Simply put, a stock market bubble occurs when prices rise significantly above their intrinsic value, driven by exuberant market behaviour and speculation.

Understanding the causes, stages, and consequences of stock market bubbles is crucial for investors aiming to navigate financial markets prudently.

What Is a Stock Market Bubble

A stock market bubble is characterised by a rapid stock price escalation followed by a contraction. This phenomenon typically arises when investors drive prices beyond the stocks' fundamental worth, often fueled by speculative enthusiasm. The bubble bursts when reality sets in, and prices revert to more reasonable levels, causing significant financial losses.

The Five Stages

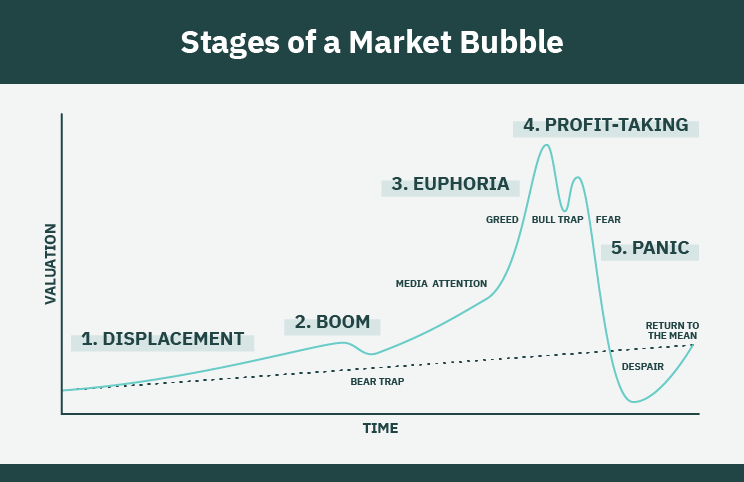

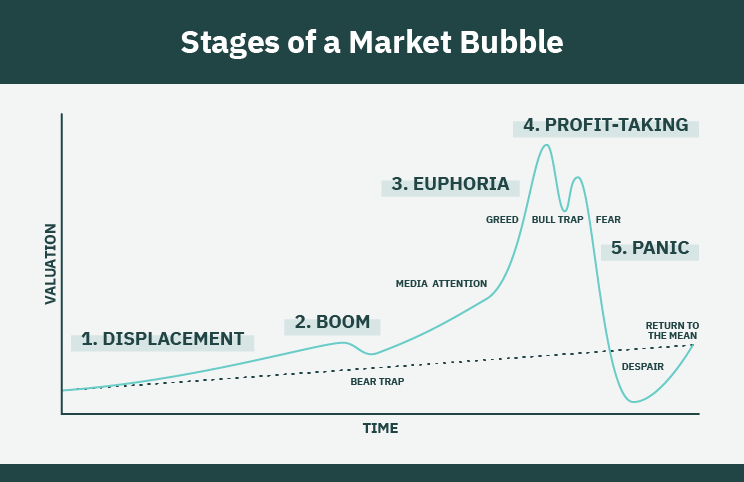

Economist Hyman P. Minsky identified five distinct stages in the lifecycle of a financial bubble:

1) Displacement: Typically starts with an external trigger or innovation that changes investor expectations. It could be a new technology, deregulation, or a shift in monetary policy.

During this phase, smart money moves into emerging opportunities, often quietly. Then, prices start rising modestly, attracting some attention but not yet public participation.

2) Boom: In this phase, more investors notice the rising prices and begin participating in the market. Media coverage picks up, and the financial news cycle focuses on the opportunity. This increased visibility draws in institutional investors and retail traders alike.

The momentum builds as prices rise at an accelerated rate, and a sense of optimism becomes dominant. However, while fundamentals may justify the price increases during this phase, speculative behaviour starts creeping in.

3) Euphoria: This is where the bubble takes on its most dangerous form. At this point, prices have diverged significantly from their intrinsic value. Valuations become difficult to justify using traditional financial metrics. Investor psychology is overwhelmed by the belief that the current trend will continue indefinitely.

Market participants disregard caution, often dismissing warnings of overvaluation. The fear of missing out — commonly known as FOMO — takes over, leading people to invest irrationally. Many use leverage or margin accounts to maximise gains, assuming the upward trend will not end.

4) Profit-Taking: Savvy investors begin to recognise the overextended valuations and decide to lock in profits. This selling creates volatility and uncertainty in the market. Although prices may still be high, the rate of increase slows, and some asset classes begin to decline.

Confidence begins to erode subtly, though many investors stay in the market, hoping it's just a temporary dip.

5) Panic: Confidence evaporates rapidly, and investors rush to sell, dropping prices sharply. The demand that had pushed the bubble upward disappeared almost overnight. Panic selling leads to a free fall in asset prices, and those who bought in at the peak suffer substantial losses.

The broader economy may also be affected, especially if the bubble is large enough to impact consumer wealth or the banking sector. Depending on the depth of the downturn, recovering from this collapse can take months or even years.

Causes and Consequences

Several factors contribute to the formation of stock market bubbles:

Excessive Liquidity: Low interest rates and easy access to credit can lead to increased borrowing and investment in stocks, inflating prices.

Speculative Behaviour: Investors may buy stocks, expecting to sell them at higher prices, disregarding the underlying fundamentals.

Herd Mentality: As more investors buy into rising markets, others follow suit, creating a self-reinforcing cycle of price increases.

Overconfidence and FOMO (Fear of Missing Out): The desire to capitalise on rising markets can lead investors to make irrational decisions, contributing to overvaluation.

Technological Innovations: Breakthroughs can lead to future earnings overestimation, as seen during the dot-com bubble.

Consequences

When a stock market bubble bursts, the consequences can be severe:

Wealth Destruction: Investors lose significant amounts of money, leading to reduced consumer spending and investment.

Economic recession: The collapse of asset prices can lead to a contraction in economic activity, increased unemployment, and reduced GDP growth.

Financial Instability: Banks and institutions may face solvency issues due to bad loans and declining asset values.

Historical Examples

One of the most iconic stock market bubbles is the dot-com bubble in the late 1990s and early 2000s. It was triggered by the widespread adoption of the Internet and the rise of technology startups. Investors became convinced that the Internet would revolutionise business, leading to a gold rush of investment in online companies. Many of these firms had little to no revenue but didn't deter speculation. Between 1995 and 2000, the Nasdaq Composite Index surged more than 400%, fueled by excitement over new technology and venture capital inflows.

Stocks like Pets.com, Webvan, and eToys soared in valuation despite lacking viable business models. By March 2000, reality caught up with the hype, and the market began to unravel. Over the next two years, the Nasdaq lost nearly 80% of its value, wiping out trillions in market capitalisation. Many companies went bankrupt, and investor confidence in tech stocks remained subdued for years.

Another significant bubble was the U.S. housing bubble during the 2008 financial crisis. In the early 2000s, low interest rates and relaxed lending standards surged home buying and real estate speculation. Subprime mortgages or home loans issued to borrowers with poor credit became widespread. Wall Street financial institutions bundled these loans into mortgage-backed securities and sold them to global investors, believing housing prices would continue to rise.

Between 2002 and 2006, home prices in the United States increased rapidly, drawing more buyers and investors into the market. But by 2007, rising interest rates and an oversupply of housing began to reverse the trend. Defaults on subprime mortgages skyrocketed, triggering a collapse in the value of mortgage-backed securities. The financial system, heavily exposed to these toxic assets, began imploding. Lehman Brothers filed for bankruptcy in 2008, leading to a global meltdown and the Great Recession.

How to Identify and Mitigate a Stock Market Bubble

While predicting bubbles with certainty is challenging, certain indicators may suggest overvaluation:

Price-to-Earnings Ratios: Unusually high P/E ratios may indicate that stocks are overpriced.

Rapid Price Increases: Sustained, sharp rises in stock prices without corresponding earnings growth can be a warning sign.

Speculative Investment Behaviour: A surge in speculative trading and IPOs may reflect bubble-like conditions.

In addition, investors can adopt several approaches to protect themselves:

Diversification: Spreading investments across various asset classes can reduce exposure to any single market bubble.

Fundamental Analysis: Focusing on companies with strong financials and reasonable valuations can help avoid overhyped stocks.

Long-Term Perspective: Maintaining a long-term investment horizon can help weather short-term market volatility.

Conclusion

In conclusion, stock market bubbles are complex phenomena driven by investor behaviour, economic factors, and regulatory environments.

While it's impossible to eliminate bubbles completely, awareness and prudent financial practices can mitigate their impact on the economy and individual portfolios.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.