Gold has long been considered a reliable store of value, especially during times of economic uncertainty. But in today's rapidly changing financial landscape, it's natural to ask: Is gold still a good investment? Let's take a closer look at why gold remains a popular choice for traders, how it performs during economic turmoil, and whether it truly deserves a place in your portfolio.

Why Gold Is Seen as a Safe-Haven Asset

One of the main reasons gold is viewed as a solid investment is its reputation as a safe-haven asset. This means that when stock markets are volatile, or when geopolitical tensions rise, gold tends to retain—or even increase—its value. It's often the first choice for traders seeking stability when uncertainty looms.

The primary reason gold holds this safe-haven status is its intrinsic value. Unlike paper currencies or stocks, gold isn't tied to any particular country or company. It isn't subject to the whims of government policy or corporate performance. This makes gold a reliable store of value when everything else seems to be fluctuating. Whether it's the aftermath of a financial crisis, or the risk of global conflict, gold has shown time and time again that it can weather storms that affect other assets.

Gold's durability as an asset has been evident throughout history. From ancient civilisations to modern economies, it has remained a symbol of wealth. Unlike paper currencies, which can lose value due to inflation or mismanagement, gold's scarcity and physical nature make it less vulnerable to such fluctuations.

Gold's Performance During Economic Uncertainty

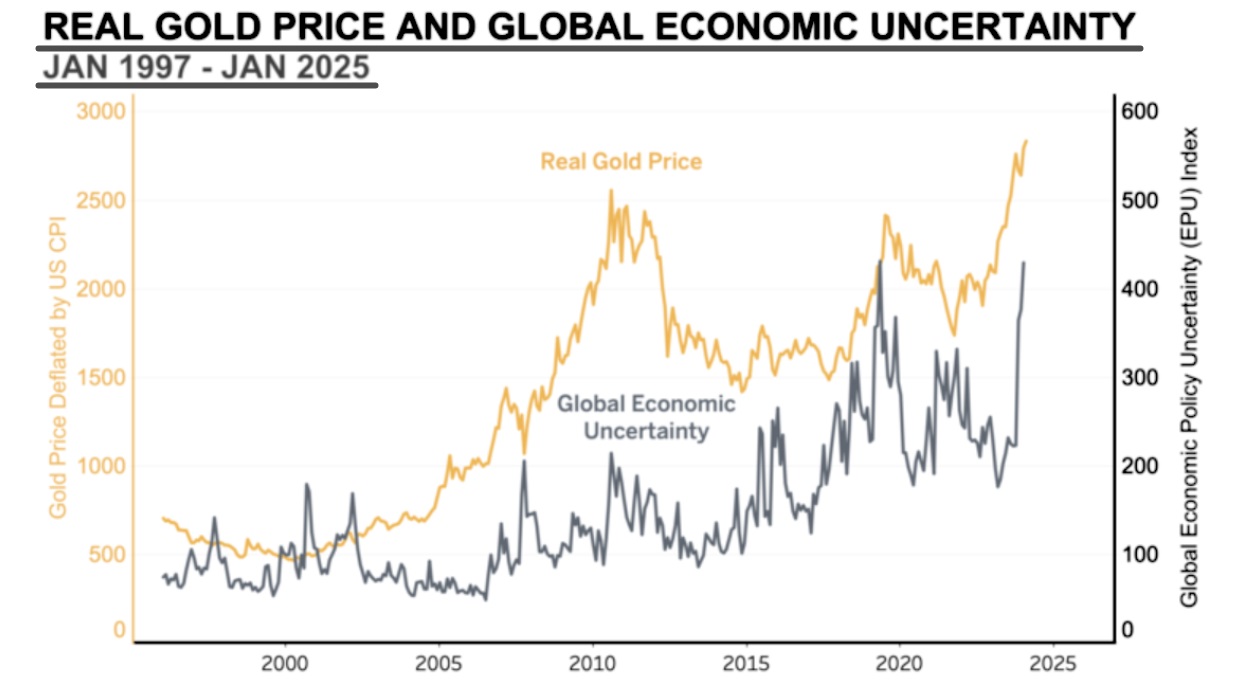

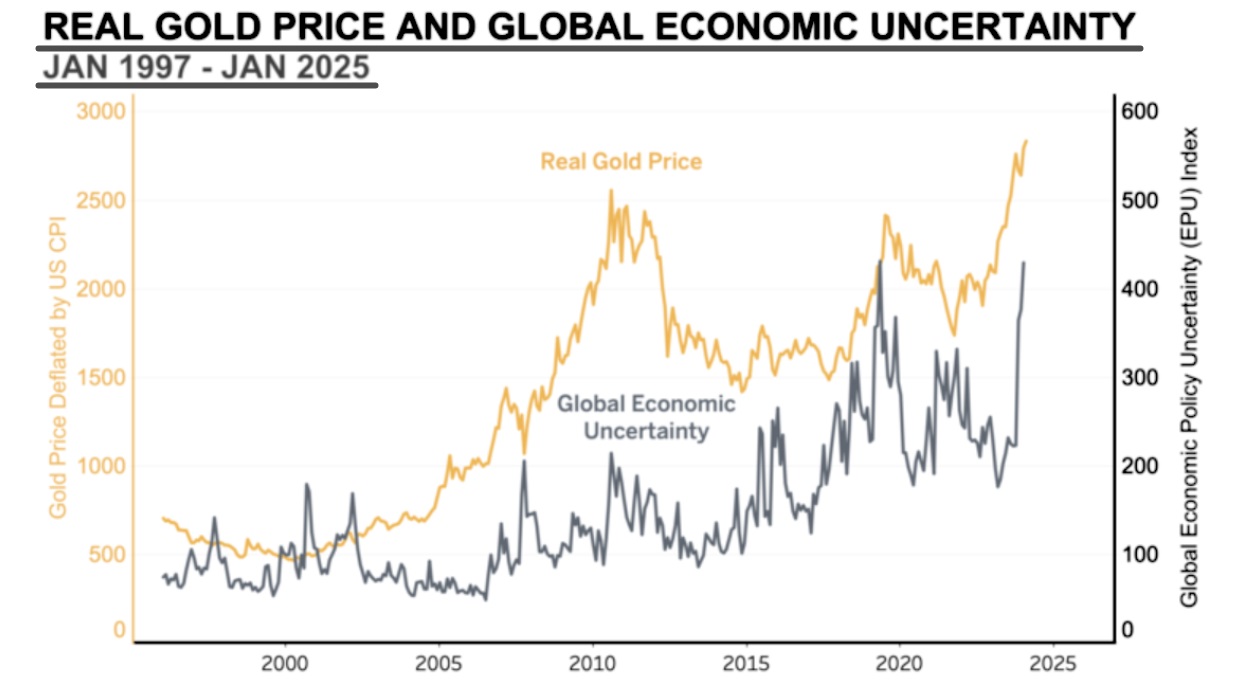

Gold's performance during times of economic uncertainty is one of the primary reasons many people view it as a hedge against economic instability. During past market downturns, gold has often acted as a protective asset, holding or increasing in value when stocks and bonds were losing ground.

For example, during the 2008 global financial crisis, while the stock market was in freefall, gold prices surged as traders flocked to it as a safer alternative. Similarly, in the wake of the COVID-19 pandemic, gold prices saw significant increases as the world experienced an economic slowdown and government stimulus packages weakened currencies.

The reason for gold's resilient performance during these times comes down to its role as a store of value. In economic downturns, traders lose confidence in traditional assets, such as stocks and bonds, and seek out assets that have stood the test of time. As a tangible asset, gold has historically offered this reassurance.

The reason for gold's resilient performance during these times comes down to its role as a store of value. In economic downturns, traders lose confidence in traditional assets, such as stocks and bonds, and seek out assets that have stood the test of time. As a tangible asset, gold has historically offered this reassurance.

However, it's important to note that gold is not immune to market forces. Like any investment, it can be impacted by economic conditions. But when looking at historical trends, gold tends to perform better than many other assets when uncertainty is at its peak.

How Gold Helps Hedge Against Inflation

Another reason many traders consider gold a good investment is its ability to hedge against inflation. Inflation erodes the purchasing power of cash, meaning that over time, the same amount of money buys fewer goods and services. During periods of high inflation, traders look for assets that can keep pace with rising prices, and gold has traditionally been one of the best ways to do this.

Unlike paper money, the value of gold is not directly tied to inflation. In fact, as inflation rises and the purchasing power of fiat currencies declines, the price of gold often increases. This is because gold is a finite resource, and its scarcity only adds to its value during times of economic pressure.

A key example of gold's inflation-hedging properties can be seen in the 1970s when inflation in the United States reached double-digit levels. During this period, gold prices surged dramatically, making it a highly effective hedge against the eroding value of the dollar.

Gold's Price Volatility and Its Impact on Returns

While gold is often praised for its stability, it's important to note that it can still experience price volatility. The price of gold doesn't rise in a straight line, and it can be influenced by many factors, including changes in interest rates, shifts in trader sentiment, and fluctuations in the US dollar.

One of the factors that can cause gold prices to fluctuate is the relationship between gold and the US dollar. Gold is typically priced in dollars, so when the dollar strengthens, gold becomes more expensive for foreign buyers, leading to a potential drop in price. Conversely, when the dollar weakens, gold tends to become more attractive, driving its price higher.

Despite this volatility, many traders are drawn to gold because of its long-term stability compared to more speculative investments like stocks or cryptocurrencies. However, it's important to understand that short-term fluctuations can still have an impact on gold's returns, which may not suit every trader's risk tolerance.

The Role of Gold in a Balanced Investment Portfolio

So, is gold a good investment? The answer really depends on your overall financial goals and risk tolerance. For many traders, gold can play a key role in a diversified portfolio. By including gold alongside other assets, such as stocks, bonds, and real estate, you can create a more balanced portfolio that can withstand different economic environments.

Gold's primary role in a portfolio is often as a diversifier. It behaves differently from stocks and bonds, meaning that it can help reduce overall risk. In times of stock market declines or economic stress, gold's performance may not follow the same trends, providing a counterbalance to other, more volatile investments.

That said, it's important to remember that gold should not make up the majority of any portfolio. Its role is typically that of a complementary asset. As with any investment, it's important to strike the right balance that aligns with your investment goals, time horizon, and risk appetite.

Conclusion

Gold has proven itself to be a valuable investment for many reasons: it's seen as a safe haven during economic uncertainty, it offers protection against inflation, and it can provide diversification in a portfolio. However, it's not without its risks, including price volatility and the influence of the dollar. Ultimately, whether or not gold is a good investment depends on your individual financial goals and how it fits within your broader portfolio.

While gold may not always provide the same level of returns as more aggressive investments, its stability and role as a hedge against inflation and economic turmoil make it a solid option for many traders seeking to safeguard their wealth. When considering gold as part of your investment strategy, remember to assess your risk tolerance and time horizon, and always be mindful of the broader economic environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The reason for gold's resilient performance during these times comes down to its role as a store of value. In economic downturns, traders lose confidence in traditional assets, such as stocks and bonds, and seek out assets that have stood the test of time. As a tangible asset, gold has historically offered this reassurance.

The reason for gold's resilient performance during these times comes down to its role as a store of value. In economic downturns, traders lose confidence in traditional assets, such as stocks and bonds, and seek out assets that have stood the test of time. As a tangible asset, gold has historically offered this reassurance.