In primitive societies where materials were extremely poor, there was neither money nor developed commerce. But if two people were interested in what the other had on hand, they would trade with each other, bartering to get what they needed. This type of exchange is still widely practiced today. In the capital market, there is such a popular financial instrument as swaps. Let's find out: what types of transactions are there in swap?

What is a swap?

What is a swap?

It is also known as a swap transaction, which is a form of transaction in which both parties agree to exchange certain assets with each other at a certain time in the future. As the saying goes, a ruler has its own strengths and weaknesses. Whether it is a trading organization or a country, each has different strengths and weaknesses in the financial market. If you can find a partner who is willing to swap with each other, and both parties can exchange their strengths for their weaknesses, many problems can be solved.

Swap contracts usually stipulate key terms such as the timing of the exchange, the frequency of payments, and the number or amount of assets to be exchanged and can be used to hedge against a variety of risks, such as exchange rate risk, interest rate risk, and commodity price fluctuations. By exchanging assets or liabilities with another party, a participant is able to reduce the impact of a particular risk on its financial position. For example, if two counterparties exchange cash flows in different currencies, it is often used to hedge against exchange rate risk, enabling companies to better manage currency fluctuations in cross-border transactions.

And it can help investors diversify their portfolios. By exchanging different types of assets, investors are able to diversify their investment risk and improve the robustness of their overall portfolio. For example, two counterparties exchange stakes in companies with each other. Such transactions can be used for a variety of purposes, including diversifying investment portfolios, realizing corporate mergers and acquisitions, and managing shareholder structures.

It can also help companies reduce their borrowing costs. By exchanging different types of interest rate payments with another party, companies can better adapt to changes in market interest rates and realize more competitive financing terms. For example, two counterparties exchange a range of future cash interest rate payments. The mutual exchange of fixed and floating interest rates is used to hedge against interest rate fluctuations and reduce borrowing costs or investment returns.

Not only can such a contract be customized to the specific needs of the participants, it may also offer tax advantages. This flexibility allows it to meet the unique needs of different industries, businesses, or investors, providing a more personalized solution. And by cleverly designing the structure, companies are also able to reap some tax benefits.

It also provides an additional source of liquidity, allowing participants more flexibility in the management of assets or liabilities. This is particularly important for large financial institutions and corporations. For this reason, this type of market is usually dominated by large financial institutions and corporations, and for this reason, these transactions may involve greater risk and capital.

Today, it is increasingly diversified, extending from traditional currencies and interest rates to a wide range of categories such as equities and bonds. The use of the main body is no longer limited to enterprises; central banks, exports, and credit institutions have become a force in this type of trading.

It has its own advantages in different varieties; for example, in currency exchange, both sides can raise the money they need in a shorter period of time. And it can save the cost of raising capital by eliminating the transaction fees and underwriting fees incurred through bank loans, bond issuance, and so on. In addition, the swap agreement agreed in advance that a fixed exchange rate could effectively avoid the risk of exchange rate fluctuations, thus reducing the loss of currency exchange.

However, although it is good, there are certain risks, of which credit risk is the biggest enemy. Therefore, before the exchange transaction, both parties should try to improve the exchange agreement's terms and conditions to maximize the protection of their own interests. It is important to note that it is a complex financial instrument, and participants should fully understand the terms and risks of the contract, seek professional advice, and ensure that the contract complies with regulations and legal requirements.

swap

| Characteristics |

Description |

| Definition |

Financial agreement swapping flows, e.g., interest rates. |

| Purpose |

risk management, cost reduction, diversification, etc. |

| Participants |

Usually a financial institution, business or investor. |

| Process |

Sign agreements, set terms, make regular payments. |

| Risks and Benefits |

Risk tool: Interest, market, and credit risk. |

Equity Swap

This is a type of financial transaction that involves two companies exchanging equity interests in each other. In this type of transaction, the two companies agree to exchange a certain number or percentage of shares with each other, thereby changing their shareholding structure. This transaction is usually based on an agreement reached between the two parties for purposes that may include strategic cooperation, business integration, risk diversification, and so on. It may also be an exchange of wholly-owned shares or a transfer of part of the shares, depending on the negotiation between the parties.

The advantages of such transactions include the possibility of strengthening cooperative relationships, optimizing corporate structure, and sharing business resources, but they are also accompanied by certain risks and legal compliance considerations.

Companies can integrate their respective resources, such as technology, market channels, brands, etc., through the exchange of equity interests to realize complementary advantages and improve overall competitiveness. It can also reduce the risk of a company's single business or industry and diversify the impact of business and market fluctuations on the enterprise by holding stakes in different companies.

It is usually accompanied by a strategic cooperation agreement, which facilitates deeper cooperation between companies to jointly address market challenges and create more business opportunities. If the respective businesses of the two partners complement each other, it can increase the overall valuation. The market may look favorably on the potential growth and synergies of the cooperation between the two companies.

Through the exchange of equity interests between the companies, the companies can share financing channels, reduce financing costs, and improve fundraising efficiency. If the cooperation after the exchange generates synergies, it will have a positive impact on the performance of the companies and is expected to create more shareholder value and increase shareholder satisfaction.

In the competitive business landscape, companies often look for innovative strategies to overcome challenges and seize opportunities. For instance, consider Company A and Company B, both operating in the same industry but facing distinct business challenges. To address these issues and leverage each other's strengths, they decide to engage in an equity swap.

Company A excels in technological innovation, while Company B has a strong market expansion and sales network. They agree to exchange a portion of their equity: Company A transfers a percentage of its shares to Company B, and Company B reciprocates by transferring an equivalent portion of its shares to Company A.

This equity swap enables Company A to gain access to a broader market share and a robust sales network, benefiting from Company B's market expertise. Conversely, Company B receives technological support, enhancing its competitiveness and innovation capabilities.

Through this exchange, both companies share resources, mitigate risks, and strengthen their cooperative relationship, paving the way for future business growth. However, it's crucial to navigate the legal and financial aspects carefully to ensure compliance and sustainability.

Interest Rate Swap (IRS)

Interest Rate Swap (IRS)

This is a financial instrument that allows two counterparties to exchange interest rate payments over a period of time in the future. It typically involves one party paying a fixed interest rate and the other party paying a floating interest rate in order to hedge or adjust their exposure to different interest rate risks on debt or investments.

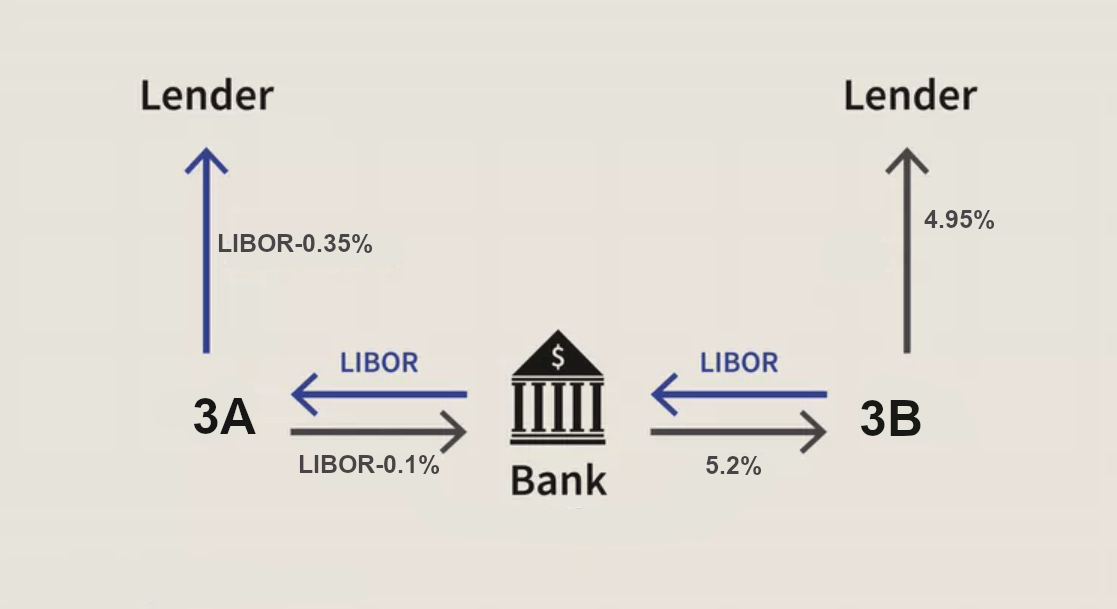

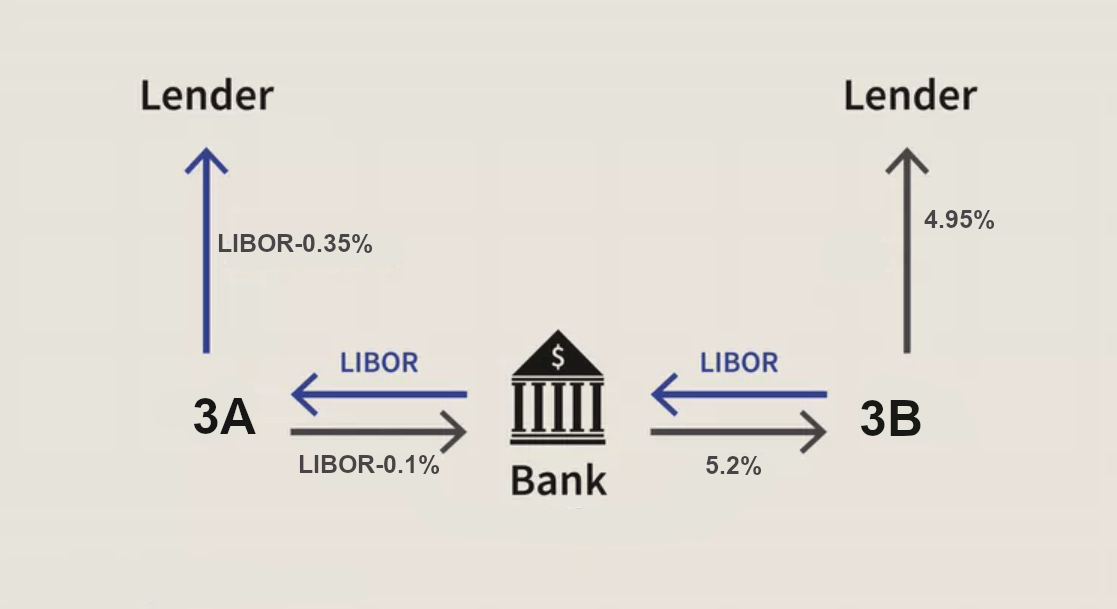

Suppose there are two companies, Company 3A and Company 3B, both of which want to borrow a $10 million loan with a term of five years. Assume that Company 3A wishes to borrow a variable-rate loan, while Company 3B wishes to borrow a fixed-rate loan. However, because of credit and other reasons, Company 3A has a relative advantage in the fixed rate market, while Company 3A has a relative advantage in the floating rate market.

Assuming that such contracts are not used, then Company 3A would borrow a floating-rate loan at a cost of 6 months' amortization (interest rate fluctuation) minus 0.1%. Firm 3B, on the other hand, would lend a fixed-rate loan at a rate of 5.2%. The total cost to both firms is 6 months of interest rate fluctuations plus 5.1% of the total cost.

Then, with this swap contract, Company 3A can lend the fixed-rate loan at 4%, while Company 3B can lend the floating-rate loan at a cost of 6 months' LIBOR plus 0.6%, and then exchange cash flows between the two companies.

So for firm 3A, the actual cost of intervention is the 6-month rate minus 0.35%, which is lower by 0.25% compared to the cost of directly intervening in a variable-rate loan. Then for the 3B firm, the actual cost of revenue is 4.95%, which is 0.25% lower than the cost of direct intervention on a fixed-rate loan at 5.2%. The total cost is Libor plus 4.6%, which is 0.5% lower than the total cost without the swap.

Thus, we can say that the interest rate swap enhances the welfare of the participating parties by lowering their cost of financing through an international trade-like approach. As an effective tool, it can be used to hedge the risk due to different interest rate structures. Firms or investors can use it to hedge their cash flows, especially in an environment facing rising or falling interest rates.

It provides a way to increase liquidity, allowing a business or financial institution to better adapt to market conditions and funding needs. And it allows participants to obtain the financing terms they need at a relatively low cost. By paying a fixed interest rate and charging a variable rate, a party can obtain more competitive financing terms in the marketplace, thereby reducing the cost of financing.

The contract can be customized to meet the needs of the participants. This flexibility allows it to be adapted to the specific requirements of different industries, businesses, or investors, providing a more personalized risk management solution. It also helps to diversify the balance sheet of the business or investor. By choosing the appropriate swap strategy, it can lead to a more balanced and stable financial structure.

Currency Swap

It is a financial instrument that involves the exchange of a certain amount of different currencies between two counterparties and exchanging them back again on an agreed-upon future date. By way of example, it involves the exchange of two sums of money with the same amount and interest rate calculation method but in different types of currencies.

For example, in October 2014. the central banks of China and Russia signed a three-year currency swap agreement in which the two sides negotiated exchange rates and interest rates, with the Chinese central bank delivering 150 billion yuan to the Russian central bank and the Russian central bank giving the Chinese central bank the equivalent of 815 billion rubles.

At the end of the three-year period, Russia returned 150 billion yuan, and the Chinese central bank returned 815 billion rubles to Russia. In the process, the two countries receive the foreign currency they need, which can be used by banks to complete foreign currency loans and by China and Russia to settle trade and maintain liquidity in their foreign currency markets.

It allows the parties to exchange currencies at a fixed date in the future at a negotiated exchange rate, with the main objective of achieving flexible deployment of funds between different currencies and risk management. This helps to mitigate the risks associated with exchange rate fluctuations and is particularly important for international transactions and cross-border business operations.

By borrowing a currency at a relatively low interest rate and then converting it to the desired local currency through a mutual exchange structure, it allows companies to obtain more competitive financing terms. and provides a means of increasing liquidity, particularly for financial institutions and businesses operating in international markets. Liquidity and payment needs can be managed more flexibly by exchanging currencies with other counterparties.

It also provides a diversified source of funding, enabling businesses to better adapt to market conditions and funding needs. This is particularly important for international businesses, which may need to deploy funds between different countries or regions. Also, this type of contract can be customized according to the needs of the participants. This customization allows it to be adapted to the specific requirements of different industries, businesses, or traders, providing a more personalized solution.

Swaps can also be used as a tool for long-term financing, enabling companies to circumscribe their financing structure to better match their cash flow and funding needs. However, it should be noted that, like any other financial instrument, it carries certain risks, including exchange rate fluctuations, credit risk, and liquidity risk.

Benefits of currency swaps

| Benefits |

Description |

Example |

| Risk management |

Hedge currency risk, reduce exchange impact. |

Firms A and B swap to fix exchange rate. |

| Lower Financing Costs |

Secure better financing terms, lower costs. |

Firm C local funds, Firm D low-interest exchange. |

| Diversified financing |

Diversify funding sources, enhance flexibility. |

Firm E swaps for broader financing. |

| Increase liquidity |

Provide tools for currency liquidity needs. |

Firm F secures advance currency liquidity. |

| Strategic cooperation |

Promote global cooperation for business growth. |

Firm G swaps currency with foreign supplier. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is a swap?

What is a swap? Interest Rate Swap (IRS)

Interest Rate Swap (IRS)