Since the epidemic, the economy has not been too peaceful everywhere. And in life, people have noticed that some things are getting harder to buy. And a lot of things have started to increase in price, such as houses, used cars, renovation building materials, chips, and so on. This makes people have to put their eyes on inflation, wondering whether the price rise nowadays is due to high inflation. Accordingly, let's find out how to understand and calculate the inflation rate.

How to Understand the inflation rate

How to Understand the inflation rate

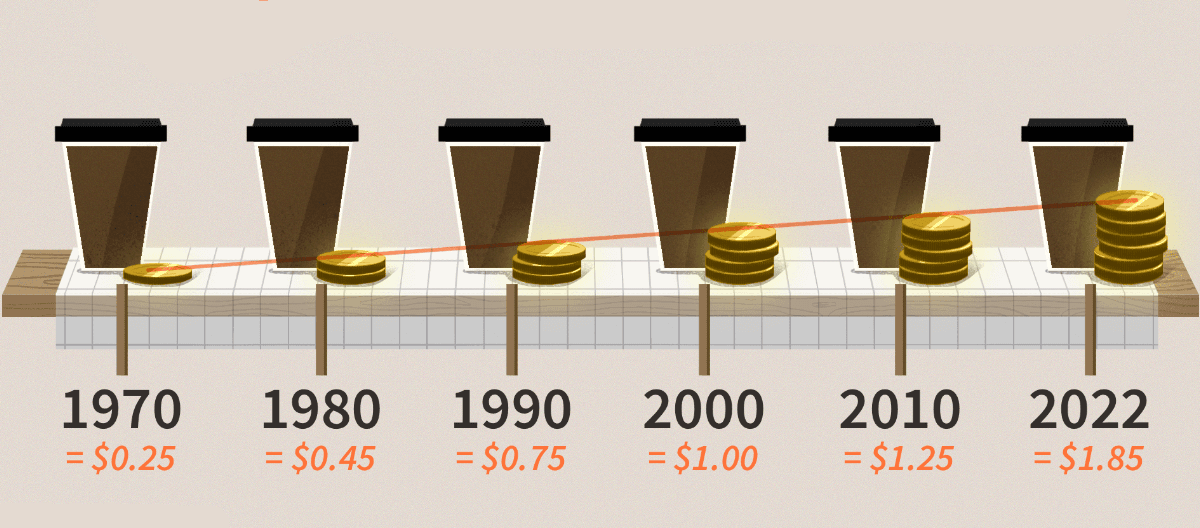

The full name is inflation rate, which is a measure of price level changes and reflects the average price changes of a basket of goods and services over a period of time. It is usually expressed as a percentage, i.e., the percentage increase in prices in a given year relative to the previous year. Its positive value indicates inflation, while a negative value indicates deflation. Inflation refers to an increase in the price level, while deflation is a decrease in the price level.

Inflation is usually caused by two main reasons: cost-push and demand-pull. Cost-push inflation is due to rising production costs, such as higher prices for raw materials; demand-pull inflation is due to demand outstripping supply, driving up prices.

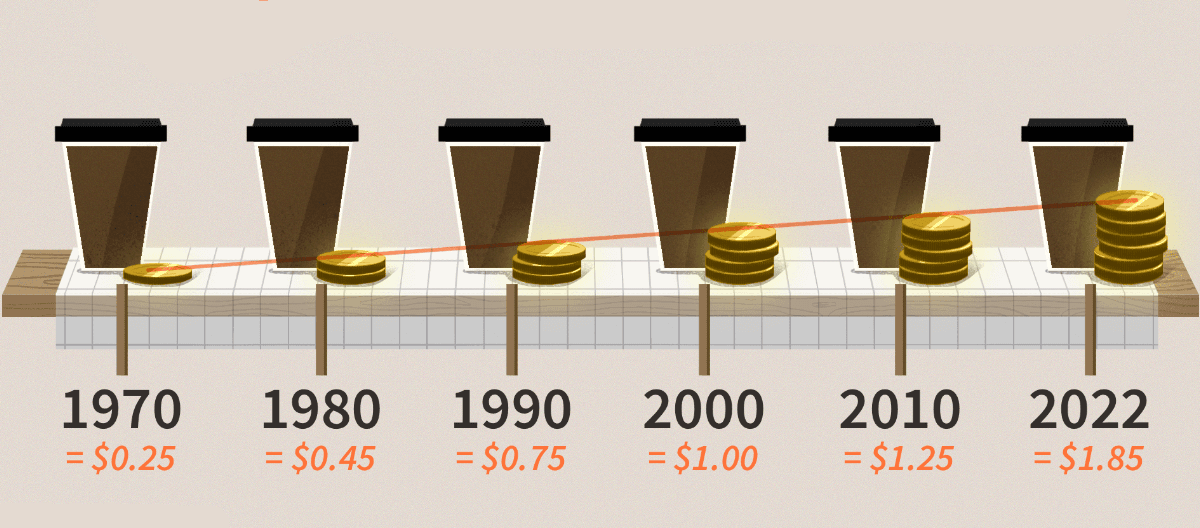

A reasonable level of inflation is one of the most important indicators that economists and policymakers focus on, as either too high or too low inflation can have an adverse effect on the economy. When the inflation rate is higher, it means that the price level is rising faster and the purchasing power is decreasing, while a lower inflation rate means that prices are rising more slowly and the purchasing power is relatively stable. A moderate level of inflation is considered good for the economy because it encourages consumption and investment while keeping the currency relatively stable.

Its rise leads to a decrease in the purchasing power of the same amount of money, as the same amount of money buys fewer goods and services. It causes people to pay more money to maintain the same standard of living and can have a possible negative impact on savers and fixed-income earners.

Its volatility may affect people's investment and saving decisions. In times of high inflation, people may be more inclined to invest in real assets, such as real estate and gold, to preserve their value. It may also affect wage negotiations. Workers usually demand salary increases to compensate for the increased cost of living caused by inflation. And it has implications for business and personal financial planning, which needs to consider the impact of inflation on assets and liabilities to better protect wealth.

Inflation may have an impact on debt and investments. In times of inflation, borrowers may benefit because they pay off their debt at a lower real interest rate. However, for holders of fixed-rate bonds, inflation may result in lower real returns.

Inflationary expectations refer to market and public expectations of future inflation. Such expectations may affect people's consumption and investment decisions and are one of the factors considered by central banks. Central banks in many countries have inflation targets, usually around 2%. The central bank influences the level of inflation by means of monetary policy, such as adjusting interest rates, in order to maintain economic stability.

Often, when inflation rises, the central bank may tighten monetary policy and raise interest rates to curb inflation. This may be more burdensome for borrowers, but it helps stabilize the price level. Moderate inflation helps to stimulate economic activity as it encourages people to buy goods and services in anticipation of higher prices, thus boosting production and employment.

Overall, inflation is an important economic indicator, and various aspects of the economic system may be affected by it. Policymakers, investors, and the general public closely monitor its evolution in order to adjust their economic behavior accordingly.

Relationship between inflation rate and CPI index

| Inflation Rate |

CPI index |

Relationship |

| Rising |

Rising |

Inflation up, CPI rises, indicating higher prices. |

| Rising |

Down |

Inflation rise correlates with potential CPI fall. |

| Declining |

Rising |

Inflation drop boosts CPI, signaling slower price growth. |

| Declining |

Declining |

Inflation drop signals slower CPI and price growth. |

| Stabilization |

Rising |

Stable inflation may slowly raise the CPI index. |

| Stable |

Down |

Stable inflation may slowly decrease the CPI index. |

How is the inflation rate calculated?

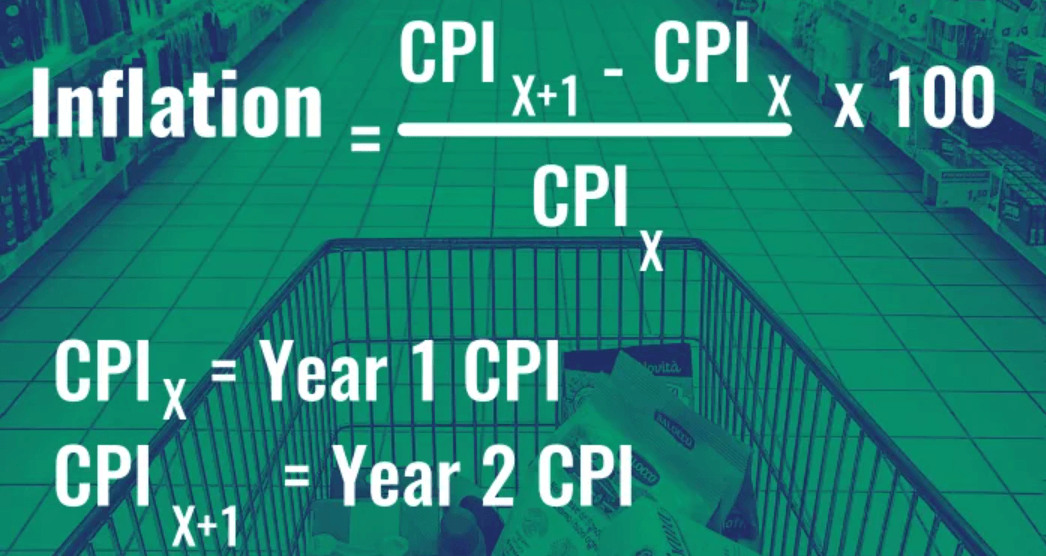

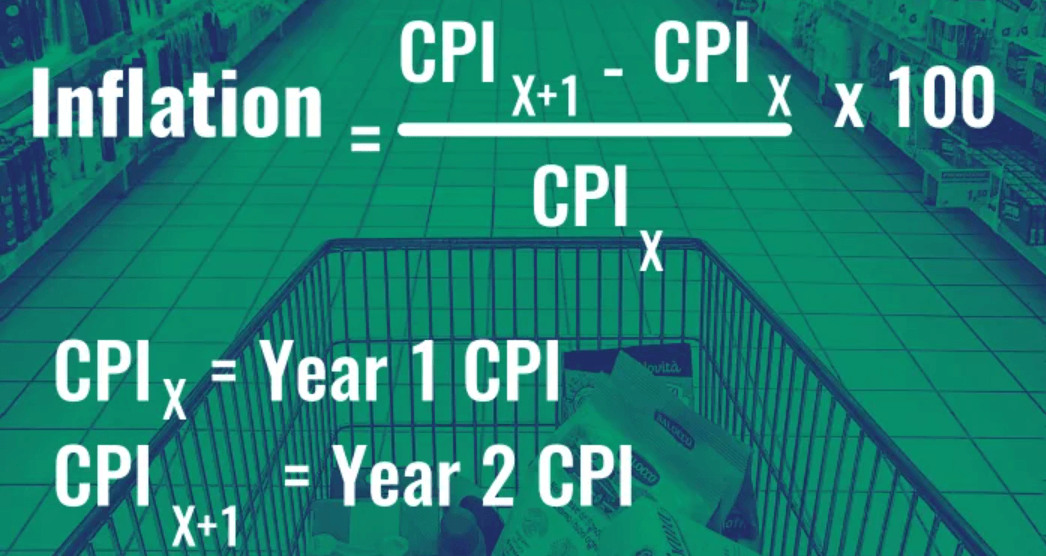

Inflation is calculated by comparing the price index of consumer goods and services, also known as the Consumer Price Index (CPI), at two points in time. The price index is a measure of the price level that represents the average price of a basket of common goods and services.

Formula for calculating the inflation rate: Inflation rate = (index value of the latest period minus index value of the base period) ÷ index value of the base period x 100

The base period is the starting point of comparison, and the latest period is the end point of comparison. This formula applies to either the CPI or the PPI, depending on whether one wants to measure consumer or raw product prices.

First, determine whether to use the CPI or the PPI, depending on the inflation profile desired. Determine the starting point (base period) and the ending point (latest period) of the comparison. Then obtain the corresponding index values for the base period and the latest period. These values are then substituted into the formula for calculating the inflation rate to arrive at the inflation rate.

For example, if the CPI is used and the CPI for the base period is 100, and the CPI for the latest period is 110. then the inflation rate is calculated as follows: Inflation rate = (110-100) ÷ 100 × 100 = 10%

This represents a 10% increase in the price level relative to the base period. Note that the calculation of the inflation rate can be based on different time periods and types of indices.

However, it is important to note that the CPI is an indicator of consumer prices for the whole of society, and there are limitations to using it as a complete replacement for the inflation rate. 262 basic categories of prices are included in the CPI, including prices for food, cigarettes, alcohol, clothing, rentals, transportation, education, and so on. Clothing, food, housing, and transportation are all included, but they are not included in the price of real estate.

And real estate market price fluctuations have a very big impact on people's perceptions of prices. For example, a 20% increase in the price of a bowl of five-dollar hot noodles and a 20% increase in the price of a house—this is a completely different perception of people who want to buy a house. So the rise in house prices, which makes our experience of prices more real, is not shown in the CPI. So you can't simply substitute the CPI for the inflation rate.

The inflation rate is a measure of how much the currency has depreciated. To get a more realistic inflation rate, you can use a comparison of the money supply and the economic growth rate.

First, measure the money supply (M2). M2 is a measure of the broad money supply, including cash, checking deposits, and savings deposits. The value of M2 can be obtained through data from the National Bureau of Statistics or related organizations.

Then measure the gross national product (GNP). GDP is the sum of the country's economic output and reflects the size of the overall economy. Again, the value of GDP can be obtained from the data of the National Bureau of Statistics or related organizations.

And by comparing the growth rate of M2 with the growth rate of GDP, the difference between money supply and economic growth can be obtained. The value of the difference in growth rate is an approximation of the inflation rate, which is calculated as: difference in growth rate = growth rate of M2 minus growth rate of GDP.

It is important to note that the calculation of the inflation rate is an approximation, as there may be some complex macroeconomic variables involved. This methodology provides individuals and investors with a means of understanding the impact of inflation on wealth, which can help to better preserve and increase value in financial decisions.

What does high inflation mean?

A high inflation rate means that the price level is rising faster and the purchasing power of money is decreasing in relative terms, i.e., the same amount of money buys fewer goods and services. While there can be a range of impacts on individuals, businesses, and the economy, the economic impact can vary for different groups of people. For example, for those who hold real assets or are able to adjust their income, inflation may result in investment gains.

High inflation leads to a reduction in the purchasing power of the same amount of money, with people needing to pay more for the same amount of goods and services. This may affect an individual's ability to spend, especially for those on fixed incomes or lower salaries. High inflation may lead to a weakening of their real purchasing power and an increase in the cost of living.

High inflation can erode the savings value of money and increase financial planning uncertainty for businesses and individuals. Firms may face higher costs, while individuals may feel that the real value of savings has declined. People may find it more difficult to maintain future purchasing power through savings as the real value of money declines.

To curb inflation, central banks may tighten monetary policy and raise interest rates. This may lead to a rise in the cost of borrowing and have an impact on the financing activities of businesses and individuals. To counteract inflation, the central bank may raise interest rates. This may lead to higher borrowing costs, affecting consumption and investment.

High inflation may lead to economic instability, making it difficult for businesses to plan for the long term and for investors to make informed investment decisions. Investors holding fixed-rate bonds may be negatively affected as inflation reduces the real purchasing power of bonds. Some investors may look for inflation-hedging assets, such as gold and real estate, to protect their assets from inflation.

Overall, rising inflation is usually seen as a destabilizing factor in the economy that requires relevant policies and measures to maintain economic stability. Central banks usually take measures to control inflation to ensure that the economy maintains healthy growth and stability.

What does a fall in the inflation rate mean?

What does a fall in the inflation rate mean?

A fall in the inflation rate usually means that the rate of increase in the general price level slows down or prices fall overall over a certain period of time. It may be a signal in the economic cycle that the economy is going through a more difficult period. When consumer confidence falls, investment declines, or the international trade situation is unfavorable, overall demand may fall, leading to a dampening of price increases for goods and services.

Some inflation is a normal sign of economic growth. If inflation is too low, it may indicate insufficient economic growth. Often, a decline in inflation may be due to a slowdown or recession in economic growth. When economic activity is weak, consumption and investment may slow down, leading to a lack of demand, which slows the rate of price increases.

The central bank may stimulate the economy by adopting an easy monetary policy, such as cutting interest rates, which may lead to a decrease in the inflation rate. By lowering interest rates, the central bank encourages borrowing and investment and increases the money supply, which in turn increases the level of consumption and investment. This easy monetary policy helps to ease inflationary pressures.

Energy prices are an important component of inflation. Declining inflation may be associated with declining energy prices, especially for commodities such as oil and natural gas. A slowdown in energy prices may have eased production and transportation costs, with a consequent impact on overall inflation.

When there is excess production capacity, firms may have difficulty raising prices. Excess production capacity may be a factor in declining inflation because firms have difficulty maintaining profits by raising prices in a competitive market.

Decreasing inflation means that the same amount of money can buy more goods and services, so people have more purchasing power. It may be easier for businesses and individuals to plan their finances, as falling inflation usually leads to a more stable price level. It may also lead to an increase in the real debt burden, as the cost of borrowing is relatively high. This may have an impact on those entities with significant debt.

Declining inflation is usually seen as a potential problem by governments and central banks, as moderate inflation helps promote healthy economic growth. In the case of deflation, it is possible that the negative effects of inflation are mitigated. Of course, it may also be accompanied by economic problems, such as debt problems and delayed purchases by consumers.

Relationship between inflation and interest rates

| Inflation Rate |

Interest Rates |

Relationship |

| Rising |

Rising |

Rising inflation may cause the central bank to raise interest rates to curb inflation. |

| Rising |

Down |

Inflation rise may trigger central bank tightening through higher interest rates. |

| Declining |

Rising |

Inflation drop may trigger central bank rate cuts for economic stimulus. |

| Declining |

Down |

Low inflation prompts central banks to cut interest rates for economic stimulus. |

| Stabilization |

Rising |

Stable inflation prompts central bank rate adjustments. |

| Stable |

Down |

Inflation stability guides central bank rate adjustments. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

How to Understand the inflation rate

How to Understand the inflation rate

What does a fall in the inflation rate mean?

What does a fall in the inflation rate mean?