Financial enthusiasts frequently encounter the terms "repurchase" and "reverse repurchase," especially in recent years as these terms have been linked to the Federal Reserve in financial news. However, many people have heard these terms without fully understanding their meanings. To clarify, it's essential to discuss the repurchase agreement, a pivotal tool in financial markets. This article aims to shed light on what repurchase agreements are and why they are significant.

What is Repurchase Agreement?

A repurchase agreement, or REPO for short, is a short-term financing instrument in which the seller receives funds from the sale of a security and the repurchaser receives a short-term investment at the cost of repurchasing the interest. This type of agreement is often used to regulate market liquidity, manage short-term funding needs, and make short-term investments.

In a repurchase agreement, one party sells Securities (usually bonds) to another party and agrees to repurchase those securities at a specified future date at a slightly higher price. The two counterparties agree on the details of the transaction, such as the quantity of securities to be sold, the transaction price, the repurchase date, and the repurchase price.

One party sells the securities to the other party and receives the corresponding funds. At an agreed-upon future date, the seller repurchases the same number of securities at a price slightly higher than the sale price. The difference is known as repurchase interest and represents the return on investment received by the repurchasing party.

It is important to realize that financial institutions have to tie up their books before they close for the day, and this is when there is a requirement for daily cash. Especially commercial banks, in the end of business before the end of the hands of the reserves, must meet the minimum requirements of the Federal Reserve. There are also many hedge funds in order to keep the position in hand but also to keep enough cash on the books.

But the financial markets change very quickly, and the situation is different every day. Sometimes these institutions have enough money of their own, but sometimes the money in the hands of these institutions is not enough. If they don't have enough money on hand before they tie up the books, they have to go to the money market to find a short-term loan. Since it is a loan, they have to have collateral. The collateral provided by these financial institutions is also known as financial products, which are usually Treasury bonds, corporate bonds, securities, and so on.

And in the money market, there are money market funds, and they focus on short-term investments. Therefore, they are also usually lenders to these banks, lending money to financial institutions in need. When the lender and the borrower come to an agreement, they will sign a buy-sell agreement.

This agreement will contain roughly what the market value of the financial collateral is and what it will be sold to the lender for. Of course. This sale price will usually be slightly lower than the market price. How many days later will the seller buy the financial collateral back at what price, which will be slightly higher than the price at which it was sold?

But because of the different positions of the two parties, this agreement is called differently. From the seller's point of view, which is the bank, it's called a repo, and from the lender's point of view, which is the money market fund, it's called a reverse repo. So although it's one agreement, it has two names, but they actually say the same thing.

A repurchase agreement usually involves a pledge rather than collateralization. In this agreement, the seller sells securities to the buyer and agrees to repurchase them at a specific date in the future at a slightly higher price. In the process, the seller effectively pledges the securities to the buyer as security for the transaction. If the seller is unable to repurchase the securities on the agreed terms, the buyer has the right to dispose of these pledged securities to cover losses.

A pledge is a security provided by the seller in a transaction, as opposed to a mortgage, which usually involves the use of a debt instrument as security for a loan. In a repurchase agreement, the debt article is the pledged security. The collateral changes hands each time, even if there is a temporary change in ownership.

This is to hedge additional risk so that, assuming the seller, the borrower, is insolvent on the repayment date, the buyer, the lender, can take these financial collaterals into their own hands and sell them directly on the market. Because technically, the ownership of these financial products already belongs to the buyer's money market fund.

Characteristics of repurchase agreements

|

Characteristics

|

Description

|

|

Short-term nature

|

Short-term deals with defined repurchase dates and prices. |

|

Financing

|

Offers flexible funding for short-term needs of both parties. |

|

Interest Returns

|

The spread is used as repo interest and represents the cost of financing. |

|

Benefits for both parties

|

Seller gets funds, repurchaser gains short-term investment chances. |

|

Liquidity Management

|

Used by financial institutions to flexibly manage liquidity risk. |

|

Market Instruments

|

Common instrument for short-term finance and investment. |

Functions of a Repurchase Agreement

It has a wide range of uses in the financial markets, covering a variety of areas such as financing, investment, and liquidity management. For example, the agreement allows the seller to obtain short-term funding by selling securities to the buyer and buying them back at a future date at a price slightly higher than the selling price. This provides a means of short-term financing.

At the same time, financial institutions can use it to manage their liquidity needs. By engaging in repo transactions, they have the flexibility to adjust their funding positions. And for investors, it can be used as a short-term, relatively low-risk investment vehicle. Purchasers can earn a certain amount of return by purchasing the securities in the agreement.

And with the repurchase agreement market, it also plays an important role in providing market liquidity. Financial institutions and investors can buy and sell through this market, thus ensuring the smooth functioning of the market. And the central bank can also utilize it as a tool for monetary policy. By conducting reverse repo operations, the central bank can inject liquidity into the market, while through positive repo operations, it can absorb excess liquidity in the market.

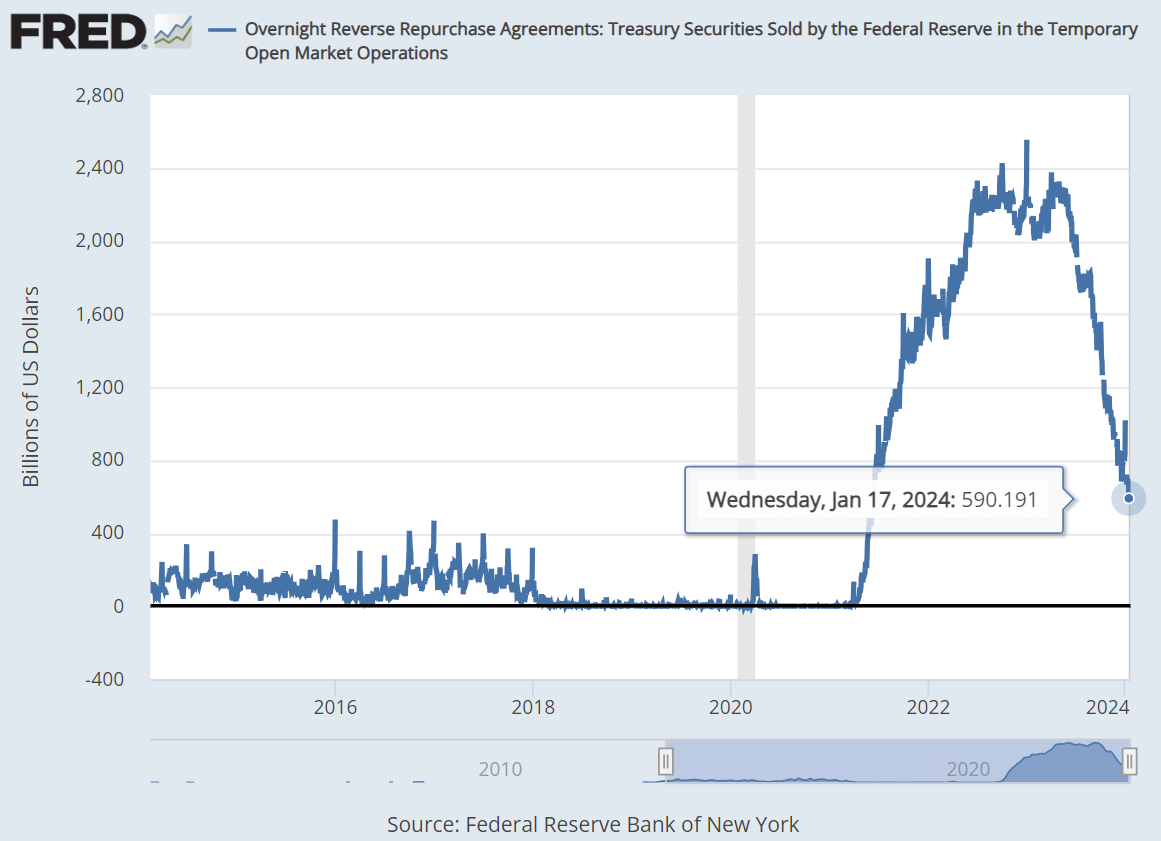

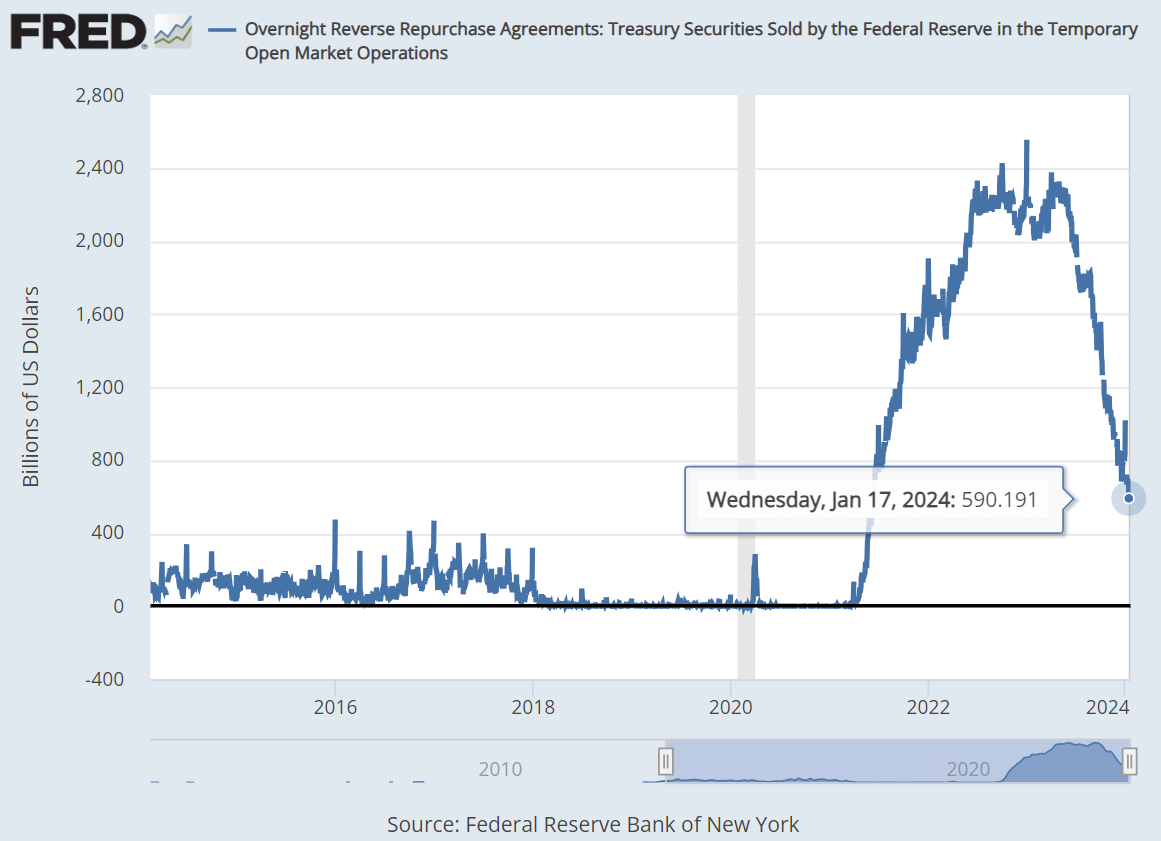

Specifically, you can look at the Federal Reserve. Over the years, the Fed has become a very active borrower and lender in the repo market through repo and reverse repo operations. The Fed can control the amount of money issued through these two means. For example, through the repurchase transaction, it sells the bonds on hand to the bank or other financial institutions so that they can gather the cash flowing into the market. Wait until a certain level and then buy the bonds back, so that injects cash into the market.

The Fed is also controlling the repo rate, and the reverse repo facility provides a good place for money market fund money to go. That's because the Fed provides a fixed interest rate. If primary dealers and other financial institutions don't give as high an interest rate as this, then money market funds simply keep their money at the Fed.

At the same time, the Fed's repurchase mechanism prevents the interest rate from rising too quickly at the time of repurchase. This is because the Fed's repo provides a cap on interest rates. Because he is the primary dealer, he is authorized to borrow directly from the Fed. If the interest rate on money market funds is higher than the interest rate set by the Fed, surely everyone will borrow directly from the Fed.

Repurchase Agreement Market

Repurchase Agreement Market

It is a financial market in which repurchase transactions are carried out between participants. This market provides a mechanism for short-term financing and trading of assets and usually includes financial institutions, central banks, and other large organizations.

The repo market is a very huge and integral part of the modern financial market. According to incomplete statistics, the repo market is roughly $3.4 trillion, and overnight repos secured by U.S. Treasury bonds alone can reach $1 trillion per day.

In the repo market, one party (usually a financial institution or central bank) agrees to sell some assets (usually bonds) and agrees to repurchase those assets at a specific date in the future. The other party provides short-term funding by purchasing these assets. The duration of such transactions can be very short, usually a day, a week, or a little longer.

In the repo market, the common borrower is also known as the seller. There are usually primary dealers, which are large financial institutions that have the authority to deal directly with the Federal Reserve. In addition to primary dealers, the borrower has other large investment funds.

And the main body on the lender side is the money market funds. They are a special type of investment fund that focuses only on short-term investments. Money market funds allow investors to withdraw their money at any time, usually on the second business day.

Financial institutions can utilize this market to manage their short-term liquidity needs. By selling and repurchasing assets, they can effectively adjust their cash flows. Central banks usually use this market to implement monetary policy. By changing repo rates, they can influence the level of short-term interest rates in the market.

Financial institutions can use this market for balance sheet adjustments. At quarter-end or year-end, they may need to balance their assets and liabilities, and repo transactions provide a convenient way to do so. Participants can use the conversion market to obtain short-term financing. This is essential to meet short-term liability and spending needs.

U.S. Treasury bonds, in particular, are very liquid because repo transactions in U.S. dollars are conducted in all major financial centers around the world. It is with such a large repo market behind it that even United States Treasury bonds can be considered money.

Because the U.S. Treasury market itself has very strong liquidity and a very large scale, the daily repo scale of $1 trillion can ensure that investors at any time turn the Treasury bonds into deposits in the bank, and there is almost no cost. And if they wish, they can also turn dollars back into Treasury the next day.

If you need to borrow for a longer period of time, you can roll over your repurchase agreements. It is with the ready conversion between Treasury bonds and bank deposits that U.S. Treasury bonds can be considered money.

In addition to the liquidity and size of the repo market, it is often used as cheap financial leverage. Let's say you're a hedge fund planning to buy $1.000 of Apple stock from another capital management firm. When it arrives, turn around and sell it in the repo market; after all, stocks aren't as safe as Treasury bonds.

The money market fund may discount the price slightly more, let's say by $100. and actually receive $900. and then agree that tomorrow you'll buy those shares back at $900.05. and that nickel will be the overnight interest.

This would be the same as, for only $100. buying $1.000 worth of Apple stock. The next day, if you look in the right direction, Apple's stock price goes up, and the $1.000 stock now becomes $1.100. After selling the stock, you pay the money market fund back $900.05. The 199.95 in between is the profit.

The repurchase agreement market plays an important role in the financial system and has an impact on the smooth operation of the entire financial market and economy. Due to its flexibility and efficiency, this market is a key tool for short-term financing and asset management for all types of financial institutions.

Characteristics of the repurchase agreement market

|

Characteristics

|

Description

|

|

High mobility

|

Assets are easily liquidated to meet short-term financing needs. |

|

Flexibility

|

Allows flexible funding adjustments for adapting to balance sheet changes. |

|

Large scale

|

Large scale, many participants, vital liquidity in financial markets. |

|

Diversification

|

There are various options such as treasury bonds and corporate bonds. |

|

Regulatory policy

|

Central bank's repo rate adjustment influences short-term rates. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

Repurchase Agreement Market

Repurchase Agreement Market