For investors who want to see if a company is worth investing in, they must look at the profitability of that company. And there are many different metrics that can serve the purpose regarding this. But for long-term and especially value investors, return on capital (ROIC) is a very important financial indicator. Now let's talk more about what this return on capital tells you. And see why it's so important.

What is Return on Capital?

What is Return on Capital?

Also known as return on invested capital, it measures the rate of return on the actual capital invested by a company, regardless of whether the source of that capital is debt or equity. Therefore, it is often used to assess the profitability of a company and the efficiency of capital utilization.

It is very similar to return on equity (ROE) in that it counts down how efficiently a company is using its capital. But while ROE tends to see only one of the company's perspectives, ROIC complements the other. In other words, ROIC looks at the company's perspective as opposed to Roe's perspective from the shareholders' point of view.

Roe will only look at the net profit brought in by the shareholders after investing in the assets and will only look at the percentage of profit and net worth. Here, you can only see the equity of the shareholders and not the value of the enterprise as a whole. ROIC, on the other hand, is a measure of a company's ability to make money after investing all its capital, which is a more comprehensive measure of profitability and removes the impact of different financing structures on profitability.

ROIC reflects the profitability of the main business, reflecting whether the enterprise is a good business, that is, what we now often say is not a good track. In simple terms, the assets of an enterprise can be divided into three categories: financial assets, equity investments, and operating assets, which correspond to financial income, investment income, and profit from the main business.

ROIC, however, excludes the other two categories outside of operating assets and measures only the ability of the main business to earn profits. In other words, it can be used to assess a company's core profitability and the upper limit of its future value creation. It is also one of the most important indicators for evaluating a company.

Perhaps it would be more intuitive to compare it to ROE. Measured together, they can ensure whether the increase in RoE is due to a higher amount of financing or simply to an increase in the core profitability of the company. That is, an increase in ROIC, rather than an increase due to increased financial leverage.

For example, let's say there are two companies, company a and company b. Company A has a ROE of 15% and an ROIC of 12%. Company B's ROE is 5% to 20% higher than company A's, but its ROIC is only 8%.

If you only look at the ROE, there is basically no doubt that you would choose company B because it has a higher ROE. Making shareholders' capital more efficient means investing a dollar to earn back 20%. Whereas a company can only earn 15%. But if you add ROIC together, you can see that company A is more worth investing in.

This is because company a has borrowed less money and has more cash, while company b has borrowed more money or has less cash because he has borrowed more money or has less cash. So although his Roe is higher than company A, his actual capital is used very inefficiently. So in this case, it would be better for us to invest in company A than in company B.

ROIC takes into account a company's total capital, including shareholders' equity and debt, and therefore provides a more comprehensive assessment of a company's efficiency in achieving profitability. It is often used by investors and analysts as one of the most comprehensive financial assessment metrics to understand the quality and profitability of a company's operations.

Difference between Return on Capital and Return on Equity

|

Indicators

|

Return on Capital (ROIC)

|

Return on Equity (ROE)

|

|

Definition

|

Evaluates profit efficiency from capital. |

Evaluates equity profit efficiency. |

|

Capital Considered

|

Evaluates profit efficiency with total capital. |

Considers equity. |

|

Capital structure treatment

|

Considers debt and equity, ignores structure. |

Emphasizes equity, excluding debt. |

|

Calculation formula

|

ROIC = NOPAT / invested capital |

ROE = Net Profit / Shareholders' Equity |

|

Measurement perspective

|

From the perspective of the firm as a whole |

From the perspective of shareholders |

|

Effect of Measurement

|

Evaluates firm's profit and capital efficiency. |

Evaluates net profit on equity. |

Return on Capital Calculation Formula

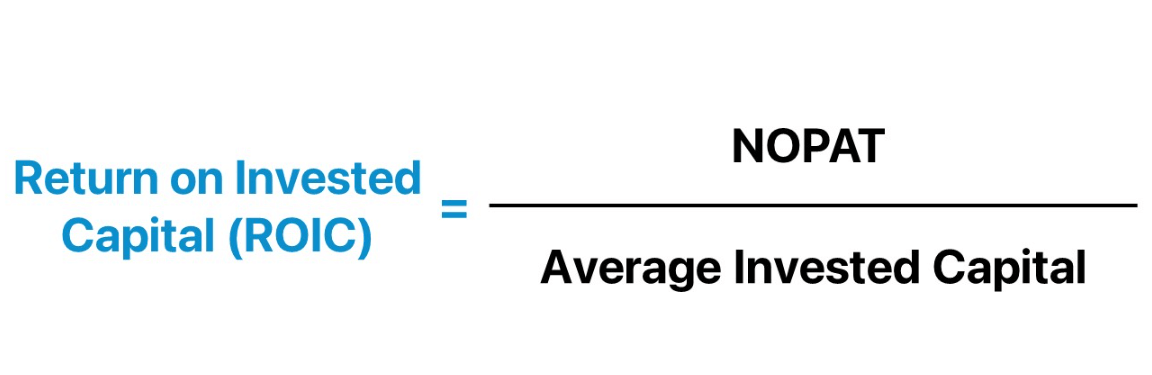

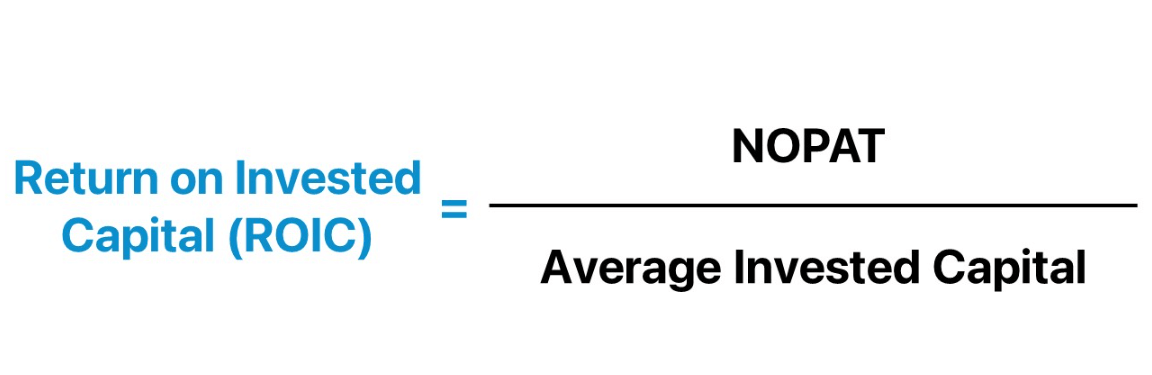

ROIC is a financial indicator that measures the efficiency of a company in realizing net profit on its total invested capital, which is calculated by the formula: ROIC = (Net Operating Profit ÷ Invested Capital) x 100.

where net operating profit is the company's net profit minus tax profit. Capital invested is the company's total assets minus non-operating current liabilities, which represents the capital invested by the company to run its business.

It is important to note that net operating profit is the operating profit that remains after deducting all operating expenses and then depreciation and claim expenses, also known as NOPAT, whereas invested capital is the capital invested by adding bonds and then subtracting cash, leaving the invested capital, which can be written as invested capital.

So, the ROIC formula can also be written as NOPAT divided by average invested capital, as shown below.

ROIC is mainly about how companies use their capital, and one of the company's capital is the company's shares, and the other is debt. Debt includes not only money borrowed from banks but also financing obtained by issuing bonds.

And the requirement is to add debt as well as subtract cash. That means that what is required is how the company earns money after counting how many shares it has, after counting how much money it has borrowed, and after subtracting the cash. It is also perfectly clear that the business itself is capable of utilizing capital.

This is the Example below:

Assuming that a company's net operating profit (NOPAT is $1 million and its invested capital is $5 million, then the company's ROIC is calculated as follows: ROIC = ($1 million ÷ $5 million) x 100% = 20%

This means that the company is able to generate 20 cents of net operating income for every dollar of capital invested. A higher percentage of ROIC indicates that the company is more efficiently utilizing the invested capital to achieve a return.

ROIC is a measure of how efficiently a company realizes a profit on its invested capital. A higher ROIC generally indicates that a company is using its capital more efficiently. ROIC is calculated similarly to ROCE, but with some differences in the denominator of the capital.ROCE typically uses the sum of shareholders' equity and debt, while ROIC uses total assets minus non-operating current liabilities.

What is Generally an Appropriate Return On Capital?

What is Generally an Appropriate Return On Capital?

The appropriate level of ROIC varies by industry, company size, economic conditions, and other factors, and there is no universal standard. In general, however, investors usually want to see a relatively high ROIC because it indicates that a company is able to utilize its capital efficiently to achieve profitability.

The ROIC standard can vary considerably from industry to industry because different industries have different profitability models and capital requirements. In general, highly capital-intensive industries may have a lower ROIC, while asset-light industries may have a higher ROIC. Therefore, the best way to get an idea of the general level of performance within an industry is to compare it with other companies in the same industry.

Industries such as general technology, software, healthcare, etc. usually tend to have a higher ROIC because they may not require a lot of physical assets. Manufacturing, retail, etc., on the other hand, may have a moderate ROIC because they may require some level of physical assets to support production and sales. Raw material extraction, traditional manufacturing, etc. may have a low ROIC because they may require significant capital investment and face high operating costs.

A company's strategic decisions and capital allocation can also affect ROIC. Some companies may be more focused on growth and willing to accept a lower rate of return, while others may be more focused on improving profitability. You can also look at a company's ROIC over the past few years to understand its historical performance and trends. A consistently stable and increasing ROIC may be a positive sign.

The current economic environment and market conditions can also have an impact on ROIC expectations. Companies may face different challenges during different economic cycles. Therefore, when comparing the ROIC of different companies, their specific environments and competitive conditions should be considered.

Overall, a company that is able to maintain a relatively high ROIC in its industry may be more attractive. However, there is no one specific number that applies to all situations, and investors should consider return on capital as part of an overall financial analysis, taking into account company-specific circumstances, industry standards, and market conditions.

Understanding Higher Return on Capital and Profitability

Understanding Higher Return on Capital and Profitability

Yes, in general, a higher ROIC indicates that a company is more profitable. It indicates that the company is able to effectively convert the total capital invested (including shareholders' equity and debt) into profitability, indicating that the company is performing well in the utilization of capital.

The company may have adopted a sound capital structure that allows it to maximize the benefits of its debt and equity mix. A sound capital structure reduces costs and improves ROIC. The company may have made intelligent capital investment decisions and selected high-return projects, thus improving the overall return on capital.

A high ROIC indicates that the company possesses some sort of competitive advantage that allows it to differentiate itself in the industry. This may include brand value, technological innovation, supply chain efficiency, etc. This allows the company to be potentially more competitive in its industry, able to maintain market share, attract customers, and achieve better pricing.

It also suggests that the company may have an excellent business model that enables it to achieve higher revenues in the marketplace and provide products or services at a lower cost. and is usually able to achieve higher levels of profitability in its primary business. This may be due to high gross margins on products or services, a low cost structure, or growth in market share.

A high ROIC reflects the company's efficiency in its operations and its ability to achieve strong profitability with relatively low total capital investment. The company may have adopted efficient management practices in its operations that allow it to create more value for each unit of capital invested.

It also means that the company is able to efficiently utilize its invested capital to generate a higher net operating profit after tax. This may be achieved through efficient operations, effective resource utilization, and excellent capital allocation. A high ROIC usually indicates that the company realizes relatively high net profits and that these earnings may be achieved through efficient operations and capital allocation rather than simply through debt.

A higher ROIC usually indicates that a company is achieving higher returns when utilizing its capital for operating activities. However, investors should also consider the risks and uncertainties associated with high returns. Sometimes, extremely high returns can correspond to high risks.

What a declining return on capital indicates

A declining ROIC may indicate that a company is experiencing some problems or challenges with capital utilization and profitability. It may be affected by a number of factors, such as inefficient capital utilization, declining profitability, and changes in capital structure, among others.

This may be due to the failure of the company to utilize its total invested capital efficiently, resulting in investments that do not generate sufficient profitability. This may be caused by low returns on capital projects, inefficient capital expenditures, poor capital management, poor investment decisions such as investing in projects with low returns, or inappropriate capital allocation strategies.

There may also be reasons for a decline in the company's net profit or a change in the company's capital structure. Declines in net profits due to declining sales, rising costs, increased competitive pressures, or other operational problems, as well as increased debt or changes in the equity structure, result in an increase in the cost of total capital, which can affect ROIC.

Changes in the industry-wide or macroeconomic environment may affect the company's profitability and ROIC levels. If the industry as a whole is facing challenges, the company's ROIC may be affected. If the industry is highly competitive, the company may face price wars or a decline in market share, resulting in a decrease in ROIC. Changes in the macroeconomic environment, such as recession or instability, may have a negative impact on the company's earnings and return on capital.

There are also times when a company experiences extraordinary events, such as major lawsuits, natural disasters, or significant changes, which may have an impact on earnings and ROIC.

When analyzing ROIC declines, investors and analysts usually need to dig deeper to understand the specific reasons behind them and consider the company's overall business conditions. Sometimes, ROIC declines can be temporary, but if the problem persists, the company may need to take stEPS to improve its capital utilization and profitability.

Return on Capital (ROIC) Industry Standard Data

| Industries |

ROIC(%) |

| Semiconductor and Other Electronic Component Manufacturing |

37.5 |

| Software Publishers |

17.2 |

| Insurance companies |

15.1 |

| Pharmaceutical and medical manufacturing |

14.2 |

| Navigation, Measurement, Electromedical and Control Equipment Manufacturing |

12.7 |

| Business support services |

12.3 |

| Medical equipment and supplies manufacturing |

11.3 |

| Cable and other subscription programming |

9.6 |

|

Securities and commodities contract brokerage and related businesses |

8.8 |

| Oil and gas extraction |

5.9 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Return on Capital?

What is Return on Capital? What is Generally an Appropriate Return On Capital?

What is Generally an Appropriate Return On Capital? Understanding Higher Return on Capital and Profitability

Understanding Higher Return on Capital and Profitability