In the arena of international trade, a country's economic performance is often closely linked to its trade relations with other countries. One of the key concepts is the trade surplus, a term that appears frequently in economic news and policy discussions. For example, when reading economic news, it is common to hear that Europe and the United States often use it to force an appreciation of the renminbi. So what exactly does a trade surplus mean?

What is Trade Surplus?

A trade surplus is a situation in which the total value of a country's exports of goods and services exceeds the total value of its imports of goods and services in international trade. In short, it means that the amount of foreign currency or foreign assets a country earns through exports exceeds the amount of foreign currency or foreign assets it pays for through imports over a certain period of time.

Suppose China earns 100 dollars selling goods to the world, but China takes the money and buys all over the world and only spends 80. This leaves 20 dollars as a surplus. Simply put, a trade surplus is when exports are greater than imports. It is when the foreign exchange or foreign assets the country acquires with its exports exceed the foreign exchange or foreign assets it pays for through its imports, creating a positive trade balance.

It has benefits and disadvantages, but overall, it is more beneficial because, after all, real money is actually being made. And unless all the money earned is hidden under a pillow, all the money earned from exports goes to the country and its people. Just being involved in the domestic economy brings about growth in the local economy. Domestic demand in particular is coupled with the fact that, because of the multiplier effect, the banking system can multiply the release of capital to accelerate economic development.

Specifically, it arises because the value of goods and services exported by the country is higher than the value of its imports. This means that by selling goods and services to other countries, the country achieves a surplus in the international market. And this surplus not only helps to increase its foreign exchange reserves and international payment capacity but also favors an enhanced international image.

Trade is a transaction with another country, so its surplus can cause the country to increase its foreign exchange reserves. Of course, the advantage of increasing foreign exchange reserves is that they can hold a variety of different currencies and have a slightly diversified exchange rate risk. In addition to this, it also helps to enhance the international image and credibility. A good international image can, of course, attract more foreign capital inflows.

For example, since 2000. China has been exporting fabrics, home appliances, toys, and so on to countries all over the world to achieve trade surpluses in successive years, so that China's foreign exchange reserves continue to increase and wealth is soaring. China has thus become the largest creditor country in the world, and its premium capacity in the international arena has also increased greatly. In 2015. China led the Asian Investment Bank, the Belt and Road Initiative, and so on. This is the fruit of this.

It's not just the numbers that make the difference; it's also the country's currency and foreign exchange markets that are profoundly affected. Through a trade surplus, a country can accumulate more foreign exchange reserves, affecting the supply and value of its currency. Since the dollar was decoupled from gold, the vast majority of currencies float freely in the foreign exchange market, and prices are determined by the market. A trade surplus makes the country have enough foreign exchange and reserves to, when appropriate, adjust the foreign exchange market to make the national currency more stable.

Trade surplus, as a necessary stage for developing countries, is usually regarded as a sign of economic strength and competitiveness because it shows that the country's products and services are popular in the international market, but its size and impact also caused a series of discussions and controversies in the international economic system. This is because such surpluses may give rise to pressures for the appreciation of the country's currency as demand for its currency increases in other countries. This may have far-reaching implications for the country's exports and imports, economic growth, and monetary policy.

Trade surplus formula

|

Projects

|

Amount (in units)

|

Explanation

|

|

Export

|

X |

Total value of exported goods and services |

|

Import

|

M |

Total value of imported goods and services |

|

Surplus

|

X−M |

Exports - Imports |

Trade Surplus Local Currency Appreciation or Depreciation

Generally, it leads to pressure for the local currency to appreciate. When a country has a large trade surplus, it means that its exports exceed its imports, creating foreign buyers who demand to purchase the national currency. The rise in demand causes more pressure for the domestic currency to appreciate. Because more foreign buyers are willing to purchase the national currency, this can lead to an increase in the currency exchange rate.

When a country earns more foreign exchange through exports than it pays out through imports, it has more of its own currency on the foreign exchange market. Also, the relative value of the national currency may rise as a result of increased demand from other countries that buy the national currency to pay for imports.

The process of appreciation may occur as a result of foreign investors purchasing the national currency to carry out transactions or as a result of foreign countries paying for their own currency by purchasing their own exports. As a result of the appreciation of the national currency, domestic products become more expensive on the international market, which may lead to a decrease in exports. However, the price of imported goods may fall, thereby increasing the domestic demand for imported goods.

An appreciating national currency has a direct effect on the exchange rate. An appreciation of domestic currency may make exported goods more expensive on the international market, thereby reducing the demand for domestic exports. Conversely, imported goods may become more affordable. At the same time, it increases the accumulation of foreign exchange reserves. This can be used to preserve the country's international capacity to pay and to deal with trade deficits or other economic challenges.

In other words, a trade surplus appreciates the national currency. However, this is not always a positive effect and may also have a negative impact on the export sector as its products become more expensive in the international market. At the same time, some countries may adjust its effect on the currency through monetary policy. For example, central banks may adopt policies to intervene in the exchange rate to prevent their currencies from appreciating too quickly or excessively while avoiding the negative effects of excessive appreciation on the economy.

The Harmful Effects of an Excessive Trade Surplus

While it is often seen as an indication of a strong and competitive economy, it does not necessarily mean that a larger trade surplus is better. Excessive surpluses can pose a number of problems and challenges and therefore need to be considered in a holistic economic context.

Excessive surpluses may lead to an appreciation of the national currency, which may make exports more expensive in international markets. While appreciation can reduce the cost of imports, it can also make exports more expensive, which may undermine the competitiveness of export industries.

At the same time, too large a surplus can greatly increase the foreign exchange reserve currency, which can lead to appreciation pressure or the expectation of appreciation. This expectation will then attract foreign capital inflows, further appreciating the currency. National currency appreciation under control was originally good, but too fast appreciation will affect exports and even trigger inflation.

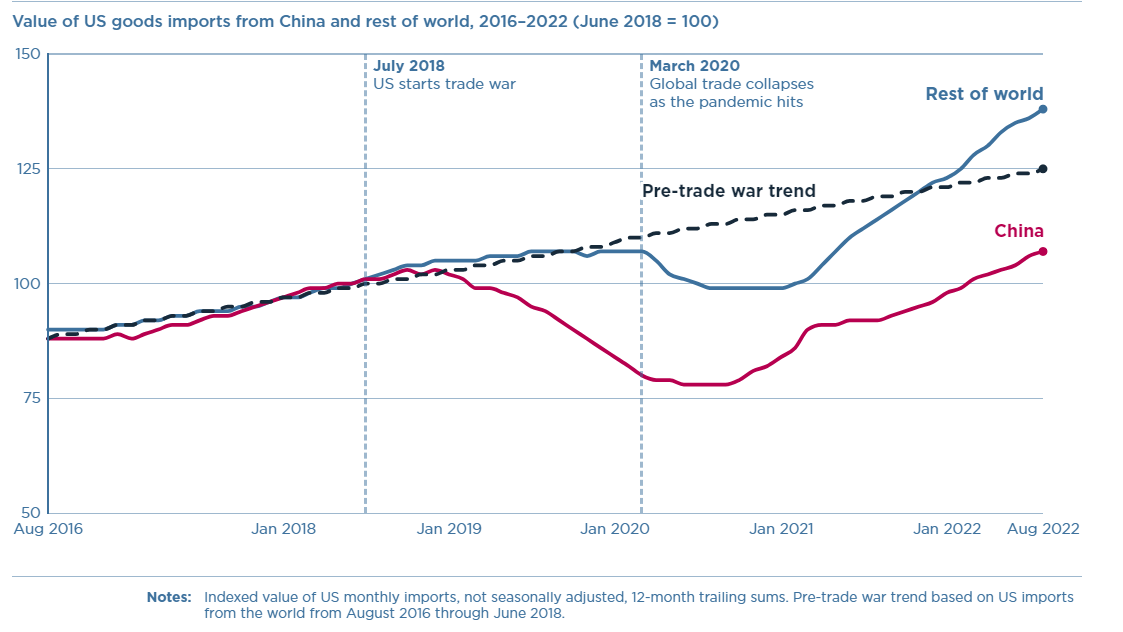

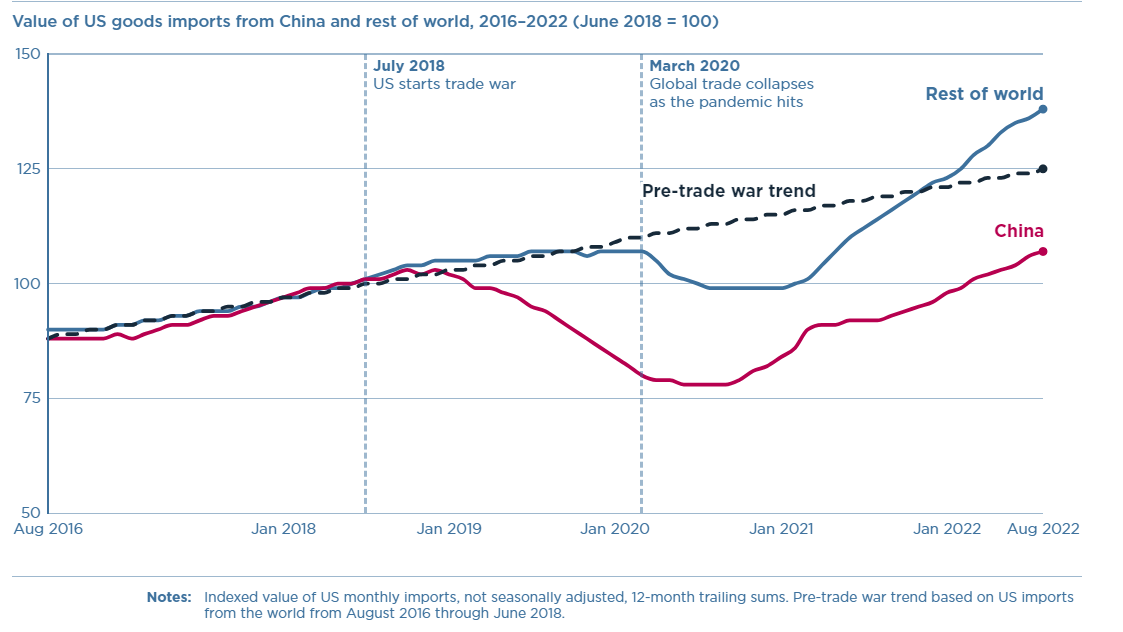

Resulting in a large accumulation of foreign exchange reserves, how to effectively manage these reserves has become a challenge. After all, this kind of exchange rate pressure is also likely to have a negative impact on domestic industries. At the same time, it could also trigger tensions with trading partners, especially if other countries see it as a result of unfair trade practices. This could lead to trade tensions or even a trade war. For example, there has been a trade war between the United States and China because of the large trade gap. As shown in the chart below, since the U.S. imposed tariffs on Chinese imports, U.S. imports from China (red line) are still lower than before (dashed line).

Trade surpluses bring with them friction with deficit countries, bringing with them anti-dumping and forced currency appreciation. Long and large surpluses are bound to attract public anger; after all, a country has a large amount of money while the other side is losing money every year, so anti-dumping and other actions should be taken. In 2009. the eurozone to all countries continued to have trade deficits, especially with China. The euro zone to China to implement a series of anti-dumping actions, which has China's exports of screws levied large anti-dumping duties.

Trade surpluses bring with them friction with deficit countries, bringing with them anti-dumping and forced currency appreciation. Long and large surpluses are bound to attract public anger; after all, a country has a large amount of money while the other side is losing money every year, so anti-dumping and other actions should be taken. In 2009. the eurozone to all countries continued to have trade deficits, especially with China. The euro zone to China to implement a series of anti-dumping actions, which has China's exports of screws levied large anti-dumping duties.

Without China's supply, there is naturally more demand for screws, including other traded goods, within the EU zone. So looking for the EU region's own supply, the eurozone trade deficit is to be relieved. China's side of the domestic screw exporters certainly cannot afford the heavy tax; China's screw exports have fallen back significantly. With this series of anti-dumping actions, coupled with other deficit countries such as the United States joining, China's trade surplus has been shrinking to date.

The high reliance on trade surpluses may have masked structural problems in the domestic economy, such as inefficiency, a lack of innovation, and insufficient internal consumption. This could lead to imbalances and vulnerabilities in the domestic economy and cause the country to miss opportunities for adjustment and reform.

It can also lead to overdependence on exports, which is never guaranteed when the bulk of GNP is derived from exports, representing the fate of the country in the hands of another country. And the policies introduced by the country in times of economic downturn do not necessarily work, as evidenced by Japan 30 years ago.

In fact, as early as 1820 AD, Britain succeeded in turning its trade deficit into a surplus. At that time, in order to get rid of its trade deficit, Britain shipped opium from its colony, India, to China, and as a result, opium was imported into China in large quantities. The result in history is known to all: eventually China spent money to buy opium in large quantities, and the money maker turned out to be Britain.

It may also make the country more dependent on external markets and make its economy more sensitive to global economic fluctuations. This makes the country more vulnerable to fluctuations in other countries' economies. And surpluses in some countries can have a negative impact on others, triggering tensions and instability in the global economy.

Thus, while trade surpluses are often seen as a sign of a strong economy, their excessive size can lead to a range of problems. Policymakers usually need to take measures to ensure that it is of a reasonable size and does not lead to undesirable economic and trade consequences.

Impact Of The Trade Surplus

|

Influencing Factors

|

Description

|

Description

|

|

Economic Growth

|

Promotes growth, boosts production, creates jobs. |

Positive Impact |

|

Exchange rate

|

May lead to currency appreciation, impacting trade. |

Negative Impact |

|

Industry Structure

|

May spur export-focused economic restructuring. |

Affects industry |

|

Employment

|

Exports create jobs, but surplus risks exist. |

Possible positive impact |

|

Trade relations

|

Excessive surpluses can spark trade tensions. |

Possible negative impact |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Trade surpluses bring with them friction with deficit countries, bringing with them anti-dumping and forced currency appreciation. Long and large surpluses are bound to attract public anger; after all, a country has a large amount of money while the other side is losing money every year, so anti-dumping and other actions should be taken. In 2009. the eurozone to all countries continued to have trade deficits, especially with China. The euro zone to China to implement a series of anti-dumping actions, which has China's exports of screws levied large anti-dumping duties.

Trade surpluses bring with them friction with deficit countries, bringing with them anti-dumping and forced currency appreciation. Long and large surpluses are bound to attract public anger; after all, a country has a large amount of money while the other side is losing money every year, so anti-dumping and other actions should be taken. In 2009. the eurozone to all countries continued to have trade deficits, especially with China. The euro zone to China to implement a series of anti-dumping actions, which has China's exports of screws levied large anti-dumping duties.