Gold well supported amid trade tensions

2025-04-17

Summary:

Summary:

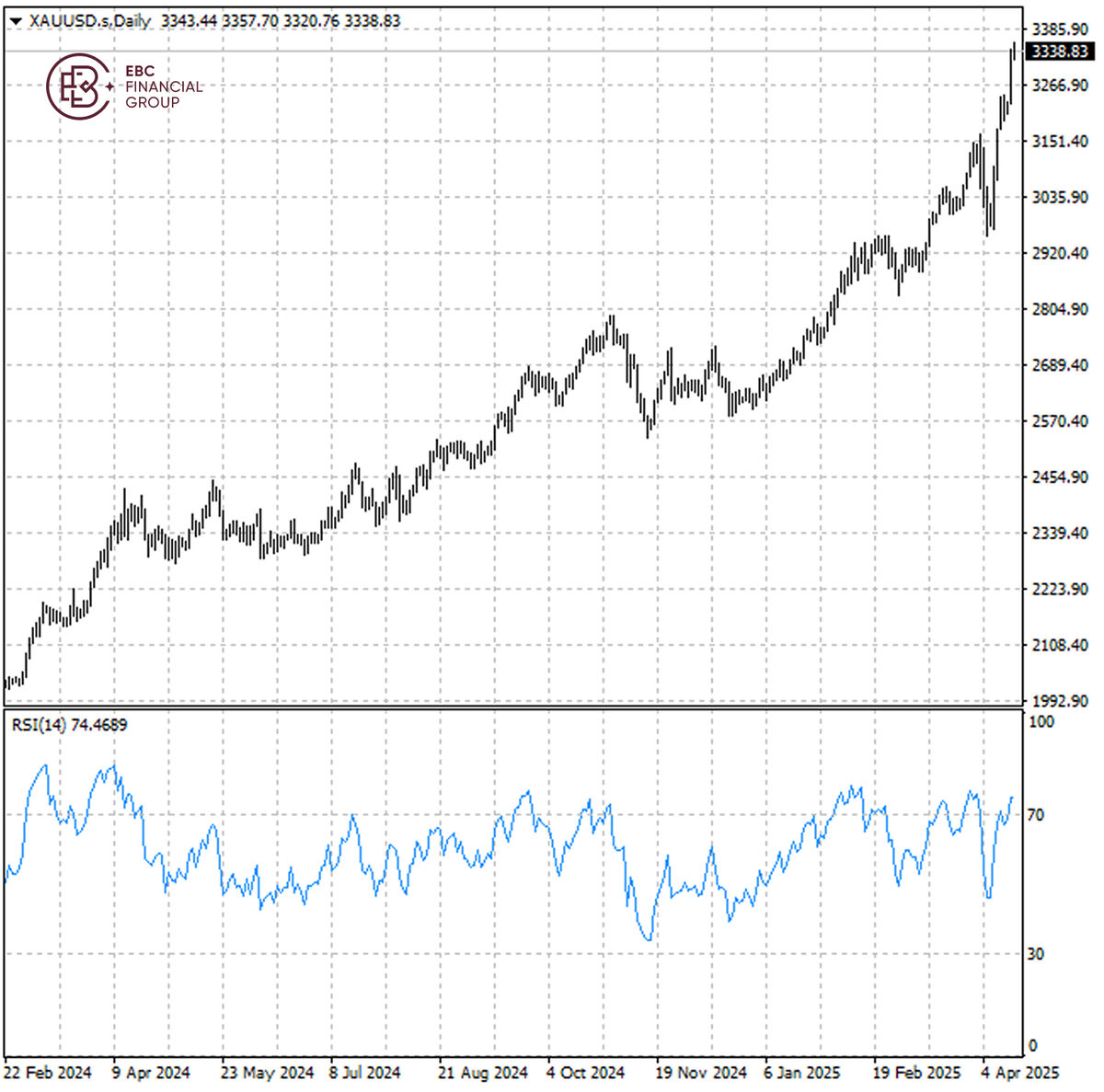

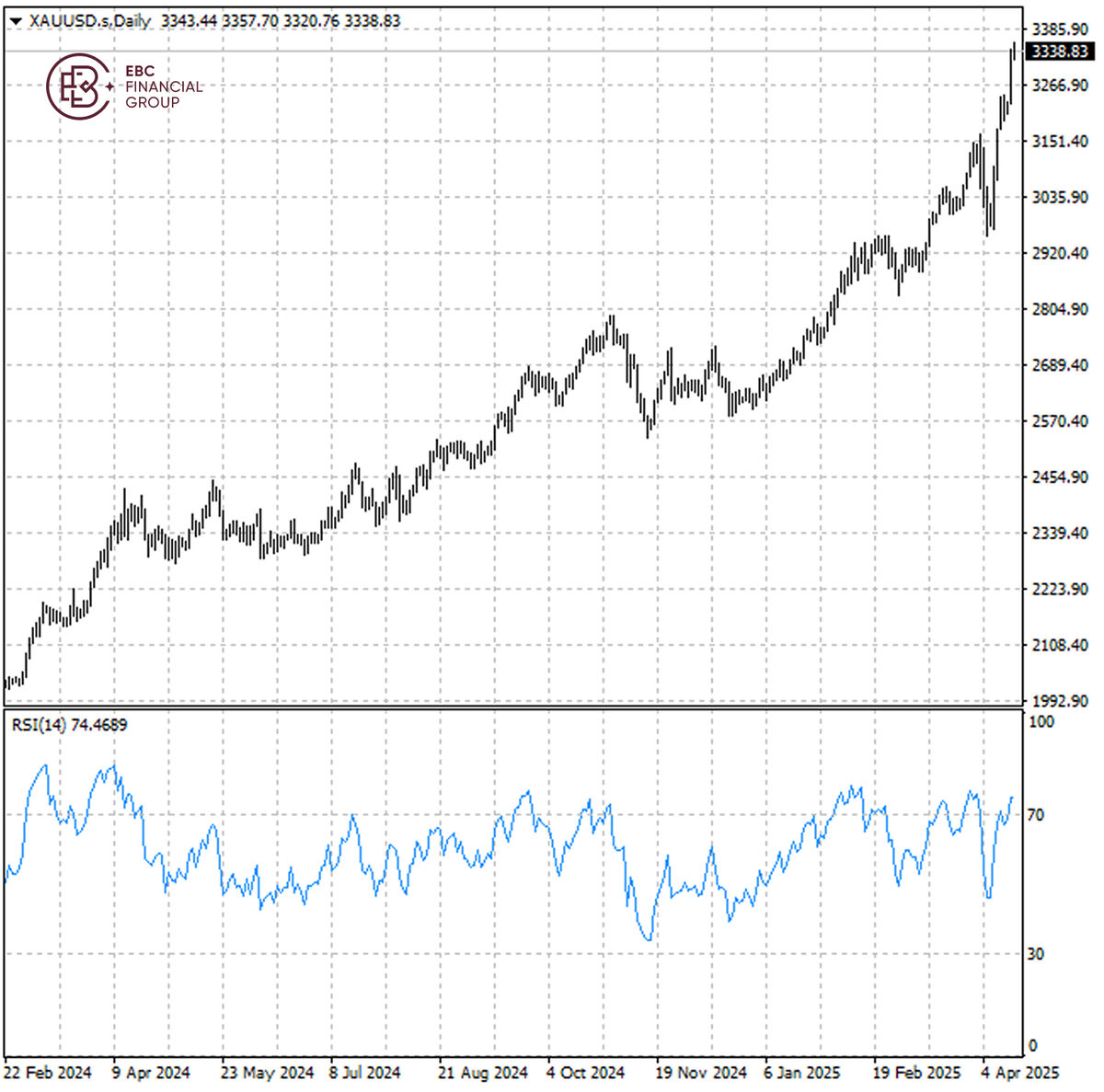

Gold dipped from its high on Thursday but stayed firm as US stocks fell again after Trump ordered a probe, sparking new global trade war concerns.

Gold retreated from its fresh high on Thursday but remained on solid footing

as US stocks slumped again after Trump ordered a probe that could open up a new

front in the global trade war.

China is open to trade talks if the US names a point person to represent the

country and shows respect by reining in disparaging remarks, according to a

person familiar with the Chinese government's thinking.

China on Wednesday appointed Li Chenggang as vice minister of commerce and a

top representative for international trade negotiation, according to an official

statement, replacing Wang Shouwen.

In a BofA fund manager survey this week, 42% of respondents expected gold to

be the best performing asset class in 2025. Goldman Sachs forecasts that prices

will jump to $4,000 by mid-2026.

The WTO warned on Wednesday that the outlook for global trade has

"deteriorated sharply". the volume of world merchandise trade is now expected to

decline by 0.2% in 2025, before a recovery of 2.5% in 2026.

Investment flows into Chinese physically backed gold ETFs so far this month

have exceeded those for the whole of the first quarter and overtaken inflows

registered by US-listed funds, WGC data showed.

Bullion has entered overbought territory with potential support around

$3,260, but the uptrend will likely remain intact until all the dust has settled

on US tariffs.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.