In the forex market, traders pay a lot of attention to exchange rates. But did you know that there is one thing that greatly affects the exchange rate? This is purchasing power parity, which is one of the most important theories of exchange rate determination. Not only that, it provides traders with a way to assess whether a currency is overvalued or undervalued based on commodity price comparisons. Now, let's learn more about the theoretical basis and application of Purchasing Power Parity.

What is Purchasing Power Parity?

Purchasing Power Parity (PPP) is an economic theory that aims to compare the real purchasing power of currencies between different countries. The basic idea behind PPP is that, ideally, the same basket of goods and services should have equal prices in different countries, even when purchased using their respective currencies.

This means that the exchange rate should be able to accurately reflect the true value of each country's currency, thus eliminating currency effects in international trade and allowing the prices of goods between different countries to be effectively compared and evaluated. PPP therefore provides a way to measure and compare the cost of living and economic power of countries.

The emergence of the doctrine can be traced back to the dawn of money, but its modern resurgence is largely attributed to the contributions of the Swedish economist Gustav Cassel during the two world wars of the 20th century. It is one of the most important theories in exchange rate determination, and an understanding of its basic concepts is fundamental to mastering more complex models of exchange rate determination.

The theory of purchasing power parity (PPP) holds that, in the absence of transaction costs and other barriers, currency exchange rates between different countries should reflect differences in the purchasing power of goods and services across countries. In other words, the same set of goods should have equal prices in different countries, and this state of parity reflects the true value of each country's currency.

It has two main forms: absolute and relative. Absolute purchasing power parity is one of the foundational concepts of the theory and refers to the fact that the same goods should have the same price across countries in the absence of transportation costs and trade barriers. In other words, the purchasing power of one currency should be equal to the purchasing power of other currencies.

It is assumed that a basket of identical goods and services should have equal prices between different countries. Under this assumption, the exchange rate between the currencies of different countries should be equal to the ratio of the prices of goods in those countries. For example, if a basket of goods costs $100 in the United States and £80 in the United Kingdom, the exchange rate between the dollar and the pound sterling should be 1.25 (100/80).

Relative Purchasing Power Parity, on the other hand, takes into account differences in inflation rates. It argues that the change in the exchange rate of one country's currency relative to another's should be equal to the difference in inflation rates between the two countries. If one country's inflation rate is higher than another's, then the exchange rate of that country's currency should depreciate to remain relative. For example, if the inflation rate in the United States is 2% and the inflation rate in the United Kingdom is 3%, then the exchange rate of the dollar against the pound sterling should depreciate by 1% per year in relative terms.

Apart from that, it has wider applications in economics and finance. One of these is exchange rate assessment, which means that it is used to assess whether a country's currency is overvalued or undervalued. By comparing the real exchange rate with the PPP rate, the relative value of a currency can be derived, thus helping to analyze people's purchasing power and the real purchasing power of a currency.

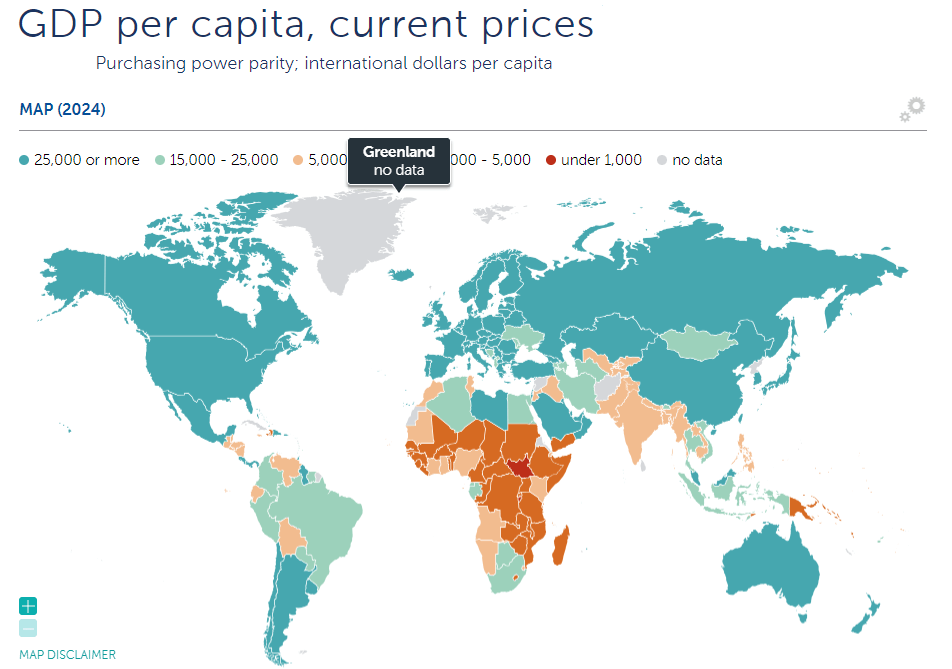

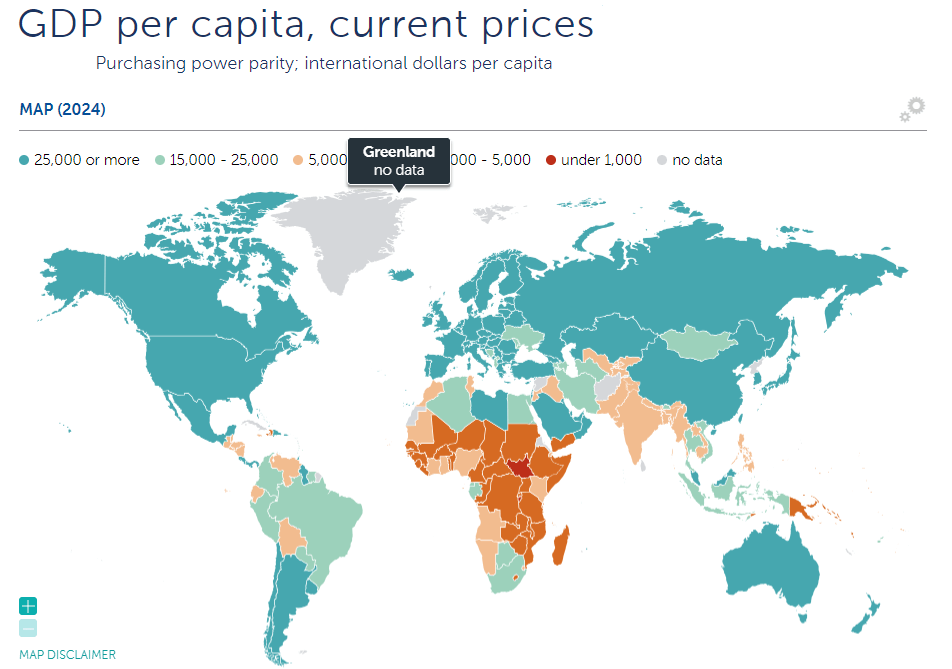

Also, the theory is widely used in cross-country economic comparisons, especially in calculating and comparing real gross domestic product (GDP). Organizations such as the International Monetary Fund (IMF) and the World Bank often use PPP-adjusted GDP data to compare the size of economies and living standards across countries. This approach helps to eliminate price level differences between different countries and provides a more accurate and objective basis for comparison, making international economic research and policymaking more informative.

Moreover, the theory also states that monetary and economic policies affect the purchasing power of money and exchange rates. Countries can influence the relative purchasing power of their currencies and exchange rates by means of adjusting the money supply, interest rates, and fiscal policy. This suggests that monetary and economic policies play an important role in shaping international economic relations and adjusting international trade, while also having an impact on exchange rate movements and international capital flows.

That said, purchasing power parity (PPP) is an important method for understanding and analyzing international exchange rate movements, especially over long time horizons. However, due to its limitations in practical application, it is often used in conjunction with other economic theories and actual data to provide more comprehensive economic analysis and forecasting (Wikipedia) (MGM Research).

Challenges and Limitations of Purchasing Power Parity (PPP)

While a key concept in economic theory, Purchasing Power Parity (PPP) often fails in practical applications due to discrepancies between theoretical assumptions and actual economic conditions. One major limitation is its assumption of free tradeability of goods, neglecting transaction costs like tariffs, quotas, and taxes.

Another drawback is its focus solely on goods, overlooking services where significant value disparities can arise. Exchange rates are further influenced by inflation, interest rate differentials, economic data releases, asset markets, and political developments.

This is because international trade is often not completely barrier-free but is subject to various factors that may lead to differences in the price of goods between different countries, thus affecting the realization of purchasing power parity. Factors such as transaction costs and barriers, for example, need to be taken into account in international economic comparisons and exchange rate analyses.

Firstly, transportation costs are an important factor, as there are costs involved in transporting goods from one country to another, and these costs are added to the price of the goods, thus affecting their final price. Second, governments impose tariffs and other taxes on imported goods, which can also lead to differences in the price of the same goods in different countries. In addition, there are various forms of non-tariff barriers, such as quotas, licenses, and standards, which also have an impact on the price of goods.

At the same time, a country's monetary and economic policies may directly affect the exchange rate and price level by adjusting factors such as the money supply, interest rate levels, and fiscal spending. If a country adopts an aggressive monetary or economic policy, this may lead to a deviation in the relative purchasing power of the country's currency and the exchange rate, which in turn affects the realization of the theory.

Specifically, adjustments in monetary policy, such as changes in interest rates and the money supply, can have a direct impact on prices and exchange rates, which can lead to the failure of purchasing power parity. Meanwhile, government fiscal policies, including measures such as taxes and subsidies, can also have an impact on the prices of goods and services, which in turn affects the realization of the theory.

Price stickiness, non-traded goods and services, price rigidity, and differences in consumption habits and preferences are all important factors contributing to its failure. Adjustments in commodity prices may not immediately reflect changes in market supply and demand, and firms may delay price adjustments in the face of external shocks or internal economic changes, which can lead to deviations between real prices and PPPs.

In addition, non-traded goods and services also have an impact on PPPs. Prices of localized goods and services, such as housing, health care, and certain services, vary considerably from country to country, and markets may be segmented from one country to another for reasons such as market segmentation, resulting in different prices for goods and services.

In addition, price rigidities are an important factor, including menu costs and wage and contractual rigidities, which can prevent prices from adjusting quickly to parity levels. Finally, differences in consumption habits and preferences can also affect PPP. Consumers in different countries have different preferences and consumption habits, and certain goods may have more substitutes in a country, which can also lead to price differences.

It is important to realize that differences in production technology and efficiency lead to different costs of goods and services in different countries, which in turn affect the price level. The degree of market competition is also a key factor, with highly competitive markets tending to have lower prices. In addition, factors such as the economic structure, industrial structure, and labor market conditions in different countries also have an impact on commodity prices. Thus, even in the absence of trade barriers, PPPs can fail due to these structural factors.

Then again, events such as natural disasters, wars, or financial crises may lead to abnormal market fluctuations, which can affect short-term changes in commodity prices and exchange rates. Such short-term fluctuations may render PPPs ineffective in these exceptional circumstances, as market supply and demand and investor sentiment may have a temporary impact on prices and exchange rates, causing them to deviate from their long-run equilibrium levels.

To summarize, although the theory of purchasing power parity (PPP) is important in theory, it may fail in practical application due to various factors. Therefore, when making international economic comparisons and exchange rate analyses, it is necessary to comprehensively consider a variety of factors and carefully assess their applicability.

Factors Affecting the Purchasing Power Parity Exchange Rate

The basic idea of the PPP theory is to eliminate the effect of price differences by comparing the prices of the same goods in different countries. This theory assumes that people need to use local currency to buy domestic goods and services and foreign currency to buy foreign goods and services. Therefore, by comparing the price of the same good in different countries, the real purchasing power of each country's currency can be more accurately reflected, thus revealing the true value of the exchange rate.

For example, the Big Mac Index created by the Economist magazine uses the prices of McDonald's Big Macs sold in each country for comparison. While other commodities are difficult to compare, the Big Mac is available in many countries and is made on a similar scale, making it an example of purchasing power evaluation. Nominal exchange rates, on the other hand, are a direct comparison of the exchange rates of the two countries' currencies, reflecting market supply and demand. It was found that there is a discount in the nominal exchange rate for most of the countries, while the premium gradually transforms into a discount for the European countries.

The exchange rate between the currencies of the two countries takes into account the price level of the two countries. The PPP exchange rate is more comprehensive than the traditional exchange rate because it takes into account not only the relative value between currencies but also the real purchasing power parity of goods. This type of exchange rate can more accurately reflect the true level of commodity prices between different countries, which helps in cross-country economic comparisons and assessments.

The theory states that differences in inflation rates are one of the important factors in determining the appreciation or depreciation of exchange rates. If the inflation rate of one country is higher than that of another, the real purchasing power of its currency may fall, leading to a depreciation of the exchange rate. This difference can be measured by comparing the price indices of the two countries, with a relatively higher price level in a country with a high inflation rate leading to a decrease in the real purchasing power of the currency. Therefore, the appreciation and depreciation of the exchange rate depend largely on the difference in inflation rates in order to maintain relative parity.

Adjustments in monetary and economic policies are critical to maintaining or adjusting PPP exchange rates. By means of adjustments in the money supply, interest rates, and forex market intervention, the state can directly influence the relative purchasing power of its currency and the exchange rate. Aggressive monetary policy, such as expanding the money supply or lowering interest rates, may lead to a decline in the relative purchasing power of the currency and trigger a depreciation of the exchange rate.

Conversely, a tightening of monetary policy may lead to an increase in the relative purchasing power of the currency, triggering an appreciation of the exchange rate. In addition, a country's economic policies, such as fiscal spending and tax policies, can also have an impact on the money supply and economic performance, thereby affecting the exchange rate and price level.

At the same time, the size and direction of capital flows also have a significant impact on the supply and demand for money, which in turn affects the relative purchasing power of money and the exchange rate. Large capital inflows usually increase the demand for a country's currency, leading to Currency Appreciation; conversely, capital outflows may lead to currency depreciation. This effect may be realized through adjustments to the money supply and interest rates, which have an impact on purchasing power parity.

The government can influence the level of the exchange rate by directly intervening in the forex market or by implementing monetary policy. For example, the government may intervene in the market by purchasing or selling forex in order to influence the supply and demand for money and hence the exchange rate. In addition, the government can adjust the money supply, and thus the exchange rate, by changing the level of interest rates or implementing other monetary policy measures. While government intervention may change the exchange rate in the short term, it is usually difficult to sustainably influence long-term exchange rate trends.

When a country's economic growth rate and productivity levels increase, the relative purchasing power of its currency may increase. This is because economic growth and increased productivity can boost the production and supply of goods and services in the country and increase its gross domestic product (GDP) level. This growth and increased productivity may increase the demand for the country's currency and consequently lead to currency appreciation.

The theory of purchasing power parity (PPP) suggests that, in the absence of transaction costs and other barriers, the exchange rates of currencies between different countries should reflect differences in the purchasing power of goods and services in each country. In other words, the same set of goods should have equal prices in different countries, and this state of parity reflects the true value of each country's currency.

The PPP exchange rate is precisely the level of exchange rate that makes the prices of the same goods equal in different countries, and it provides a measure of the relative value of currencies that overcomes possible biases in exchange rates. Thus, price-level differences are key to the formation and understanding of PPP exchange rates.

In summary, the formation of PPP exchange rates is influenced by a variety of factors, including price level differences, transaction costs and barriers, monetary and economic policies, structural differences in the economy, differences in production technology and efficiency, the degree of competition in the market, and price stickiness. Understanding this is important for forex traders to develop trading strategies and predict market movements.

Factors affecting purchasing power parity exchange rates

| Influencing factors |

Description |

| Price differences |

Commodity price differences across countries affect parity exchange rates. |

| Transaction costs |

Transportation costs and trade barriers affect international price differences. |

| Monetary policy |

Adjustments in money supply and interest rates directly affect the level of exchange rates. |

| Economic Structure |

Differences in production technology and efficiency affect commodity costs and prices. |

| Market competition |

Market supply and demand and the degree of competition affect commodity prices. |

| Government policy |

Fiscal spending and tax policies affect economic performance and money. |

| Capital flows |

Capital flows impact money demand and exchange rates. |

| Economic growth |

Economic growth and productivity gains affect the demand for and value of money. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.