There are many financial instruments available in the investment market, and which one to choose depends on the investor's own preferences and trading decisions. For example, those who want high returns but are not afraid of high risk can choose stocks, and those who are afraid of risk and want long-term stable returns can choose bonds. In the stock market, there is a suitable investment tool that can withstand high risk and yield a high return: warrants. Now we will look at the characteristics of the warrants and their role.

What is Warrant?

What is Warrant?

It is a certificate that gives the holder the right to be able to purchase shares of a company at a specific price at a specific time in the future.However, it is not an obligation, which means that its holder can choose whether or not to exercise this right, giving the investor some flexibility. At the same time, it has a certain term, usually expiring at a specific date in the future. During the term, the investor can choose whether or not to exercise the right.

It is neither an equity nor a liability, and it is usually categorized as an equity instrument on a company's financial statements. This is because warrants give their holders the right, not the obligation, of the company to provide payments or services. An investor holding a warrant has the right, but not the obligation, to exercise the right in order to purchase the company's stock.

The three elements of a warrant are the exercise price, the exercise period, and the underlying asset. It specifies the exercise price of the stock to be purchased, also known as the strike price, which is the price that the investor holding the warrant will pay to purchase the stock in the future. It sets a predetermined price at which the holder can exercise the right to purchase the company's stock.

The exercise period, on the other hand, is the time frame in which the holder of that warrant can exercise the right. It has a specific period of time within which the holder must decide whether or not to exercise the right. Once the period expires, the right will lapse. The underlying asset is the underlying asset to which it is linked, usually the company's common stock. Investors holding the warrant can purchase the underlying asset to which it is linked at the exercise price.

Together, these three elements form its basic characteristics and determine the conditions under which the holder can purchase the company's stock in the future. It is important to note that its market value fluctuates with market conditions and changes in the price of the underlying stock. The funds received by the company when issuing warrants are considered part of the share capital, but the warrants themselves do not represent shares in the company. It is only when the holder exercises the right and purchases shares of the company that an increase in share capital results.

Warrants can be categorized into company warrants and structure warrants. A company warrant is issued by a company to purchase new shareholder shares at a specific price and for a specific period of time. Simply put, it is a flat order that can be converted into the mother stock for a period of up to 10 years, and if it is not converted before expiration, it becomes worthless.

Structured warrants are issued by a third party, such as a qualified economic or financial institution, and give the holder the right to buy or sell the underlying asset at a fixed price in the future. It can be issued on stock exchange-traded fund indices or baskets of stocks; basically, investing in it means that it is predetermined to buy or sell a specific amount of an asset at a specific price.

There are also two types of structured warrants. The first is a call warrant, which allows the holder to buy the underlying stock at an agreed price during an agreed period. The second is a put warrant, which allows the holder to sell the underlying stock at an agreed price during an agreed period.

The difference between the two is that one applies to a bullish market and the other to a bearish market. The holder of a call warrant hopes that the price of the underlying stock will rise so that when the warrant is exercised, he or she can buy the stock at a lower strike price and make a profit. The holder of a put warrant wants the price of the underlying stock to fall so that he can sell the stock at a higher strike price and make a profit when the warrant is exercised.

The existence of warrants provides investors with an opportunity to purchase shares of a company in the future and provides a way for the company to raise capital. However, in comparison, company warrants are traded for a longer period of time and do not expire as quickly. They are traded for 3.5 or even 10 years, so the risk is lower. Structured warrants, on the other hand, are traded for a shorter period of time and expire quickly. The trading period is not much more than one year, so the risk is higher.

Warrants can be categorized according to the period of time allowed to purchase stock

|

Duration

|

European Call Warrants

|

American Call Warrants

|

Asian Call Warrants

|

|

Time to exercise rights

|

Exercisable at maturity. |

Exercise in specified period. |

Average price exercise. |

|

Flexibility

|

Lower |

Higher |

Lower |

|

Exercise Period

|

Fixed maturity end date |

Fixed, expiration date ends |

Fixed maturity end date |

|

Market liquidity

|

Usually lower |

Usually higher |

Usually lower |

|

Applicable scenarios

|

Fixed bullish strategy. |

For flexible strategies. |

Average price strategy fit. |

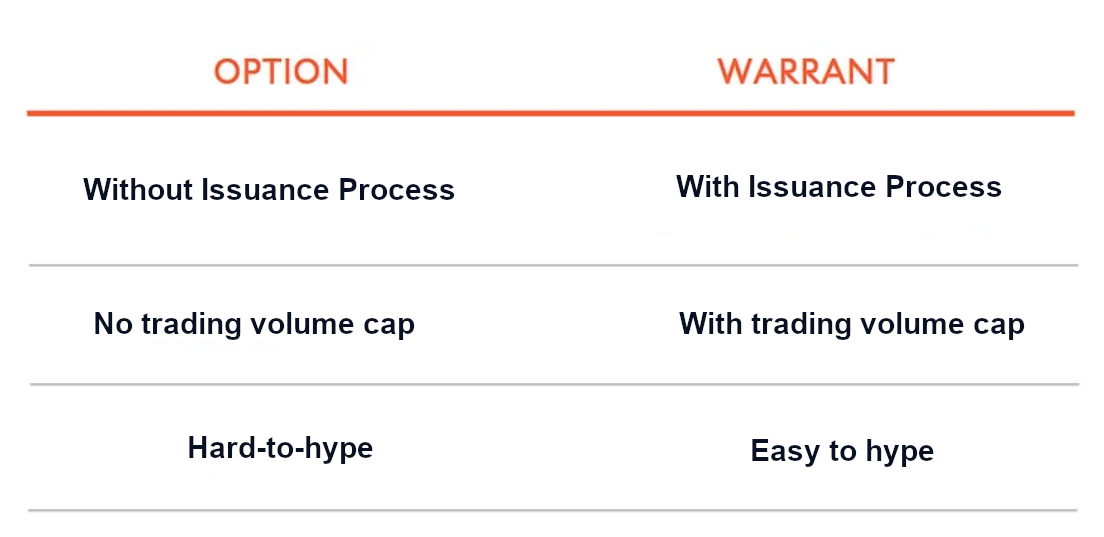

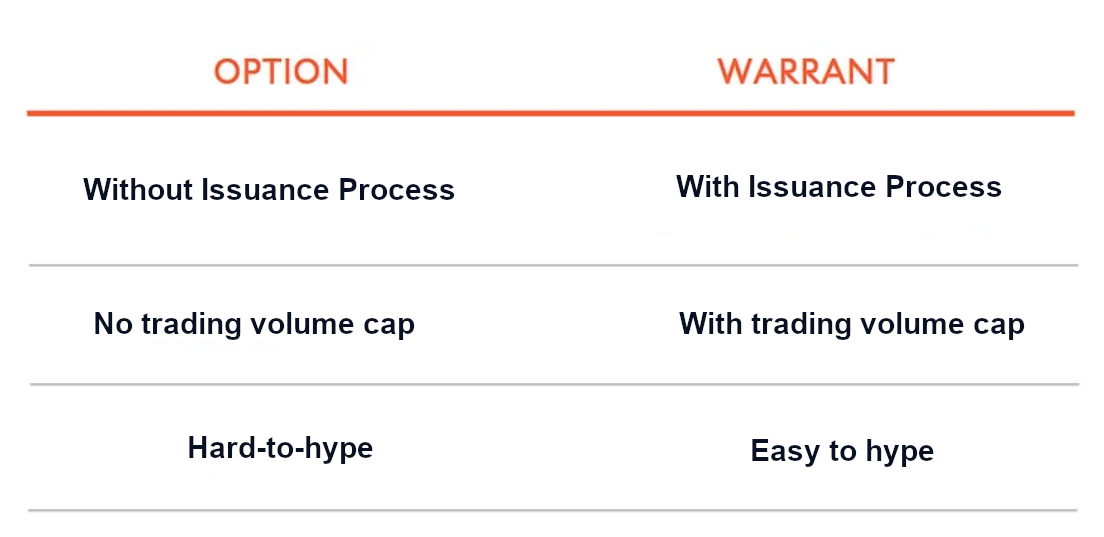

Differences Between Warrants and Options

Many people think of them as the same thing because buying a warrant means getting the right to buy or sell an asset at a certain price in the future. It sounds very similar to an option, and many people think of it as a call option. But they are two different financial instruments. While there are similarities in some ways, there are some key differences.

First and foremost, it depends on whether it has an issuance aspect. In terms of the method of issuance, warrants are issued directly by the company. And there must be an issuance aspect—an issuer. That is, the company must choose a certain day and a certain date and then issue a certain warrant. In fact, it is also the uniform seller of warrants; the future expiration of the warrant holders who want to exercise the power is to find the issuer; it is the case of many to one to exercise the right.

Options, on the other hand, are more commonly traded on the exchange-listed options market, although some are issued by companies. The buyers and sellers of options are investors and have nothing to do with the direct issuance of the company. This means that there is no issuance aspect to options, as long as the exchange can start trading the options.

All the exchange has to do is announce it, and then the contract can start trading. Then, in the market, as soon as someone buys and someone sells, a match is made, and the deal is called an open position. As soon as a few more people open positions, the number of options starts to increase. And as soon as a few more people close their positions, the number of options decreases. So it doesn't have a formal issuance process; it just relies on spontaneous transactions in the market.

And then accordingly, that leads to the second difference: is there a cap on the number? The warrants will be announced on the day of issuance. How many total units will be issued? For example, if 100 million warrants are issued, the number of warrants will not increase in the future. Unless it is created additionally, the quantity will be 100 million. Normally, the so-called trading of warrants is among the 100 million that have been issued, and the number of changes of hands cannot exceed this limit.

But in the case of options, once the contract can be traded, everyone starts to match the transaction. Then the number of contracts opened by two more people will increase, and the number of contracts closed by two more people will decrease. So the lower limit on the number of contracts in an option might be zero, while the upper limit is no limit; the more people open positions, the more contracts there are.

Then you can see the third difference: whether there is speculation. Like China's past experience, warrants can easily be speculated on because they are limited in number. When everyone likes to buy warrants, then the market will follow the trend and buy them all. In that case, it is easy for the price to be speculated at a very high level.

But unlike options, there is no upper limit to the number of options. Even if there are a lot of people buying them, they can be supplied continuously. In this case, the degree of speculation in this option is actually more difficult than warrants, so it is difficult to speculate and manipulate a phenomenon.

These are the three basic differences, which also show that there are some essential differences between them. In addition, there are also differences between them in terms of the underlying object, the exercise of rights, and market liquidity. For example, in terms of underlying objects, warrants are usually associated with a company's common stock, giving the holder the right to purchase the company's stock. The types of options are more diverse, involving a wide range of assets such as stocks, stock indices, foreign exchange, and commodities.

As for the conditions for exercising the right, a warrant line usually involves the purchase of company stock at a predetermined price by a specific date. Options, on the other hand, may involve a specific date and a specific price, but they may also involve other conditions, depending on the option contract.

In terms of market liquidity, warrants are usually relatively less traded and may be less liquid. Options are listed on exchanges and widely traded on open markets, where market liquidity is usually high. Meanwhile, warrants may be traded through the Securities markets, but with lower trading volumes than options. Options are traded on specialized options markets and have a more sophisticated market base.

As you can see, there is a huge difference between the two. And if warrants are so illiquid, why would anyone choose to invest in them? The fact is that it also has its own unique role and function.

Characteristics and Roles of Warrants

This financial instrument has a number of features and functions that give it a role and function in the market. Its features include providing leverage, acting as a fundraising tool, and incentivizing employees. Its role involves speculation, hedging, market liquidity enhancement, and corporate fundraising.

It gives the holder the right to purchase a certain number of shares at a predetermined price at a specific time in the future, and the investor holding the warrant has the right, but not the obligation, to exercise this right. It also specifies the exercise price at which the holder can purchase shares of the company. And it has a specific term, i.e., a time frame within which the holder can exercise the right. Once the period expires, the right will lapse.

The warrants are usually issued directly by the company. The company raises funds by issuing warrants to investors, and the purchase of warrants by investors means additional capital for the company. Its issuance usually results in an inflow of capital, which is important for the company to undertake expansion, investment, or other capital projects.

For investors, a warrant is a tool that allows them to participate in a company's stock market and benefit from rising share prices. It is often purchased as part of a bullish strategy because investors buying warrants mean that they expect the price of the underlying stock to rise, thus enabling them to purchase the stock at a lower strike price when they exercise their rights in the future.

The trading of warrants adds a financial instrument to the market and increases its liquidity. Investors can buy and sell warrants in the market, resulting in a more active market. It should be noted, however, that the liquidity of warrants may be relatively low because they are not traded in the market as frequently as stocks. However, as long as warrants can be bought and sold in the securities market, investors will have the flexibility to adjust their positions as and when required.

For investors, it is an investment tool that can be used to participate in the upward movement of a company's stock while limiting the investor's potential losses. Its market price reflects the investor's expectation of the future movement of the underlying stock. The ups and downs are closely related to the market's perception of the company's prospects.

It is used as part of a bullish strategy. Investors buy warrants to indicate that they expect the price of the underlying stock to rise. This strategy allows the investor to profit when the stock rises without having to actually buy the stock. Also, if the investor expects the company's performance to improve and the price of the stock to rise, the warrant may also be a tool to express this market expectation.

It is also a leverage tool, allowing investors to acquire a larger stock position with a smaller capital investment. When the stock price rises, the value of the warrant may increase rapidly, resulting in a higher return on investment. It also offers a high degree of flexibility in that the holder can exercise the right to purchase shares at any time during the specified period. This flexibility allows investors to better respond to market fluctuations and changes.

It is also important to note that its market price is affected by a number of factors, including the market performance of the underlying stock, the exercise price, and the remaining term. Also, its market value will change with the fluctuation in the price of the underlying stock. When the price of the underlying stock increases, the market value of the warrant usually increases, and vice versa.

Overall, warrants serve a specific purpose in the market, both to provide capital to a company and as a tool for investors to participate in the market and express their views on the future upward and downward movements of a stock. As a speculative tool, potential profits are made through bullish views on the future price of a company's stock. In addition, warrants can be used to hedge risk in an investment portfolio.

Investors choose to invest in warrants because of the limited capital available and the smaller amount of money required to do so. Rather, it is because of the smaller capital outlay and, therefore, lower transaction costs and commissions. Three is for diversification. Fourth is the desire to free up equity investment capital while maintaining market exposure.

Value per warrant

|

Elements

|

Factors Affecting Value

|

Specific impacts

|

|

Underlying stock price (S)

|

Current market price |

Upside rises, downside falls. |

|

Exercise price (X)

|

Mandated purchase price of stock |

Lower price, higher value. |

|

Exercise term (T)

|

Remaining exercise time |

Longer term, higher potential. |

|

Risk-free interest rate (I)

|

Discounts future cash with interest. |

Higher rate, lower value. |

|

Volatility (0 )

|

Volatility of the underlying stock |

Higher volatility, higher value |

|

Warrant Value

|

Option pricing model value. |

Value fluctuates with markets. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Warrant?

What is Warrant?