In the dynamic world of financial markets, traders need reliable tools to navigate price movements and volatility. Bollinger Bands have emerged as one of the most versatile and widely respected technical analysis indicators since their development by John Bollinger in the 1980s.

This powerful tool creates a visual representation of price volatility that adapts to changing market conditions, helping traders identify potential trading opportunities across virtually any financial market.

What Are Bollinger Bands?

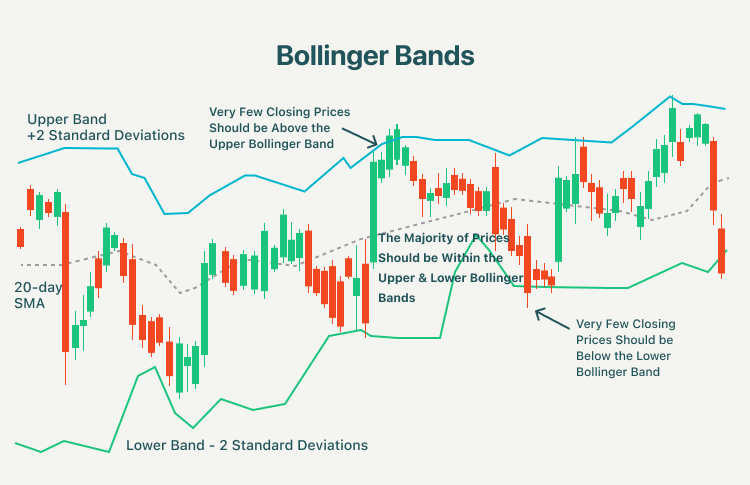

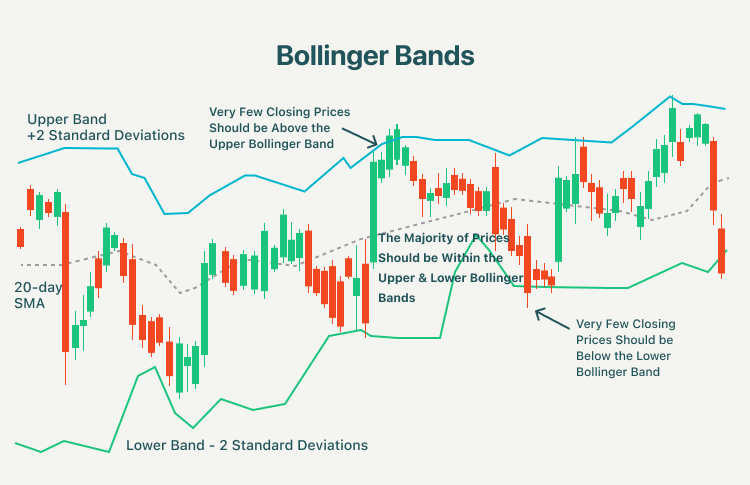

Bollinger Bands are a technical analysis tool consisting of three lines that form an envelope around price action on a chart. These three components work together to provide insights into market volatility and potential price direction:

Middle Band: A 20-period Simple Moving Average (SMA) that serves as the base for the indicator

Upper Band: The middle band plus two standard deviations of price

Lower Band: The middle band minus two standard deviations of price

The standard deviation is a statistical measure of volatility, making Bollinger Bands uniquely responsive to changing market conditions. When volatility increases, the bands widen; when volatility decreases, the bands contract. This adaptive quality allows the indicator to maintain relevance across different market environments.

While the default settings are 20 periods for the SMA and 2 standard deviations for the bands, these parameters can be adjusted based on trading style, timeframe, and the specific asset being analysed.

How Bollinger Bands Work

The fundamental principle behind Bollinger Bands is that prices tend to stay within the upper and lower bands during normal trading conditions. The bands create a relative definition of high and low prices, helping traders identify potential overbought and oversold conditions.

The statistical foundation of Bollinger Bands is particularly significant. By setting the bands at two standard deviations, they create a range expected to contain approximately 95% of price action. This means that when prices touch or move outside the bands, they've reached a statistically significant extreme that may warrant attention.

Bollinger Bands serve several key functions:

Measuring volatility: The width of the bands indicates market volatility—wider bands signal higher volatility, while narrower bands indicate lower volatility

Identifying potential reversals: Prices touching or exceeding the bands may suggest an extreme that could reverse

Providing dynamic support and resistance: The bands themselves often act as support (lower band) and resistance (upper band) levels

Recognising consolidation phases: When the bands contract (known as a "squeeze"), it often precedes a significant price movement

Key Bollinger Band Trading Strategies

1) The Bollinger Band Squeeze Strategy

The Bollinger Band squeeze is one of the most popular strategies and identifies potential breakout opportunities. When the bands contract significantly, it indicates decreasing volatility, which is often followed by a sharp increase in volatility and a strong price movement.

To implement this strategy:

Identify when the bands are contracting, creating a squeeze

Wait for the price to break out above the upper band (bullish) or below the lower band (bearish)

Enter a position in the direction of the breakout

Set a stop-loss on the opposite side of the breakout

The squeeze strategy is particularly effective because periods of low volatility are typically followed by high volatility. As of April 2025, this approach remains popular among traders across various markets.

2) The Bollinger Band Reversal Strategy

This strategy focuses on identifying potential price reversals when the market reaches extreme conditions:

Look for prices touching or exceeding the upper or lower band

Wait for confirmation of a reversal (such as a candlestick pattern or indicator divergence)

Enter a position against the previous trend (sell near the upper band, buy near the lower band)

Set a target toward the middle band or opposite band

For example, if USD/JPY touches the lower Bollinger Band and shows signs of reversal, a trader might enter a long position with a target near the middle band.

3) The Bollinger Band "Walk" Strategy

During strong trends, prices can "walk" along the bands, touching them repeatedly as the trend continues. This strategy capitalises on the strength of established trends:

Identify a strong trend where price is consistently touching one of the bands

Enter positions in the direction of the trend when price pulls back to the middle band

Set targets at the appropriate band (upper band for uptrends, lower band for downtrends)

Trail stops to protect profits as the trend develops

4) The W-Bottom and M-Top Patterns

Bollinger Bands can help identify specific chart patterns that signal potential reversals:

W-Bottom: A double bottom pattern where the first bottom touches or exceeds the lower band, but the second bottom stays within the bands while making a similar low. This often signals a bullish reversal.

M-Top: A double top pattern where the first peak touches or exceeds the upper band, but the second peak stays within the bands while making a similar high. This often signals a bearish reversal.

5) The Double Bollinger Band Strategy

Some traders use two sets of Bollinger Bands with different standard deviation settings (typically 1 and 2) to create trading zones:

When price is between the upper 1 and 2 standard deviation bands: Buy zone

When price is between the lower 1 and 2 standard deviation bands: Sell zone

When price is between the inner bands: Neutral zone

6) Combining Bollinger Bands with Other Indicators

While Bollinger Bands are powerful on their own, they become even more effective when combined with other technical indicators:

Bollinger Bands + RSI: Use the Relative Strength Index to confirm overbought/oversold conditions when price touches the bands

Bollinger Bands + MACD: The Moving Average Convergence Divergence can help confirm trend direction and momentum when price interacts with the bands

Bollinger Bands + Volume: Volume spikes during band breakouts can confirm the strength of the move

Practical Tips for Using Bollinger Bands

Adjusting the Settings

While the standard 20-period, 2 standard deviation setting works well in many situations, consider these adjustments:

For longer-term analysis, increase the period (50 or 200)

For shorter-term trading, decrease the period (10 or 5)

For more sensitivity, reduce the standard deviation (1.5)

For fewer signals but higher reliability, increase the standard deviation (2.5 or 3)

Risk Management with Bollinger Bands

Effective risk management is crucial when trading with Bollinger Bands:

Place stop-loss orders beyond significant price levels

During Bollinger Band squeezes, use tighter stops due to potential false breakouts

Consider position sizing based on volatility—smaller positions during high volatility (wide bands) and larger positions during low volatility (narrow bands)

Never rely solely on Bollinger Bands for trade decisions; seek confirmation from other indicators or analysis methods

The Mathematical Foundation

For those interested in the technical details, here's the formula behind Bollinger Bands:

Where:

SMA(n) is the n-period Simple Moving Average

k is the number of standard deviations (typically 2)

σ[n] is the standard deviation of price over n periods

This formula allows the bands to adapt dynamically to market conditions, making them relevant across different market environments and timeframes.

Conclusion

Bollinger Bands remain one of the most versatile and powerful technical analysis tools available to traders in 2025. Their ability to adapt to changing market conditions while providing insights into volatility, potential reversals, and breakouts makes them valuable across all financial markets.

Whether you're trading forex pairs like USD/JPY, commodities like gold and oil, or global stock indices, Bollinger Bands can help identify potential trading opportunities and manage risk. As with any technical indicator, Bollinger Bands are most effective when used as part of a comprehensive trading approach that includes proper risk management, confirmation from other analysis methods, and a solid understanding of market fundamentals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.