Klarna, the Swedish fintech giant known for its "buy now, pay later" (BNPL) services, has been a focal point in the financial world as it prepares for its initial public offering (IPO).

With a significant global presence and a history of rapid growth, Klarna's move to go public has garnered attention from investors and industry analysts alike.

However, recent developments have introduced uncertainties into its IPO plans. This article delves into Klarna's IPO timeline, valuation history, and the associated risks, providing investors with a comprehensive overview.

Klarna IPO Timeline: From Filing to Pause

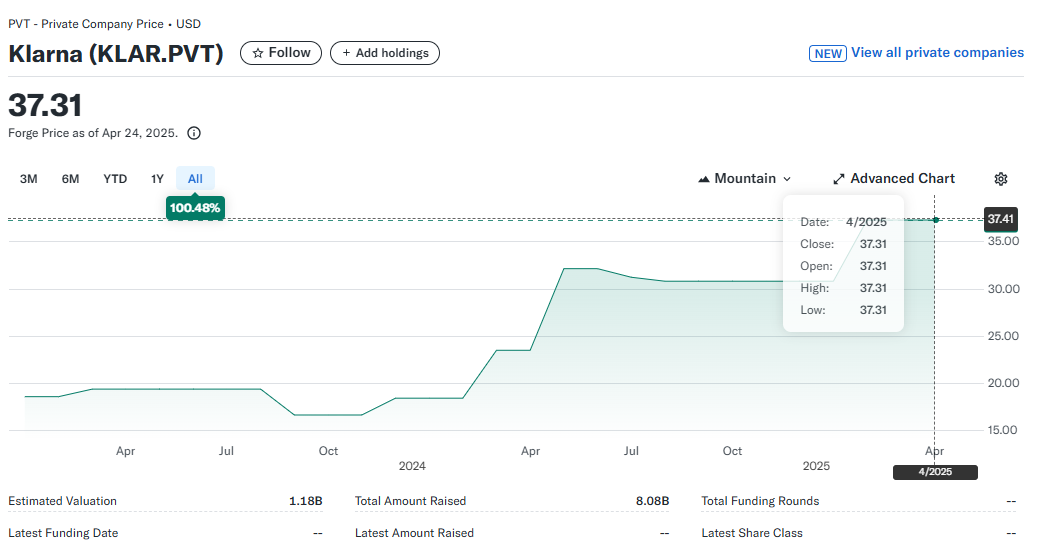

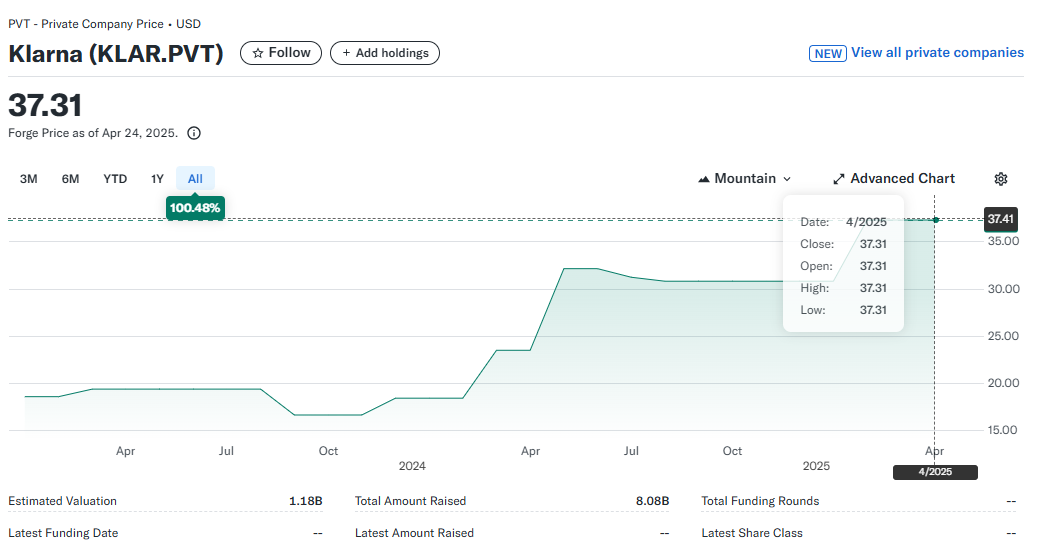

Founded in 2005, Klarna experienced rapid growth, reaching a peak valuation of $45.6 billion in 2021. However, by 2022, its valuation plummeted to $6.7 billion due to market corrections and rising interest rates.

In a strategic turnaround, Klarna confidentially filed for an IPO with the U.S. Securities and Exchange Commission in November 2024, officially announcing its plans in March 2025 under the ticker symbol "KLAR". The initial plan was to go public in April 2025, with rising expectations of over $1 billion at a valuation exceeding $15 billion.

However, unforeseen geopolitical events have impacted this timeline. In early April 2025, the Trump administration announced sweeping tariffs, leading to significant market volatility. As a result, Klarna decided to pause its IPO plans, citing the need to reassess the timing amid the uncertain economic environment. While the company has not provided a new date for the IPO, it has indicated that it will proceed once market conditions stabilise.

Valuation Journey: Peaks and Troughs

Klarna's valuation trajectory has been marked by significant fluctuations:

2021: At the height of the fintech boom, Klarna achieved a peak valuation of approximately $45.6 billion.

2022: Economic headwinds and rising interest rates led to a sharp decline, with the company's valuation dropping to around $6.7 billion.

2024: A rebound in investor confidence saw Klarna's valuation climb back to an estimated $14.6 billion, as indicated by Chrysalis Investments.

2025: Ahead of its planned IPO, Klarna aimed for a valuation exceeding $15 billion, seeking to raise over $1 billion from the public market.

These valuation shifts reflect the broader volatility in the fintech sector and underscore the challenges Klarna faces in stabilising investor perceptions.

Key metrics include:

Gross Merchandise Volume (GMV): $105 billion in 2024, up from $92 billion in 2023.

Active Customers: 93 million by the end of 2024.

Daily Transactions: Approximately 2.5 million

Risks Associated with Klarna IPO

Investors considering Klarna's IPO should be aware of several risks and challenges that the company faces:

1) Market Volatility:

The recent pause in Klarna's IPO plans underscores the impact of geopolitical events on market stability. Tariffs and trade tensions can lead to unpredictable market conditions, affecting investor confidence and the success of public offerings.

2) Regulatory Scrutiny:

In 2024, Klarna was fined $50 million by Sweden's financial regulator for breaches related to anti-money laundering rules. Such regulatory issues can impact the company's reputation and operational capabilities, specifically as it seeks to expand in markets with stringent compliance requirements.

3) Competitive Landscape:

The BNPL market is becoming increasingly crowded, with players like Affirm, Afterpay, and PayPal offering similar services. Klarna's ability to maintain its market share and differentiate its offerings will be crucial for sustained growth.

4) Consumer Behavior:

Klarna's revenue is heavily reliant on consumer spending. Economic downturns or shifts in consumer behaviour can adversely affect the company's earnings, as seen with declining sales from major partners like H&M and Inditex.

Conclusion

In conclusion, Klarna's anticipated IPO represents a significant moment in the fintech industry, reflecting both the company's growth trajectory and the evolving landscape of digital finance. While the potential for substantial returns exists, investors must weigh the associated risks, including market volatility, regulatory challenges, and competitive pressures.

As Klarna navigates these complexities, its performance post-IPO will serve as a bellwether for the broader BNPL sector and the fintech market at large.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.