In recent years, stagflation has become a hot topic of concern in the economic community and on Wall Street. In particular, recently released U.S. economic data for the first quarter showed a lower-than-expected economic growth rate, while the Consumer Price Index (PCE) sharply exceeded market expectations, sparking concerns about the future direction of the U.S. economy. These signs have rekindled the discussion of possible "stagflation" (stagflation), which, if it happens, could have a serious impact on the economy and financial markets. Now let's explore the causes, effects, and strategies for dealing with stagflation.

What is Stagflation?

What is Stagflation?

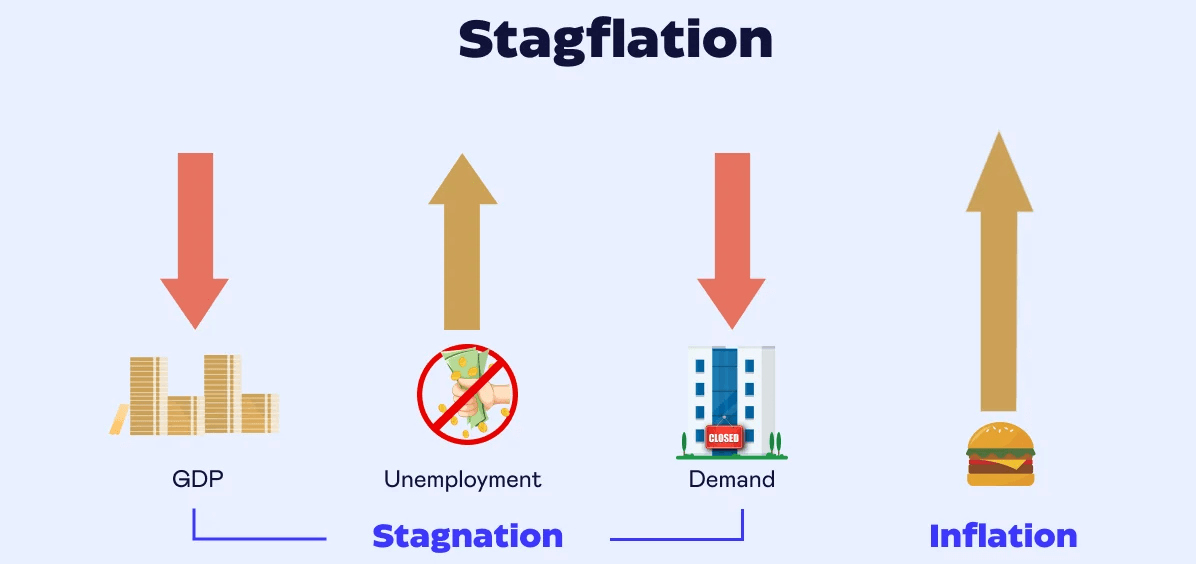

Stagflation, short for "stagnant inflation," is an economic phenomenon that refers to a sustained increase in the rate of inflation in the face of stagnant or recessionary economic growth. This economic phenomenon is often considered abnormal because economic stagnation and inflation are usually mutually exclusive.

Economic stagnation refers to a slowdown or complete stagnation of economic growth, which may even be negative (recession), leaving the gross domestic product (GDP) growth rate below the long-term average or even negative. This situation results in reduced business investment and weak consumer demand, leading to higher unemployment and lower corporate profitability. The central feature of economic stagnation is a marked weakening of economic activity, with broad and far-reaching effects on overall economic performance.

Inflation, on the other hand, is an economic phenomenon in which there is a sustained rise in the price level, which can usually be reflected by indicators such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). When the money supply increases, costs rise (e.g., energy and raw material costs), demand exceeds supply, etc., this leads to a general increase in the prices of goods and services on the market, thus affecting the purchasing power of consumers and the cost structure of businesses.

Both economic stagnation and inflation have far-reaching economic and social implications, such as the phenomenon of high unemployment. This is because when economic growth is stagnant or negative, enterprises are under the pressure of reduced market demand and falling sales. In order to cut costs or adapt to market changes, they may resort to layoffs or stop recruiting new staff. This situation leads to an increase in the unemployment rate, making the labor market tighter.

And a high unemployment rate not only affects the economic situation of individuals and households but may also further erode consumer confidence and reduce consumer spending, thus further inhibiting the recovery of overall economic vitality. Policymakers usually endeavor to stimulate employment and promote economic growth through various economic policies to alleviate the socio-economic problems brought about by high unemployment.

Moreover, stagflation is still a more complex and intractable economic problem because it is usually difficult for traditional economic policy tools to deal with both high inflation and economic stagnation at the same time. For example, controlling inflation usually requires raising interest rates, which may further dampen economic growth, while measures to stimulate economic growth, such as lowering interest rates or increasing government spending, may exacerbate inflation.

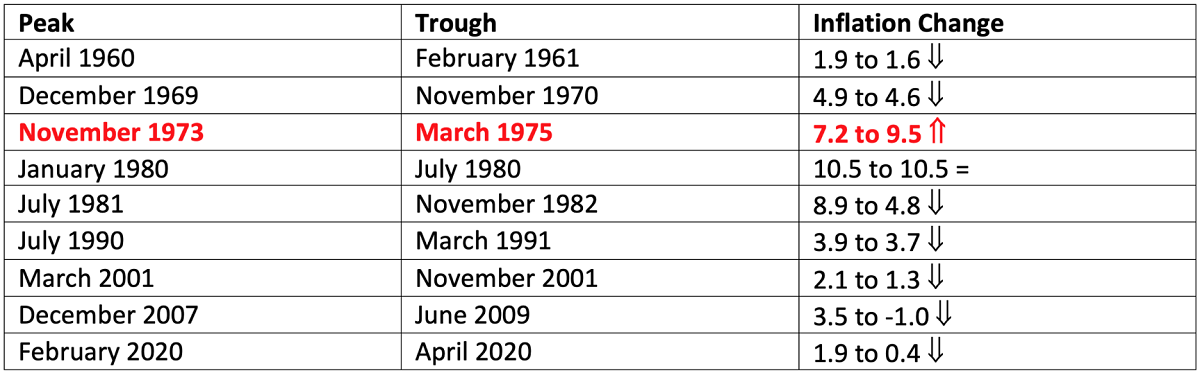

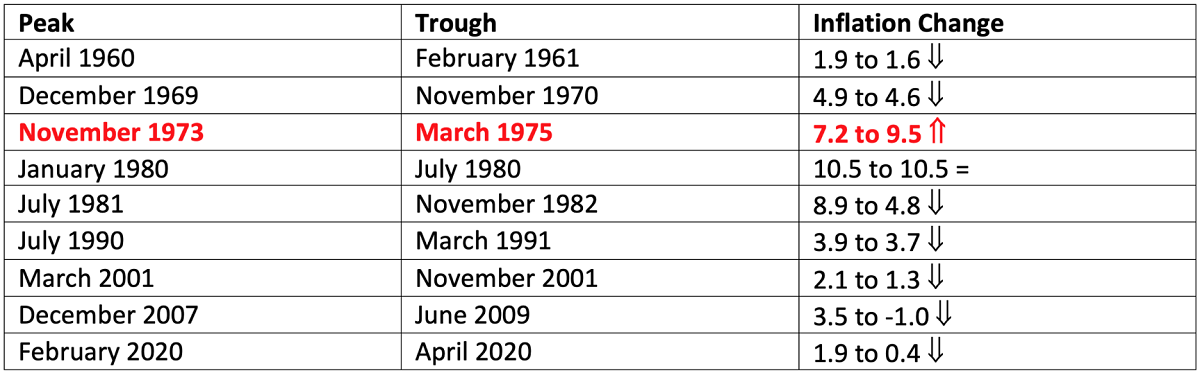

In the 1970s, Western economies faced significant stagflation, mainly due to sharp increases in energy prices triggered by two oil crises. These crises led to significant cost increases, especially for countries dependent on imported oil, and production and transportation costs rose sharply, driving broad-based inflationary pressures.

Enterprises faced with high energy costs have seen their production costs increase and profits suffer, leading to reduced investment, lower productivity, and even layoffs and shutdowns. Together, these factors have led to slower or even negative economic growth, exacerbating the problem of economic stagnation. The twin shocks of high inflation and economic stagnation have further aggravated socio-economic instability, including rising unemployment, social unrest, and increased political pressure.

Policymakers had to find a balance between stabilizing inflation and promoting economic growth and adopted a series of monetary and fiscal policy measures to address the challenges. This experience profoundly affected the Western economic system at the time, prompting a rethinking and reorientation of economic policy.

In sum, stagflation is regarded by economists as a serious economic dilemma, as it not only has a serious impact on economic growth and employment conditions but may also have far-reaching negative effects on social, political, and fiscal stability and is a major challenge that needs to be given great attention and addressed by economic policymakers.

What are the Consequences of Stagflation?

What are the Consequences of Stagflation?

The coexistence of inflation and economic stagnation can have multifaceted consequences with far-reaching economic and social implications. For example, stagnant economic growth is often accompanied by multiple negative impacts, including reduced investment and inefficient production.

First, businesses often choose to reduce investment in the face of high inflation and an uncertain economic outlook. In this case, firms may scale back investments in new equipment, technological innovation, and market expansion, which are essential for the growth and long-term productivity of the economy.

Second, economic stagnation may also lead to a decline in productivity. Because firms lack incentives to expand and innovate, they may reduce their investment in improving productivity. Stagnant productivity not only affects the competitiveness of firms but also limits the overall economy's potential and ability to grow.

Rising unemployment is an important consequence of stagnant economic growth, mainly in the form of corporate downsizing and long-term unemployment. First, stagnant economic growth has led to a decline in corporate profitability, and enterprises facing cost pressures tend to take measures such as layoffs or reduced hiring to control expenditures. In this case, corporate layoffs not only affect the livelihood of individual employees but also further weaken consumption and demand in the overall economy.

Secondly, rising unemployment may lead to an aggravation of the problem of long-term unemployment. Long-term unemployment may lead to a deterioration of an individual's financial situation and increased mental health problems, while increasing social unrest and inequality. Unemployed individuals face income disruption, debt risk, and mental health challenges, which may lead to increased social discontent, rising welfare needs, and uneven income distribution, among other issues.

Rising costs of living are a major consequence of high inflation, both in terms of price increases and the impact on basic needs. First of all, high inflation leads to a continuous rise in prices, thus reducing the real purchasing power of the population. Residents need to spend more money on the same goods and services, which directly affects their living standards and spending power.

Secondly, price increases in basic necessities, especially food and energy, have a direct impact on the basic needs of residents. Price increases in these categories may force residents to make adjustments in their daily expenses or look for substitutes, further affecting the quality of life and economic pressure.

Social instability is one of the serious consequences of high inflation and economic stagnation, manifesting itself in two ways: widening income disparity and increasing pressure on social welfare. First, high inflation and rising unemployment have led to widening income gaps, making social stratification more pronounced. Higher-income groups may be able to cope with inflation because of their greater financial resilience, while lower-income groups are more likely to fall into poverty and economic hardship, and this gap may lead to increased social discontent and even trigger social unrest and instability.

Second, the pressure on social welfare increases as unemployment rises. The government usually needs to increase social welfare expenditures to help those affected by economic hardship, including the unemployed and the poor. This situation requires the government to commit more resources to support the social safety net, but it also increases the fiscal burden and budget deficit, which in turn affects the stability and sustainability of public finances.

Fiscal pressure is an important consequence of economic stagnation and high inflation. Economic stagnation leads to lower corporate profits and higher unemployment, thus reducing tax revenues, while the government may need to increase spending, such as on social welfare and infrastructure investment, in order to stimulate the economy, further increasing the fiscal deficit. With high inflation, the government may have to increase borrowing to maintain public expenditure, but this will also lead to a rise in the level of public debt, increasing the debt burden and fiscal risk.

All these, in turn, make it a major challenge for policymakers to face stagflation. First, they have to find a balance between controlling inflation and stimulating economic growth, which is often a policy dilemma. The policy tools of governments and central banks may be limited in this context, as taking some measures may have a negative impact on the other side of the equation.

Second, the risk of policy failure is also high, as inappropriate or excessive policies may further exacerbate the problem of stagflation and lead to a deterioration of the economic situation. Therefore, policymakers need to carefully assess and adjust their policies to cope with the complex economic environment and ensure economic stability and sustained growth.

In the early 1970s, the global economy faced dual pressures: a surge in energy prices as a result of the oil crisis and the problem of rising global commodity prices and generalized inflation. Together, these two factors led to multiple challenges for the U.S. economy, especially after the global economic turmoil of the early 1970s. Stagflation (i.e., the coexistence of economic stagnation and high inflation) became a prominent feature of U.S. economic history in the 1970s, with far-reaching economic and social implications.

Beginning in 1972. despite some short-term signs of economic recovery in the United States and other Western economies, the problem of inflation was not effectively addressed. The United States adopted tight monetary policy measures during this period in an attempt to curb inflation, but this also led to a slowdown in economic growth and a rise in unemployment. In particular, during the second oil crisis resulting from the 1979 Iranian revolution, oil prices soared again, further exacerbating the inflation problem and making the economic situation even more complex and difficult.

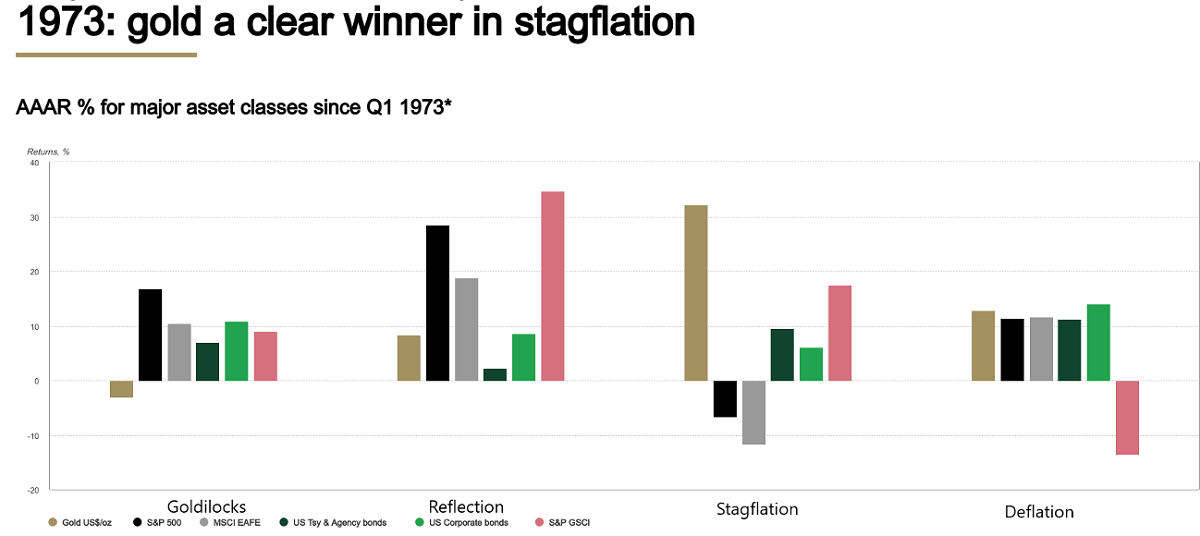

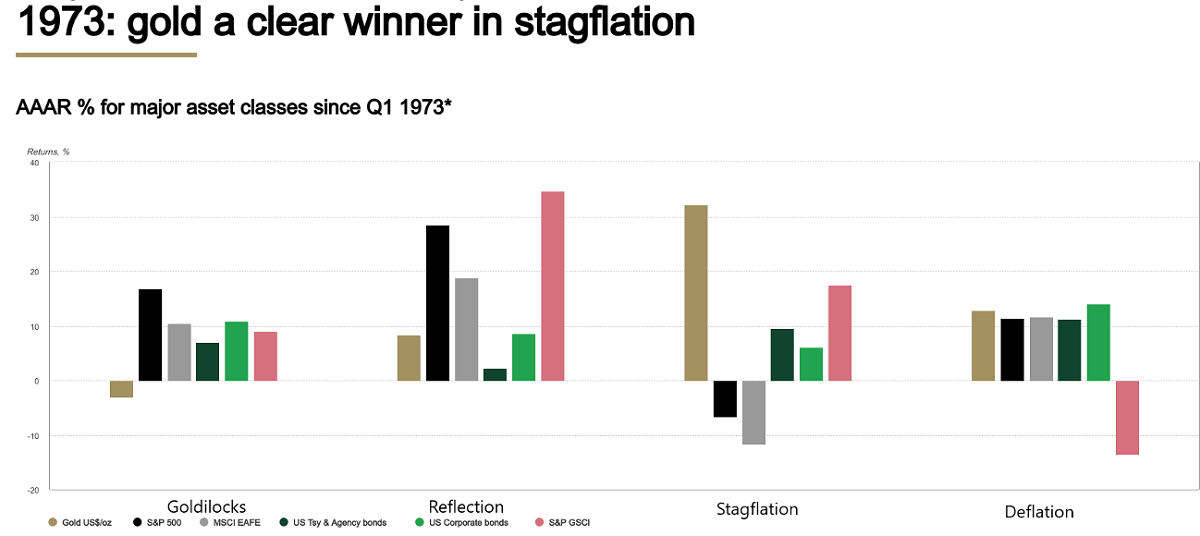

Meanwhile, the impact of stagflation on the economy and financial markets became more pronounced. The economy faced multiple challenges during this period, including slower growth, high unemployment, and high inflation. Enterprises often cut back on investment in the face of rising costs, leading to a slowdown in economic activity, and despite the monetary policies adopted by the central bank, they had limited effect in effectively mitigating the downward pressure on the economy. Financial markets are also often volatile, with investors favoring safe-haven assets, such as gold, because of the uncertain economic outlook. This in turn led to a decline in equity markets and a rise in bond yields, with a significant increase in market volatility.

Stagflation has a significant negative impact on the investment climate. First, an unstable economic environment undermines investor confidence, and high inflation and economic uncertainty raise market concerns, exacerbating capital outflows, which in turn increase economic and market volatility. Second, a high inflation and interest rate environment increases borrowing costs for businesses and individuals, with businesses paying higher interest rates to finance operations and expansion and individuals facing higher loan costs that may dampen consumption and borrowing demand, limiting business investment and development and affecting overall economic growth.

The consequences of stagflation are multifaceted, including both direct economic impacts such as stagnant economic growth, rising unemployment, and increased costs of living and indirect impacts such as social instability, fiscal pressures, and the deterioration of the investment climate. The causes of such crises are usually complex and include imbalances between demand and supply, monetary policy failures, volatility in international raw material prices, and the impact of political and geopolitical factors. The interaction of these factors leads to disruptions and destabilization of the economic system, which in turn has serious consequences.

What are the Causes of Stagflation?

What are the Causes of Stagflation?

Typically, stagflation is considered to be an abnormal and challenging economic situation that is accompanied by both inflation and economic stagnation, creating multiple difficulties and stresses in economic operations. There is no real consensus among economists on its causes; rather, some conclusions are drawn from past experiences.

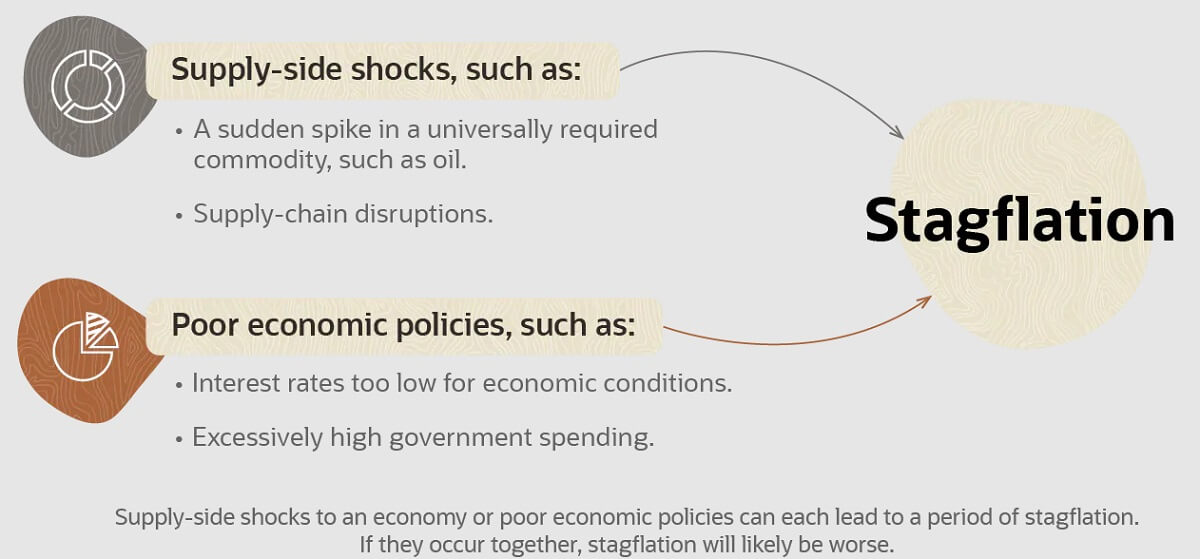

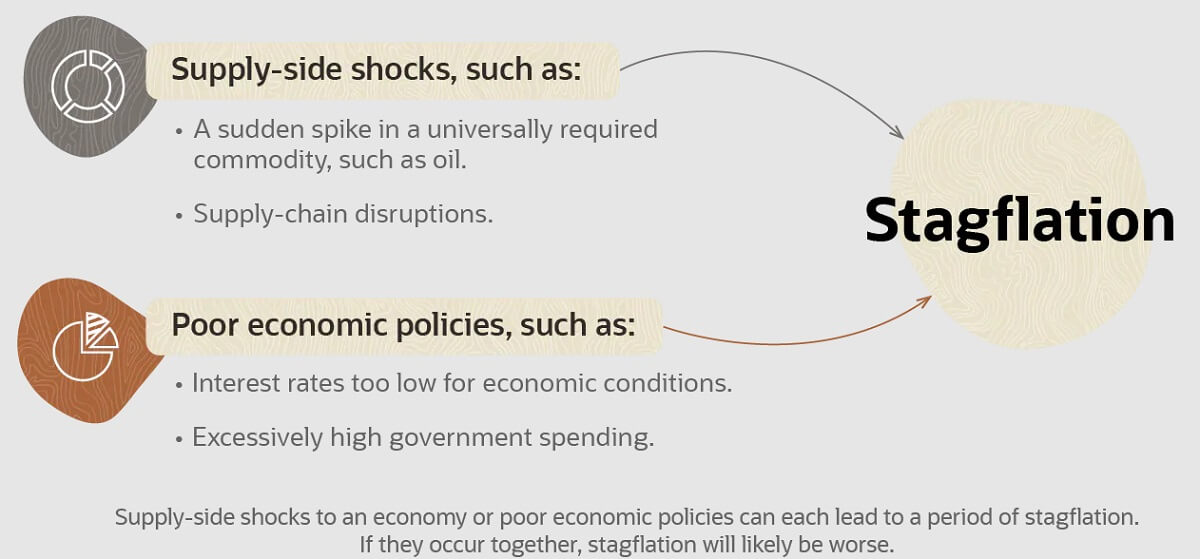

For example, supply bottlenecks and cost pressures.supply bottlenecks and cost pressures Supply bottlenecks refer to problems in the supply chain or insufficient supply of certain key resources, which can lead to limitations in the production capacity of a product and thus drive up its price. For example, if the supply of a certain raw material is disrupted due to geopolitical issues or natural disasters, firms will have difficulty obtaining enough raw materials and, in turn, will have to raise the price of their products in order to maintain production and profits.

Cost-push inflation occurs when firms have to raise the prices of their products in order to offset rising costs due to increases in labor costs, prices of raw materials, etc. In this case, rising costs can lead directly to inflation, even if there is no significant increase in demand.

And shrinking demand can be one of the causes, which is caused by a variety of factors, including declining consumer confidence, reduced government spending, and reduced investment by the private sector. Lack of consumer confidence leads to a decline in consumer spending; reduced government spending affects public demand; and reduced private sector investment slows the economy's capital formation and growth potential. The interaction of these factors may lead to a slowdown or even stagnation in overall economic activity, negatively affecting the economy.

Structural problems in the economy, such as labor market rigidities, slower productivity growth, and insufficient technological progress, may also contribute to some extent to the simultaneous emergence of economic stagnation and inflation. Labor market rigidities imply difficulties in allocating labor resources efficiently, which may limit productivity and the ability of firms to innovate, thus constraining economic growth. At the same time, slower productivity growth and insufficient technological progress can slow down the economy's potential growth rate, making it more vulnerable to the double whammy of inflation and economic stagnation in the face of demand growth or external shocks.

If monetary policy is not effective in controlling inflation or is too aggressive in dealing with it, it may have a negative impact on economic growth and ultimately lead to the emergence of stagflation. Excessive growth in the money supply can be one of the main causes of inflation, especially when the additional money is not supported by commensurate economic growth. Excess money released into the market can drive up prices and exacerbate inflationary pressures, thus adversely affecting the economy.

There are also external economic or political events, such as sharp fluctuations in international crude oil prices or major trade conflicts or wars, that can have a negative impact on the economy. For example, in the history of the United States, the 1970s saw a period of significant stagflation, mainly due to two major oil crises.

Inappropriate or faulty government economic policies, such as inappropriate tax policies, over-regulation, or a lack of stable fiscal policies, can exacerbate economic imbalances and lead to this phenomenon. For example, the United States in the early 1970s experienced stagflation as a result of the Fed's expansionary monetary policy and the resulting increase in inflationary expectations.

Meanwhile, in the early 1970s, the stagflation crisis in the US was also caused by the wage-price spiral. It refers to the process of rapid wage increases due to strong labor unions, which forces firms to raise the prices of their products, thus pushing up the level of inflation. This phenomenon in the economy may lead to a further increase in inflation.

There is also the fact that the changing international economic environment has had a profound effect on the manufacturing sector of the U.S. economy. In the face of increased foreign competition, the U.S. manufacturing sector has had to adjust its production strategies, increase productivity, or shift to more competitive products and markets. These adjustments not only affect employment and industry structure but also have important implications for the growth and competitiveness of the U.S. economy as a whole, requiring policymakers to take appropriate measures to address the challenges and promote sustainable economic development.

Overall, stagflation is usually a situation in which the economy is in trouble due to simultaneous problems on both the supply and demand sides that are difficult to deal with effectively. In responding to such a crisis, policymakers need to take into account a number of factors and find the right mix of policies to restore the health of the economy.

Measures to Address the Stagflation Crisis

Measures to Address the Stagflation Crisis

Responding to the stagflation crisis is indeed a complex and challenging process, as it requires addressing both stagnant economic growth and high inflation at the same time. In other words, responding to this crisis requires a combination of monetary policy, fiscal policy, structural reforms, and other tools, as well as a long-term strategic vision, in order to effectively resolve the complex challenges posed by economic stagnation and high inflation.

First, monetary policy is one of the important tools for dealing with stagflation. Central banks can control the pace and scale of inflation by adjusting interest rates and regulating the money supply. However, overly aggressive monetary tightening could lead to further economic stagnation, while too much easing could exacerbate inflation.

Second, fiscal policy also plays an important role in responding to the crisis. Governments can influence aggregate demand in the economy by adjusting tax policies and increasing or decreasing public spending. For example, appropriate fiscal stimulus measures can promote economic growth to a certain extent, but if used inappropriately or excessively, they may exacerbate inflation.

Third, supply-side reform and structural adjustment are also important means to deal with it. Measures such as improving production efficiency, optimizing resource allocation, and resolving supply chain problems can increase the flexibility and stability of the supply side, thereby easing the inflationary pressure caused by the imbalance between supply and demand.

Finally, the response to the crisis requires a holistic and long-term perspective. Policymakers need to find a balance between economic conditions, market responses, and social impacts to avoid the negative impact of short-term policies on long-term economic health. In addition, external factors such as the international economic environment and geopolitical risks need to be taken into account, as they may further exacerbate the problem of domestic stagflation.

For example, the stagflation problem that occurred in the 1970s was countered by a series of measures in the United States. In 1979. for example, Federal Reserve Chairman Paul Volcker adopted an extremely decisive tightening of monetary policy. By raising interest rates sharply, thus effectively controlling the money supply and limiting the growth of aggregate demand in the economy, he responded to high inflationary pressures. This policy led to a severe recession but ultimately laid the foundation for the inflation problem to be resolved.

At the same time, the U.S. government undertook reforms in fiscal policy in an attempt to reduce the fiscal deficit and curb inflationary pressures through spending cuts. These initiatives were aimed at reducing excessive government stimulus to the economy, thereby making overall economic activity more stable.

In addition, the United States has implemented a series of supply-side reform measures, in particular the restructuring of its energy policy. Against the backdrop of soaring oil prices, the pressure on dependence on imported oil has been reduced through measures such as improving energy efficiency and diversifying energy sources, thereby reducing the impact of inflation.

In combination, these measures helped the United States gradually emerge from the stagflationary dilemma of the early 1970s. Although the economy suffered some short-term challenges during the implementation process, a more stable economic foundation was eventually established, laying a solid foundation for economic growth in the coming decades.

Although stagflation has not yet occurred, investors should be prepared for the risks associated with the current economic environment and market conditions. Investment decisions should be based on the financial performance of companies and macroeconomic data, and it is wise to choose companies with strong fundamentals, solid management, and good growth prospects.

Blue chips and multinational corporations usually show greater resilience to risk in times of economic instability. These companies usually have stable cash flows and broad market reach and are able to maintain relatively stable performance in an uncertain market environment. Their business scale and diversified market presence make them better able to cope with economic fluctuations and market pressures, making them one of the preferred choices for investors in times of instability.

In an inflationary environment, real estate is often viewed as a safe-haven option, as home prices and rents may rise, thus contributing to asset preservation or appreciation. Investors may consider investing in real estate investment trusts (REITs) or purchasing properties outright for steady cash flow and capital appreciation. The physical asset nature of real estate and the usual rental income make it attractive against risk in times of inflation, which makes real estate part of portfolio diversification.

In summary, the response to the stagflation crisis requires the state to comprehensively utilize a variety of policy tools by regulating the money supply, adjusting fiscal spending, and promoting structural reforms in order to effectively curb inflation and promote economic stability and growth. Investors, on the other hand, should remain vigilant in the current environment and build a balanced portfolio to cope with possible market volatility and risks.

Causes, effects, and responses to stagflation

| Causes |

Impact |

Response |

| Supply shortage |

Economic slowdown |

Monetary Policy |

| Demand driven |

Worsening employment |

Fiscal Support |

| Cost Push |

Rising prices |

Structural Reform |

| Structural problems |

Social instability |

Energy Policy |

| External Shocks |

Fiscal pressure |

International Cooperation |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Stagflation?

What is Stagflation? What are the Consequences of Stagflation?

What are the Consequences of Stagflation? What are the Causes of Stagflation?

What are the Causes of Stagflation? Measures to Address the Stagflation Crisis

Measures to Address the Stagflation Crisis