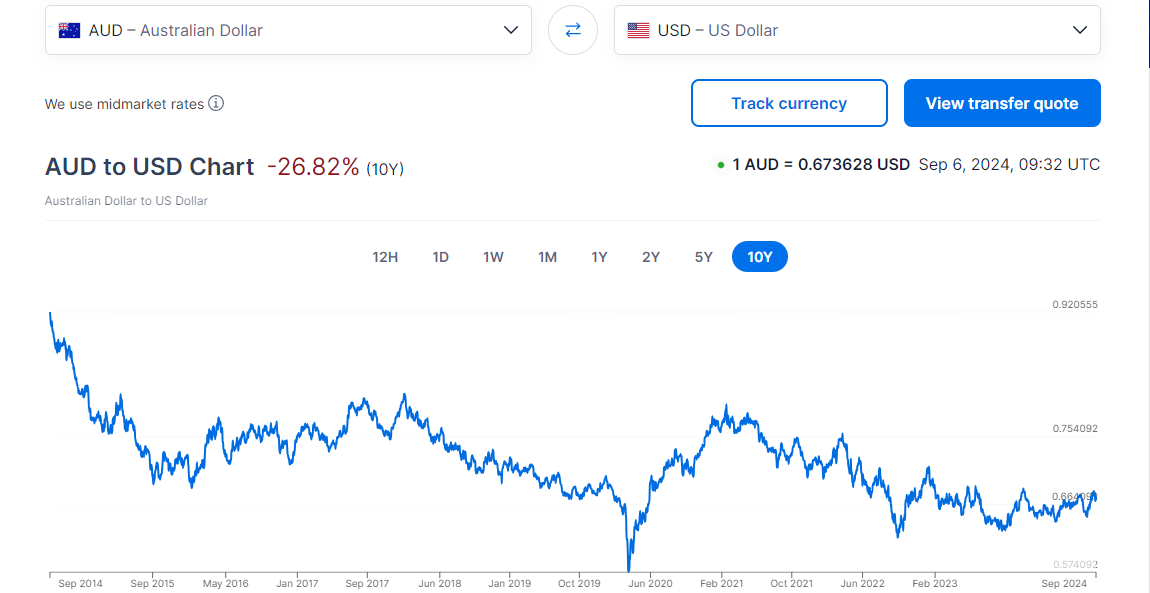

Specifically, the AUDUSD exchange rate reflects how many US Dollars (USD) can be exchanged for 1 Australian Dollar (AUD). For example, when the AUD/USD exchange rate is 0.6500. this means that 1 Australian dollar can be exchanged for 0.65 US dollars. This exchange rate directly demonstrates the relative value of the two currencies, and by following its movements, investors can get a sense of how the AUD and USD are performing in the market.

As one of the major currency pairs in the forex market, the AUDUSD reflects the relative strength of the Australian dollar and the US dollar. By trading this currency pair, investors can capture profit opportunities from exchange rate movements by investing based on exchange rate fluctuations, betting on or hedging the relative value of the AUD to the USD.

When an investor buys AUDUSD, they are effectively buying Australian dollars (AUD) and selling US dollars (USD) at the same time. This means they are betting on the Australian dollar strengthening relative to the US dollar. If the expectation is correct and the AUD/USD exchange rate rises, the investor profits because at that point the value of the Australian dollar rises relative to the US dollar.

Conversely, if the AUDUSD rate falls, it means that the Australian dollar is losing value relative to the US dollar, and traders may face losses. Therefore, investors need to trade forex based on their expectations of the currency movements and economic conditions of the two economies in order to gain from exchange rate fluctuations.

AUDUSD is one of the most common currency pairs in the forex market, as it directly reflects the value of the Australian dollar against the US dollar. This currency pair is widely followed, mainly due to its close correlation with Australian economic data, commodity prices, and US economic data. Traders and analysts regularly monitor the dynamics of AUD/USD to assess the performance of both economies and market trends in order to make more accurate investment decisions.

Key Factors Affecting the AUD/USD Exchange Rate

To be profitable in AUD/USD trading, investors must be able to accurately identify upward and downward trends in the exchange rate. However, changes in the AUD/USD exchange rate are influenced by a combination of factors. These factors interact with each other to determine the trend of the exchange rate, which in turn has a profound impact on the investor's trading decisions.

One of the biggest influences on the AUDUSD exchange rate is the interest rate policy of both countries. Interest rate policy determines the costs and benefits of currencies, which in turn affects investor demand for both the AUD and USD. For example, when the Reserve Bank of Australia (RBA) raises interest rates, the Australian dollar typically strengthens as higher interest rates attract more capital flows into Australia, thus strengthening the value of the AUD.

On the contrary, if the Federal Reserve raises interest rates, the US dollar may appreciate because higher interest rates boost the yield on the dollar, which attracts more money into the US market. This scenario increases the demand for the US dollar and pushes its exchange rate higher. Because of this, investors should not only pay attention to the change in interest rates of USD or AUD but also consider the relative interest rates of the two.

Assuming that the interest rate in Australia is 1 percent and the interest rate in the US is 3 percent, as an investor you may be inclined to invest in US assets that offer a higher rate of return. This scenario reduces the demand for Australian assets, resulting in a weaker AUD. Conversely, if interest rates in Australia rise, demand for the Australian dollar increases, and the Australian dollar may strengthen. Interest rate differentials have a direct impact on capital flows and the relative value of currencies, which in turn affects the AUD/USD exchange rate.

Recently, the AUD/USD exchange rate has begun to trend higher due to increased expectations of a Fed Rate Cut. Expectations of a depreciation of the US Dollar mean that the US Dollar is less attractive and the US Dollar Index is likely to decline. At the same time, the AUD/USD exchange rate is likely to rise against the US dollar against the backdrop of US interest rate cuts, and the trend of AUD appreciation will become more pronounced.

To accurately grasp the trend of the AUDUSD exchange rate, investors need to pay attention to economic indicators such as GDP, employment data, and the inflation rate; GDP demonstrates the overall health of the economy and its potential for growth, employment data reflects the health of the labor market, and the inflation rate affects the purchasing power of the currency.

These economic indicators not only influence the market's expectations of future monetary policy but also have a direct impact on the exchange rate between the Australian Dollar and the US Dollar. Changes in economic data can have a direct impact on market sentiment, which in turn affects the movement of AUD/USD. For example, strong GDP growth and improved employment data could support Currency Appreciation, while high inflation could prompt the central bank to take steps to raise interest rates, further impacting the pair's exchange rate performance.

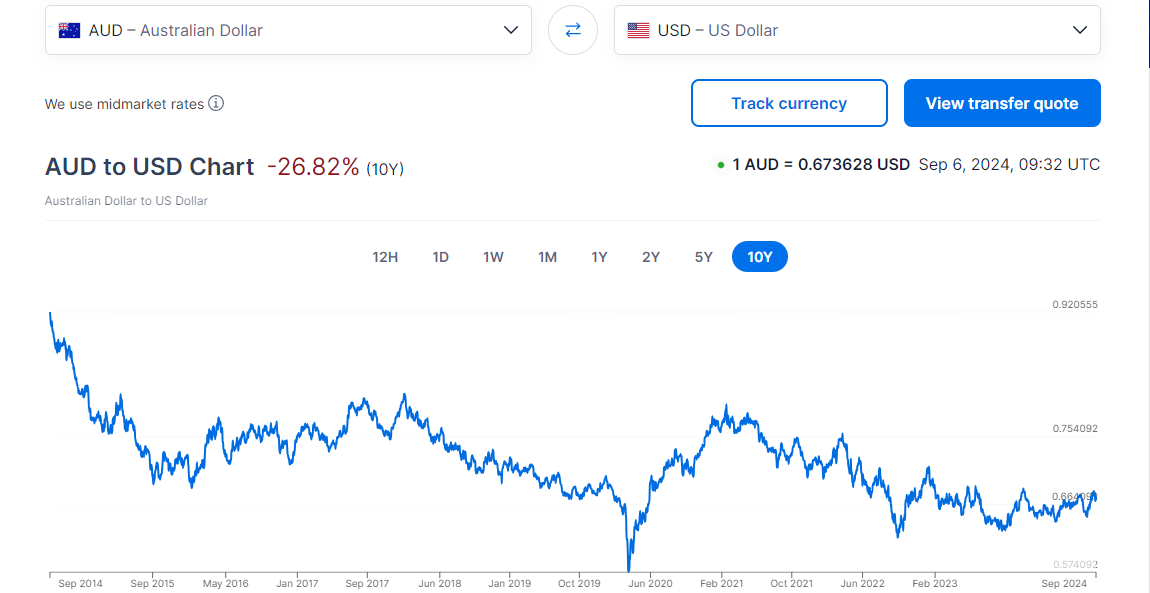

As shown above, between July and August 2024. the AUDUSD exchange rate experienced three consecutive weeks of downward movement and was even at risk of falling below the $6 mark at one point. This movement was largely influenced by favorable US inflation data, which resulted in the Federal Reserve's continued postponement of interest rate cuts. Market expectations for future interest rate adjustments were reduced from an initial five or more to one or two, which pushed the US dollar higher and exerted significant downward pressure on the Australian dollar.

As shown above, between July and August 2024. the AUDUSD exchange rate experienced three consecutive weeks of downward movement and was even at risk of falling below the $6 mark at one point. This movement was largely influenced by favorable US inflation data, which resulted in the Federal Reserve's continued postponement of interest rate cuts. Market expectations for future interest rate adjustments were reduced from an initial five or more to one or two, which pushed the US dollar higher and exerted significant downward pressure on the Australian dollar.

Meanwhile, Australia's labor market report showed a decline in full-time jobs in December last year, despite a relatively strong overall labor market performance. If this trend continues, it could increase market expectations for further interest rate cuts from the Reserve Bank of Australia (RBA), which could have a negative impact on the AUDUSD exchange rate.

And as a globally important mining exporter, changes in the prices of Australia's major export commodities (such as mineral resources) have a significant impact on the AUDUSD exchange rate. In particular, iron ore, as one of Australia's major export commodities, has price fluctuations that directly affect the trend of the Australian dollar.

When the price of iron ore rises, Australia's export revenues increase, which typically pushes the AUD up. Higher ore prices mean more foreign exchange earnings for Australia, which strengthens the purchasing power of the Australian dollar and increases market demand for the Australian dollar, which in turn appreciates.

However, a fall in iron ore prices could pose a risk to the Australian economy. Falling prices could reduce export earnings, which in turn could affect economic growth and fiscal revenues. A prolonged period of falling iron ore prices could lead to a slowdown in the economy, putting pressure on the government budget. Therefore, volatility in iron ore prices not only affects the short-term currency market but could also have far-reaching implications for Australia's overall economic health.

In addition, global market sentiment has a significant impact on changes in the AUD/USD exchange rate. Factors such as geopolitical risks and economic growth expectations can significantly influence investor sentiment. For example, geopolitical tensions could lead to a rise in risk aversion, pushing the US Dollar higher, while optimistic economic expectations could enhance demand for riskier currencies such as the Australian Dollar. These global factors sway the AUD/USD exchange rate by influencing market risk appetite and capital flows.

Therefore, to accurately capture the major upward and downward trends in the AUDUSD exchange rate, investors need to have an in-depth understanding of the various factors mentioned above. Understanding the impact of economic data, interest rate policy, commodity prices, and global market sentiment can help investors conduct a comprehensive fundamental analysis. By understanding these key factors, investors are better able to predict exchange rate movements and make more informed trading decisions.

AUDUSD Trading Strategies to Know

It is critical to fully assess the various factors that influence the rise and fall of the AUDUSD exchange rate, including economic data, international commodity prices, major economic policies, and global market sentiment. By analyzing these fundamentals in depth, investors can more accurately judge market movements.

And to more accurately understand the potential movement of AUDUSD, investors can use technical indicators to conduct a multi-dimensional market analysis. K-line charts provide information on market price openings, closings, highs, and lows, helping to identify price action and market sentiment. Trend lines are used to depict the direction of price action and the level of support and resistance, thus determining trend persistence and reversal signals.

While technical indicators such as MA are used to smooth out price data and identify long-term trends; RSI measures the overbought or oversold state of prices and predicts price retracements or reversals; MACD reveals changes in trends and buy and sell signals by comparing moving averages of different periods. Used together, these technical indicators can help investors analyze the market more comprehensively and develop more accurate trading strategies.

Of course, the impact of economic news on the market cannot be ignored, and paying attention to economic events and data releases is key to understanding market dynamics. Investors should keep an eye on the release of key Australian and US economic data such as Gross Domestic Product (GDP), employment reports, etc. These provide important information on the health of the economy and have a direct impact on currency pairs.

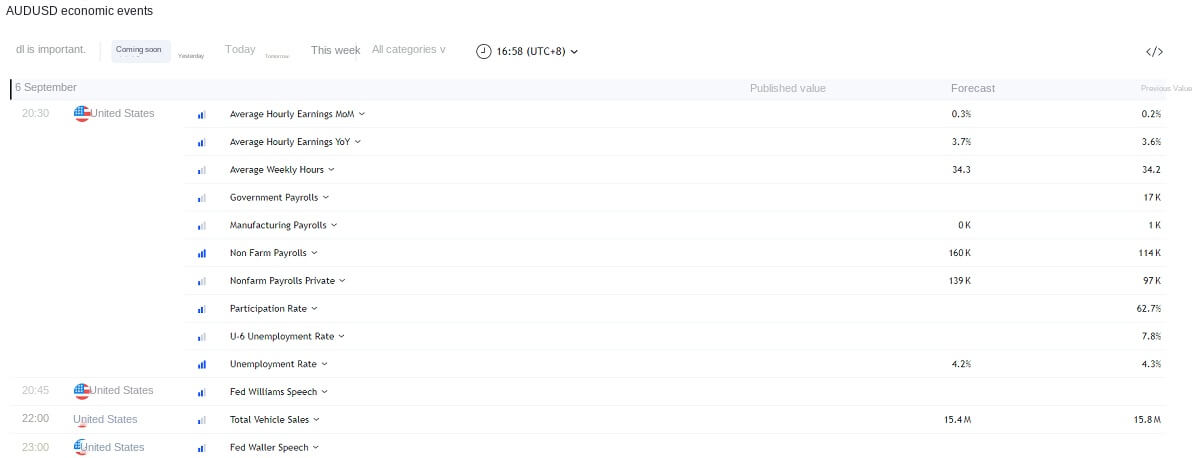

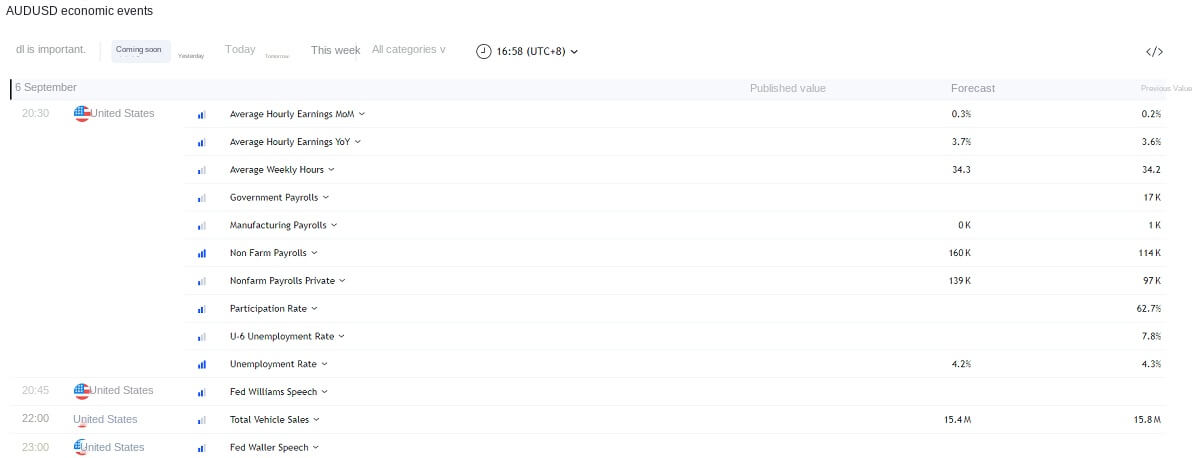

As shown above, timely tracking of economic events such as monetary policy meetings, interest rate decisions, and other important announcements by the RBA and the Federal Reserve can help investors capitalize on market trends and policy changes and thus make more informed trading decisions. By following these economic news, investors can better predict the direction of the market and the potential volatility of the AUDUSD currency pair.

As shown above, timely tracking of economic events such as monetary policy meetings, interest rate decisions, and other important announcements by the RBA and the Federal Reserve can help investors capitalize on market trends and policy changes and thus make more informed trading decisions. By following these economic news, investors can better predict the direction of the market and the potential volatility of the AUDUSD currency pair.

In forex trading, choosing the right timing and strategy for trading is crucial. Investors need to develop a detailed Trading plan based on market conditions and their own analysis. Strategies can include technical analysis, fundamental analysis, or a combination of both. When choosing the timing of a trade, it is important to consider the volatility of the market, the cycle of economic data releases, and other factors that may affect the exchange rate.

It is also important to make timely adjustments to your trading plan based on market trends and data changes. For example, when there is a clear trend in the market, traders may choose a trend-following strategy, while during periods of market oscillations, a range trading strategy may be more applicable. By having the flexibility to adjust strategies and timing, investors can optimize trading results and maximize returns.

In AUDUSD trading, risk management is the key to ensuring long-term profitability. Investors should set clear stop-loss and take-profit points to control potential losses and lock in profits. A stop-loss point is a point at which a position is automatically closed when the price reaches a certain level to avoid further losses, while a take-profit point is a point at which a position is automatically closed when the price reaches a pre-determined level of profitability to ensure that the profit that has been made is not cut.

It is also important to manage positions wisely. Investors should decide the position size of each trade according to the account capital and market conditions to avoid excessive leverage and over-concentration of investment, thus reducing risk. Through these measures, investors can control risk while optimizing trading strategies to achieve more stable investment returns.

Market sentiment plays an important role in AUDUSD trading because it directly affects investor behavior and exchange rate fluctuations. Paying attention to changes in market sentiment and understanding how investors react to economic data, policy changes, and geopolitical events can help predict exchange rate movements.

For example, market optimism about the economic outlook may drive currency appreciation, while pessimism may lead to currency depreciation. In addition, unexpected events and sentiment-driven market volatility may trigger sharp fluctuations in the short term. Therefore, understanding the changes in market sentiment and their potential impact can help you better grasp the exchange rate trend and adjust your trading strategy.

In addition, choosing a reliable trading platform is one of the key factors in successful AUDUSD trading. A quality trading platform should not only have stability and security but also need to provide real-time market data and efficient execution functions. Understanding the platform's trading costs, including spreads, commissions, and any hidden fees, is fundamental to developing an effective trading strategy.

AUDUSD currency pair and its trading strategy

| Exchange Rate Influencing Factors |

Trading Strategies |

| Interest rate changes impact the exchange rate. |

Technical analysis for trends and reversals. |

| Economic data affects the strength of currencies. |

Risk management to limit losses and boost returns. |

| Higher commodity prices boost the Australian dollar. |

Economic news for decision-making and forecasting. |

| Investor sentiment affects exchange rate fluctuations. |

Trading platforms affect costs and execution. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

As shown above, between July and August 2024. the AUDUSD exchange rate experienced three consecutive weeks of downward movement and was even at risk of falling below the $6 mark at one point. This movement was largely influenced by favorable US inflation data, which resulted in the Federal Reserve's continued postponement of interest rate cuts. Market expectations for future interest rate adjustments were reduced from an initial five or more to one or two, which pushed the US dollar higher and exerted significant downward pressure on the Australian dollar.

As shown above, between July and August 2024. the AUDUSD exchange rate experienced three consecutive weeks of downward movement and was even at risk of falling below the $6 mark at one point. This movement was largely influenced by favorable US inflation data, which resulted in the Federal Reserve's continued postponement of interest rate cuts. Market expectations for future interest rate adjustments were reduced from an initial five or more to one or two, which pushed the US dollar higher and exerted significant downward pressure on the Australian dollar. As shown above, timely tracking of economic events such as monetary policy meetings, interest rate decisions, and other important announcements by the RBA and the Federal Reserve can help investors capitalize on market trends and policy changes and thus make more informed trading decisions. By following these economic news, investors can better predict the direction of the market and the potential volatility of the AUDUSD currency pair.

As shown above, timely tracking of economic events such as monetary policy meetings, interest rate decisions, and other important announcements by the RBA and the Federal Reserve can help investors capitalize on market trends and policy changes and thus make more informed trading decisions. By following these economic news, investors can better predict the direction of the market and the potential volatility of the AUDUSD currency pair.