When it comes to Apple, the first thing that comes to mind is the company's cell phone products. Just as people are passionate about Apple's cell phone products, investors in the stock market are also passionate about Apple's stock. Whether you're a tech enthusiast or a financial expert, people are confident that Apple will continue to deliver great returns. Recently, however, Warren Buffett, who has been heavily invested in Apple stock, has begun to reduce his holdings, making people worry about its investment value. Now let's take a good look at the value and investment outlook for Apple stock.

Apple is a globally recognized technology company headquartered in Cupertino, California. Apple is known for its innovative products and services, which include iPhone smartphones, iPad tablets, Mac computers, Apple Watch smartwatches, AirPods wireless headphones, and more.

In addition, Apple offers software and services such as iTunes, the App Store, and iCloud that provide users with digital content entertainment, cloud storage, and application downloads. Apple is globally recognized for its high-quality product design, strong ecosystem, and broad user base.

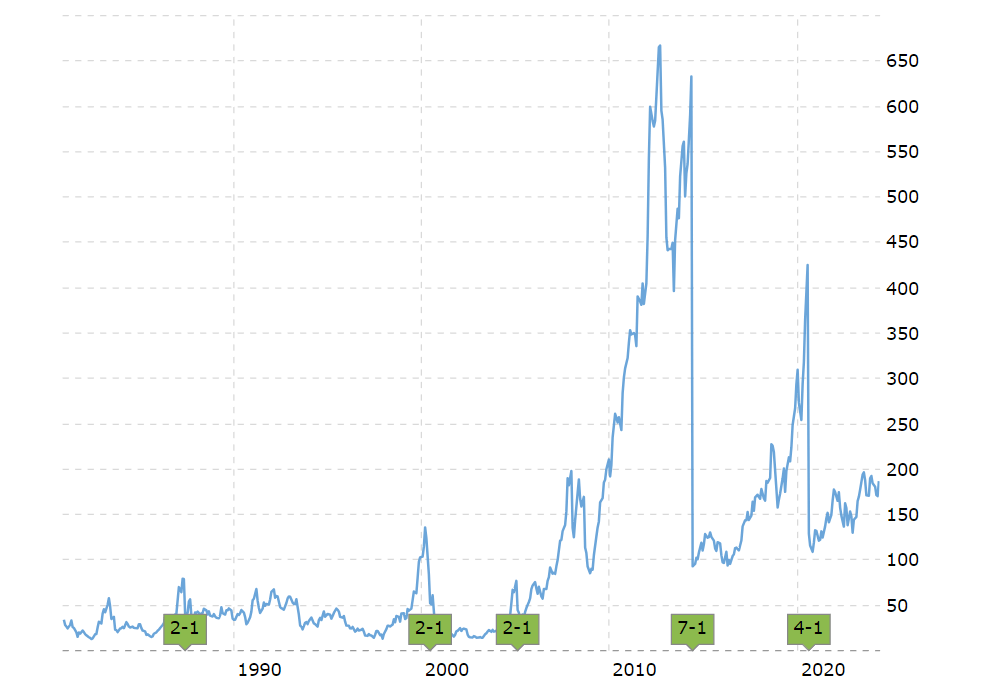

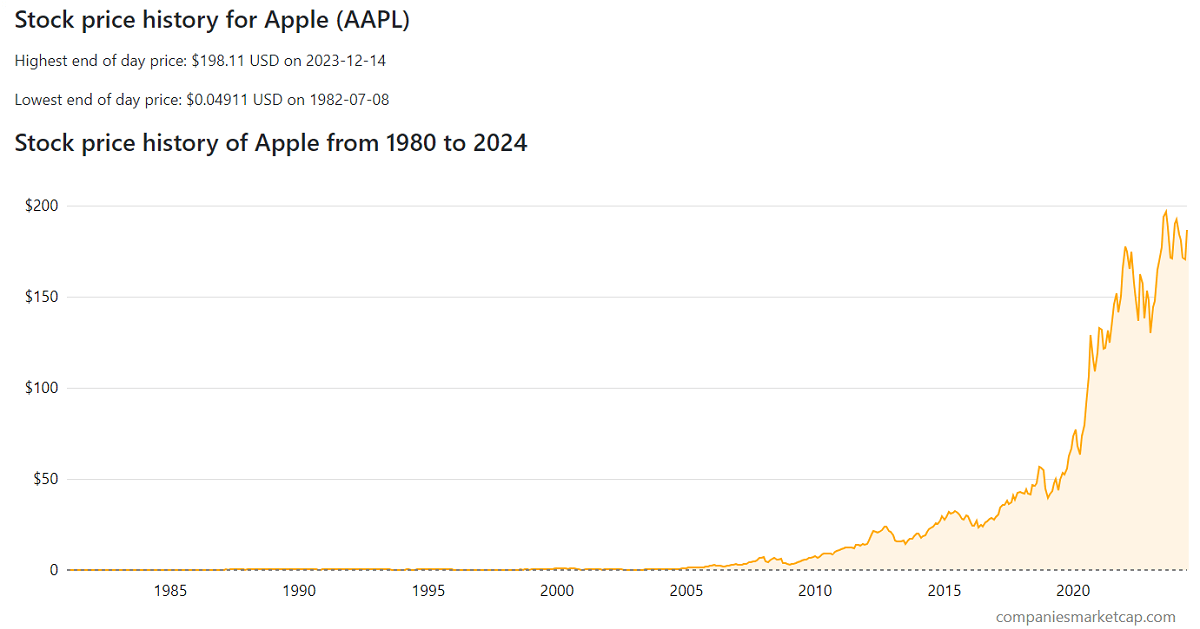

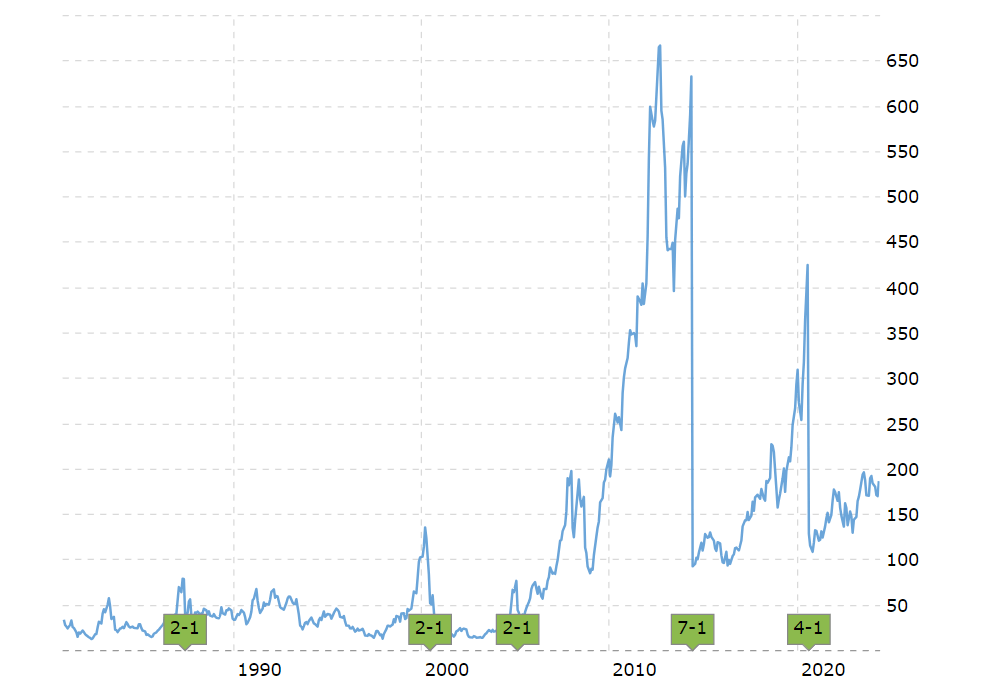

Apple's stock symbol is AAPL, and it was listed on December 12, 1980, on the NASDAQ stock exchange. At that time, the issue price of the stock was $22, and today it has risen to $186.88. This represents a percentage increase of approximately 749.45% since its ipo. If one had invested $22 in Apple stock then, it would now be worth $186.88, representing a return of 7.49 times the original investment.

Of course, Apple's road to success hasn't been smooth. In the early 1990s, Apple was facing a crisis of near-bankruptcy; its market share was squeezed by competitors such as Microsoft; its internal management was in disarray; and Steve Jobs was forced to leave the company. During Jobs' departure, Apple's stock price hit rock bottom, and the company was in trouble.

The downturn lasted for a long time, and it was not until 2000 that a turning point was reached. The invention of the iPod gave Apple a boost, but the real leap forward came with the launch of the iPhone in 2007. In those seven years, Apple's stock price rose 20-fold, taking the company to a whole new level. The success of the iPhone revolutionized the smartphone market and turned Apple into a global technology giant.

Through continuous innovation, Apple has launched a series of popular products, such as the iPad, Mac computers, Apple Watch, etc., expanding its product line and constantly improving the user experience. The success of these products has not only boosted the company's profitability but also allowed Apple's stock price to continue to rise. As you can see, its stock price has been flying high, rising every year since 2014.

This trend of continuous growth has made Apple a favorite in the eyes of investors. Though it has experienced periodic fluctuations and adjustments, for example, sometimes the stock price may fall before the release of a new product or when market conditions change. But whenever a successful product is released or there is a good earnings report, it may drive the stock price up.

Also, in order to make the stock more attractive and increase liquidity, Apple has also split its stock several times, which lowers the share price per share and makes the stock more attractive, especially for retail investors who can more easily buy small amounts of stock. And splits also increase the liquidity of the stock as more shares become available for trading, which attracts more investors and increases trading activity.

And in addition to the capital appreciation from the rising stock price, Apple pays out generous dividends to its shareholders, providing additional returns to investors. This solid financial performance and focus on shareholder value further strengthened Apple's stock in the minds of investors.

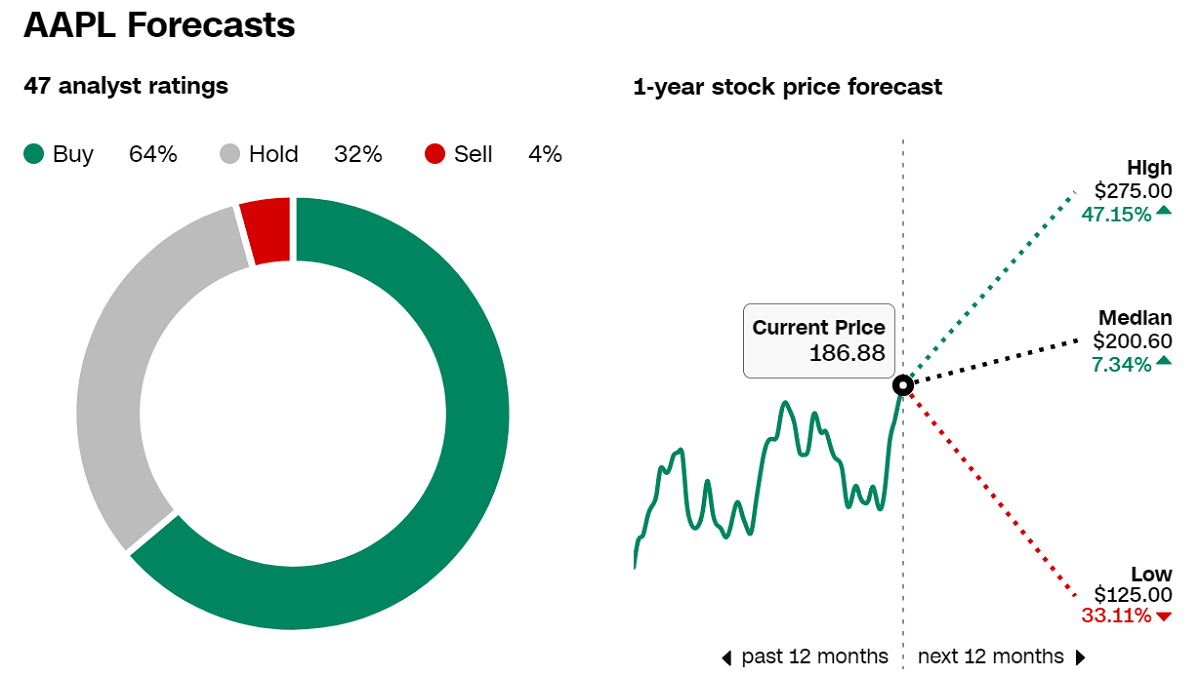

Apple also became the first company to surpass $3 trillion in market capitalization, which was favored by many investors. But Apple's stock performance this year has been weaker, rising less than the broader market and even falling 14% from its peak. And Buffett's reduction in holdings has added to the market's concern, and I wonder if it still has investment value.

Reasons for Apple's Stock Decline

Apple stock hasn't been doing well this year since the beginning of the year. Not only is the stock price volatile, but it has been trending down overall. Especially in March and April, the stock price once fell to $165. Compared to other tech giants, Apple hasn't fared as well. Since 2024. its stock price has fallen 11%, while in contrast, NVIDIA's stock price has doubled and Meta's stock price has risen 42%.

In fact, looking at its financial statements for the past four quarters of 2023. Apple has done well overall. Both Q4 and Q1 realized over $100 billion in revenue, while Q2 and Q3 saw a slight pullback but remained at high levels. Sales have continued to grow since the second quarter, and gross and net profits have improved, showing a solid growth trend in the company's business. In addition, the debt issue was relatively under control, with a downward trend in the final quarter.

Despite the strong results shown in the financial statements, the final assessment from Wall Street was not as favorable, leading to short-term volatility in the stock price. The reasons for this may stem from a variety of causes, including poor product performance, declining sales, judicial litigation and regulatory investigations, industry competition and market concerns, and global economic factors.

First, Apple's recent product innovation has been insufficient, mainly launching newer versions of older products and lacking noteworthy innovations. At the same time, increased competition has also challenged Apple's market share, especially in the Chinese market, where competition from other cell phone brands has become increasingly fierce, affecting Apple's sales performance.

For example, the recent release of Apple's new Vision Pro eyeglasses has not been as warmly received by the market as expected, which may have contributed to the drop in share price. Compared with the Mate glasses, the Visample seems to perform less well than the latter and is also more expensive. So that creates a situation where the market has not responded well, and that's a natural multiple hit for Apple stock.

Meanwhile, Wall Street sees Apple's iPhone sales in Greater China as unfavorable and expects this trend not to reverse in the future but to continue to decline. That's because recent financial statements have shown declining revenue in Greater China, which is seen as a reflection of overall economic problems. Even though Apple has introduced better and more appealing products, the overall capacity of the market to absorb these products has led to a decline in iPhone sales in the Greater China region. As a result, the current situation may be unlikely to be reversed.

In addition, the antitrust lawsuit filed by the U.S. Department of Justice against Apple has also had a negative impact on its stock price. Although the outcome of this lawsuit is unclear, similar antitrust cases have historically had a large negative impact on the defendant company's business and share price. The potential for such legal disputes to result in Apple facing large fines, as well as stricter regulations and restrictions, are all factors that have created concerns about the company's future growth, which in turn has impacted investor confidence and the stock price.

Over the past decade, frequent antitrust lawsuits have been filed against Apple in the European Union. Most recently, Apple was hit with another major lawsuit when Spotify, the world's largest music streaming platform, sued Apple in early March, which ultimately resulted in a €1.84 billion fine.

Such a fine can mean huge financial pressure for a company, can have a considerable impact on its profits, and is therefore also seen as a negative. More surprisingly, a monopoly lawsuit was also filed against Apple in the United States, where the U.S. Department of Justice, in conjunction with 16 states, sued Apple. The news caused Apple's stock to drop 4.1% on the same day, further exacerbating the company's internal and external problems.

Despite the current downward pressure on Apple's stock, investors with a long-term investment horizon may see this as an attractive investment opportunity. Because Apple was once one of the companies with the highest market capitalization, Apple's brand value, technological prowess, and huge potential in the global market will remain an important source of attraction in the long run, and its share price gains still have the potential to yield large returns.

How to Buy Apple Stock

How to Buy Apple Stock

Despite recent weakness in Apple's stock price due to a variety of factors, the company's business fundamentals remain sound over the long term. Consistent and stable dividend payments, high profitability, and strong cash flow are all indicative of its value. Therefore, for investors with a long-term investment horizon, the current share price decline may offer an attractive buying opportunity.

Apple is currently facing some challenges, but it still has a solid financial foundation, a strong brand presence, and continued innovation as a leading global technology company. With the launch of new products and a rebound in the market, Apple is expected to regain its growth momentum and bring substantial returns to investors.

Fundamentally, Apple stock is supported by a number of favorable factors. Recently, the company announced that it was discontinuing car manufacturing and shifting to the development of artificial intelligence (AI), a move that was recognized by Wall Street. Additionally, Apple made some announcements that it will be working with Google's AI system in the iPhone 16 to provide artificial intelligence services for the iPhone.

The news, once released, caused Google's share price to plummet, increasing by about 6%. Similarly, the rumor about the combination of Apple's AI system with Baidu's AI system also made Baidu's stock price rise by about 8%. As you can see, the AI concept has had a significant impact on Stock Prices, and with the launch of the iPhone 16. it is expected to further unlock the value of Apple's combination with the AI concept.

In addition, the market for Apple's own AI system as well as the development status of the existing AI system are still in a certain speculative space, which provides a certain opportunity for fundamental speculation. Therefore, it is wise to lay out the current situation in anticipation of a lucrative gain from the Apple new product launch in September to October.

And since Apple's intrinsic value is considered to be much higher than the current share price level, as assessed by the discounted cash flow model and price-to-earnings multiple, investors may see this as a bottom-feeding opportunity. Investors remain optimistic about the long-term growth potential of Apple stock as the company continues to introduce new products and services and its leadership in innovation.

From a technical analysis standpoint, Apple stock could be facing a downtrend and has some price targets to watch closely. First, $165 is an important key support point and could be the stock's first retracement. Second, around $157 is another important retracement point that corresponds to the 0.618 level of the maximum time period and could be a key point for a long-short turn.

Therefore, investors need to be on the lookout for these retracement points and position themselves at these locations when it comes to long-term strategies. If investors are unable to keep an eye on the market on a daily basis, they can resort to setting up pending orders and waiting for the stock to touch a specific price before buying. In addition, consider the time factor as part of risk sharing, whereby unexecuted pending orders can be canceled within a set point in time. It is advisable to take about two months to lay out in anticipation of future hype opportunities when the iPhone releases new products.

It is a wise strategy to keep a close eye on the 0.618 level in the mid-maximum time frame, as this is usually an important indicator in technical analysis. If the stock doesn't fall below $150 for a day, it may still be in an uptrend wave. This strategy can help investors determine stop-loss or exit points and reduce investment risk to some extent.

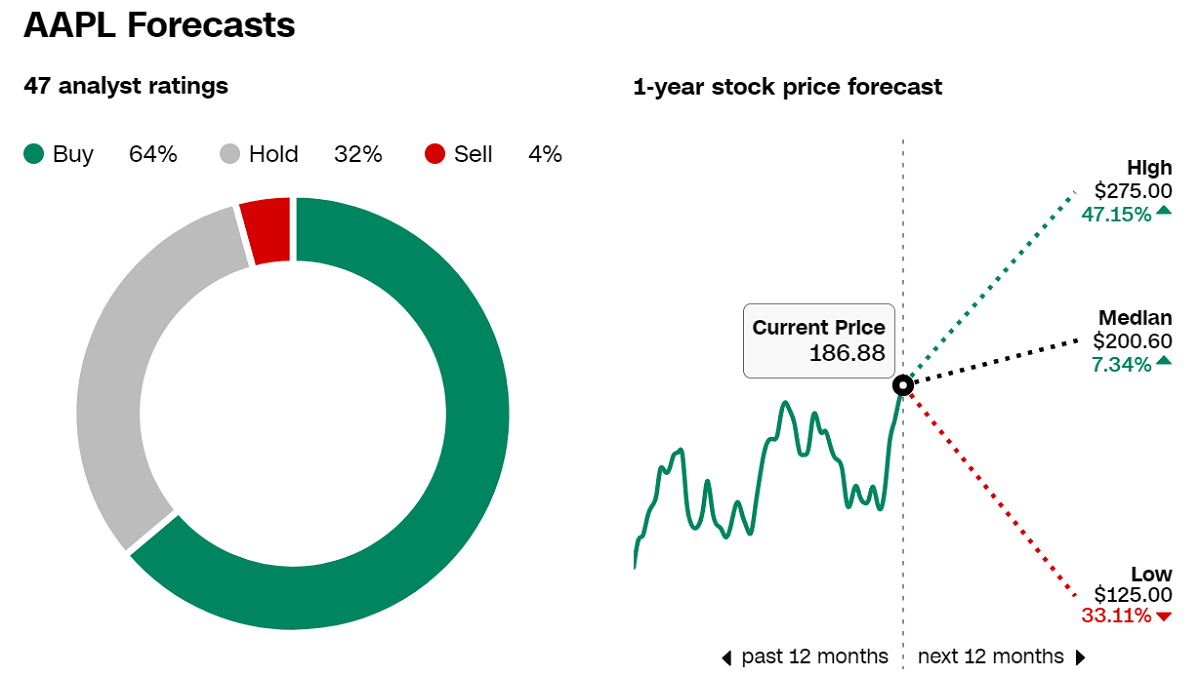

On top of that, it's worth noting that most Wall Street analysts hold buy ratings on Apple, and funds continue to add to their holdings, suggesting that the market is optimistic about Apple's long-term prospects. In addition, with the Federal Reserve likely to start cutting interest rates in the second half of the year, this will also be a positive factor for large technology stocks such as Apple, which is expected to boost its share price.

As such, the current decline in Apple stock is a buying opportunity worth considering. Of course, while these factors collectively reflect investor confidence in Apple's future and could have a positive impact on the stock price, investors still need to carefully assess the risks and rewards and make decisions based on their own investment objectives.

Apple Stock Value and Investment Outlook

| Value |

The Challenge |

Investment Outlook |

| Brand Recognition |

Lack of product innovation |

Long-term investing is bullish for the future |

| Strong Ecosystem |

Market share challenges |

Stock Price Declines as Opportunities |

| High quality products |

Judicial proceedings and regulatory pressures |

Stock price volatility favors short-term trading |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

How to Buy Apple Stock

How to Buy Apple Stock