China's Q1 GDP beat expectations, underpinned by solid consumption and

industrial output even as policymakers brace for the impact of US tariffs that

analysts say pose the biggest risk to the Asian powerhouse in decades.

Despite that, higher unemployment and persistent deflationary pressures are

fuelling concerns over weak demand. Exports are expected to reverse sharply in

the months ahead as fresh levies take effect.

Exports have an outsized impact on employment, supporting almost a fifth of

the overall workforce, according to an estimate by China Galaxy Securities in

2023. So the labour market's exposure to the US is significant.

For 2025, the world's second largest economy is expected to grow at 4.5% pace

year-on-year, the Reuters poll showed, slowing from last year's 5.0 pace and

falling short of the official target of around 5.0%.

The Politburo is going to hold a meeting later this month to set its policy

agenda for the coming months. Goldman Sachs said stronger stimulus is needed to

offset the negative effects of the tariffs.

Expectations are rising that Chinese policymakers will roll out greater

stimulus. While they have signalled determination to boost consumption this

year, measures enacted remain limited.

China ordered airlines not to take further deliveries of Boeing jets,

according to people familiar with the matter, indicating there is no end in

sight to fight that has seen both sides raise trade barriers.

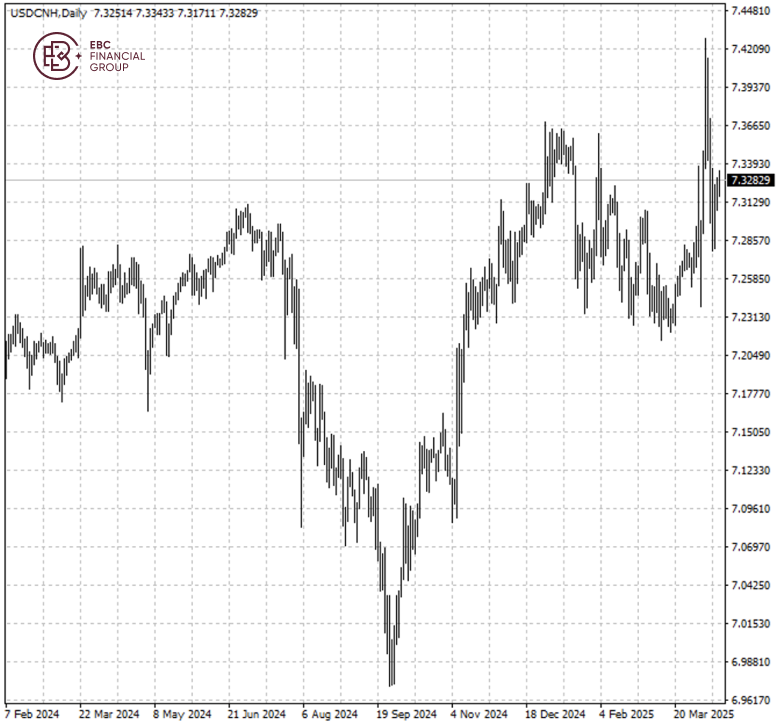

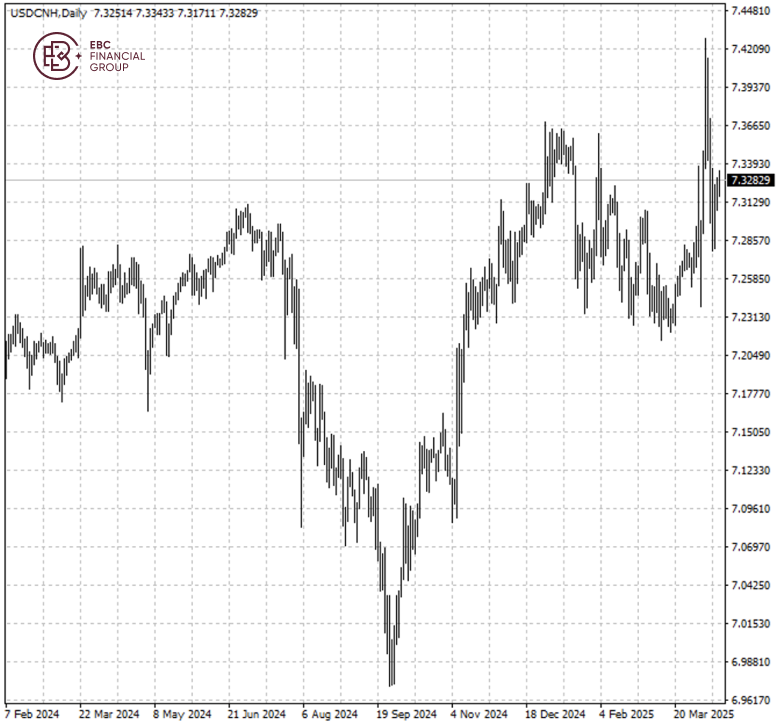

Yuan protection

The Chinese yuan hit an 18-year low last week as a result of flare-up in the

trade war, while the Hong Kong dollar rose to its highest level since 2021.

Barclays believes the process will be orderly and controlled.

China will not be able to wield a weaker yuan as a weapon against the shock

from falling exports due to concerns that such a move could trigger financial

market instability, market watchers told CNBC.

They say that a significant weakening of the yuan is unlikely in the long

term as it could have ripple effects, including triggering capital outflows,

something policymakers are keen to avoid.

"The government will try everything it can to assure the market that it has

the ability to defend the yuan against the US sanction and that no one in the

market should short yuan," said Eurasia Group.

Christopher Wong, OCBC's FX strategist, said that in the very near term, the

bank does not rule out "wild swings" in the currency that would see it trade

between 7.20 and 7.50 for both onshore and offshore currencies.

There are also limits to the benefits a weaker yuan could unlock considering

a tariff rate as high as 145%. But not everyone CNBC surveyed believes that

Beijing will opt for a stable yuan.

Jonas Goltermann, deputy chief markets economist at Capital Economics,

expects the USD/CNY rate to hit 8 by the end of the year. He added even that

would not fully offset the hike in tariffs.

Worse than a recession

America may not be made great again by Republicans. If China is going to lose

some manufacturing as a result of Trump's tariffs, the US will not be the main

beneficiary, according to a new CNBC Supply Chain Survey.

Most companies that responded to the survey say that bringing back supply

chains could as much as double their costs and that instead a search for

low-tariff regimes around the world will commence.

The most widespread reaction to the tariffs is the cancellation of orders,

according to 89% of respondents, and an expectation that consumers will pull

back on spending given layoffs and inflation resurgence.

The Federal Reserve Board found that the tariffs in 2018 caused a reduction

in manufacturing jobs as modest gains in domestic producers' competitiveness

were "more than offset" by rising input costs and retaliatory tariffs.

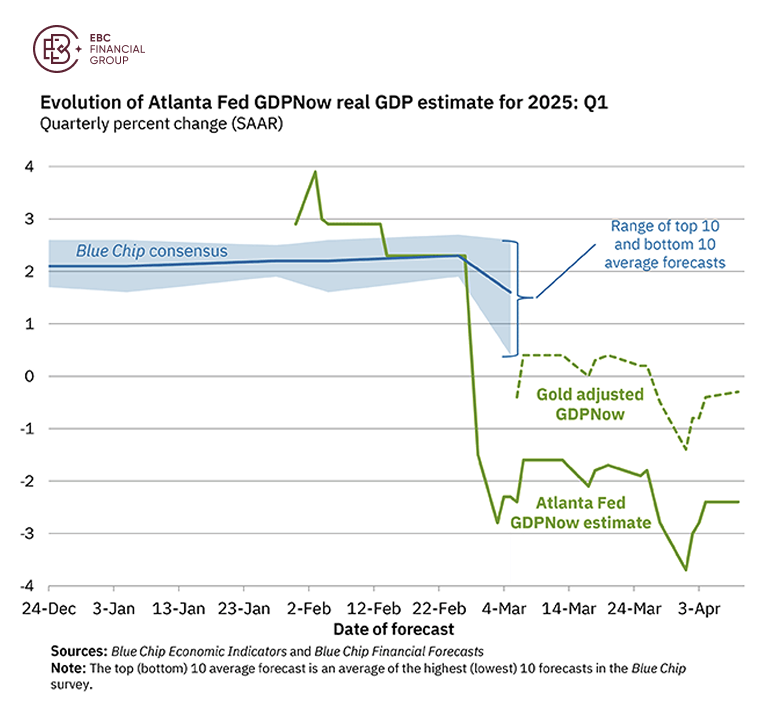

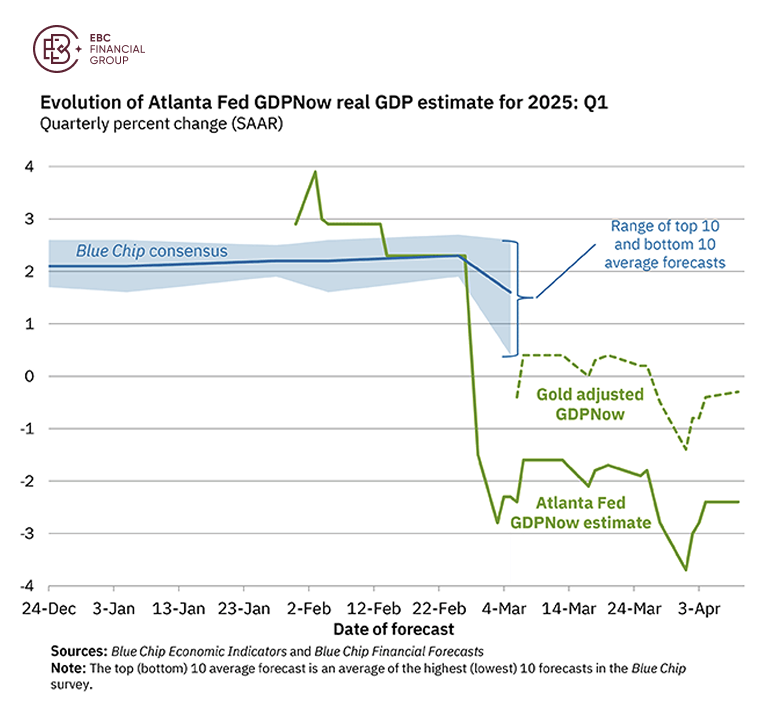

BlackRock CEO Larry Fink said that based on conversations he has had with

CEOs across the economy, the US is either very close to or already in a

recession now, in line with Atlanta Fed GDPNow estimate.

Bridgewater founder Ray Dalio compared current times with the 1930s, saying

"changes in the orders, the systems, are very, very disruptive. How that's

handled could produce something that is much worse than a recession."

The lingering pessimism could pour cold water on the belief that the US

dollar will resume uptrend in the near future and thereby helps cap the Chinese

currency's potential losses ahead.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.