In the eyes of many people, quantitative trading has always been synonymous with mystery. This trading strategy involves a series of high-frequency AI algorithms and other esoteric words, giving it a high-tech attribute. As a result, it is a high-end trading strategy in the minds of many ordinary traders. Others, however, see it as a very sharp scythe inside the stock market. Now let's take a good look at the pros, cons, and techniques of quantitative trading, the investment tool of the digital age.

What is Quantitative Trading?

It is an investment method originating from Wall Street, mainly using mathematical models and computer technology to find investment targets in the stock market and execute trading strategies. It utilizes big data technology to collect market data, quickly screen stocks from multiple perspectives, and conduct buying and selling transactions.

It makes trading decisions based on the analysis of large amounts of historical data and pattern recognition, as well as real-time monitoring of market conditions. The goal, then, is to obtain stable profits through an automated and systematic approach that reduces the influence of human emotions and subjective judgments on trading.

In quantitative trading, trading decisions are usually executed by predefined algorithms and strategies rather than directly by human traders. These algorithms and strategies may involve techniques such as statistical analysis, mathematical modeling, and machine learning in order to identify price discrepancies, trends, and trading opportunities in the marketplace and execute trades based on this information.

It is more systematic and scientific than the traditional way of trading based on personal experience and intuition. Because it relies on a large amount of historical and real-time data, it is based on building mathematical models to predict market movements and execute trading strategies automatically. Therefore, this method eliminates the influence of human emotions and subjective judgment, improves the accuracy and consistency of trading decisions, and focuses on risk management to make trading more stable and sustainable.

Its core idea lies in the use of a large amount of historical data for analysis and the construction of complex mathematical models to identify patterns and trends in the market. Through in-depth research and statistical analysis of historical data, quantitative trading can identify potential market patterns and develop trading strategies based on these patterns. These trading strategies can be adjusted and optimized according to market conditions to achieve more robust and sustainable investment returns.

How does Quantitative Trading Work?

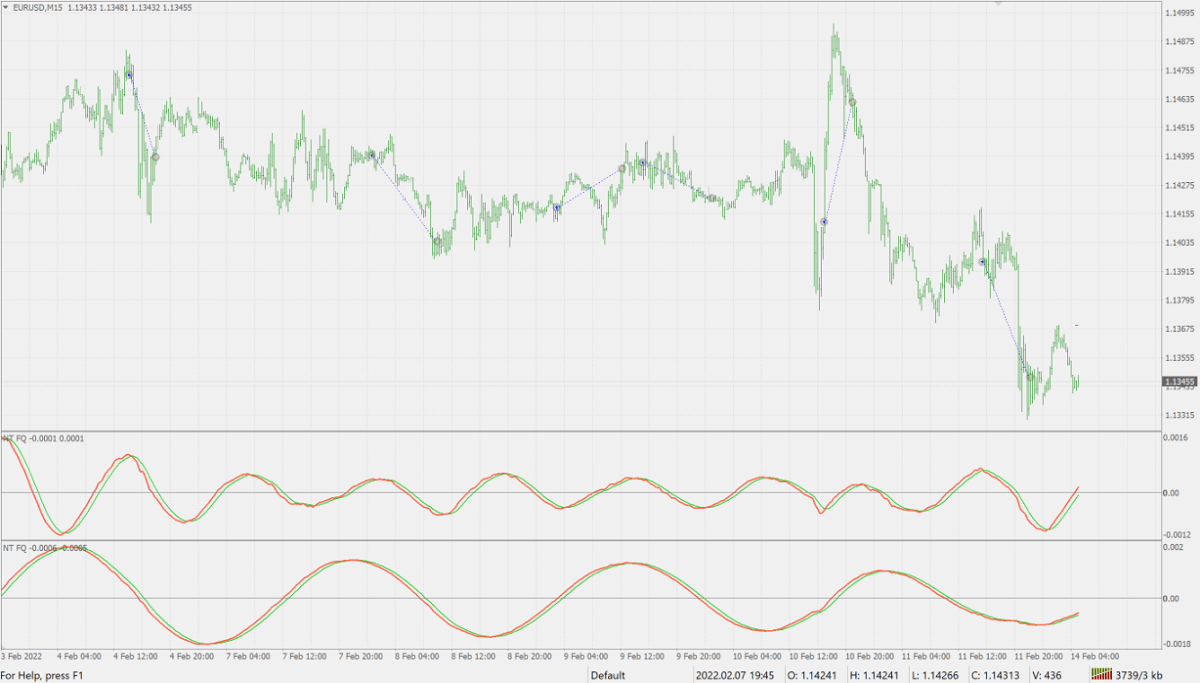

The process involves collecting and organizing a large amount of historical data, including financial market prices, trading volumes, and economic indicators. This data comes from a variety of financial markets and includes data from different asset classes, such as equities, futures, foreign exchange, etc.

The data collected includes not only historical data but also real-time data in order to update and adjust trading strategies in a timely manner. These data are typically obtained through various means, including financial data vendors, data interfaces provided by exchanges, and self-developed data collection programs. The collected data is used to construct mathematical models and perform technical analysis to identify patterns and trends in the markets in order to develop appropriate trading strategies.

Once the data has been collected, the quantitative trader cleans, organizes, and processes it to ensure its quality and accuracy. This may involve dealing with missing values, outliers, and duplicate data, as well as standardizing or normalizing the data for subsequent analysis.

Next, using methods such as statistics, mathematics, and computer science, traders will construct mathematical models that are capable of predicting market trends and price fluctuations based on historical data. The construction and adaptation of models is an ongoing process that requires constant optimization and updating based on market conditions and data performance to ensure their validity and adaptability.

Based on the constructed mathematical models, quantitative traders will develop specific trading strategies that cover timing of buying and selling, position management, risk control, etc. By utilizing methods such as statistics, mathematical models, or machine learning, they develop trading strategies and algorithms for identifying trading opportunities and making trading decisions.

These strategies may include the use of techniques such as technical analysis indicators, price pattern recognition, quantitative factor analysis, etc. to determine the timing of buying and selling, as well as the development of appropriate position management rules and risk control strategies to maximize returns and minimize risk.

At the same time, these trading strategies and algorithms are often repeatedly tested and optimized to ensure their effectiveness and robustness in various market situations. For example, trading strategies are backtested using historical data to assess their performance in past markets as well as potential risks and returns.

And based on the backtesting results, traders can optimize and adjust their strategies, including the adjustment of parameters, modification of trading rules, and updating of risk management strategies, in order to improve the performance and adaptability of the strategies. Through continuous backtesting, optimization, and adjustment, traders can continuously improve their trading strategies to cope with changing market conditions, maximize return on investment, and reduce risk levels.

Finally, trading strategies are automated through computer programs that monitor the market and make trading decisions in real time. Traders are able to utilize programming techniques to translate proven trading strategies into algorithms and then apply these algorithms to real-time market data to identify trading opportunities and automatically execute buy and sell operations. In addition, Automated Trading systems are able to monitor market changes in real time and dynamically adjust trading strategies based on pre-set risk management rules to ensure that portfolio risk is controlled within acceptable limits.

Compared with traditional trading methods, quantitative trading is fast, precise, and efficient, and computer algorithms can be utilized to execute trades in a very short period of time to realize small profits. This type of trading uses high-speed computing power and real-time market data to quickly identify and take advantage of minor price fluctuations to perform buying and selling operations, thereby maximizing profits.

In recent years, with the continuous development of technology and the increasing complexity of financial markets, quantitative trading has rapidly emerged globally and is playing an increasingly important role in financial markets. Quantitative funds have grown rapidly in size, utilizing advanced technologies such as big data, machine learning, and artificial intelligence to generate profits through the automated execution of trading strategies. This trend is particularly evident in the A-share market, where more and more institutional and individual investors are adopting this trading strategy.

Quantitative Trading Pros and Cons

Quantitative Trading Pros and Cons

This type of trading uses technical means to detect unreasonable behavior in the market so as to obtain excess returns, which has great advantages compared to traditional trading methods. However, despite its significant advantages, there are also some shortcomings. Therefore, quantitative traders need to carefully assess and manage risks and constantly optimize and adjust their trading strategies to cope with the complex market environment.

Its strength lies in the use of mathematical models and statistical analysis of large amounts of historical and real-time data as a means of identifying potential patterns and opportunities in the market. Through in-depth analysis of data, the trading system is able to more accurately predict market trends and formulate effective trading strategies, thus achieving more robust portfolio management and more reliable trading decisions. And this data-driven decision-making process is then able to utilize data and information more effectively to make more informed investment decisions and be more competitive in different market environments.

At the same time, because it relies on historical data and mathematical models to make decisions, it avoids the influence of human emotions on investment decisions. And because the trading process is controlled by a computer program rather than being influenced by human factors, it eliminates the interference of investors' emotions and ensures the objectivity and consistency of trading decisions.

This not only improves the efficiency and reliability of trading but also helps investors better manage risk and achieve stable investment performance. In addition, it improves investors' self-confidence, enabling them to execute trades more decisively, independent of market volatility, and thus realize more robust investment returns.

Secondly, automated trading systems are able to execute trades quickly to capture instantaneous opportunities in the market, thereby increasing the efficiency and responsiveness of trading. By utilizing computer programs to execute trading strategies, quantitative trading enables millisecond trading decisions and execution. As a result, this type of trading is more efficient and faster at executing trades than traditional manual trading.

It also has the advantages of testability and optimization. It can be backtested on historical data to assess its effectiveness and stability. This testing and evaluation process helps traders to continually optimize and improve their strategies to cope with different market conditions and changes. By constantly testing and optimizing, traders can improve the performance of their trading systems, reduce risk, and increase returns.

Finally, quantitative trading also offers the advantages of diversification and risk management. Through this type of trading, investors can easily diversify their portfolios with different combinations of assets and strategies, thereby reducing overall investment risk. In addition, it can utilize sophisticated risk management models to control potential losses, helping investors manage risk more effectively and protect their portfolios from market volatility.

The downside is that it is technically demanding, which can be a challenge for many traders. Conducting quantitative trading therefore requires traders to have expertise in a wide range of areas such as programming, math, statistics, and financial markets, hence the high technical barrier. This means that traders need to have a wide range of technical skills and expertise in order to effectively design, develop, and implement trading strategies.

In addition to this, this type of trading is also affected by the quality of the data. The accuracy and timeliness of market data are critical to the success of a trading strategy, but obtaining high-quality data is usually costly. As a result, traders need to invest significant resources to ensure the quality and reliability of the data, which can increase the cost and complexity of trading.

Another challenge is the management of systemic risk. Although quantitative trading can control losses through sophisticated risk management models, it can lead to serious losses in the event of systematic errors or technical failures. Therefore, it is crucial for traders to have a robust risk management system in place, including close monitoring and contingency plans to deal with unexpected situations.

Moreover, the success of this type of trading also depends on the trader's understanding and insight into the market. Despite its reliance on data and algorithms, the uncertainty and complexity of the markets mean that traders still need to have a keen eye for and understanding of market movements and events. As a result, even the most advanced quantitative trading systems require guidance and oversight from human traders to ensure the effectiveness and adaptability of the strategy.

Finally, the complexity and maintenance costs of trading systems are also a significant challenge. As market conditions and trading strategies change, trading systems need to be constantly updated and optimized to ensure their performance and effectiveness. This requires a significant investment of time, manpower, and resources, including monitoring the system, fixing bugs, and updating models and algorithms.

That said, quantitative trading offers significant advantages in terms of efficiency, objectivity, and risk management, but it also faces challenges such as high technical barriers, dependence on data quality, and market adaptability. Successful trading requires continuous learning and optimization of strategies to cope with rapidly changing market conditions.

How Individual can Engage in Quantitative Trading?

There are generally two ways for individuals to engage in quantitative trading: one is to write their own trading program with technical programming and market understanding; the other is to purchase trading software developed by others and utilize off-the-shelf trading strategies. Whichever route you choose, you will need to continually learn and improve in order to increase the success and returns of your trading.

To engage in this type of trading, one first needs to have a basic understanding of financial markets and investment theory, including knowledge of portfolio theory, the capital asset pricing model, and technical and fundamental analysis. And one should have an in-depth understanding of the basic principles and methods of quantitative trading, learn related knowledge such as statistics, econometrics, and mathematical modeling, and master quantitative analysis tools and programming languages such as Python, R, or Matlab.

Then, develop a quantitative trading strategy that suits your investment objectives and risk appetite, including designing algorithms, collecting and analyzing market data, and optimizing trading models. Next, backtest and optimize the trading strategy with historical data to verify its effectiveness and robustness and ensure that it performs well under different market conditions.

Finally, develop effective risk management strategies, including setting stop-loss and take-profit points, controlling position sizes, and diversifying portfolios to protect funds from significant losses. It is important to maintain discipline in executing trades, avoid emotional interference, and make timely adjustments to trading strategies based on market conditions.

At the same time, traders must possess several key qualities and attitudes. First, a long-termist mindset is essential, as trading success often requires sustained patience and determination rather than the short-term pursuit of quick profits. Second, trust in the quantitative system is essential, as traders need to believe in the effectiveness of quantitative models and algorithms in order to stick to their trading strategies.

Moreover, this type of trading also requires traders to possess a high degree of trading cognition and market understanding, which means they need to have an in-depth understanding of the fundamentals of how the market works and how various factors affect the market. Through in-depth market analysis and an understanding of market factors, traders are able to more accurately formulate trading strategies and adjust them in a timely manner to respond to changes in the market, thereby increasing the success rate and profitability of their trades.

Finally, quantitative trading is more than simply executing code; it is a complex process of continuous optimization and execution of trading logic. It requires traders to constantly learn and improve in order to adapt to market changes and optimize trading strategies to achieve solid long-term investment returns.

The problem for many traders is that they are unable to utilize this type of trading for stable returns. In fact, the stability of this type of trading depends on a number of factors, including the design and optimization of the trading strategy, changes in the market environment, the reliability of data quality, and the effectiveness of risk management. If the trading strategy is effective in identifying patterns and opportunities in the market and is matched with appropriate risk management measures, then it is possible to achieve relatively stable returns.

However, market changes are unpredictable, and past performance is not indicative of future results. Even fully back-tested and optimized trading strategies may fail under certain circumstances. Therefore, investors should exercise caution when using trading strategies and monitor and adjust them adequately in practice to cope with changing market conditions in order to minimize risk and pursue stable returns.

At the same time, to truly rely on this type of trading for stable returns, it actually requires a certain level of skill. The king of quantitative trading, James Simmons, said that trading with the trend is the core of technical analysis because large price trends are not accomplished in the short term but can be captured and exploited.

Follow the market trend and utilize the power of the trend for gains rather than rebelling against it. By observing and analyzing long-term trends in the market, investors can get a clearer picture of the direction of prices and adjust their portfolios and trading strategies accordingly. This approach not only helps investors reduce risk but also maximize potential revenue opportunities in the market.

It is also important to note that quantitative trading now accounts for 80% of the U.S. stock market and is gradually growing in the Chinese market. And in this market, ordinary investors who are still using traditional technical analysis, experience, or news investment strategies may become the target of institutional harvesting.

In the highly competitive field of quantitative trading, large institutional investors have a wealth of resources and technological advantages, making it challenging for individuals and small investors. These institutions are typically able to invest more capital and manpower to develop sophisticated trading strategies and systems and access high-quality market data and research tools. In contrast, individual and small investors may be limited by resources and technology and need to participate in other ways, such as investing in specialized funds or working with trading firms.

Quantitative Trading Fund Return Rankings

| ETF Name |

YTD Price Change |

Avg. Daily Volume |

1-Day Change |

| JPMorgan NASDAQ Equity Premium Income ETF |

10.99% |

2,752,077 |

-0.76% |

| iShares US Equity Factor ETF |

12.72% |

159,834 |

0.17% |

| Cambria Shareholder Yield ETF |

4.98% |

83,706 |

-1.05% |

| Hartford Multifactor Developed Markets (ex-US) ETF |

5.11% |

233,082 |

0.28% |

| iShares International Equity Factor ETF |

9.24% |

143,638 |

0.07% |

| iShares U.S. Small‑Cap Equity Factor ETF |

5.87% |

74,531 |

-0.38% |

| JPMorgan Market Expansion Enhanced Equity ETF |

6.68% |

88,775 |

-0.68% |

| iMGP DBi Managed Futures Strategy ETF |

14.64% |

331,343 |

-0.91% |

| SPDR MSCI EAFE StrategicFactors ETF |

4.50% |

40,305 |

-1.19% |

| ALPS O'Shares U.S. Quality Dividend ETF |

6.09% |

29,482 |

-0.27% |

| Avantis Core Fixed Income ETF |

-1.20% |

83,115 |

0.15% |

| Vanguard U.S. Value Factor ETF |

2.97% |

13,042 |

-0.84% |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Quantitative Trading Pros and Cons

Quantitative Trading Pros and Cons