The euro was flat on Monday after last week ECB chief Christine Lagarde and

other policymakers hint about a rate cut at the meeting this month.

ECB's Rate Cuts and Eurozone Inflation: What’s Happening with the Economy?

The European Central Bank (ECB) has already cut interest rates twice this year, and it looks like another rate cut in October is almost certain. Financial markets are bracing for it, thanks to a sluggish economy and a quicker-than-expected drop in inflation.

Inflation in the eurozone, which fell to 1.8% last month, is expected to tick back up and hit the ECB's target of 2% by next quarter, according to a Reuters poll. Economists believe that inflation will stay close to this 2% mark until at least 2027. This gradual uptick is part of the ECB’s plan to keep prices stable while supporting growth in the region.

Although the ECB hasn’t given an exact "neutral" interest rate, a paper from the bank’s staff earlier this year suggested that the real rate (adjusted for inflation) is around zero, or about 2% in nominal terms. This gives us a glimpse into how the ECB might be thinking about future rate adjustments.

Germany's Economic Struggles and What It Means for the Eurozone

Germany, the eurozone's largest economy, is going through a tough time. According to government forecasts, the country’s economy is set to shrink for the second year in a row in 2024. This would be the longest downturn Germany has faced in over 20 years.

The problem? Consumer spending is weak, and businesses aren’t investing as much as they usually would. Concerns about rising tensions in the Middle East and growing competition from China are making companies nervous. All of this is eating away at business confidence, which is slowing the economy even further.

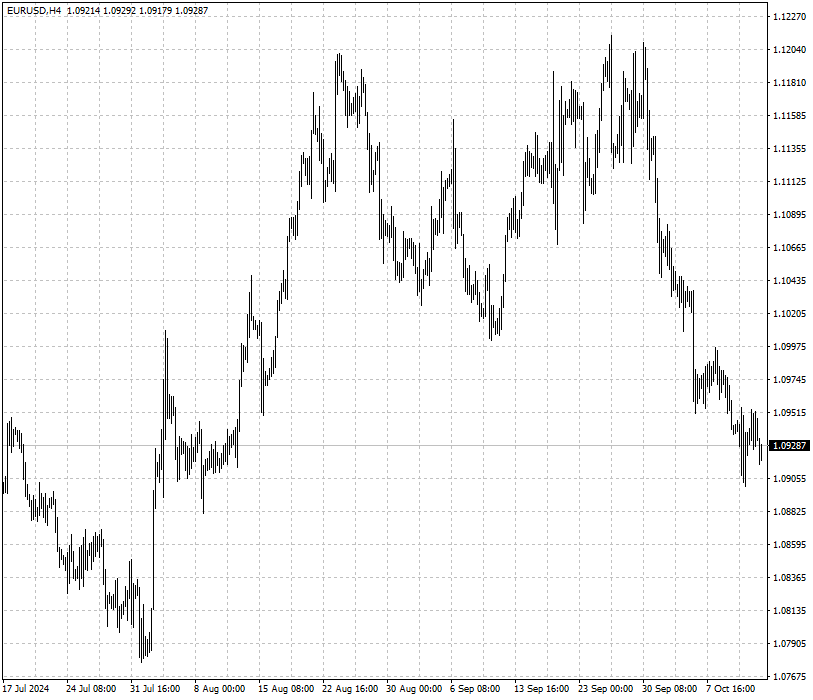

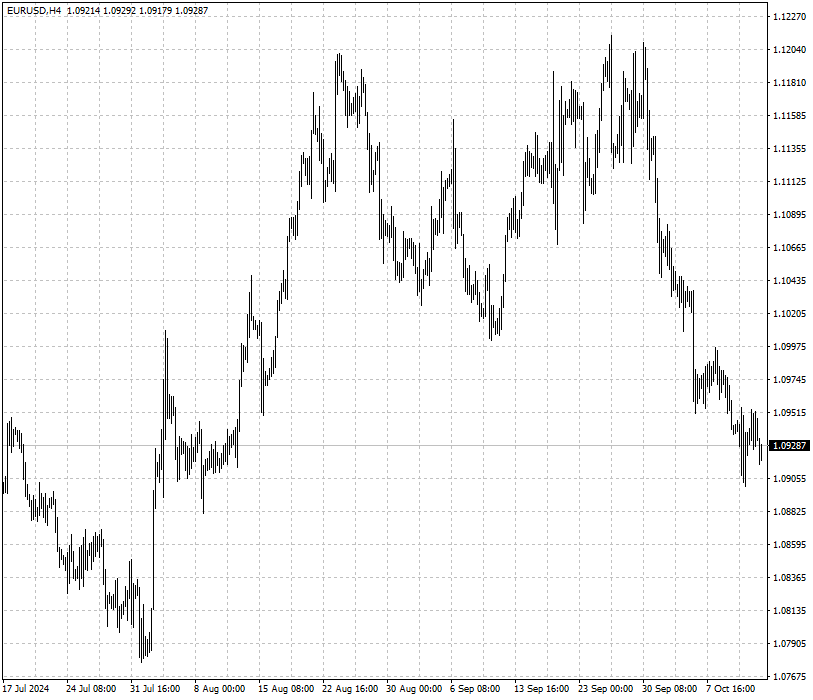

The euro has seen a quick retreat this month, falling below the neckline

around 1.1000. The double top pattern suggests the risk may be skewed towards

the downside with potential support at 1.0880.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.