With indexed long-term mutual funds and ETFs now holding around $18 trillion in U.S. assets as of August 2025, these low-cost, diversified vehicles continue to expand their market share.

Investors favor ETFs for broad market exposure, minimal fees, and resilience amid economic uncertainty, geopolitical tensions, and shifting monetary policy.

Whether you’re a beginner or an experienced investor, selecting the right index fund remains a cornerstone of a robust 2025 investment strategy.

What Is an Index Fund?

An index fund is a passive investment vehicle that tracks the performance of a specific market index, such as the S&P 500 or Nasdaq-100. It aims to match, not beat, the market by holding the same securities in the same proportions as the index.

This approach offers broad diversification at a low cost, making it efficient for long-term investors.

Why Choose Index Funds in 2025?

The growing dominance of indexed mutual funds and ETFs reflects the appeal of index funds in a year marked by economic slowdowns, geopolitical risks, and market volatility.

Their low fees, broad diversification, and ability to mirror market performance make them a strong choice for investors seeking stable exposure amid uncertainty.

Pros and Cons Of Investing In Index Funds

While index funds remain a top choice for investors in 2025, they’re not without trade-offs.

| Pros |

Cons |

| Low Cost |

Limited Outperformance |

| Broad Diversification |

Market Risk Exposure |

| Simplicity and Transparency |

Less Flexibility

|

Index funds offer long-term stability and cost efficiency, but they’re best suited for investors comfortable with tracking overall market performance rather than chasing short-term gains.

Understanding their strengths and limitations helps you decide if they align with your investment goals.

Top ETF And Index Funds for 2025

The S&P 500, representing 500 of the largest U.S. companies, remains a benchmark for broad market performance. Here are some of the best ETFs tracking this index:

1. Vanguard S&P 500 ETF (VOO)

Expense Ratio: 0.03%

5-Year Annualised Return: ~16.0%

Why It’s Top: Ultra-low cost, broad market exposure, massive size and liquidity.

Best For: Core portfolio holdings for long-term investors.

2. SPDR S&P 500 ETF Trust (SPY)

Expense Ratio: 0.0945%

5-Year Annualised Return: ~16 % (based on ~107.9% cumulative return over five years)

Why It’s Top: The original S&P 500 ETF, exceptionally high liquidity, widely traded.

Best For: Traders seeking flexibility and high trading volume.

3. iShares Core S&P 500 ETF (IVV)

Expense Ratio: 0.03%

5-Year Annualised Return: ~16% (consistent with peers)

Why It’s Top: Matches VOO’s cost efficiency with similar exposure and strong liquidity.

Best For: Cost-conscious investors wanting a reliable S&P 500 exposure.

4. Invesco QQQ Trust (QQQ)

For those seeking growth via technology and innovation-driven companies, Nasdaq-100 ETFs are ideal.

Expense Ratio: 0.20% (with a proposed cut to 0.18% pending approval)

5-Year Annualised Return: ~17.8%–19% (based on a 5-year cumulative return of ~119.2% through July 2025)

Why It’s Top: QQQ tracks the Nasdaq-100 Index, heavily weighted toward major tech leaders like Apple, Microsoft, and Nvidia. Its strong long-term performance, liquidity, and massive scale make it a cornerstone for investors seeking innovation and growth exposure.

Best For: Growth-focused investors comfortable with higher volatility in pursuit of superior tech-sector returns.

Top International ETF and Index Fund For 2025

For investors seeking wider diversification beyond U.S. large-cap exposure, total-market and global ETFs offer access to thousands of companies across multiple regions and sectors.

These funds provide a balanced way to capture global equity performance while keeping costs low and holdings transparent.

5. Vanguard Total Stock Market ETF (VTI)

Expense Ratio: 0.03%

5-Year Annualised Return: ~14.3% according to recent data.

Why It’s Top: VTI tracks the CRSP U.S. Total Market Index, covering nearly 4,000 U.S. stocks across all sectors at ultra-low cost.

Best For: Investors wanting full U.S. market diversification.

6. Vanguard Total World Stock ETF (VT)

Expense Ratio: 0.07%

5-Year Annualised Return: ~14.1% as of recent data.

Why It’s Top: VT gives exposure to both U.S. and international stocks in one fund, offering global equity reach.

Best For: Investors seeking worldwide equity exposure.

Top Specialised Index Funds for 2025

Beyond broad market exposure, some ETFs cater to more specific portfolio objectives such as steady dividend income, sector concentration, or defensive diversification. These specialised index funds can complement core holdings by adding either growth potential or risk balance.

7. Schwab U.S. Dividend Equity ETF (SCHD)

Expense Ratio: 0.06%

5-Year Annualised Return: ~12.9% per recent data.

Why It’s Top: Focuses on high-quality U.S. dividend-paying stocks; low cost, solid income-plus-growth profile.

Best For: Income-focused investors seeking stability.

8. Vanguard Dividend Appreciation ETF (VIG)

Expense Ratio: 0.05%

5-Year Annualised Return: ~11.6% per comparison data.

Why It’s Top: Tracks companies with long-term dividend growth (10+ years of growth required); benefits from recent fee cuts.

Best For: Long-term investors wanting dividend growth rather than current yield.

9. VanEck Semiconductor ETF (SMH)

Expense Ratio: 0.35%

5-Year Annualised Return: ~28.4% per recent data.

Why It’s Top: Invests in semiconductor leaders like Nvidia and TSMC; positioned to capture AI/tech-cycle gains.

Best For: Investors seeking aggressive tech-sector growth and willing to accept higher volatility.

10. iShares Physical Gold ETC (SGLN)

Expense Ratio: ~0.12% (for the ETC version tracked)

Recent Return: ~45.3% 5-year annualised, and YTD ~36% for one version of the gold ETC.

Why It’s Top: With gold prices above $3,000/oz in 2025, SGLN gives low-cost gold exposure, a hedge against inflation and market stress.

Best For: Investors seeking a safe-haven allocation or non-correlated diversification.

While specialised ETFs can enhance returns or reduce risk, they tend to be more volatile or concentrated. A balanced allocation that blends core index funds with select specialised ETFs can provide both growth and resilience in uncertain markets.

Key Considerations for Choosing Index Funds in 2025

Selecting the right index fund in 2025 requires balancing cost, diversification, and risk tolerance amid shifting market conditions.

Expense Ratios: Pick low-cost funds like VOO, IVV, or VTI, even small fees add up over time. Major providers such as Vanguard and Fidelity continue to cut costs in 2025.

Diversification: Choose funds that match your goals like S&P 500 for broad U.S. exposure, Nasdaq-100 for growth, or VT for global reach.

Performance: While past results don’t guarantee future returns, funds like QQQ and VOO have shown steady long-term strength.

Liquidity: Larger funds such as SPY and VOO trade easily with low costs, making them ideal for most investors.

Market Conditions: With ongoing volatility in 2025, balance growth ETFs like SMH with defensive picks such as SCHD or SGLN for stability.

Risks to Consider

While index funds offer diversification and low costs, they’re not risk-free. Their performance mirrors the broader market, meaning when the market declines, so do your returns.

In 2025, volatility driven by interest rate uncertainty, inflation pressures, and slowing global growth has reminded investors that “passive” doesn’t mean “safe.”

Market Volatility: Index funds can face steep drops during economic slowdowns or corrections, as seen in early 2025’s rate-driven selloffs.

Sector Concentration: Major indexes like the S&P 500 and Nasdaq-100 are heavily weighted toward tech, exposing investors to sector-specific risks.

Interest Rate Sensitivity: Higher interest rates can pressure both stock valuations and bond index fund returns.

Tracking Error: Some ETFs may slightly lag their benchmarks due to fees or minor tracking inefficiencies.

Despite these risks, index funds remain attractive for long-term investors who can tolerate short-term swings in pursuit of steady, compounding growth.

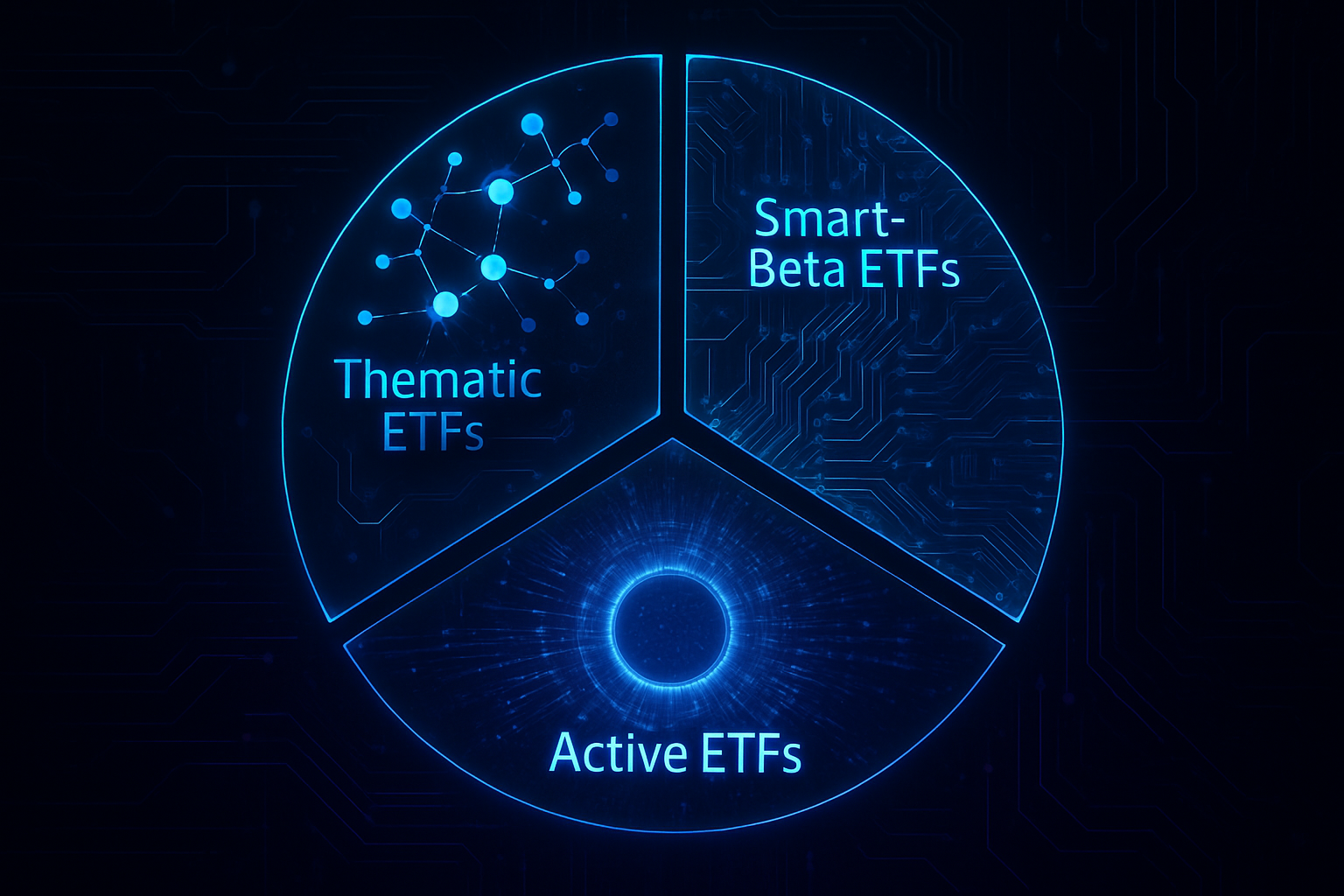

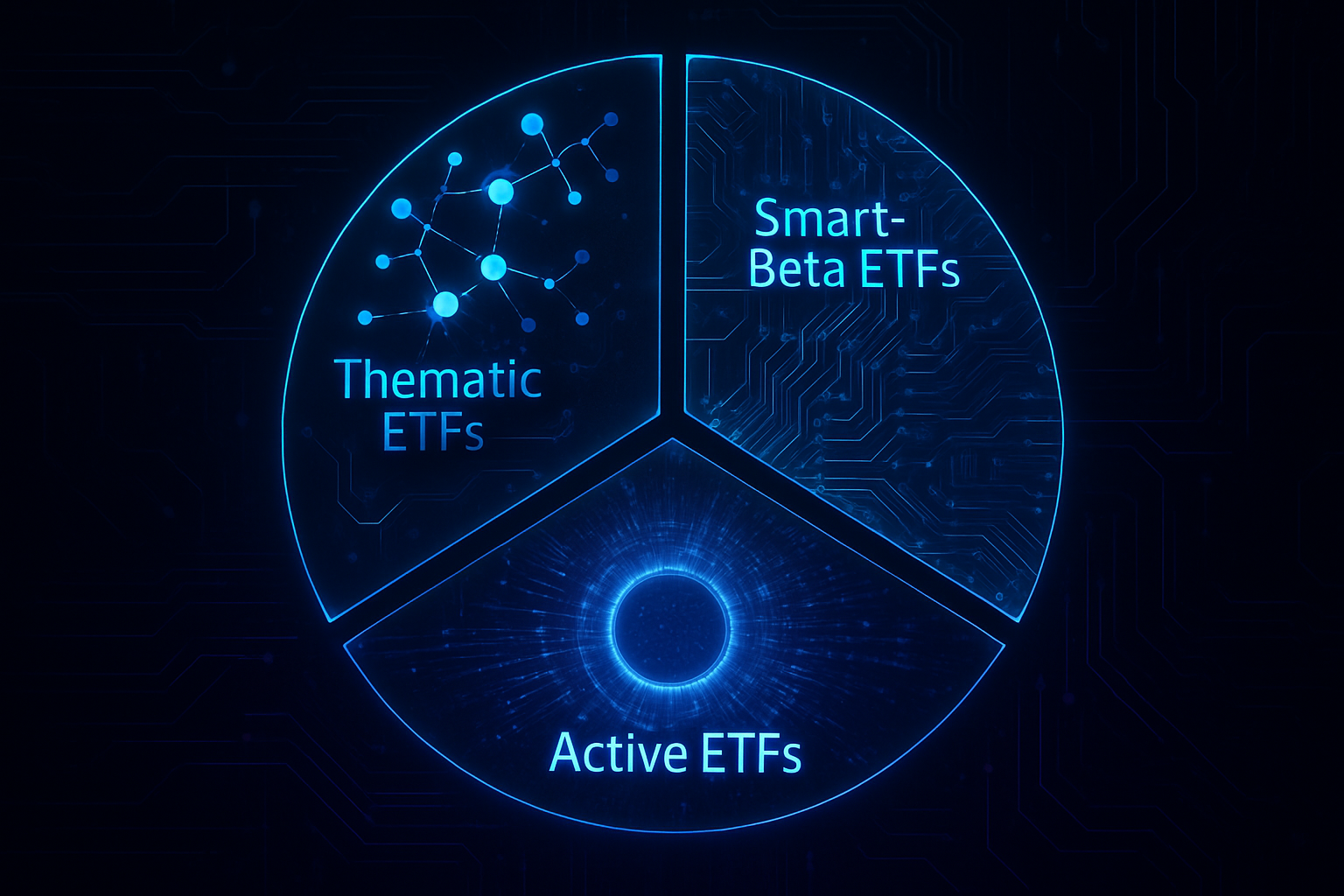

How New ETF Categories Are Emerging in 2025

ETFs in 2025 go beyond simple index tracking. Alongside traditional funds like VOO or VTI, newer categories such as thematic, smart-beta, and active ETFs are gaining ground.

Thematic ETFs focus on big trends like AI, clean energy, and cybersecurity, offering higher growth potential but also more volatility.

Smart-Beta ETFs adjust weights based on factors like value, momentum, or low volatility, aiming to beat standard indexes with a rules-based approach.

Active ETFs let managers make selective decisions while keeping the low costs and liquidity of passive funds.

These innovations blur the line between active and passive investing, giving investors more choice and more need for careful selection.

Frequently Asked Questions (FAQ)

1. Are index funds still good in 2025?

Yes. They remain popular for low costs, diversification, and consistent long-term returns.

2. Which is better: S&P 500 or total market ETFs?

S&P 500 ETFs offer stability; total market ETFs provide broader exposure and growth potential.

3. Are specialised ETFs like SMH or SGLN risky?

Yes. They’re more volatile but can boost returns when used alongside core funds.

4. How much should I invest in index funds?

It depends on your goals, but most investors hold 60–80% in diversified index ETFs.

5. Are active ETFs replacing index funds?

No. Active ETFs are growing, but low-cost index ETFs still dominate for long-term investing.

Conclusion

In 2025, index funds remain a cornerstone for investors seeking a balance of cost efficiency, diversification, and reliable performance.

From broad-market leaders like VOO and QQQ to defensive plays such as SCHD and SGLN, the right mix depends on each investor’s goals and risk profile.

Staying disciplined with allocation and focusing on long-term fundamentals continues to be the most effective strategy in a volatile market environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.