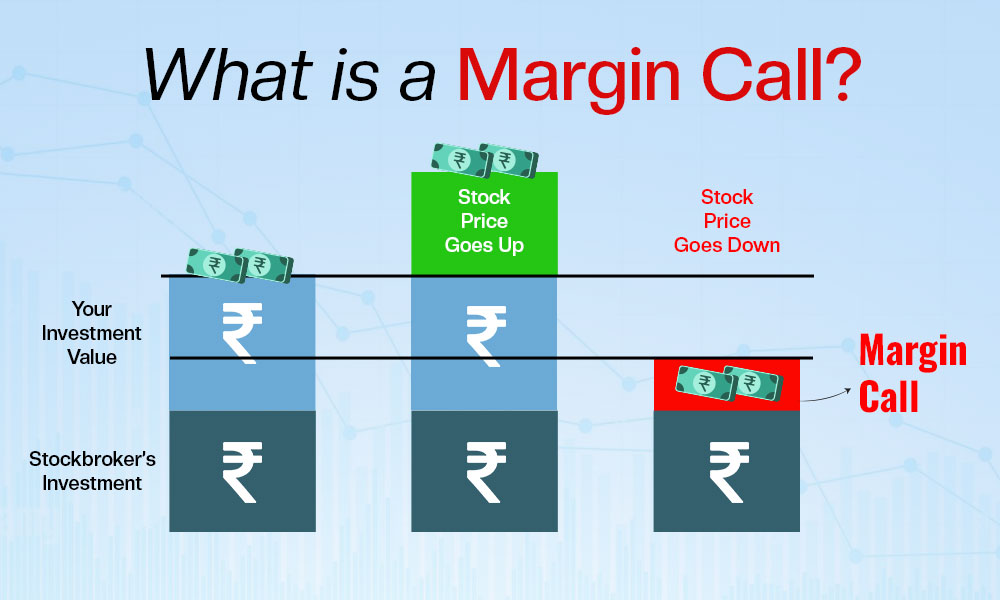

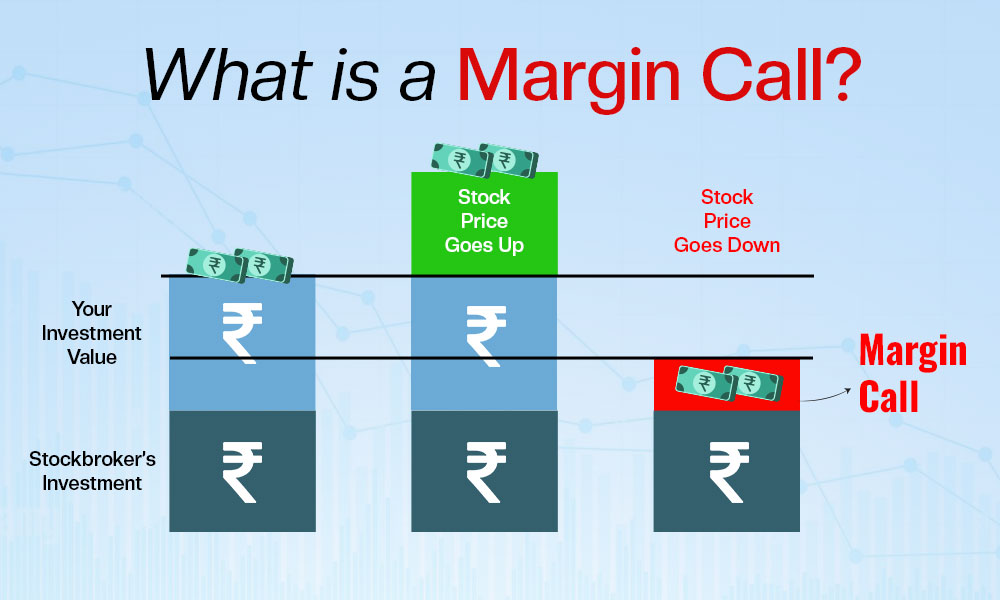

A margin call is a critical event in trading that occurs when an investor's account value falls below the required minimum balance broker sets. It serves as a warning that additional funds or securities must be deposited to maintain open positions.

What Is a Margin Call and How It Works?

A margin call occurs when the equity in a margin account falls below the broker's required minimum, known as the maintenance margin. This situation prompts the broker to demand additional funds or securities to bring the account back into compliance.

If the investor fails to meet the margin call, the broker may liquidate assets in the account to cover the shortfall, potentially at unfavourable prices.

How It Works

A margin call happens when the value of an investor's margin account falls below the broker's required maintenance margin. Here's how it works step by step:

Opening a Margin Position: You borrow money from your broker to buy securities with capital and borrowed funds. This is called buying on margin.

Maintenance Margin Requirement: Brokers require you to keep a certain percentage of your investment's value in your account —typically around 25% to 40%. This is known as the maintenance margin.

Decline in Asset Value: If the value of your securities drops significantly, your equity (the value of your assets minus what you owe) can fall below the maintenance margin.

Margin Call Triggered: When your equity dips below the required level, the broker issues a margin call, demanding that you deposit more funds or sell some securities to restore the account to the minimum required balance.

Meeting the Margin Call: You must either deposit more cash into your account, deposit additional securities or sell existing holdings to reduce the loan balance.

Failure to Act: If you don't meet the margin call in time, the broker can sell your assets — without your consent — to cover the shortfall and protect themselves from risk.

Risks Associated with Margin Calls

Margin calls can be dangerous for several reasons:

Forced Liquidation: If the investor cannot meet the margin call, the broker may sell securities in the account without notice, potentially at depressed prices during market downturns.

Amplified Losses: Using borrowed funds increases the potential for significant losses, as declines in asset value can quickly erode the investor's equity.

Emotional Stress: The urgency of margin calls can lead to hasty decisions, such as selling assets at a loss or injecting additional funds under pressure.

Real-World Example: The Archegos Capital Management Collapse

One of the most notorious and recent examples of the dangers of margin calls unfolded with Archegos Capital Management, a family office run by investor Bill Hwang. In March 2021, Archegos found itself at the centre of a massive financial collapse that shook global markets and caused billions in losses for some of the world's largest banks.

Archegos used total return swaps to build highly leveraged positions in a handful of stocks, including ViacomCBS, Discovery Inc., Baidu, and Tencent Music. These instruments allowed the firm to take on large bets without owning the underlying stocks and without publicly disclosing the extent of their exposure.

By leveraging its investments at a reported ratio of 8:1 or higher, Archegos was deeply exposed to even minor price fluctuations. When the price of ViacomCBS fell sharply following a large secondary stock offering in late March 2021, the value of Archegos's portfolio plunged. This drop triggered margin calls from its prime brokers, including Goldman Sachs, Morgan Stanley, Credit Suisse, and Nomura.

Hwang's firm was unable to meet the demands. In response, the brokers began to liquidate Archegos's holdings en masse, a process that caused a ripple effect in the stock prices of those companies and intensified selling pressure. The result was catastrophic:

Credit Suisse reported a loss of over $5.5 billion, one of the biggest single losses in its history.

Nomura, the Japanese investment bank, suffered around $2 billion in losses.

Goldman Sachs and Morgan Stanley managed to act quickly and avoided more significant losses by offloading positions early.

Strategies to Avoid Margin Calls

1. Maintain a Conservative Leverage Ratio

While margin trading inherently involves borrowing, the level of leverage you use makes a substantial difference in risk. It's often tempting to use the maximum margin, but doing so leaves little room for market fluctuations.

By using a lower leverage ratio—such as 2:1 instead of 4:1—investors reduce the risk of a sudden drop in account equity that could trigger a margin call.

2. Monitor Your Account Regularly

One of the most effective ways to stay ahead of margin calls is to maintain constant awareness of your account status. Real-time tracking of your margin levels, maintenance requirements, and overall equity allows you to react quickly if your positions deteriorate.

Most brokerage platforms offer alerts and dashboard tools to help you monitor your risk exposure efficiently.

3. Set Stop-Loss Orders

Stop-loss orders can serve as a crucial safety net in margin accounts. By setting predefined price points at which to sell your positions, you can limit your losses and protect your equity before it falls below the maintenance margin.

This automated approach helps you avoid emotional decision-making and acts quickly in volatile markets.

4. Keep Extra Cash or Marginable Securities in Your Account

A buffer of cash or other marginal assets in your account gives you a cushion during downturns. It can help absorb losses without immediately violating margin requirements.

Investors who maintain this buffer are more likely to withstand short-term dips without facing a margin call, especially during periods of heightened volatility.

5. Diversify Your Portfolio

Holding a diversified range of securities reduces the impact of a sharp downturn in any single asset. Concentrated bets, as in the case of Archegos, amplify risk.

By spreading investments across industries, asset classes, and geographies, you reduce the probability that a single event will threaten your entire portfolio and result in a margin call.

6. Understand Broker Requirements

Different brokers may have varying margin requirements, both in terms of initial and maintenance margins. Some may also change requirements during times of high market volatility.

Being fully aware of your broker's rules and any changes in their policies ensures you are not caught off guard.

7. Avoid Highly Volatile Stocks

Highly volatile assets can be enticing due to their potential for quick gains but can lead to sudden equity drops in a margin account. Stocks with high beta values (indicating price volatility relative to the overall market) are more likely to fluctuate sharply.

By favouring lower-volatility assets, you minimise the chances of wild price swings triggering margin calls.

8. Rebalance Regularly

Your account's risk profile can change as markets move. Rebalancing your positions periodically helps ensure your exposure aligns with your goals and risk tolerance.

For example, selling off overperforming assets and reallocating to underweighted positions can prevent your portfolio from becoming skewed in a way that increases margin risk.

Conclusion

In conclusion, Margin calls serve as a critical risk management mechanism in margin trading, signalling when an account's equity has fallen below acceptable levels.

While leveraging can enhance returns, it also introduces significant risks, including the potential for forced asset liquidation and amplified losses.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.