Investing comes in many forms, but two of the most popular options are stocks and futures. While both involve buying and selling assets to make a profit, they operate in very different ways. Stocks give you ownership in a company, while futures are contracts that speculate on the price of an asset.

If you've ever wondered why some traders focus on futures while others invest in stocks for the long haul, this guide breaks down the key differences. Whether you're looking for steady growth or fast-paced trading opportunities, understanding how these markets work can help you make smarter investment decisions.

Understanding Stocks and Futures

At its simplest, a stock represents partial ownership in a company. When you buy shares of a publicly traded company, such as Apple or Tesla, you become a shareholder. If the company performs well, the value of your shares increases. Many stocks also pay dividends—regular payments to shareholders based on company profits. This makes stocks a popular choice for long-term traders looking to build wealth over time.

Futures, however, work differently. A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a specific date in the future. These contracts don't involve ownership of the underlying asset. Instead, they are often used for speculation or hedging against price movements. Futures can be based on commodities (such as oil, gold, or wheat), stock indices (like the S&P 500), interest rates, or even cryptocurrencies.

Leverage and Margin: A Crucial Difference

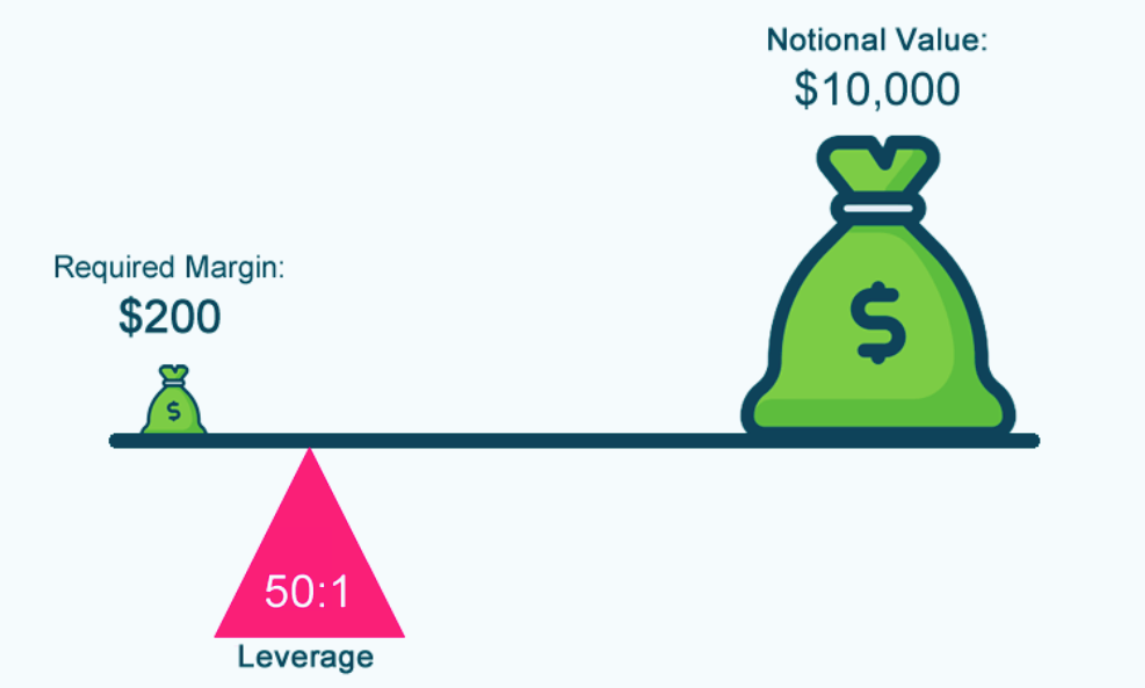

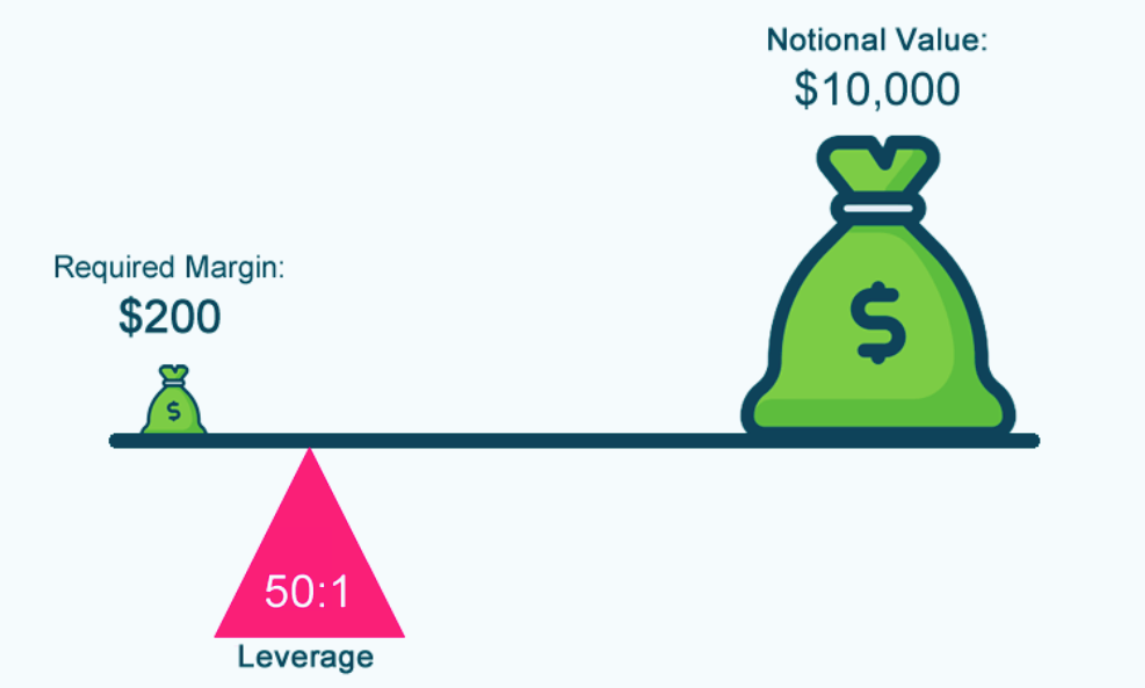

One of the biggest differences between stocks and futures is how leverage works.

When you buy stocks, you generally need to pay the full price of the shares upfront. If you want to purchase £5.000 worth of shares, you need £5.000 in capital (unless using a margin account, which allows partial borrowing but still has strict limits).

Futures trading, on the other hand, is heavily leveraged. You only need to deposit a fraction of the total contract value, known as the margin. For example, if a futures contract is worth £10.000. you might only need to put down £200 to control the full position. This amplifies both potential profits and losses.

For example, let's say you're trading oil futures and the price moves in your favour by 5%. If you had to pay the full contract price, a 5% gain would give you a 5% return. However, because you're only putting down a small margin, that same 5% movement could mean a return of 50% or more.

For example, let's say you're trading oil futures and the price moves in your favour by 5%. If you had to pay the full contract price, a 5% gain would give you a 5% return. However, because you're only putting down a small margin, that same 5% movement could mean a return of 50% or more.

But the same principle applies to losses—if the price moves against you, you could quickly lose more than your initial margin deposit. This makes futures riskier and more suitable for traders who understand risk management.

Trading Hours and Market Access

Another key difference is when and how these assets are traded.

Stock markets have set trading hours. In the UK, for example, the London Stock Exchange is open from 8:00 AM to 4:30 PM GMT on weekdays. The New York Stock Exchange follows US business hours, closing at 4:00 PM Eastern Time. Outside of these hours, stock trading is limited, though some brokers offer after-hours or pre-market trading.

Futures markets, however, operate almost 24/7. Because futures contracts are linked to global commodities, currencies, and indices, they trade across different time zones. This allows traders to react to economic events as they happen, rather than waiting for stock markets to open.

For example, if a major economic announcement is made overnight, futures traders can adjust their positions immediately. Stock traders, however, have to wait until the market opens, potentially missing key price movements.

Risk and Volatility: What Traders Should Know

All investments carry risk, but the type and level of risk differ between stocks and futures.

Stocks can be volatile, but their risk is generally lower than futures. If a company performs poorly, its share price might drop significantly, but you won't lose more than what you invested. In the worst-case scenario, if the company goes bankrupt, shareholders might lose their entire investment, but no more.

Futures, however, are inherently riskier due to leverage. Since you're trading contracts rather than owning an asset, sudden market swings can lead to large gains or heavy losses. If a futures position moves sharply against you, you may be required to add more funds (a margin call) or have your position forcibly closed.

For example, during periods of high volatility—such as economic downturns or geopolitical crises—futures prices can swing dramatically within minutes. This creates both opportunities and significant risks for traders.

Because of this, futures trading requires a solid understanding of market movements and risk management strategies, such as stop-loss orders to limit potential losses.

Futures vs Stocks

| Aspects |

Futures |

Stocks |

| Ownership |

A contract to buy/sell an asset at a future date |

Represents partial ownership in a company |

| Trading Hours |

Nearly 24/7 trading |

Limited to stock exchange hours |

| Leverage |

High leverage, amplifying both gains and losses |

Low (unless using margin) |

| Risk Level |

Higher due to leverage and contract obligations |

Generally lower |

| Investment Horizon |

Mostly used for short-term trading or hedging |

Suitable for long-term holding |

| Dividends |

No dividends, as futures are contracts |

Some stocks pay dividends |

| Regulations |

Also regulated but may have more complex rules |

Highly regulated and standardised |

| Market Access |

Requires understanding of leverage and risk management |

Buy and hold approach; easier for beginners |

How Investors and Traders Use Stocks and Futures

Stocks and futures cater to different types of investors and traders, depending on their goals and risk tolerance.

Stocks are typically used by long-term traders who want to build wealth gradually. Traders often buy shares in stable, well-performing companies and hold them for years or even decades. Dividend stocks, in particular, provide a steady income stream in addition to potential price appreciation.

Futures, on the other hand, are mainly used for speculation and hedging. Short-term traders often use futures to profit from price movements within hours or days. Because futures allow both long (buy) and short (sell) positions, traders can attempt to profit whether prices rise or fall.

Hedging is another major use of futures. Large companies and institutional traders use futures contracts to protect against price fluctuations. For example:

An airline company might use oil futures to lock in fuel prices, avoiding the risk of rising oil costs.

A farmer might use wheat futures to secure a set price for their crop before harvest.

An trader holding stocks might use index futures to hedge against a potential market downturn.

This ability to hedge against risk makes futures valuable in industries where price stability is crucial.

Final Thoughts

Both stocks and futures have their place in the financial markets, but they serve different purposes. Stocks are well-suited for long-term investing, offering stable growth and potential dividends. They are generally lower risk, making them accessible to most traders.

Futures, on the other hand, are more complex and suited for traders who understand leverage and risk management. They offer opportunities for speculation and hedging, but they also come with a much higher level of risk due to their leveraged nature.

If you're just starting out, stocks might be the safer and more straightforward choice. If you have experience and a strong grasp of risk management, futures could offer unique opportunities—but they require caution and strategy.

By understanding how these two markets work, you can make informed decisions that align with your financial goals and risk tolerance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

For example, let's say you're trading oil futures and the price moves in your favour by 5%. If you had to pay the full contract price, a 5% gain would give you a 5% return. However, because you're only putting down a small margin, that same 5% movement could mean a return of 50% or more.

For example, let's say you're trading oil futures and the price moves in your favour by 5%. If you had to pay the full contract price, a 5% gain would give you a 5% return. However, because you're only putting down a small margin, that same 5% movement could mean a return of 50% or more.