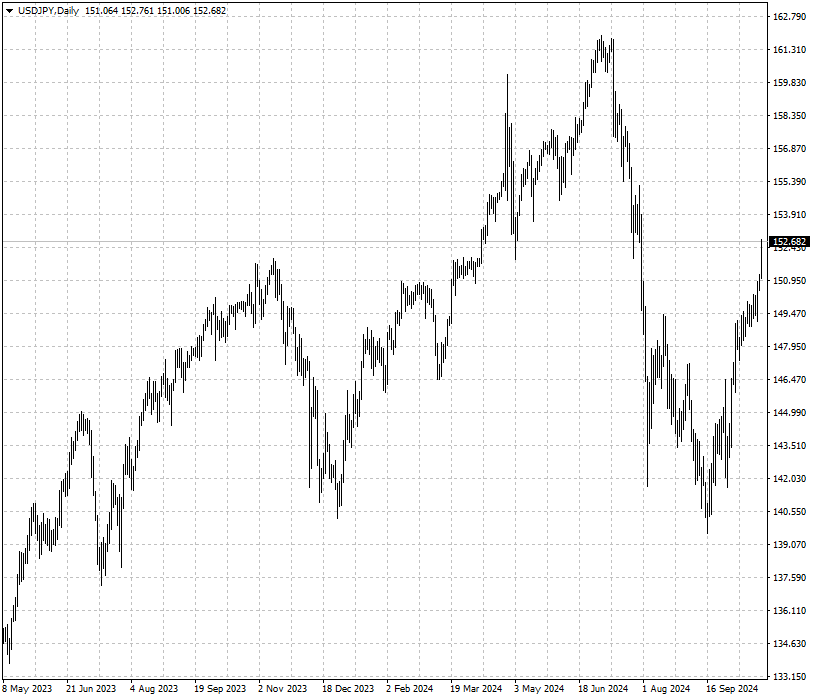

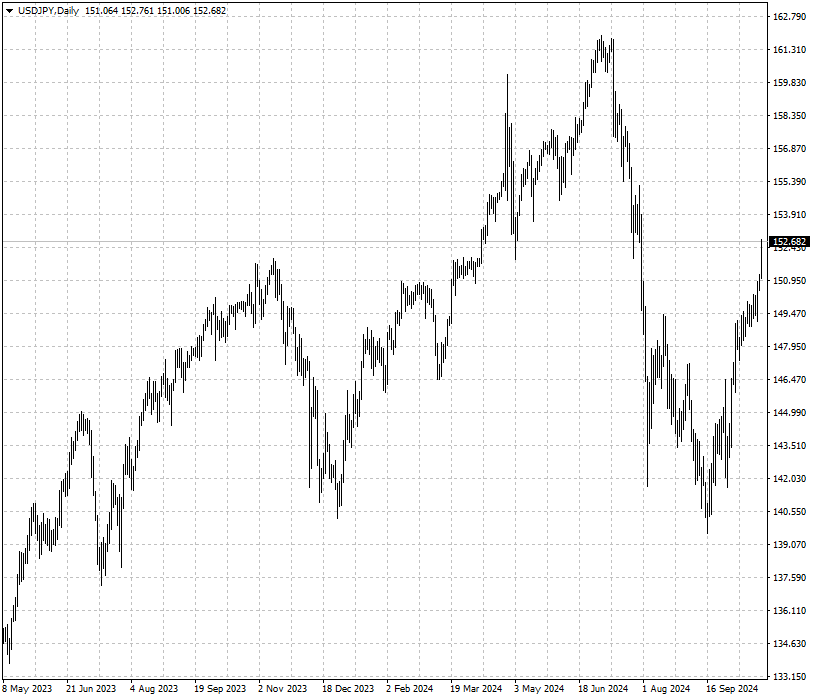

The Japanese yen has fallen to its weakest level against the US dollar in nearly three months, primarily driven by a strong dollar. This strength comes as Trump gains ground in critical battleground states and signs of a robust US labor market emerge.

Japan's top currency official recently warned that the yen’s depreciation beyond a certain threshold raises the risk of further declines, despite potential intervention risks.

Tokyo intervened in the forex market around May to curb the yen's slide, as reported by the Ministry of Finance. However, this controversial action, along with two rate hikes, has failed to halt the yen's long-term downtrend.

Yujiro Goto, head of forex strategy at Nomura Securities, noted, "We expect the dollar-yen to readjust toward the end of the year, but in the near term, it looks like it will remain high at around 150."

Currently, the yen is on track to be the worst-performing currency among G7 currencies for the fourth consecutive year. The US-Japan interest rate differentials—the primary driver of this currency pair—have only begun to narrow in 2024.

PM Shigeru Ishiba suggested earlier this month that the nation is not ready

for more interest rate hikes, though he later said he would not intervene in

monetary policy affairs.

"If we break 152, I see 156 if we do not see any intervention from the

Ministry of Finance," said Shoki Omori, chief desk strategist at Mizuho

Securities. He added Japan can do little ahead of US election.

Wage-push

The IMF is gaining confidence over the sustainability of Japan's inflation,

and expects the BOJ to stay on a gradual path of raising interest rates in

coming years, said mission chief Nada Choueiri.

"We have seen indicators of consumption starting to increase, and we have

seen employees' scheduled earnings starting to increase, and this is an

indication of a positive price-wage cycle working in the economy."

The fund expects Japan to reach a nominal neutral rate at about 1.5% - higher

than private economists' estimate of 1% - around the end of 2026. The central

bank will unlikely act at this month's meeting.

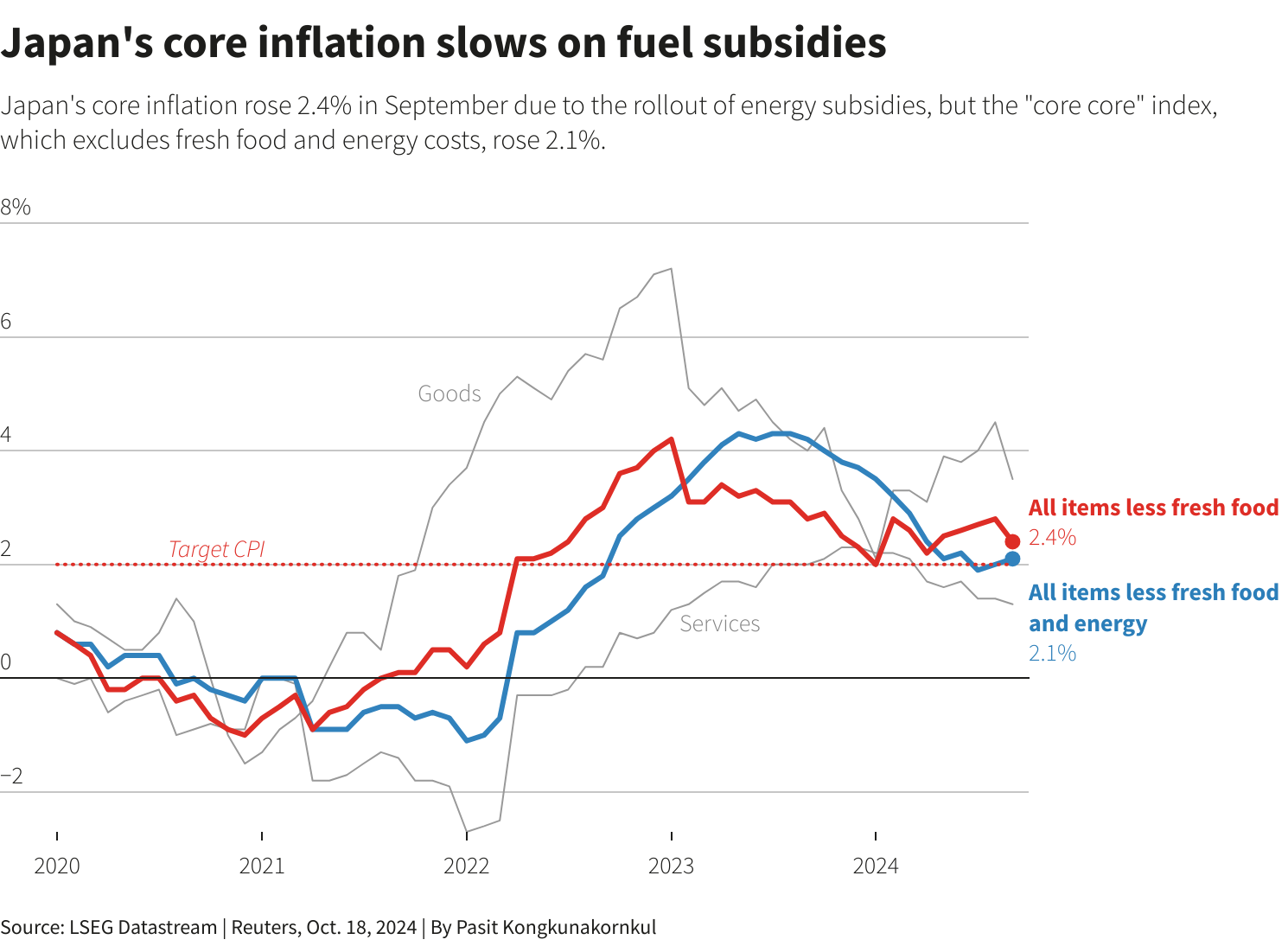

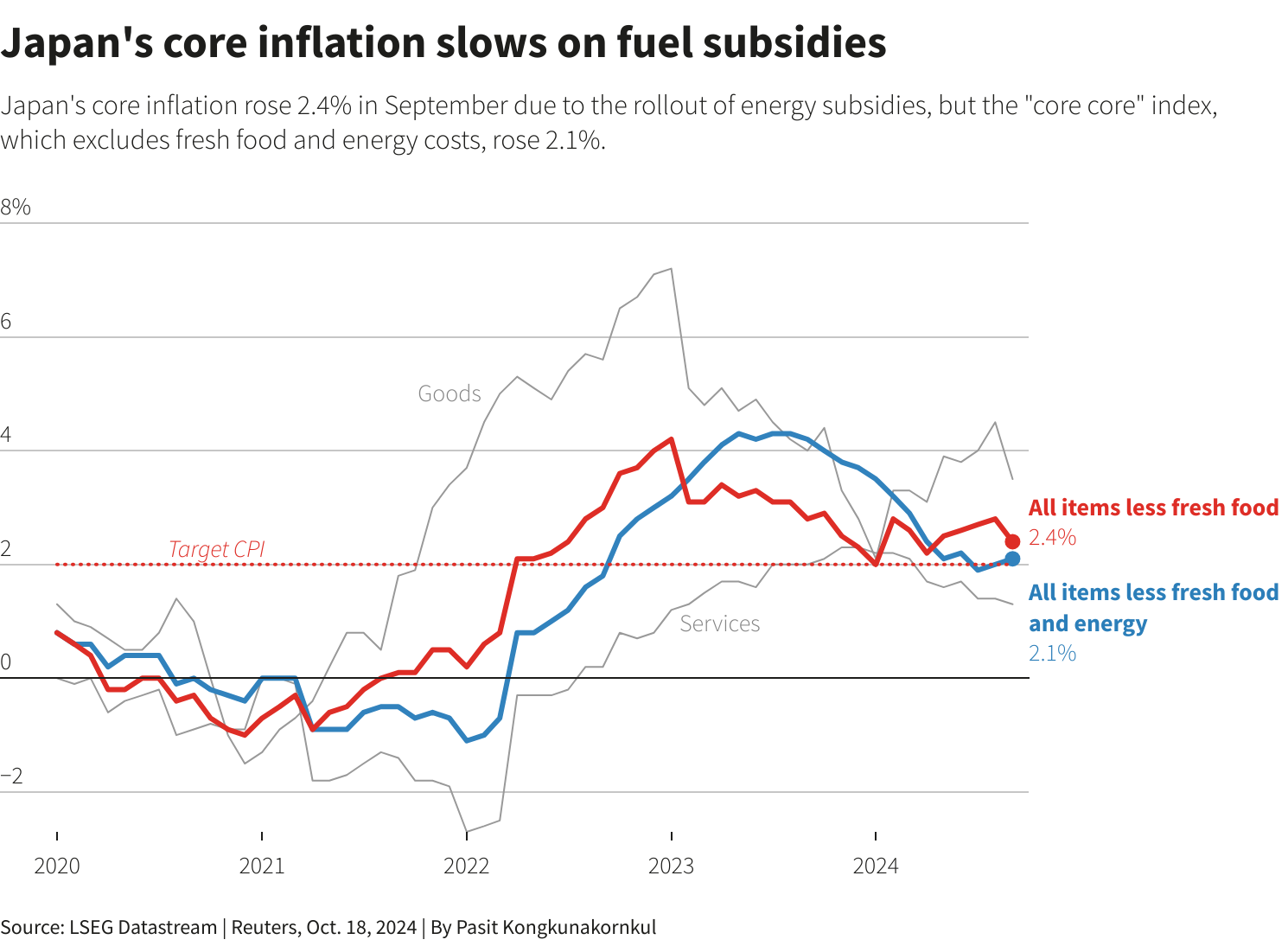

Japan's core inflation slowed in September due to the rollout of energy

subsidies but an index excluding the effect of fuel held steady, a sign that

broadening price pressure will prompt interest rate increases further.

The reading has exceeded the 2% target for well over two years. Governor

Kazuo Ueda has said the bank will keep tightening if inflation remains on track

to stably hit 2% as it projects.

Economy expanded an annualised 2.9% in Q2 as steady wage hikes underpinned

consumer spending, though soft demand in China and slowing US growth cloud the

outlook for the recovery.

Another key factor would be next year's wage negotiations. While many firms

are likely to keep hiking pay, some may not repeat the increases offered this

year if slowing demand weigh on profits, analysts say.

A Different Election

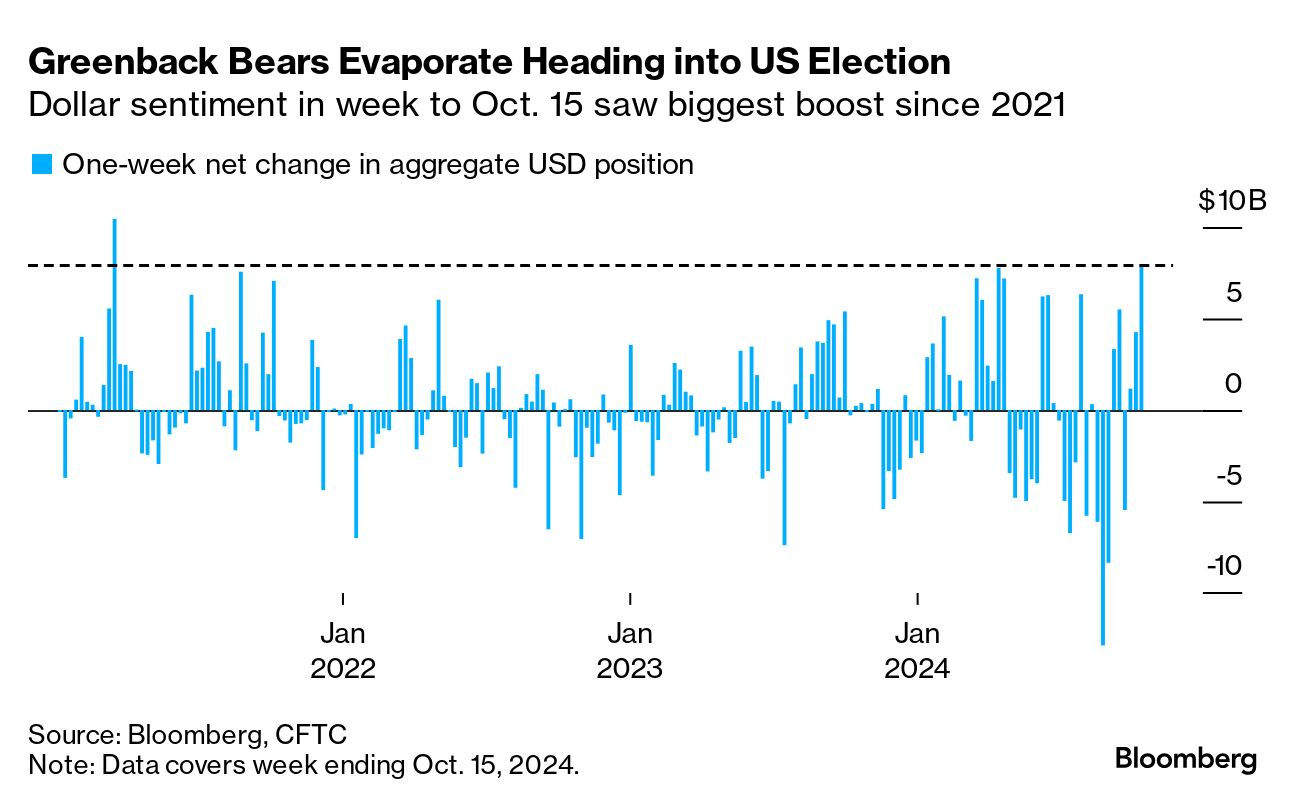

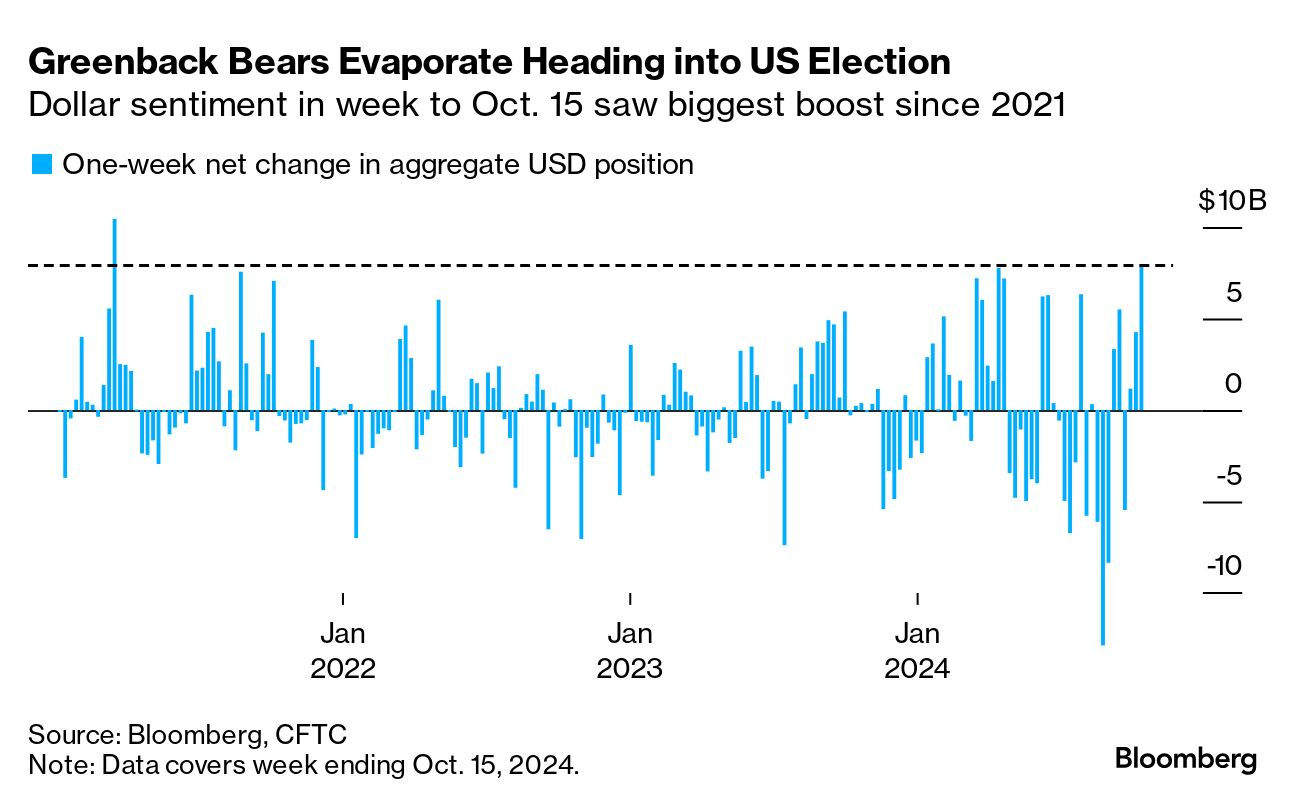

Speculative currency traders who vacillated all year on the dollar just made

their biggest move in three years. They reduced dollar shorts by around $8

million in the second week of October.

Another sign of bullishness is the price of calls relative to puts on a broad

dollar basket through the next 30 days has surged over the last month and is now

at its highest mark since July.

US economic activity was little changed from September through early October

and firms saw a slight uptick in hiring, the "Beige Book" showed. The soft

landing has pushed Treasury yields higher.

Interest swaps show traders are expecting the Fed to lower rates by 128 bps

through September 2025, compared with 195 bps priced in about a month ago.

This time, rising yields also reflect growing concern that the Republican

Party could take control of both the White House and Congress after election,

potentially boosting the federal deficit and inflation.

If 2020 when a similar tight race happened is the guide, the yen should have

strengthened gradually heading into the election. However, there are few signs

of upside momentum this month.

The reasons of yen appreciation four years ago included the Covid-19 pandemic

plaguing the US and trade war de-escalation. Obviously we are at the other end

of the tunnel.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.