The "Three White Soldiers" pattern is a bullish candlestick formation that signals a potential reversal from a downtrend to an uptrend.

This pattern is widely popular among traders and analysts because it reliably indicates a shift in market sentiment. Recognising and understanding this pattern can be valuable for traders aiming to identify buying opportunities.

Understanding the Three White Soldiers Pattern

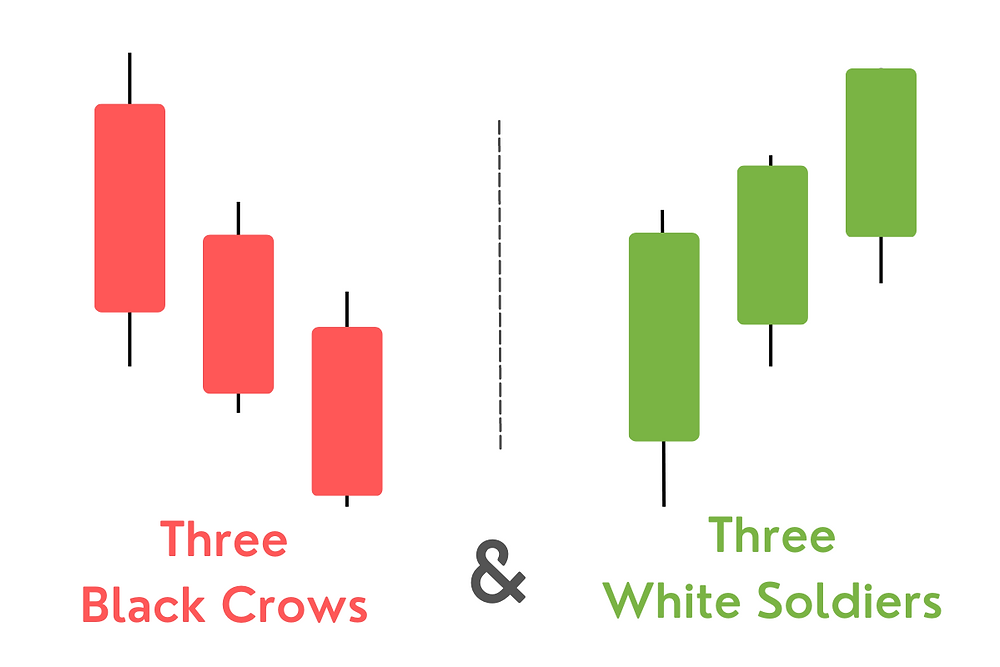

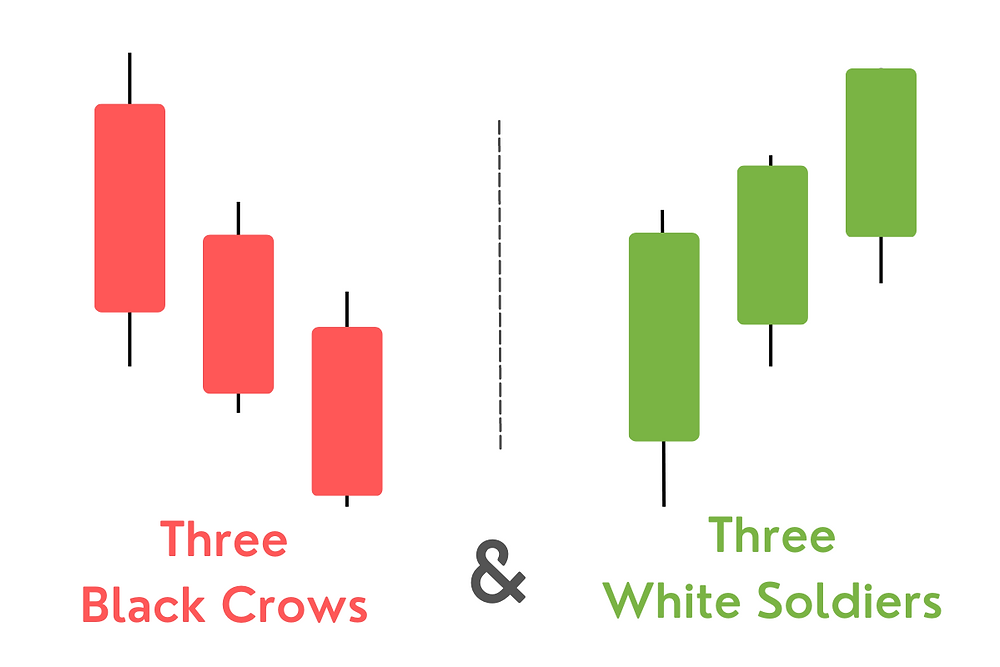

The Three White Soldiers pattern consists of three consecutive long-bodied bullish candlesticks. Each candle opens within the previous candle's real body and closes above the prior candle's high, indicating sustained buying pressure.

The absence of significant upper shadows suggests that bulls maintained control throughout each trading session. This pattern typically emerges after a downtrend, signalling a potential reversal and the beginning of an upward price movement.

Key Characteristics of the Pattern

To accurately identify the Three White Soldiers pattern, traders look for the following features:

Downtrend Preceding the Pattern: The market should be in a clear downtrend before the pattern appears, setting the stage for a potential reversal.

Three Consecutive Bullish Candles: Each candlestick should have a long real body, with each opening within the previous candle's body and closing higher than the previous candle's close.

Minimal Shadows: The candles should have small or no upper wicks, indicating that the bulls maintained control and little selling pressure during the sessions.

Consistent Volume: Ideally, the pattern should be accompanied by increasing volume, reinforcing the strength of the bullish reversal.

Interpreting the Three White Soldiers

As mentioned, the appearance of the Three White Soldiers pattern indicates a shift in market sentiment from bearish to bullish. The successive bullish candles reflect buying pressure, suggesting buyers are gaining control.

This pattern can serve as a signal for traders to consider entering long positions or exiting short positions.

Confirmation and Reliability

While the Three White Soldiers pattern is a strong bullish signal, it's essential to seek confirmation through other technical indicators:

Volume Analysis: Increased trading volume during the pattern's formation adds credibility to the reversal signal.

Support and Resistance Levels: The pattern's emergence near a significant support level enhances its reliability.

Technical Indicators: Indicators like the Relative Strength Index (RSI) or Moving Averages can provide additional confirmation of the trend reversal.

Trading Strategies

When incorporating the Three White Soldiers pattern into trading strategies, consider the following approaches:

Entry Point: Traders often enter a long position at the close of the third bullish candle, anticipating continued upward momentum.

Stop-Loss Placement: A common practice is placing a stop-loss order below the first candle's low in the pattern to manage risk.

Profit Targets: Setting profit targets based on previous resistance levels or using a risk-reward ratio can help in planning exits.

Volume Analysis: Confirming the pattern with increasing volume adds credibility to the reversal signal.

Comparing with Similar Patterns

Understanding how the Three White Soldiers pattern differs from other bullish reversal patterns can enhance trading decisions:

Bullish Engulfing Pattern: This two-candle pattern features a small bearish candle followed by a bullish candle that completely engulfs the previous candle's body. While it also signals a reversal, the Three White Soldiers pattern is considered more reliable due to its three consecutive bullish candles.

Morning Star Pattern: Comprising three candles — a bearish candle, a small-bodied candle (indicating indecision), and a bullish candle — the Morning Star pattern also suggests a potential reversal but differs in structure and interpretation.

Hammer Pattern: A single candle with a small body and a long lower shadow, the Hammer suggests a potential reversal but requires confirmation from subsequent candles.

Three Black Crows: The bearish counterpart to the Three White Soldiers, this pattern consists of three consecutive long-bodied bearish candles and signals a potential reversal from an uptrend to a downtrend.

Benefits and Limitations

Advantages

Strong Bullish Reversal Signal: It indicates a shift from bearish to bullish sentiment clearly, helping traders identify potential trend reversals early.

Easy to Recognise: The pattern is visually distinct and easy to spot on candlestick charts, even for beginner traders.

Momentum Confirmation: Suggests sustained buying pressure over multiple sessions, reinforcing the likelihood of continued upward movement.

Applicable Across Markets: Works well in various asset classes, including stocks, forex, commodities, and cryptocurrencies.

Supports Technical Strategy Building: This can be integrated into broader trading strategies with other indicators like RSI, MACD, or moving averages.

Useful for Entry Timing: Offers a structured entry signal for long positions, especially after a downtrend or consolidation phase.

Effective on Multiple Timeframes: Applicable daily, weekly, or intraday charts for short and long-term trading strategies.

Limitations

False Signals: In volatile markets, the pattern may produce false signals. It's essential to use additional technical analysis tools for confirmation.

Market Context: The pattern's reliability only increases at significant support levels or after prolonged downtrends.

Volume Confirmation: Lack of volume support may weaken the pattern's validity. Remember to assess volume trends alongside price action.

Overextension: If the three bullish candles are too large, it may indicate an overextension, leading to a potential pullback.

Conclusion

In conclusion, the Three White Soldiers pattern is a powerful tool in technical analysis, offering insights into potential bullish reversals. By understanding its formation, characteristics, and implications, traders can make informed decisions and enhance their trading strategies.

However, it's crucial to consider the broader market context, confirm signals with additional indicators, and manage risks appropriately.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.