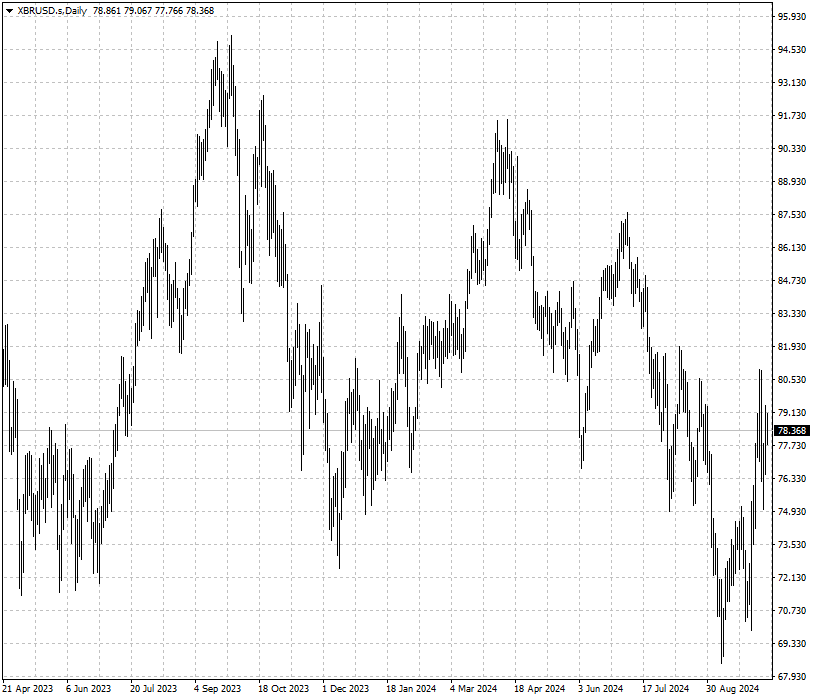

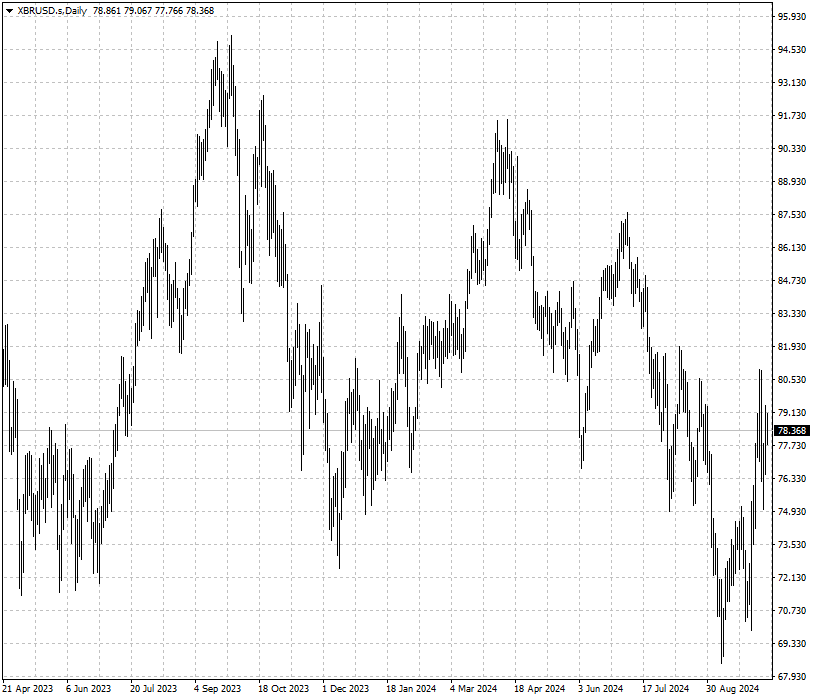

Oil futures posted their largest gain in more than a year last week and are

on course for another weekly gain despite a resilient dollar. The frenzy was

even bigger in the options market.

Traders snapped up December calls on Brent crude to bet on oil reaching $100

or higher, with aggregate call volume hitting a record after tensions escalated

in the Middle East.

Meanwhile they snapped up outlandish bets on the futures curve structure

rallying heavily. More than 5 million barrels wagered on the nearest Brent

spread hit $3.

The call skew on second-month WTI futures jumped to the highest since March

2022, when Russia's shocking invasion of Ukraine sparked supply concerns.

That marked a sharp turnaround for hedge funds, commodity trading advisors

and other money managers that raced to reverse positions that in mid-September

had turned bearish on crude.

Implied volatility for December calls climbed more than 30 points last week,

more than triple that for puts, while there was almost no change for either

bullish or bearish positions for July contracts and onward.

"Fundamental energy investors … are using call options as opposed to chasing

the rally in crude to get upside exposure to a potential supply disruption." said Rebecca Babin, senior equity trader at CIBC Private Wealth Group.

Harris' headache

Geopolitical risk premium gauges in the oil market have decreased slightly

this week, Goldman Sachs said. The bank expected a peak upside of $10-$20 for

Brent in the case of supply disruptions in Iran.

However, in the absence of major disruptions, prices could stabilize around

current levels this quarter, the bank said in a note dated Tuesday. It all

depends on if Israel will target Iran's oil industry.

Iran has previously threatened to disrupt flows through the Strait of Hormuz

which is a crucial channel through which approximately one-fifth of the world's daily oil production passes.

"In the case of a full-scale war, Brent would likely soar above $100, with

any potential shut-in of the strait threatening prices of $150 or more," Fitch

Solutions wrote in a note.

Gulf states are lobbying Washington to stop Israel from attacking Iran's oil

sites because they are concerned their own oil facilities could come under fire

from Tehran's proxies, sources told Reuters.

During meetings this week, Iran warned Saudi Arabia it could not guarantee

the safety of the Gulf kingdom's oil facilities if Israel were given any

assistance in carrying out an attack.

"If oil prices surge to $120 per barrel, it would harm both the US economy

and Harris' chances in the election. So they (Americans) won't allow the oil war

to expand," the source said.

Saudi's discomfort

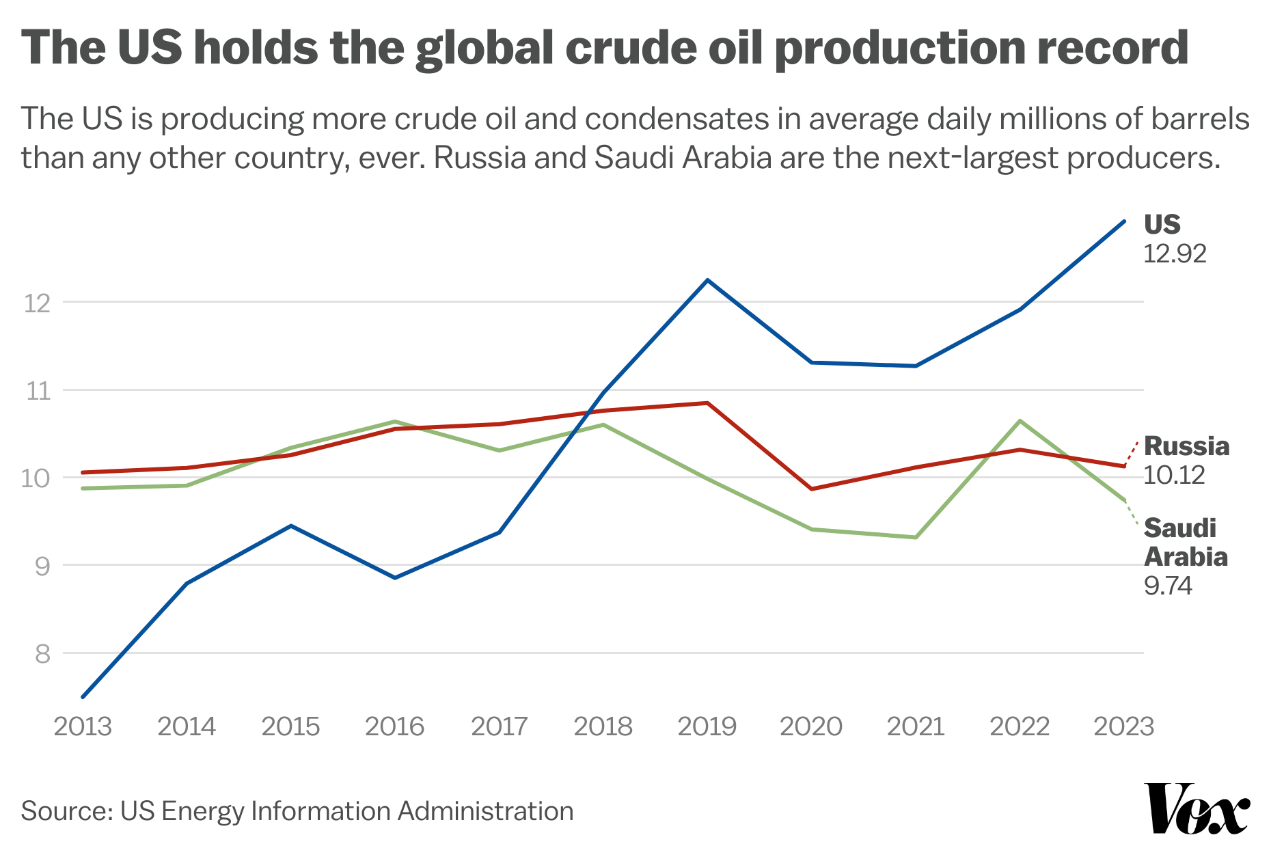

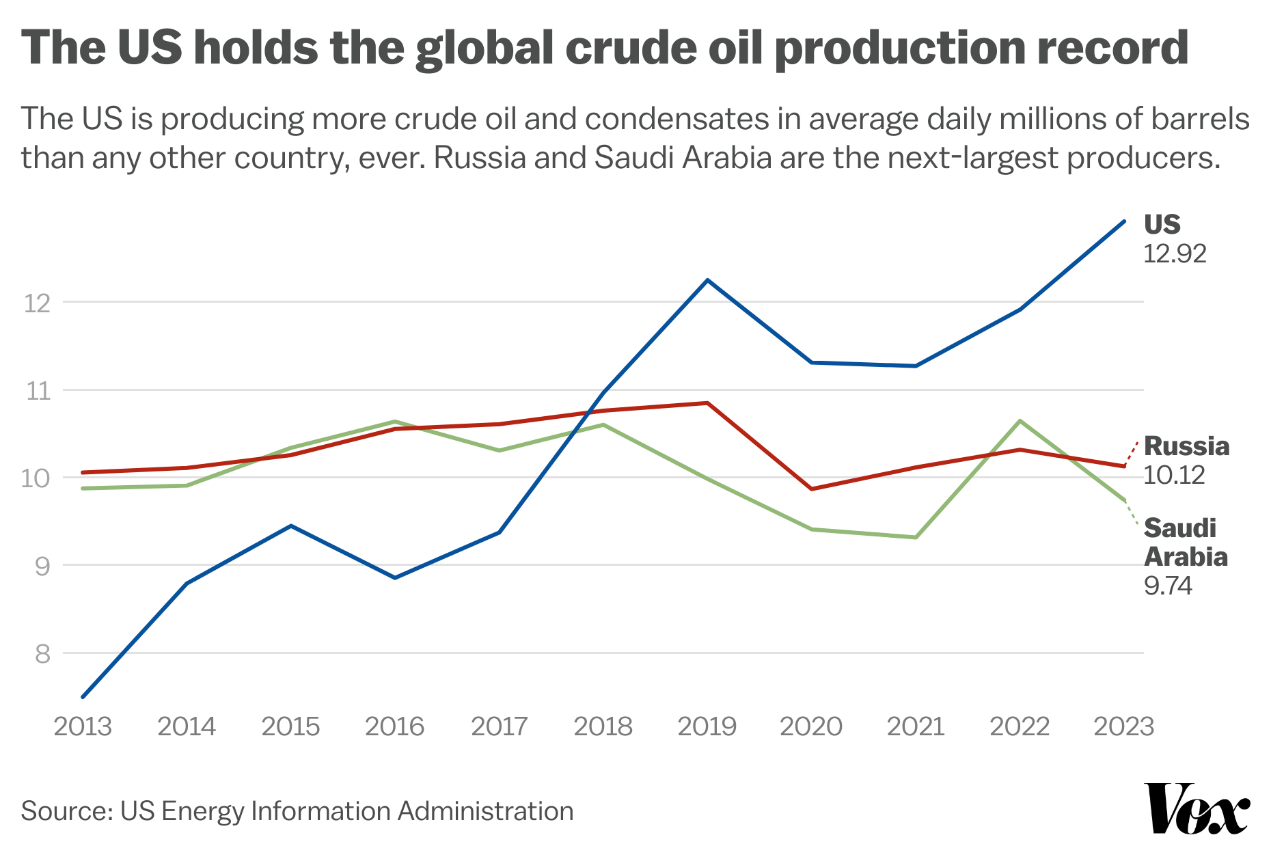

Saudi Arabia is ready to abandon its unofficial oil price target for crude as

it prepares to increase output, according to the FT. This came as non-OPEC

producers were loosening their taps.

The shift in thinking represents a major change of tack for the kingdom,

which has led other OPEC+ members in cutting output since November 2022 in an

attempt to stabilise the market.

A decade ago Saudi Arabia increased output in an effort to thwart the rapid

emergence of the US shale industry, and as a result, oil price felt the greatest

pains in 6 years.

Unconventional Oil Remains Resilient Despite OPEC+ Price War

Despite ongoing price wars, unconventional oil has shown remarkable resilience. The International Energy Agency (IEA) reports that OPEC+'s market share has fallen to historic lows due to output cuts implemented since 2022.

Currently, the country is producing 8.9 million barrels per day (bpd), the lowest level since 2011, reflecting its significant spare capacity. This reduction in output may partly stem from frustration with compliance among member nations. Several OPEC+ members, including Iraq and Kazakhstan, have exceeded their production quotas, while Riyadh has shouldered a substantial portion of the overall cuts.

Additionally, Moscow may face financial strain to support its war economy, increasing the likelihood of it deviating from the agreed output limits.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.