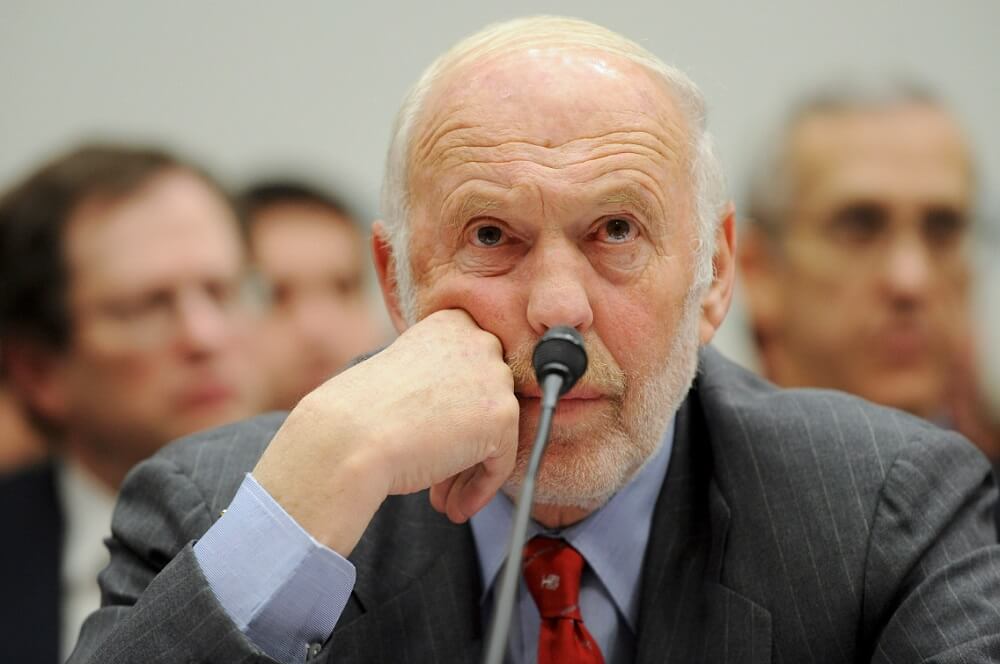

Finance is often described as a game of numbers, yet few truly harness the power of mathematics to navigate the financial world. James Simons, who passed away on May 10, 2024, was one of the rare exceptions. With his exceptional mathematical prowess and profound market insights, he achieved remarkable investment results, earning him the title of a godfather in quantitative investing. Let's delve into the financial achievements and quantitative strategies of Simons.

Simons Personal Profile

James Simons is a prominent American mathematician and hedge fund manager known for his contributions to the field of mathematics and his success in the world of finance. He achieved excellence in the fields of mathematics and mathematical statistics and successfully applied this deep mathematical knowledge to financial investments and risk management.

He was born on April 25. 1938. and grew up in a middle-class family in Newton, Massachusetts. Showing a keen interest in mathematics from an early age, he enrolled in the Mathematics Department of the Massachusetts Institute of Technology (MIT) at the age of 17. As one of the world's leading science and technology institutions, MIT provided Simons with high-quality academic resources and a favorable learning environment.

Here, he received rigorous mathematical training, acquired a solid foundation in mathematics, and developed a deep understanding and love of mathematics. This experience marked his formal entry into mathematics and laid a solid academic foundation for his future excellence in academia and finance.

Another important milestone in his academic career came in 1961. when James Simmons earned his PhD in mathematics from the University of California, Berkeley. At Berkeley, he was mentored by the renowned mathematician Bertram Kostant, under whom he studied cutting-edge topics in mathematics and actively participated in academic discussions and research projects. This period of study and research not only allowed him to deepen his understanding of mathematical theories but also to develop solid mathematical research skills and innovative thinking.

He then taught at the Massachusetts Institute of Technology and Harvard University before joining Brown University in 1964. This was followed by becoming a member of the mathematics department at Stanford University. At the same time, at the age of 26. he joined the US Ida National Intelligence Organization as a senior intelligence analyst. In this field, he demonstrated talent and unique insights and made outstanding contributions to the country's intelligence work.

In 1968. Simons assumed the chairmanship of the Department of Mathematics at the State University of New York at Stony Brook University. In this position, he demonstrated extraordinary leadership skills and greatly enhanced the reputation of the department. Through his efforts, the Department of Mathematics at Stony Brook achieved remarkable success in scholarship and teaching, attracting more outstanding faculty, staff, and students.

In 1975. he collaborated with renowned mathematician Shen-Shen Chen to develop Chern-Simons theory, a theory that has had a major impact in topology and quantum field theory in physics and has earned him an international reputation.Combining concepts from topology and quantum field theory, Chern-Simons theory has provided a theoretical framework for explaining areas such as topological phase transitions and topological quantum computation. It became one of the most important research topics in contemporary mathematics and theoretical physics.

Simons also published several influential mathematical papers, especially in the fields of differential geometry and topology. His research results brought new perspectives and theories to the mathematical community, promoted the development of related fields, and made important contributions to the progress of mathematical research.

Because his mathematical research and theoretical results have brought major breakthroughs in the field of mathematics and have had a profound impact on the development of modern mathematics, Simons was awarded the Oswald Veblen Prize, the Nobel Prize in American mathematics. This distinction marked the pinnacle moment of his academic career and was a recognition and affirmation of his longstanding contributions to the field of mathematics.

Since then, he has turned his attention to the world of finance. In 1978. he discovered the opportunities in the forex market and began trading forex. This move marked his transition from the world of mathematics to the world of finance. He then founded a company called Monemetrics, which later became the forerunner of the hedge fund Renaissance Technologies.

In 1982. he founded Renaissance Technologies, a well-known hedge fund firm. After leaving academia, he leveraged his skills in math and computing to focus on quantitative investing and algorithmic trading. Renaissance Technologies became known in the industry for its innovative quantitative trading strategies and advanced technology, and it became one of the leading companies in the financial world.

In 1988. James Simmons went on to found the Medallion Fund. This fund is the flagship fund of Renaissance Technologies, Inc., is known for its exceptional investment returns, and is considered one of the most successful hedge funds in the world.

Overall, James Simmons is a brilliant mathematician, leading hedge fund manager, and innovator in the financial world, having achieved great success in both academia and finance. His accomplishments are evident not only in his contributions to mathematical theory but also in his ability to apply mathematics to the practice of finance and achieve outstanding results.

Simons' Financial Achievements

He has achieved excellence in the field of mathematics and has successfully applied his mathematical knowledge to financial investments and risk management. As one of the founders of Renaissance Technologies, he pioneered quantitative trading and grew the firm into a leader in the investment community with his exceptional investment strategies and leadership skills.

Founded in 1982. Renaissance Technologies is renowned in the financial community for its innovative quantitative trading strategies and advanced technology. The firm focuses on quantitative investing and algorithmic trading, utilizing mathematical models and computer algorithms to make trading decisions and achieve phenomenal investment performance. It also employs unique trading models, including ultra-high-frequency trading, that enable it to quickly capture market opportunities and achieve efficient trading, making it one of the leading firms in the investment world.

The success of Renaissance is not only reflected in its efficient trading strategies and advanced technology, but also in its profitability. The company has managed to capture the industry's highest 5% commission while being known for its superb 66% annualized returns. Its high-frequency trading model of over 10.000 trades per day has also earned it widespread attention and recognition.

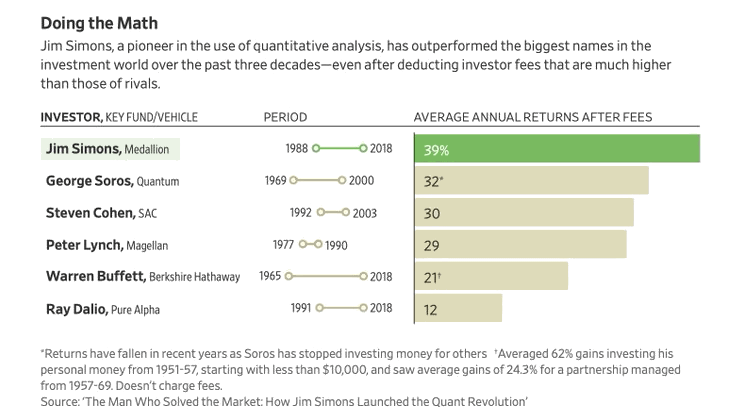

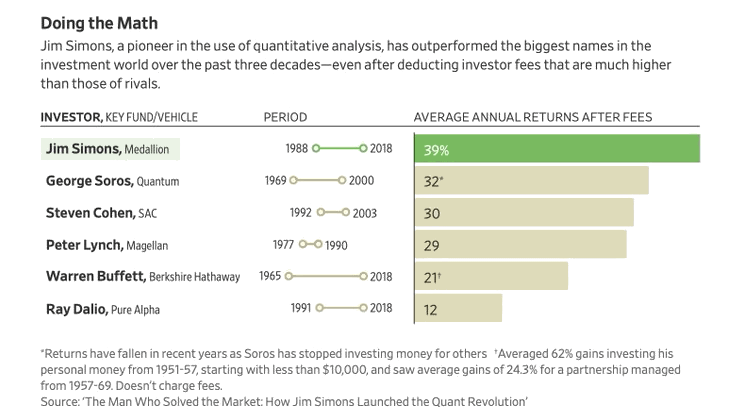

The company has generated superb profits of over $100 billion with its efficient trading strategies and outstanding performance. This record not only far exceeds that of other investors and fund managers but is even harder to match by well-known investment moguls like Warren Buffett, George Soros, Peter Lynch, Steven Cohen, and top fund managers like Rui Dalio. This groundbreaking achievement underscores Renaissance Technologies' extraordinary standing in the financial world and its leadership in quantitative trading.

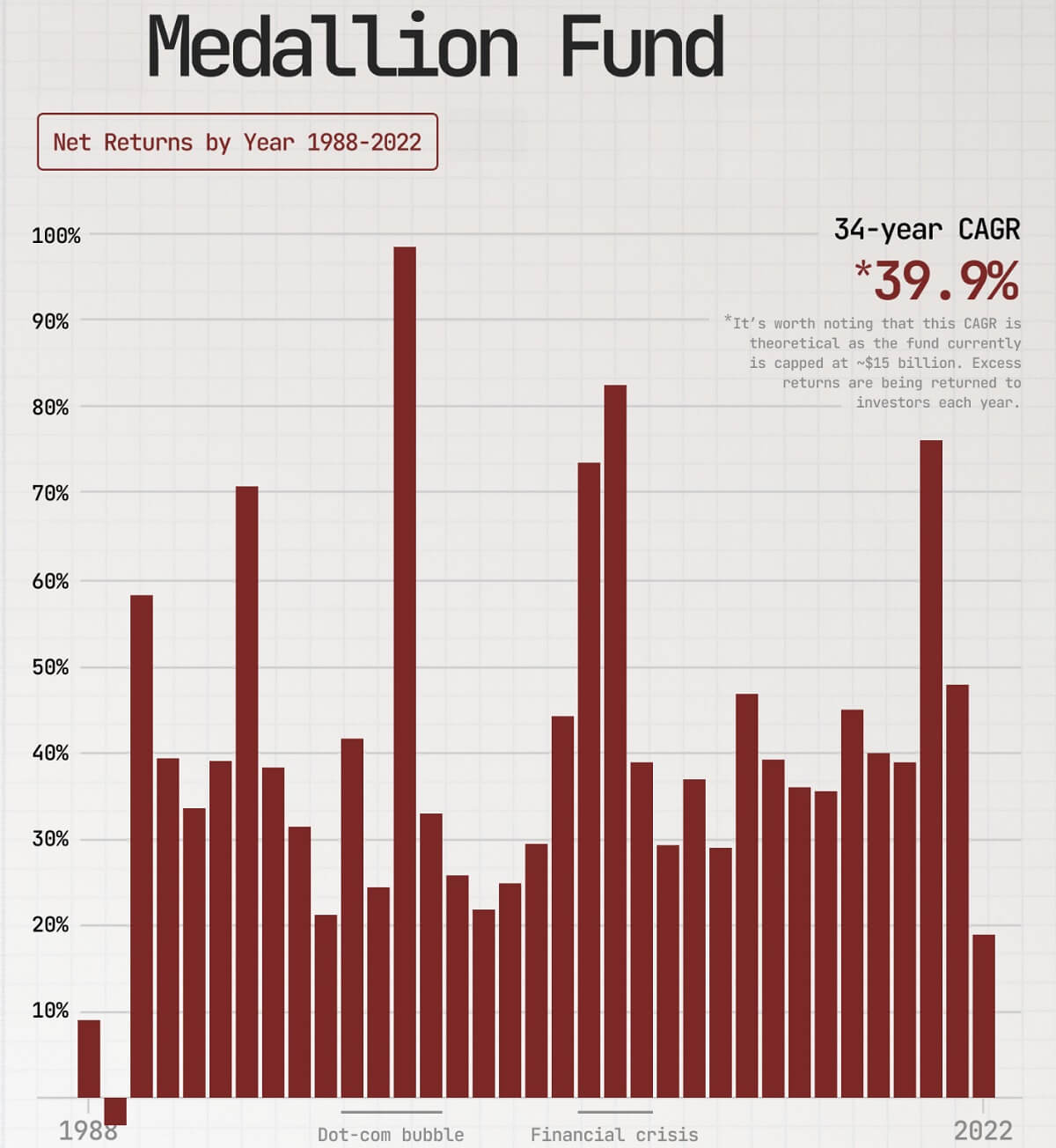

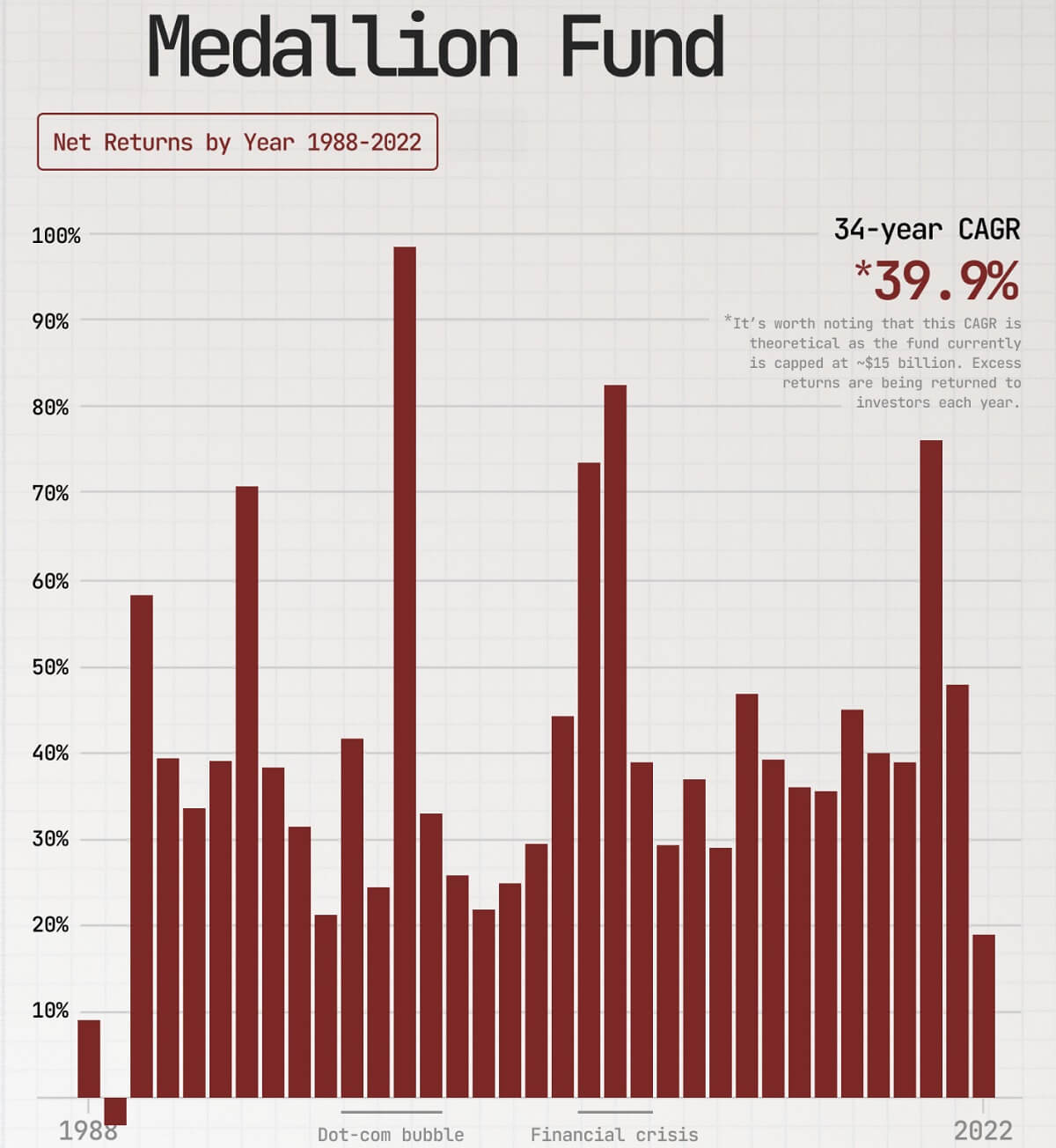

The Grand Medallion Fund, established in 1988. is another example of an industry that has attracted the attention and following of many investors. This fund is the flagship fund of Renaissance Technologies, Inc. Known for its exceptional investment returns, it is recognized as one of the most successful hedge funds in the world.

Its highest net return came in 2000. during the bursting of the Internet bubble. In this turbulent market environment, the Grand Medallion Fund achieved a staggering 98.5% net return, underscoring its outstanding performance and ability to capitalize on market opportunities in times of market turbulence.

This performance not only far exceeded that of other investment vehicles over the same period but also demonstrated the Fund's superior ability to respond to market changes and manage risk. This outstanding performance has further strengthened the Grand Medallion Fund's position as a leader within the hedge fund industry and has earned it widespread acclaim and recognition.

Not coincidentally, when the financial crisis swept the world in 2008. the Grand Medallion Fund once again demonstrated its extraordinary investment strength. While most investors suffered severe losses, the Grand Medallion Fund achieved a staggering 80% return, demonstrating its robustness and superior performance in extreme market environments. This counter-cyclical investment performance has earned a high level of trust and respect from investors, highlighting the outstanding ability of the Grand Medallion Fund in risk management and asset allocation.

Grand Medallion Funds have also demonstrated impressive performance in terms of long-term investment returns. Looking back over the past 20 years of investment history, from 1994 to 2014. the fund's average annualized return was as high as 71.8%, far exceeding the market average. Even more strikingly, from 1988 to 2023. the average annual return of the Grand Medallion Fund was nearly 40%, highlighting the stability and success of its investment strategy.

This consistently high rate of return is not only quite rare in the hedge fund industry, but it far outperforms most other investment vehicles. Through its superior investment strategies and risk management capabilities, the Grand Medallion Fund has generated lucrative returns for its investors, cementing its position as one of the top choices in the financial world in the eyes of investors.

In addition to his tremendous success in investing, one of Simons' outstanding contributions to the financial world has been the advancement and popularization of quantitative trading. By applying math and computational techniques to finance, he has pioneered new trading methods and strategies that have brought innovation and change to the financial markets. And through the success of Renaissance Technologies and the Grand Medallion Fund, he has had a profound impact on the global hedge fund industry.

Simons' ideas and methods have become the object of study and the source of reference for many hedge funds, and they have had a significant impact on the operation and development of the financial markets. With his leading-edge thinking and superior execution ability, he has opened a new path for the development of quantitative trading in the financial field, set an example for the investment community, and become an important leader in the industry.

James Simmons Quantitative Investment Strategy

James Simmons Quantitative Investment Strategy

Quantitative trading is a method of making trading decisions using systematic mathematical models and algorithms, aiming to discover patterns in the market and obtain stable returns. Simons, a pioneer of quantitative trading, is known for his innovative approach and high-frequency operations.

Known as the father of quantitative trading, Simons' contribution lies not only in the application of mathematical models to finance but also in his extensive use of high-frequency operations. High-frequency trading is a trading strategy that involves buying and selling at an extremely fast pace, utilizing computer algorithms to complete trades in a very short period of time and profit from small spreads.

Simons is one investor who focuses on short-term high-frequency trading, pursuing those tiny but replicable moments of profit rather than betting that the market will return to normal. He is a firm believer that every trade should have a clear stop-loss and take-profit target so that positions can be closed in a very short period of time to control the magnitude of losses.

For Simons, although there may be losses on each trade, the impact of these losses is relatively small because he trades a lot of high-frequency trades. He believes that as long as there are more profitable trades than losing trades, he will be able to realize a profit overall. This approach to trading, based on statistics and mathematical modeling, allows him to capture market fluctuations more effectively and make profits in a short period of time.

For example, Renaissance Technologies was able to quickly become one of the most profitable quantitative investment firms on Wall Street by utilizing mathematical models and computer algorithms for high-frequency trading, and that's why it achieved an amazing ROI. These models rely on advanced computational techniques and statistical methods that incorporate the technological tools of machine learning and artificial intelligence for efficient market forecasting and trade execution.

This approach allows Renaissance Technologies to make quick decisions and trade with efficiency and accuracy in the financial markets. As a result, the company has a compounded annualized return of 39.1% and was able to maintain positive returns even during the 2008 financial crisis. And the firm's ability to perform well in the midst of market turmoil and crises was due to its in-depth analysis of data and quick reaction to market changes.

Simons has also created a “gecko investing approach” inspired by the way geckos hunt for food. The core concept of this strategy is to wait for opportunities in the market, just like the gecko lying on the wall waiting for mosquitoes to appear. Once found in the market, trading opportunities should be taken quickly.

Similar to the way a gecko waits for a mosquito to appear, an investor will also wait for specific conditions or signals to appear in the market, which may include price changes, trend conditions, technical indicators, etc. Once these conditions are met, investors will act quickly to execute the appropriate trading strategy.

The core idea lies in the use of high-frequency trading and mathematical models to analyze the market, with rapid response to market changes as the main feature. The method emphasizes short-term directional forecasting and the use of price fluctuation opportunities to gain profits while protecting capital through strict risk control and multi-species diversification.

The Gecko Investment Method is unique in its reliance on mathematical models and statistical analysis to identify market patterns and trends in order to make precise trading decisions. In addition, the strategy focuses on strict risk management to minimize investment risk by controlling positions and setting stop-losses. The adoption of a short-term trading strategy enables it to move in and out of the market quickly and respond flexibly to market fluctuations, thereby realizing solid investment returns.

At the core of this strategy is the ability to remain alert and flexible in the market in order to quickly capture fleeting opportunities. Like the gecko, investors need to be patient and ready to be flexible and act quickly in the market. Flexibility and acumen are key to successfully executing this strategy, as market conditions can change at any time and investors need to react quickly to maximize market volatility.

Overall, Simons' quantitative trading strategy is based on mathematical models and statistical analysis designed to identify non-random phenomena in the market and exploit them for profit. His strategy focuses on short-term directional forecasting and opportunities to capitalize on price fluctuations, with high-frequency trading at its core. This approach emphasizes getting in and out of the market quickly and reacting quickly when profitable trading opportunities are identified in order to maximize short-term market volatility.

Simons' Financial Miracle and Quantitative Strategies

| Topics |

Specifics |

| Personal Background |

PhD in Mathematics, taught at MIT, Harvard, etc. |

| Renaissance Technologies, Inc. |

Established in 1982, specializes in quant and algo trading. |

| Grand Medallion Fund |

Established in 1988, boasting a remarkable 40% annual return. |

| High Frequency Trading Strategy |

High-speed trading with math models and computer algorithms. |

| Gecko Investment Method |

Applies math models for swift market analysis and trades. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

James Simmons Quantitative Investment Strategy

James Simmons Quantitative Investment Strategy