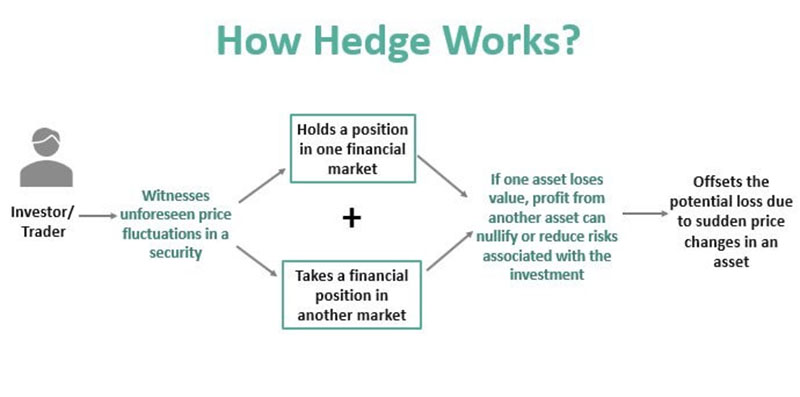

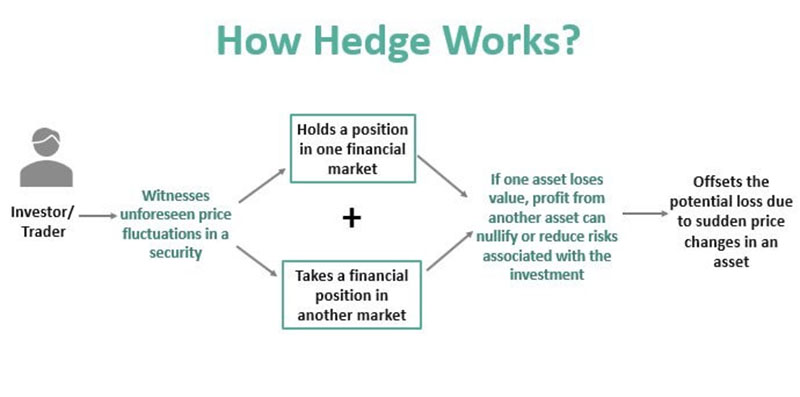

What does Hedging Mean?

Hedging, commonly known as "Haiqin" or hedging trade, refers to the trading process where a trader sells (or buys) actual goods on a futures exchange while buying (or selling) themAn equal number of futures trading contracts are used as hedging. It is an act of temporarily replacing physical trading with futures trading to avoid or reduce losses caused by adverse price changes. At a certain point in time, buying and selling the same type of commodity in both the spot and futures markets in equal quantities but opposite directions, selling or buying the same quantity of futures in the futures market. After a period of time, when price changes cause a profit or loss in spot trading, the profit or loss in futures trading can be offset or compensated by the profit or loss in futures trading.

Hedging Can be Divided Into Four Parts:

(1) Qualitative. To determine whether to maintain value during the buying or selling period, spot merchants of different natures should operate according to their production and operation needs. Copper consumers, such as cable factories, usually use buy time hedging to lock in the raw material cost of cables; Copper producers, such as smelters, use selling period preservation to ensure the profit margin of finished products. Of course, it is not ruled out that practical operations such as selling and preserving value by cable factories may be possible.

(2) Implementation. The hedging amount can be purchased or sold in the futures market based on the required amount of raw materials or planned output. The hedging amount can be completed in one go or in batches; The hedging price is determined by combining the planned production cost, expected sales price, and futures price. For example, the upper limit of the raw material copper cost that cable factories can accept is C0, and the price below C0 is the range that manufacturers are willing to accept for hedging during the purchase period; Hedge contracts are usually related to production progress, typically three month and forward contracts; The timing of hedging is determined by the futures price and production time.

(3) Dissociation. Decoupling and hedging must also follow the production process. Purchase raw copper from the cable factory, sign finished product sales contracts with the smelter, and settle corresponding contracts in the futures market. In theory, the futures and spot markets are one profit and one loss, and the hedging results are generally directly evaluated based on the changes in the basis before and after hedging (the difference between spot prices and futures prices).

(4) Avoidance. Hedge contracts face greater price risk than spot contracts, and can be avoided by reducing pounds or moving positions. When prices fall, buying futures to hedge can appropriately reduce positions or adjust forward contracts towards the near future; When prices rise, selling period hedging can be performed similarly.

The Role of Hedging

The key to the correctness of enterprise production and operation decisions lies in whether they can correctly grasp the market supply and demand status, especially whether they can correctly grasp the next trend of market changes. The establishment of the futures market not only enables enterprises to obtain the supply and demand information of the future market through the futures market, improves the scientific rationality of the enterprise's production and operation decisions, and truly determines production based on demand, but also provides a place for enterprises to avoid market price risks through hedging, which plays an important role in improving the economic benefits of enterprises.

In summary, the role of hedging in enterprise production and operation:

1. Determine procurement costs and ensure corporate profits. The supplier has already signed a spot supply contract with the demand party for future delivery, but the supplier does not need to purchase the materials required by the contract at this time. In order to avoid price increases when purchasing raw materials in the future, the supplier purchases relevant raw materials through futures to lock in profits.

2. Determine sales prices to ensure corporate profits. The production enterprise has signed a procurement contract for raw materials and sold relevant finished materials through futures to lock in production profits.

3. Ensure that the enterprise budget does not exceed the limit

4. Upstream enterprises in the industry guarantee production profits.

5. Ensure trade profits

6. Adjusting inventory

When current raw material prices are reasonable and there is a need to increase inventory, futures can be used instead of spot goods to enhance the utilization rate of enterprise funds and ensure cash flow through the leverage principle. Conversely, if raw material prices decrease and the enterprise cannot reduce inventory due to production or other factors, selling futures can help avoid price depreciation and potential losses.

7. Financing

When spot enterprises need financing, they can obtain a higher financing ratio from banks or related institutions by pledging and hedging futures warehouse receipts.

8. Avoiding Exchange Rate Losses for Foreign Trade Enterprises

When foreign trade enterprises settle in foreign currencies, they can lock in exchange rates through futures to avoid losses caused by exchange rate fluctuations and lock in order profits.

9. The procurement or sales channels of the enterprise. In certain specific circumstances, the futures market can be another channel for enterprises to purchase or sell goods, and when the goods enter the delivery stage, the real transfer of property rights of the goods can be achieved, which is an appropriate supplement to spot procurement or sales.

In addition, hedging is not rigid and rigid, as long as the operation is appropriate, it can still achieve significant additional profits while successfully hedging. On the premise of a better grasp of the price trend of the futures market, the hedging position can be appropriately increased and extended to speculative trading. If the price increases as expected during the buying period, the increased position can be profitable; If the price drops too much and causes excessive losses in the futures market, futures can be converted to spot and delivered back to spot; The same applies to selling and preserving value.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.