In the foreign exchange market, the U.S. dollar receives a lot of attention as the strongest currency. Among them is the euro against the dollar and the dollar against the yen because it has more trading volume and liquidity and more market attention. However, there are some relatively more niche currency pairs that are also in need of investor attention, such as the canadian dollar. Now let's take a good look at the currency characteristics and exchange rate dynamics of the Canadian dollar.

Characteristics of the Canadian Dollar

Characteristics of the Canadian Dollar

It is the official currency of Canada, and its currency code is CAD (Canadian Dollar). As one of the most important currencies in the world, it is widely used in international trade and financial transactions. Its common symbol is "$" or "C$" to distinguish it from other countries' currencies.

It is issued and managed by Canada's Central Bank, the Bank of Canada. The Bank of Canada is responsible for formulating and implementing monetary policy to maintain the stability of the currency and the health of the economy. The Canadian dollar is available in different denominations of bills and coins, of which the denominations of bills include $5 and $10. $20. $50. and $100. Coins are available in denominations of 1 cent, 5 cents, 10 cents, 25 cents, $1. and $2.

Canadian dollar bills and coins are made of a variety of materials and designs that reflect Canada's history, culture, and natural landscape. Each denomination usually has a specific design and color. In the 2011 version of the Canadian dollar, for example, the $5 Canadian dollar features a portrait of Canada's first French Prime Minister, Wilfrid Laurel, on the front, and on the back, Canada's Biddexter as well as astronauts and the West Wing of the Parliament building.

The 10 Canadian dollar features a portrait of Canada's first Prime Minister, John Alexander Macdonald, on the front, a design of the Library of Parliament Building in the background, and the Canadian Train and the Canadian Railway on the back. The 20 Canadian dollar features a portrait of Queen Elizabeth II on the front, a design of Canada's National Vermillion Monument, and the Yucca flower on the back.

The 50 Canadian dollar has a portrait of Canadian Prime Minister William Leyland Mackenzie King on the front, a holographic strip on the right side with Mackenzie King and Parliament Hill and the Flat Towers, and on the back, the Canadian Coast Guard ship Amundsen, an Arctic research vessel. The 100 Canadian dollar has a portrait of Robert Burden, who served as Prime Minister of Canada from 1911 to 1920. on the front, and on the back, a picture of medical researchers doing experiments, with vials of insulin being tested and a double helix of DNA.

As Canada's national currency, it is classified as a commodity currency, along with the australian dollar and the New Zealand dollar. It is widely used internationally as a freely convertible currency. It may hold a percentage of some countries' foreign exchange reserves, although its share of international reserves is relatively small compared to other major currencies such as the U.S. dollar, the euro, and the Japanese yen. However, it is extremely important in the U.S. dollar index, with a share of 9.1%.

Canada's economy as a whole is relatively stable but is constrained by factors such as geography and climate to develop relatively late. In terms of economic structure, Canada is more oriented towards the European model compared to the United States, with higher levels of taxation. Because of the contribution of resources, especially oil, Canada's economy is, to some extent, dependent on resource development. It is also due to the fact that Canada's crude oil exports account for nearly 37% of the country's exports, thus creating a highly positive correlation between the Canadian dollar and the price of crude oil.

Canada's currency exchange rate is affected by a number of factors, including the price of oil and the relationship with the U.S. dollar. In international markets, the performance of the Canadian currency is influenced by a number of specific factors. For example, the Canadian dollar's exchange rate against a basket of major currencies is affected by global economic conditions, commodity prices, international interest rates, and other factors.

Since Canada is an export-oriented country, its national currency plays an important role in international trade. Fluctuations in the exchange rate of the Canadian dollar can affect the domestic economy, particularly exports and international investment. Therefore, the government and the central bank closely monitor the level of its exchange rate and take stEPS to maintain the stability of the Canadian dollar in order to promote a healthy domestic and international economy.

Canadian Dollar Exchange rate

Canadian Dollar Exchange rate

Its exchange rate is influenced by a variety of factors, including, but not limited to, economic data, interest rate levels, commodity prices, trade conditions, political stability, global economic conditions, and more. First, there is Canadian economic data such as GDP growth rates, employment figures, inflation, unemployment rates, manufacturing and service PMI rates, etc., which directly affect the market's perception of the health of the Canadian economy and thus the Canadian dollar exchange rate.

Then there is the central bank's interest rate policy, which has a significant impact on the value of the Canadian dollar. The central bank's interest rate policy is often adjusted according to the country's economic fundamentals; when the country's economy is very good, the central bank may raise interest rates; if the economy turns bad, the central bank may take a more relaxed monetary policy. Higher interest rates usually make the Canadian dollar appreciate because high interest rates make domestic assets more attractive.

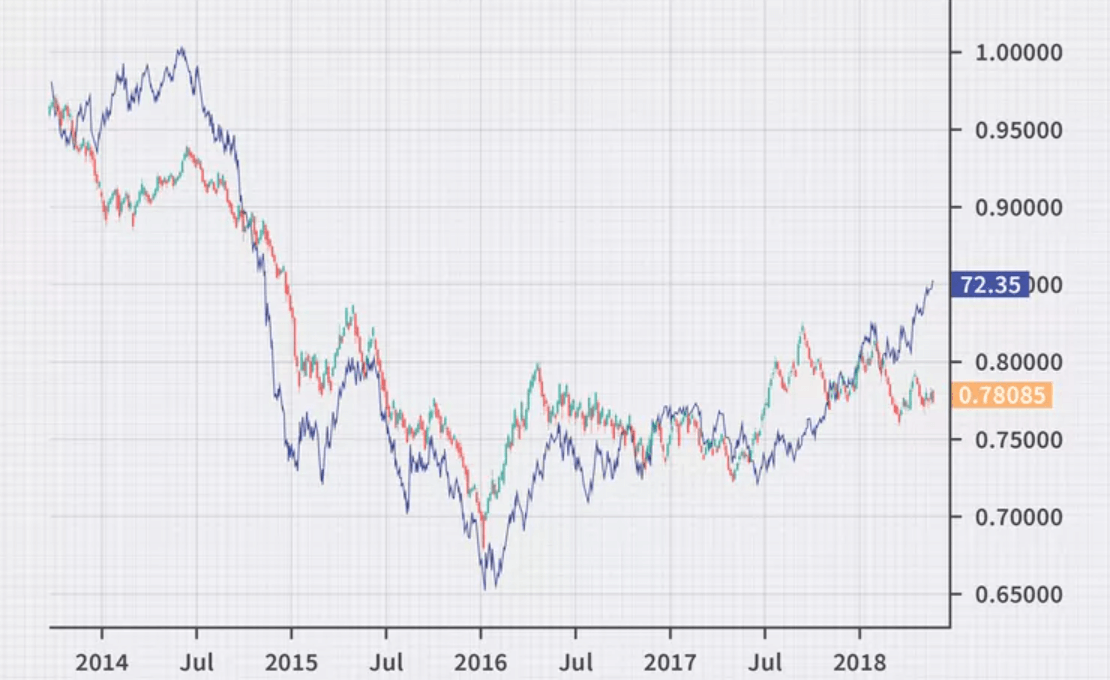

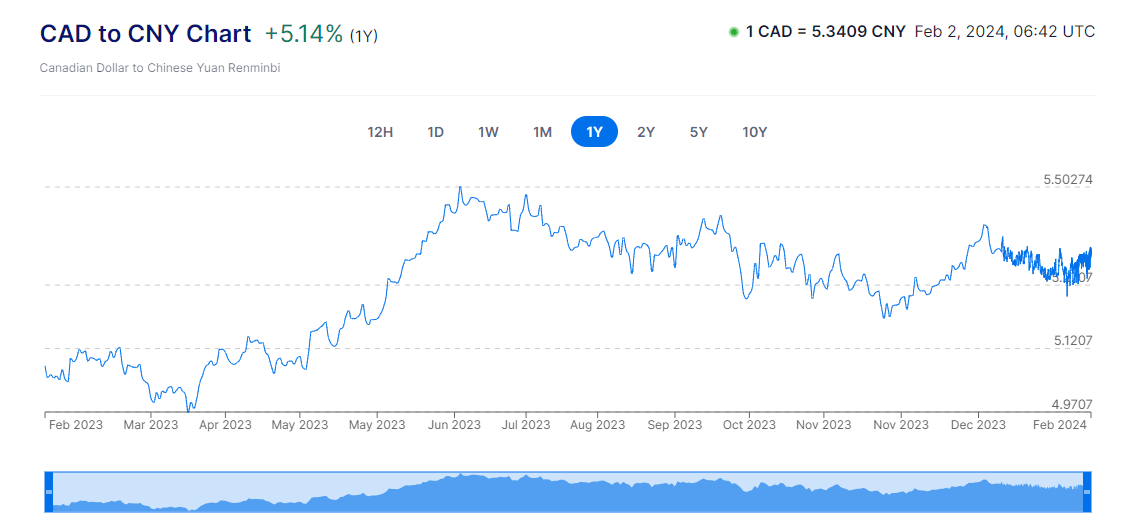

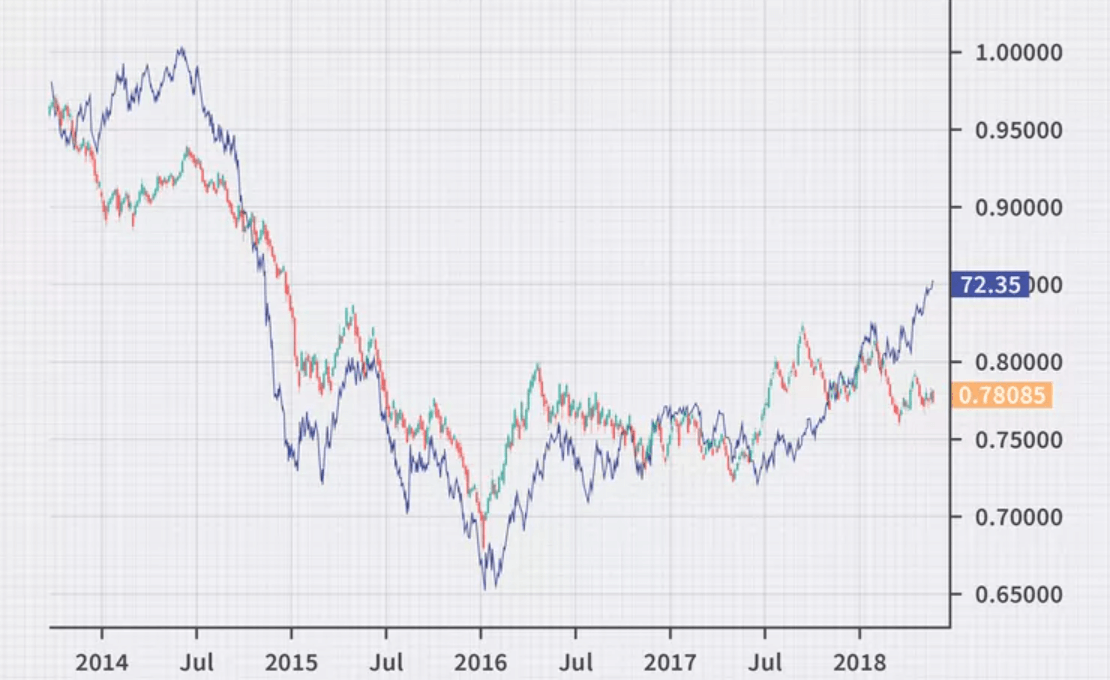

Canada is a resource exporter, and its economy is highly dependent on energy and commodities. As a result, fluctuations in global commodity prices, especially for commodities such as oil and metals, can have a direct impact on their value. As shown in the chart above, the blue line (oil price) is relative to the Canadian dollar against the US dollar. Also, OPEC's crude oil policy will affect Canada's export performance, so there is a degree of influence on its exchange rate from reports issued by the organization.

Volatility in global financial markets and investor risk appetite can also affect the performance of the Canadian dollar. If global economic growth is strong, investors may prefer to hold riskier currencies, such as the Canadian dollar. Tight market sentiment typically causes investors to seek risk aversion, affecting the relative performance of the Canadian dollar.

Trade surpluses or trade deficits also have an impact on the Canadian dollar. Trade surpluses usually support the national currency, while deficits may cause the national currency to depreciate. Political uncertainty may lead to investor concerns about country risk, which can affect the value of the Canadian dollar. Political unrest and unstable governments may trigger risk aversion among investors.

These factors usually intertwine to create complex market dynamics that lead to volatility in the exchange rate. And at the same time, fluctuations in the Canadian dollar exchange rate can have a wide-ranging impact on the Canadian economy.

For example, the appreciation and depreciation of the Canadian dollar can directly affect Canada's exports and imports. When it appreciates, Canadian exports become more expensive on the international market, which can lead to a decrease in exports. Conversely, when it depreciates, exports become more competitive, which may lead to an increase in exports.

A depreciation of the Canadian dollar results in the need to pay more in local currency for the same amount of foreign goods, so the price of imported goods rises, which has an impact on inflation. Inflationary concerns, in turn, have an impact on domestic interest rates, as the central bank may raise interest rates to maintain price stability.

This will likewise affect the balance of payments position. An appreciating Canadian dollar can lead to a trade deficit by reducing exports and increasing imports. A depreciation of the Canadian dollar, on the other hand, can help increase trade competitiveness and improve the balance of payments. Changes in its exchange rate also have an impact on tourism. An appreciating Canadian dollar may make Canada a more expensive destination for foreign tourists, while a depreciating Canadian dollar may attract more tourists.

Canada is a resource-rich country, and its economy is sensitive to the prices of energy and commodities. A depreciating Canadian dollar may push up the prices of these commodities and boost related industries. However, an appreciating Canadian dollar may pose a challenge to these industries. A depreciating Canadian dollar may make Canadian outward investment more attractive, as foreign investors can purchase Canadian assets for less in their own currencies. Conversely, an appreciating Canadian dollar may make outward investment less attractive.

Overall, investors need to consider a number of factors when forecasting the movement of the Canadian dollar exchange rate. And it is important to note that its impact is also complex and multi-layered, closely linked to the global economic environment, commodity prices, monetary policy, and other factors.

Understanding Canadian Dollar Volatitliy

Understanding Canadian Dollar Volatitliy

Predicting exchange rate movements is a complex task, influenced by a variety of factors, including economic data, global events, trade conditions, and more. And there are a number of reasons why the Canadian dollar has plummeted, starting with the fact that Canada is a resource exporter, particularly dependent on energy and raw materials. If the prices of these commodities fall, it could lead to a decrease in Canada's export revenues, which in turn could affect the exchange rate of the Canadian dollar.

Central bank interest rates are one of the key factors in determining the value of a currency. If interest rates are relatively low in Canada and high in other countries, investors may be more inclined to hold other currencies, which could lead to their depreciation.

If the global economy faces uncertainty, investors may be more inclined to seek safe haven and move their funds to relatively safer assets, which could lead to a depreciation of the Canadian dollar. Trade tensions or trade disputes could have a negative impact on the Canadian dollar. Problems in trade relations between Canada and its major trading partners could lead to a depreciation.

Geopolitical tensions or conflicts could trigger insecurity in the markets and cause investors to avoid risk, which could have a negative impact on the Canadian dollar. If a worldwide epidemic or other health emergency triggers economic concerns, this could lead to a drop in demand for the Canadian dollar, which could devalue it.

Ultimately, a sudden plunge in the value of a country's currency is still a reflection of its weak economy. For example, in September 2023. Statistics Canada released a data report on GDP for the second quarter of 2023. and the poor numbers led to a big drop in the Canadian dollar, with its exchange rate against the U.S. dollar posting its biggest drop in a month.

And if the Canadian dollar is about to surge, it could be based on an analysis of relevant factors. These factors include economic data, commodity prices, interest rate differentials, etc., before the price of crude oil seems to have been not very influential with the rise and fall of the Canadian dollar. If Canadian economic data comes in strong, such as GDP growth, better employment figures, etc., this could support an optimistic view of the Canadian dollar exchange rate.

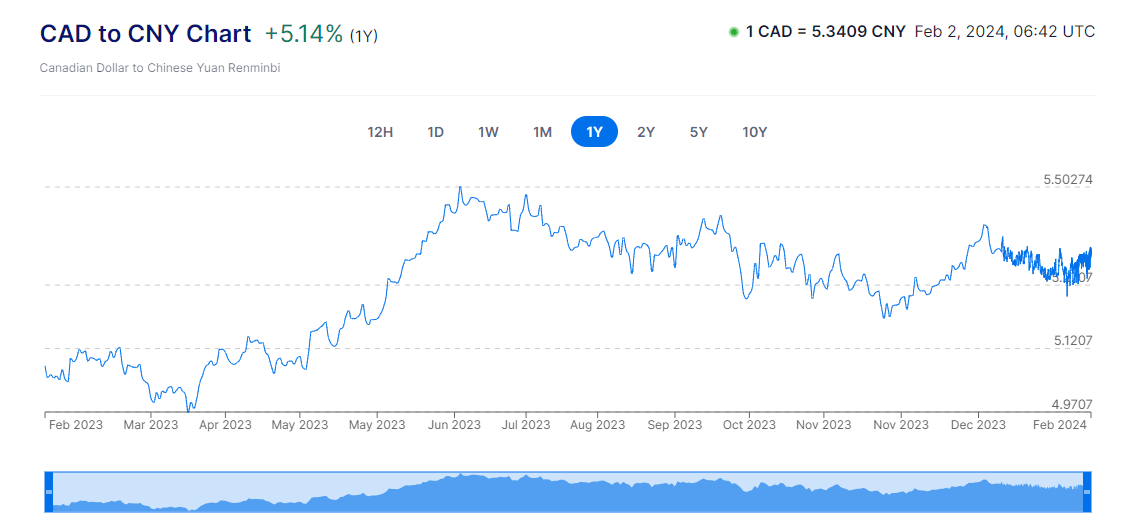

Also, if the Bank of Canada adopts a tighter monetary policy and raises interest rates, While other countries maintain relatively low interest rates, this could attract investors to hold the Canadian dollar and support its appreciation. For example, in January 2024. Statistics Canada released a report on the Canadian Consumer Price Index (CPI) for November 3.

The Canadian dollar was supported by the lackluster inflation data, which lowered expectations for interest rate cuts starting next March. In addition, higher oil prices also gave impetus to the Canadian dollar's rise. As a result, the Canadian dollar gained more than 0.4% against the U.S. dollar on the day, reaching 75.02 U.S. cents to the Canadian dollar, a new high in the last four and a half months.

Canada is heavily dependent on commodities, particularly energy and raw materials. If the prices of these commodities rise, it could boost Canada's exports and economy, with a positive impact on the Canadian dollar. If trade relations between Canada and its major trading partners improve, the outlook for exports could strengthen, with some positive impact on the Canadian dollar.

Whether it's a big fall or a big rise, the exchange rate fluctuations of the Canadian dollar can have a great impact. Investors must please note that the foreign exchange market is complex and subject to a confluence of factors. Market participants should take market forecasts with a grain of salt and be fully aware of the risks.

Canadian dollar to United States dollar exchange rate 2024

| Date |

Open |

High |

Low |

Close* |

| 2-Feb-24 |

0.7473 |

0.7482 |

0.7471 |

0.7477 |

| 1-Feb-24 |

0.7443 |

0.7475 |

0.7428 |

0.7443 |

| 31-Jan-24 |

0.7462 |

0.7485 |

0.7443 |

0.7462 |

| 30-Jan-24 |

0.7456 |

0.7464 |

0.7437 |

0.7456 |

| 29-Jan-24 |

0.7433 |

0.7449 |

0.7427 |

0.7433 |

| 26-Jan-24 |

0.742 |

0.7454 |

0.7417 |

0.742 |

| 25-Jan-24 |

0.7393 |

0.7414 |

0.7389 |

0.7393 |

| 24-Jan-24 |

0.7432 |

0.7446 |

0.7411 |

0.7432 |

| 23-Jan-24 |

0.742 |

0.7434 |

0.7412 |

0.742 |

| 22-Jan-24 |

0.7445 |

0.7455 |

0.743 |

0.7445 |

| 19-Jan-24 |

0.7415 |

0.7433 |

0.7407 |

0.7415 |

| 18-Jan-24 |

0.7406 |

0.7418 |

0.7394 |

0.7406 |

| 17-Jan-24 |

0.7413 |

0.7418 |

0.7385 |

0.7413 |

| 16-Jan-24 |

0.7443 |

0.7444 |

0.7407 |

0.7443 |

| 15-Jan-24 |

0.7457 |

0.746 |

0.7436 |

0.7457 |

| 12-Jan-24 |

0.7474 |

0.7494 |

0.7461 |

0.7474 |

| 11-Jan-24 |

0.7475 |

0.7495 |

0.7439 |

0.7475 |

| 10-Jan-24 |

0.7469 |

0.7482 |

0.7466 |

0.7469 |

| 9-Jan-24 |

0.7491 |

0.7496 |

0.7455 |

0.7491 |

| 8-Jan-24 |

0.7485 |

0.7494 |

0.746 |

0.7485 |

| 5-Jan-24 |

0.7488 |

0.7525 |

0.7464 |

0.7488 |

| 4-Jan-24 |

0.7492 |

0.7509 |

0.7482 |

0.7492 |

| 3-Jan-24 |

0.7506 |

0.751 |

0.7482 |

0.7506 |

| 2-Jan-24 |

0.7552 |

0.7559 |

0.7504 |

0.7552 |

| 1-Jan-24 |

0.7553 |

0.7553 |

0.7548 |

0.7553 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Characteristics of the Canadian Dollar

Characteristics of the Canadian Dollar Canadian Dollar Exchange rate

Canadian Dollar Exchange rate Understanding Canadian Dollar Volatitliy

Understanding Canadian Dollar Volatitliy