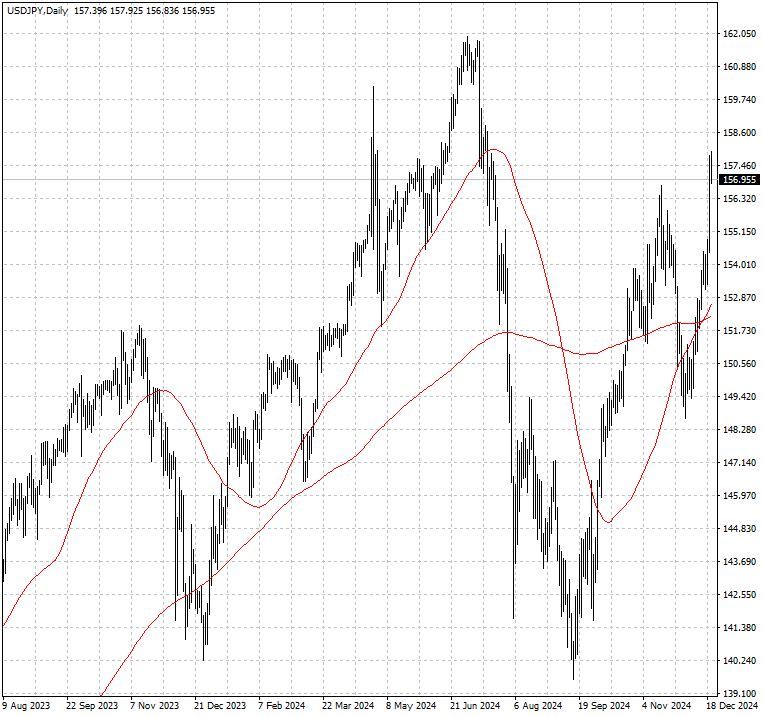

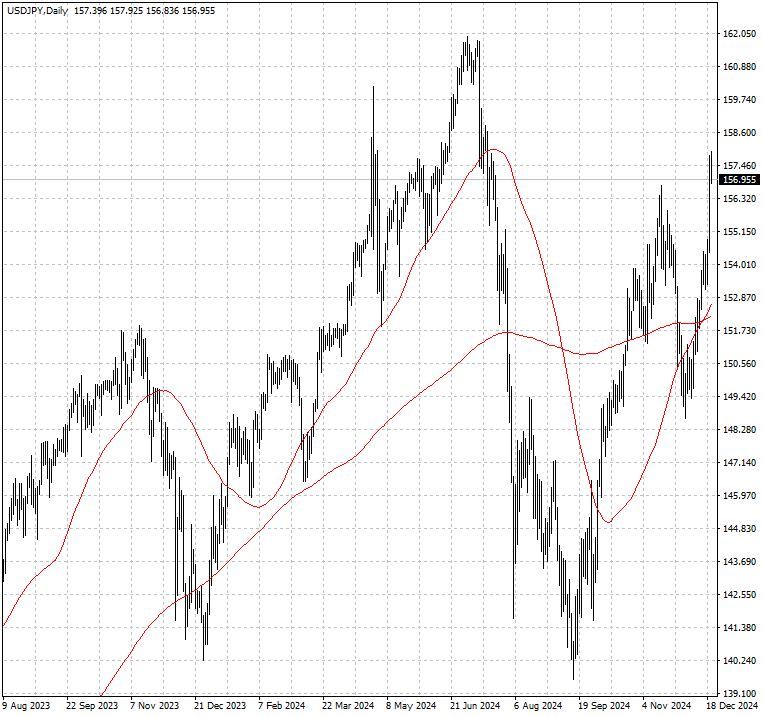

The yen weakened to a five-month low last week, while the dollar notched a two-year high bolstered by a hawkish rate outlook. US/Japan 10-year government bond yield spread has widened since early this month.

Japan consumer prices excluding fresh food rose 2.7% in November from a year earlier driven by higher energy costs, government data showed, higher than a consensus estimate of 2.6%.

The faster inflation was largely driven by a winding down of utility subsidies. PM Shigeru Ishiba has already decided to reinstate them from January to March as part of his economic stimulus package.

Top Japanese finance officials said on Friday the government is "alarmed" by recent forex moves and is ready to intervene if speculative moves were deemed excessive.

Tokyo last intervened in the market in July to support its currency after it tumbled to a 38-year low below 161 per dollar. USD/JPY has formed a golden cross in mid-November – a bearish sign for the yen.

Household spending fell at a slower pace than forecast in October. Economists attributed the underlying softness in broader consumption to rising prices and warm weather.

Meanwhile, base salary grew at the fastest pace in 32 years, boosting real wages after two months of decreases. Consumer confidence rebounded off a five-month low in November.

Neutral rate in question

The BOJ sees scope to hike short-term rates at least to around 1% without cooling growth, though some policymaker point to lacklustre consumption as a sign the level could be lower.

Most analysts expect the central bank to press ahead with rate hikes by March. Former BOJ board member Takahide Kiuchi expects the bank to slow the pace of rate hikes once it lifts them to 0.5%.

Governor Ueda has said the BOJ will hike to near neutral rate if the economy keeps recovering. But there is no consensus on where the anchor point is, due partly to a poor track record of projections.

Raising interest rates three times in one calendar year has never happened in Japan since 1989. a tightening cited by economists among the factors that led to the bursting of the nation's asset bubble.

Some BOJ officials think the rate may be lower than 1% as GDP growth is already losing momentum despite low real borrowing costs, say sources familiar with the bank's internal discussions.

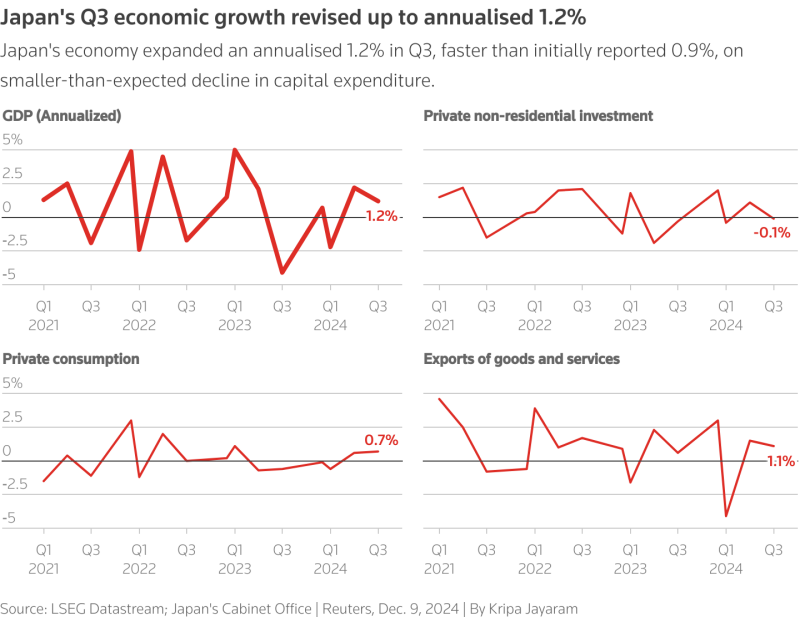

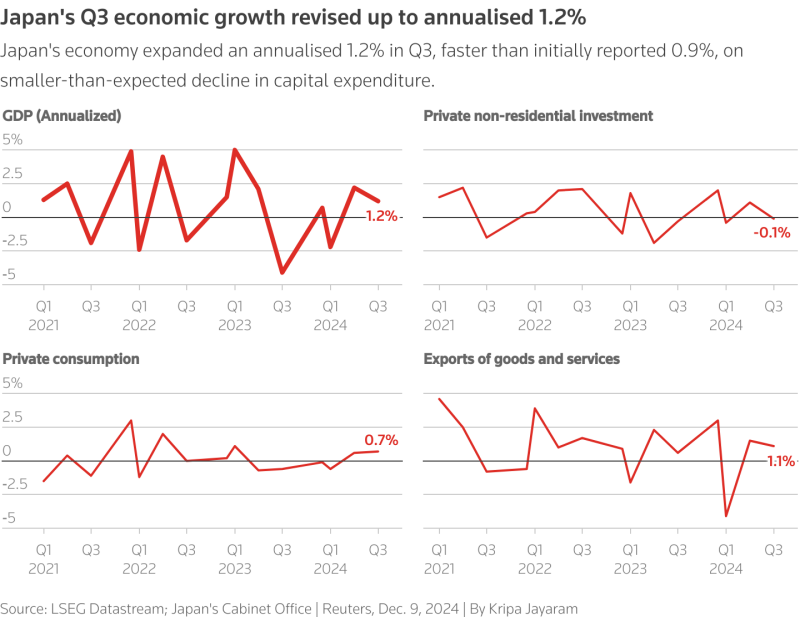

The world's fourth economy expanded in Q3 at a faster pace than initially reported, though a downward revision on consumption underscores the fragile nature of the recovery.

The growth was much slower than that in Q2. Nearly three-quarters of Japanese companies expect Trump's next term to have a negative impact on their business environment, a Reuters survey showed.

A shaky government

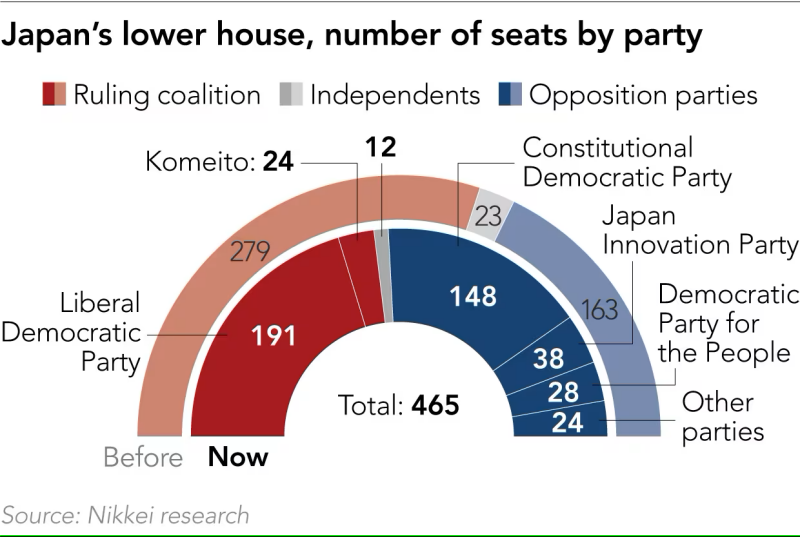

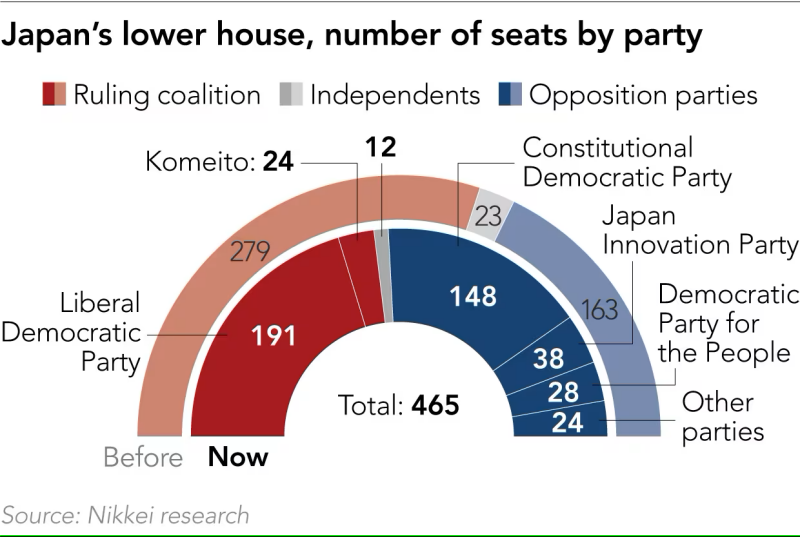

Last week Japan's ruling coalition approved a tax reform plan for the coming year without securing an agreement with a key opposition party, raising the risk of further political gridlock.

The ruling parties decided to raise the tax-free income ceiling to ¥1.23 million from ¥1.03 million. Tax revenue will likely decline by ¥600 billion to ¥700 billion as a result, according to the LDP's tax policy committee.

The disapproval rating for Ishiba's cabinet surpassed the 50% mark in the latest Nikkei-TV Tokyo poll. That could bolster the case that Japan's curse of revolving-door premiers has been in effect again.

Former PM Shinzo Abe served in two non-consecutive terms for 8 years ending in 2020. But his experience is something of a rarity in the country's political landscape characterised by chaos.

Ishiba was batted in parliamentary elections last month before surviving a runoff vote to stay in office. The set-up has left him vulnerable to any scandal or economic malaise.

Governing coalitions in Germany and France have both collapsed, underscoring the potential dysfunction of a minority government, while the dollar and the pound are enjoying political stability.

Leveraged funds bet that the yen will fall to 160-165 per dollar in the medium term. The premium to a USD/JPY put over the next two months, compared with its call, fell by the most in three months on Thursday.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.