When it comes to Google, people know it for its search engine. Though it is its flagship product, Google plays a much bigger role in people's lives than that. That's because it has long since moved beyond a single search engine service to become a world-famous tech giant. From Internet search, online advertising, and cloud computing to artificial intelligence and self-driving technology, Google's business landscape has long spanned multiple sectors. As a result, google stock is also getting a lot of attention for its diverse businesses, and investors see a lot of potential for future growth. Now let's take a deeper look at Google's stock evaluation and investment potential.

Google stock symbol

Google Inc. has been renamed Alphabet Inc., and as a U.S.-based global tech giant, its business covers a wide range of areas, including search engines, cloud computing, advertising, artificial intelligence, and more. As the parent company, Alphabet has a number of well-known subsidiaries, including Google, YouTube, Waymo, DeepMind, etc., which are leaders in their respective fields.

On August 19. 2004. Google Inc. went public on the Nasdaq exchange, then under the ticker symbol GOOG, and by the time 2014 rolled around, Google underwent a Stock Split, separating its common stock (Class C stock) from its stock with voting rights (Class A stock).

After the split, Google stock had two symbols: GOOG, a Class C stock, and GOOGL, a Class A stock. The main purpose of this split was to give the company's founders and executives more control without having to worry about the voting influence of common shareholders. This strategy allowed the company's management to be more flexible in making strategic decisions while maintaining control of the company.

This is because Google A represents stock with voting rights, while Google C represents common stock with no voting rights. In other words, shareholders holding Class A stock have the right to vote on company decisions at the company's stockholders' meeting and to participate in decisions on important matters. In contrast, ordinary investors holding Class C shares do not have this right, and their voting rights are diminished and used primarily for smaller decisions at shareholder meetings.

This distinction makes Class A shares more popular with management and founders within a company, as they can maintain control of the company by holding these shares. Shareholders who hold this type of stock are usually seen as long-term supporters and strategic partners of the company. In contrast, Class C shares are usually held by ordinary investors, whose voting rights are seen as a secondary influence on company decisions.

Despite these differences, both GOOG and GOOGL represent Alphabet Inc.'s (Google's parent company's) performance in the stock market. While they differ in terms of corporate governance, they both have equity ownership in Google and are subject to the same market and business factors.

Therefore, no matter which class of stock an investor chooses to purchase, they will become a Google shareholder and share in the company's earnings and risks. Both types of Google stock can therefore be used as part of a portfolio to achieve investment objectives and risk diversification in the stock market.

However, investors should note that these two types of Google stocks offer different investment options and risk/reward characteristics. While the share prices and returns of GOG and GOOGL may be very close, holding different classes of stock does mean that investors have different rights and responsibilities with respect to corporate governance.

First, investors holding GOOGL (Class A shares) can participate in corporate governance and play a role in decision-making, which gives them more influence over the company's growth and future. However, this control usually comes with a higher share price and less liquidity.

On the other hand, investors holding GOOG (Class C shares) are more focused on the company's operational performance and financial metrics, as they are not able to directly participate in the company's decision-making process. This makes Class C stocks more suitable for investors who are more focused on return on investment and market liquidity.

While Class A stock may offer more control and participation opportunities, it also comes with a higher level of risk and responsibility. In contrast, Class C stock is more like a traditional stock investment and is more popular with the average investor, but it lacks direct corporate decision-making power. Therefore, when choosing which type of Google stock to invest in, investors need to consider the pros and cons of both and make decisions based on their own investment objectives and risk appetite.

Google stock market analysis

Google stock market analysis

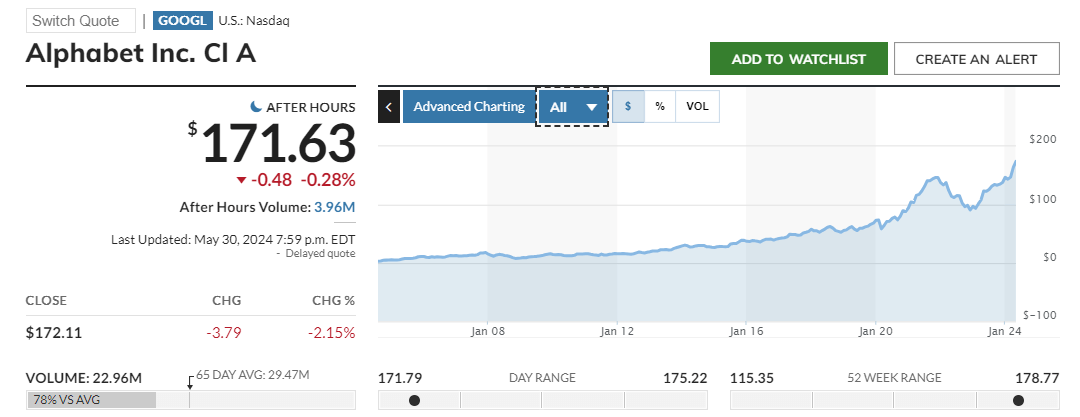

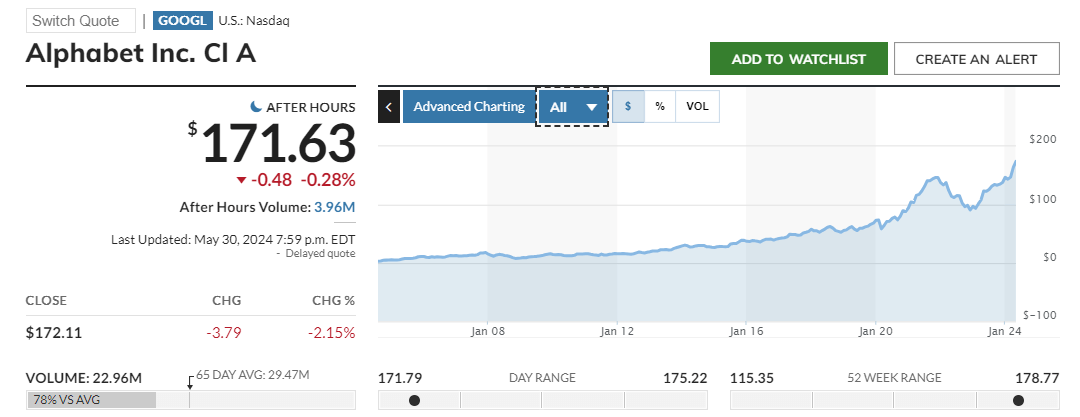

It can be seen that the two types of Google stocks have different codes. However, in terms of stock price as well as trend direction, there is actually not much difference.Google's initial public offering (ipo) in 2004 had an issue price of $85 per share, and since then, Google's stock price has been on the rise.

Despite some volatility in the course of its history, the overall trend of Google's stock price has been on an upward trend until today. 2021 saw it reach a peak of $142 before experiencing a period of significant decline. Its biggest drop came in 2023. when it fell to $86.

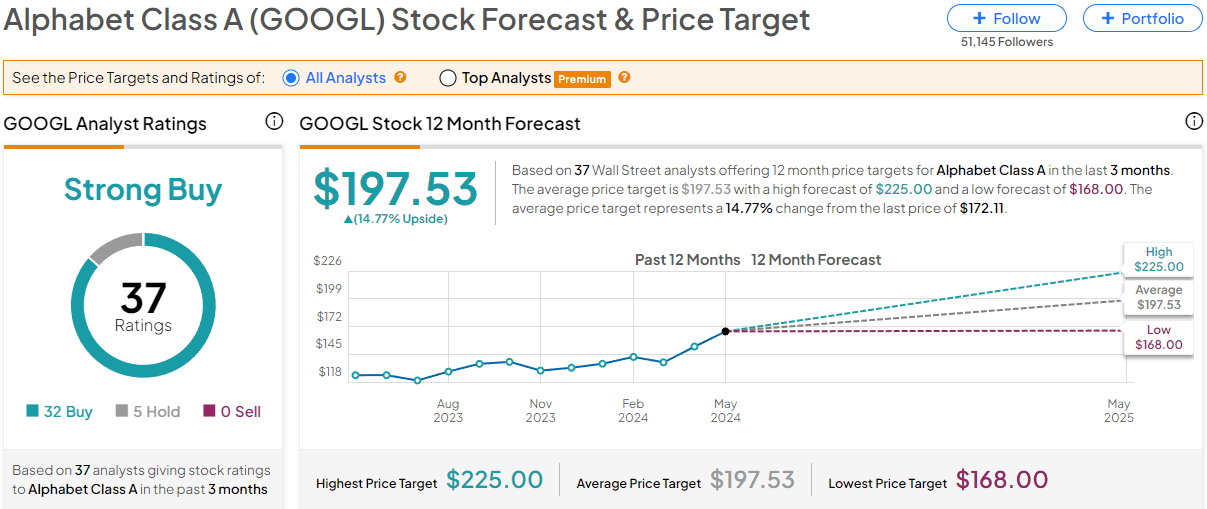

However, starting in 2023. Google's stock price began to recover and is now at an all-time high of $173.56. This upward trend in the stock price may have been influenced by the company's earnings growth, the market's optimistic expectations about its business prospects, and overall stock market conditions.

Google's cloud business performed strongly in the first quarter of 2024. growing 28.4% year-over-year on more than $9 billion in revenue, beating market expectations, according to the company's stock earnings report released on April 25th. Despite the significant costs previously invested in the business, including hardware and NVIDIA GPU purchases, the business has now begun to turn a profit and has shown multiple consecutive quarters of doubling over overall revenue growth.

As you can see from the earnings report, Google's advertising business is still its main source of revenue, although growth has been saturated. In the first quarter, Google's ad revenue grew 13% year-over-year, while YouTube's ad revenue grew 11%. This is largely thanks to Google search driving a lot of traffic to YouTube, while YouTube has also taken steps to fend off competition.

Google's AI technologies, such as products like ChatGPT, have had a significant impact on its core search and advertising business. Additionally, Google's AI technology can be used to improve ad targeting and content recommendations, which can lead to improved ad results and increased revenue. While not fully reflected yet, developments in this area could have a significant impact in the future.

Because the results of this earnings report were so glowing, this positive news drove the company's stock price soaring. At one point, the stock reportedly soared 10%, which caused widespread concern and discussion in the market. This rise was mainly due to the outstanding performance of Google's search, YouTube, and cloud computing businesses, which exceeded the market's expectations.

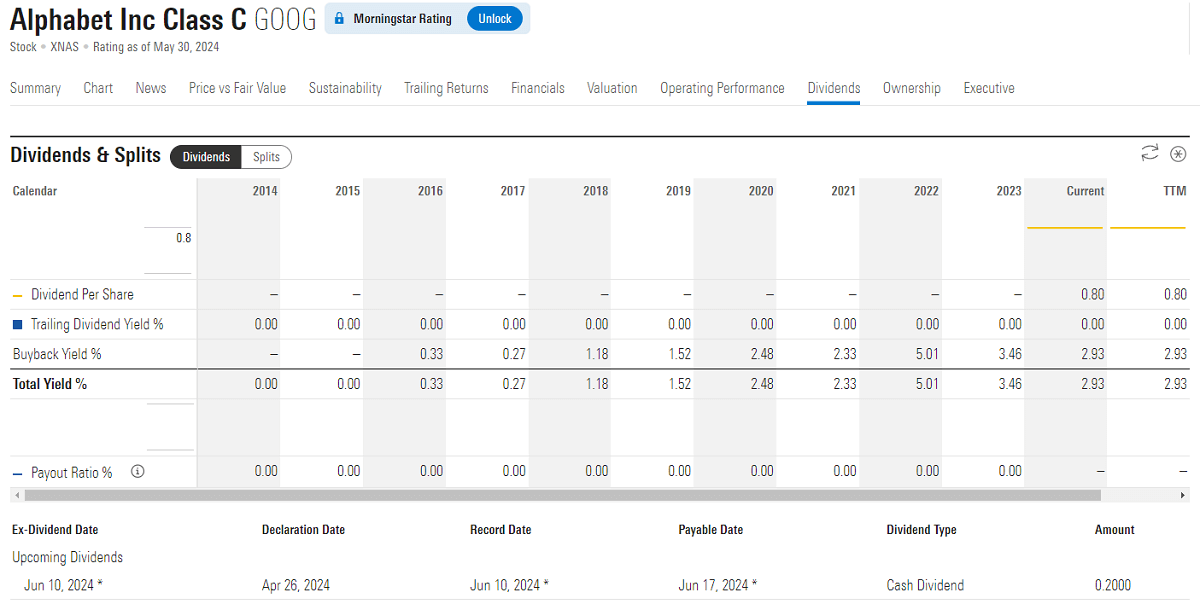

At the same time, the company announced a series of positive developments, including its first dividend payment and an increase in its share buyback program, further boosting investor confidence. These announcements had a positive impact on Google's stock price and reflected investors' optimism about the company's future prospects.

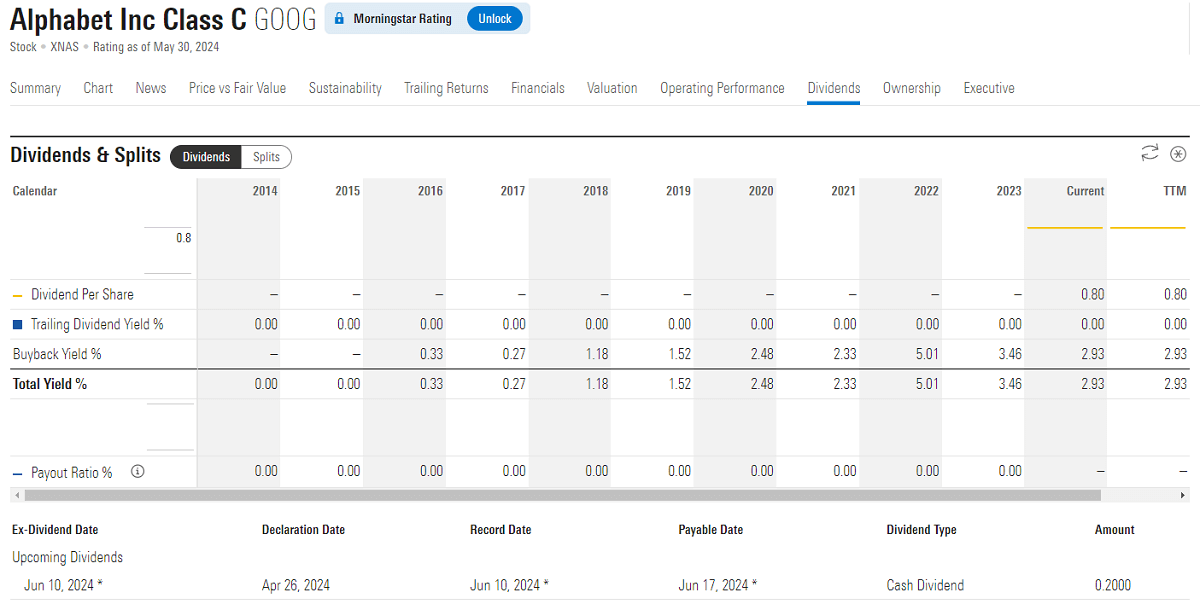

On April 26. Google announced two major initiatives that caught investors' attention. First, the company paid its first dividend of 20 cents per share. The move reflects the company's strong and solid financial position as well as shareholders' confidence in the company's long-term growth. The ex-dividend date is set for June 10. 2024. and the dividend is expected to be paid on June 17th.

Second, Google announced a $70 billion share repurchase program and has now repurchased and canceled 110 million shares at a repurchase price of $161. This write-off demonstrates the company's confidence in future growth and shows that management believes the current share price is below the company's intrinsic value.

By repurchasing and writing off shares, Google can reduce the number of outstanding shares, increase the value of each share, and send a positive signal to investors that the company is committed to optimizing shareholder value and using its strong cash flow and financial position to support steady stock price growth.

However, despite the promising results, Google's several major missteps in the field of artificial intelligence have raised concerns about its long-term growth. Problems with projects such as Bard and Gemini have exposed serious problems with the company's technology outreach, actual capabilities, and user experience, negatively impacting the company's reputation and market position. These problems reflect deep-seated pitfalls in Google's corporate culture and systems that require deep reform.

In addition to internal issues, Google faces external challenges from regulatory risks, technological competition, and market and economic risks. There are growing concerns about data privacy and security globally, and the company needs to comply with stringent regulations and respond to global antitrust scrutiny. At the same time, technological competition is intense, and the company needs to continue to innovate to maintain a competitive edge. As well, the volatility of the global economic environment has challenged the company's international operations.

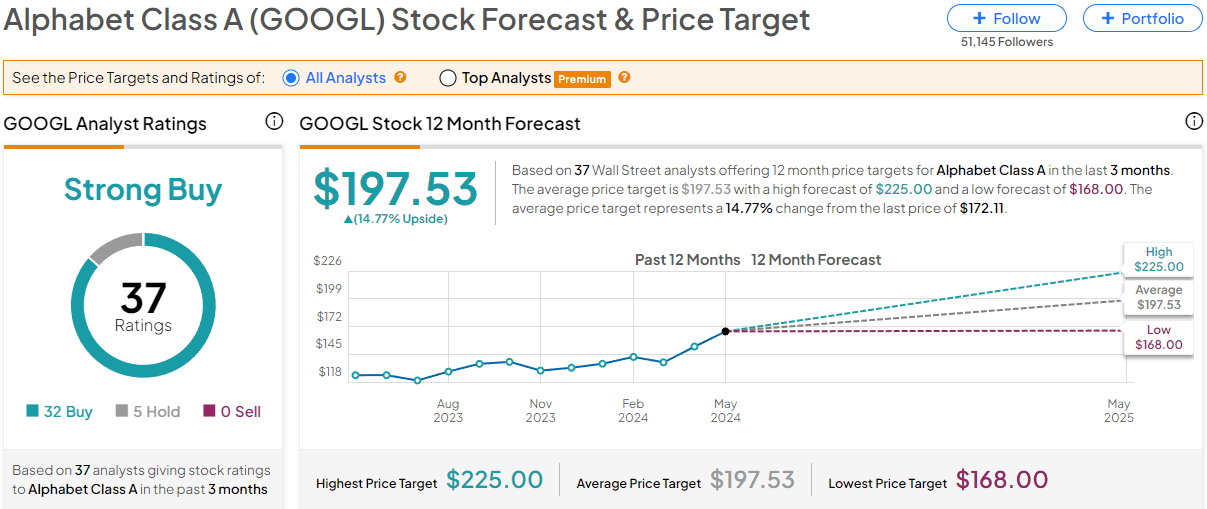

Therefore, although Google stock is currently bullish, investors should carefully evaluate the company's internal and external environments and pay close attention to the decision-making and execution capabilities of the company's management team. Long-term investors should consider the company's long-term growth potential and make investment decisions accordingly based on their investment objectives and risk tolerance.

Google stock investment analysis

Google stock investment analysis

As one of the global giants in the technology sector, Google stock has been attracting a lot of attention from investors. While its latest earnings release has been eye-catching, it has had its fair share of problems. Many investors are therefore quite cautious about whether it is worth investing in. In fact, based on the company's fundamental analysis as well as the stock's price movement, it's a stock worth investing in.

First of all, Google's investment in the field of artificial intelligence has huge growth potential for its future. With the continuous development of AI technology, Google can utilize its powerful technology and data resources to maintain its competitive advantage in core areas such as search engine optimization and advertising. By continuously improving its AI algorithms and technology applications, Google can improve the quality and accuracy of its search results and provide users with a more personalized and accurate search experience, which in turn increases user stickiness and activity.

At the same time, Google can also use artificial intelligence technology to optimize the effect of advertisement placement and improve the return on investment of advertisers, thus attracting more advertisers and increasing advertisement revenue. Therefore, Google's investment in AI will bring sustained momentum to its future growth and consolidate its leading position in the global technology market.

Secondly, Google has demonstrated strong financial performance, continuing to invest in research and development and innovation, as well as good profitability and cash flow. In particular, recent financial reports show that Google's investments in artificial intelligence are bearing fruit and are expected to drive its future earnings growth.

This investment not only strengthens Google's competitive advantage in core areas such as its search engine and advertising business but also provides a solid foundation for it to explore new growth opportunities. By continuously enhancing its AI technologies and applications, Google can improve the quality of its products and services and enhance the user experience, thereby further boosting its market share and profitability. Therefore, Google's investment in AI will provide an important boost to the company's future growth and contribute to its continued leadership in the global technology market.

Investors are optimistic about Google's performance in the next ten years and believe that the company will continue to maintain its momentum of sustained growth and generate lucrative returns for shareholders. Due to Google's leadership position in artificial intelligence, cloud computing, and other areas of innovation, as well as its continued investment in research, development, and innovation, investors are reasonably confident that the company will deliver solid growth in the future. As a result, Google stock lends itself to long-term holding for potential long-term investment returns.

Of course, not all investors prefer long-term investments. As a leading global technology company, Google not only has a strong business but is also financially sound and has great potential for future growth. As such, Google stock is also attractive for both short-term (one year) and mid- to long-term (one to five years) investors to have as part of their portfolios.

However, it is important to note that for short-term investors, the focus should be on their advertising business. This is Google's main source of revenue. This is because the advertising business is closely tied to economic cycles, especially in industries that rely on consumer purchasing power and market activity, such as travel and retail.

In a recessionary environment, companies tend to manage costs prudently and reduce spending on marketing and advertising, which could negatively impact Google's advertising business. Accordingly, investors need to carefully assess the economic risks to Google's advertising business and consider the impact that changes in the economic cycle may have on the company's share price and results.

For medium- to long-term investors, they should pay attention to Google's business diversification and new growth points. Although advertising is still its main source of revenue, its growth is limited, so Google needs to find new growth engines. YouTube and Google Cloud are seen as Google's two major growth engines, but they also face some challenges. In particular, YouTube may face the risk of declining user engagement, while Google Cloud needs to deal with increased competition in the market.

Therefore, medium- to long-term investors should pay close attention to Google's performance in these emerging business areas and how the company responds to challenges and seizes opportunities. At the same time, they should also pay attention to Google's innovative ability and technological prowess, as well as the company's growth prospects in areas such as artificial intelligence, big data, and cloud computing.

Summarizing the above factors, investors can formulate an investment strategy that suits their needs and choose the right time and way to invest in Google's stock. Long-term investors can look favorably on Google's continued development in artificial intelligence, cloud computing, and advertising and believe in its future growth potential, while short-term or medium- to long-term investors need to pay close attention to Google's business performance and market changes and adjust their investment strategies in a timely manner.

Google Stock Assessment and Investment Outlook

| Evaluation Factors |

Advantages |

disadvantageous |

Short-term Outlook |

Long-Term Outlook |

| Advertising Business |

Solid revenues |

Slowdown in growth |

Ongoing key revenues |

Innovation maintains. |

| Cloud Services |

Strong growth |

Fierce competition |

Digitally driven. |

Long-term growth. |

| Artificial Intelligence |

Technology leadership |

High cost |

Optimize revenue. |

AI fuels growth. |

| Financial Performance |

Strong earnings and cash. |

High costs |

Stocks up on earnings. |

Strong finances. |

| External Environment |

Strong market position |

Regulatory pressure. |

Adapting to rivals. |

Innovation, growth. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Google stock market analysis

Google stock market analysis Google stock investment analysis

Google stock investment analysis