Target Corporation's stock (NYSE: TGT) has experienced significant fluctuations over the years, reflecting both the company's internal strategies and broader market dynamics.

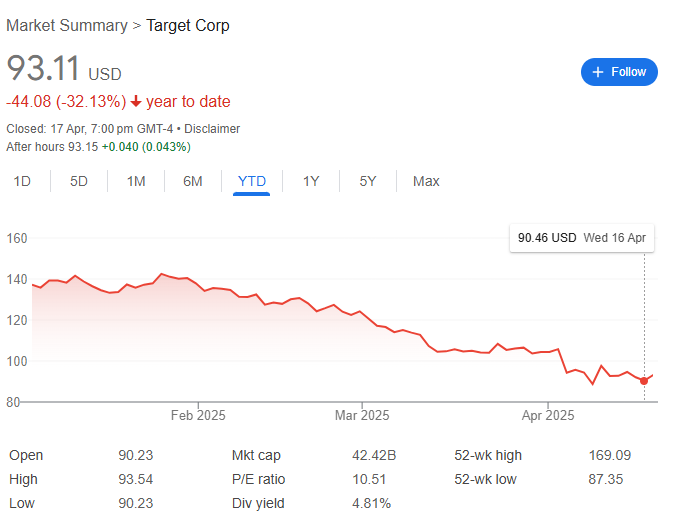

As of April 2025, Target Corporation's stock has experienced a significant decline, raising concerns among investors and analysts.

Thus, why is Target stock falling despite its successful resurgence post-pandemic? This article will explain its history and the four reasons for its downward spiral.

Target Stock's History and Current Financial Status

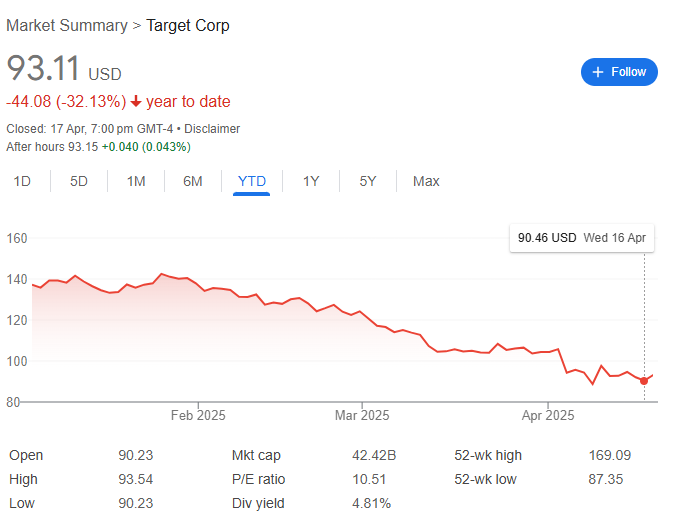

As mentioned, Target Corporation's stock has experienced a significant decline in 2025, reaching its lowest valuation since the COVID-19 pandemic.

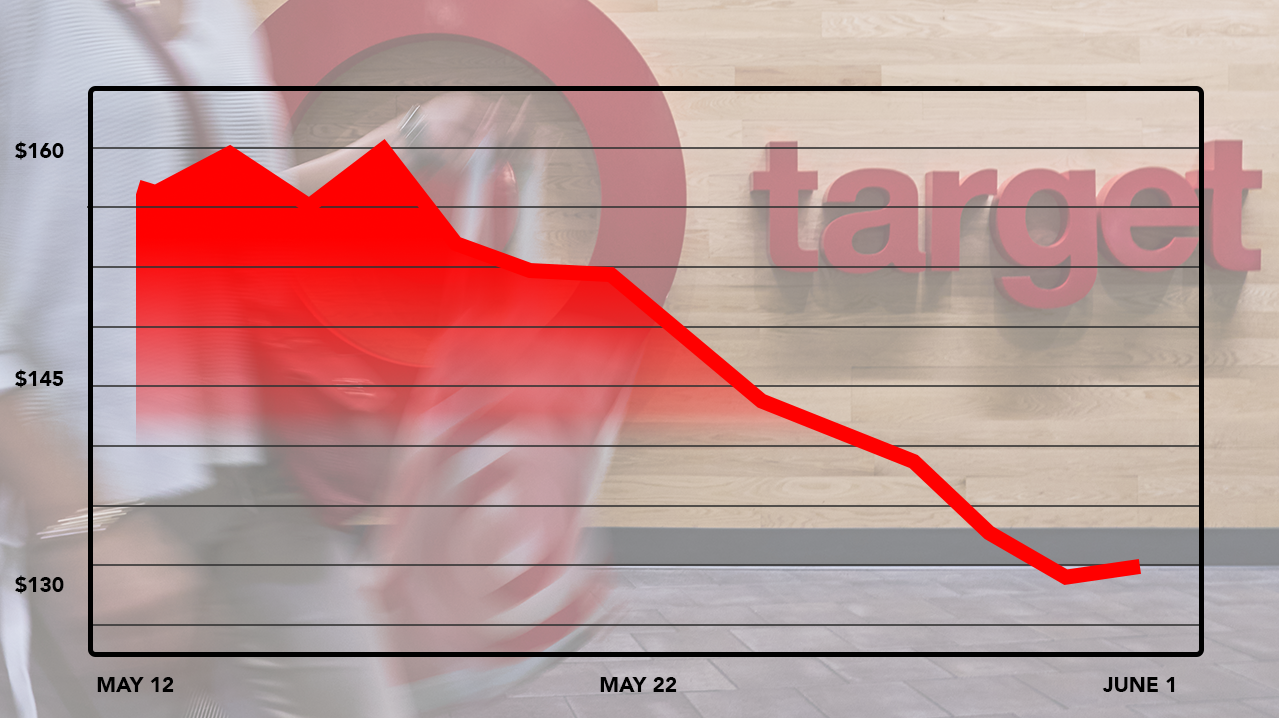

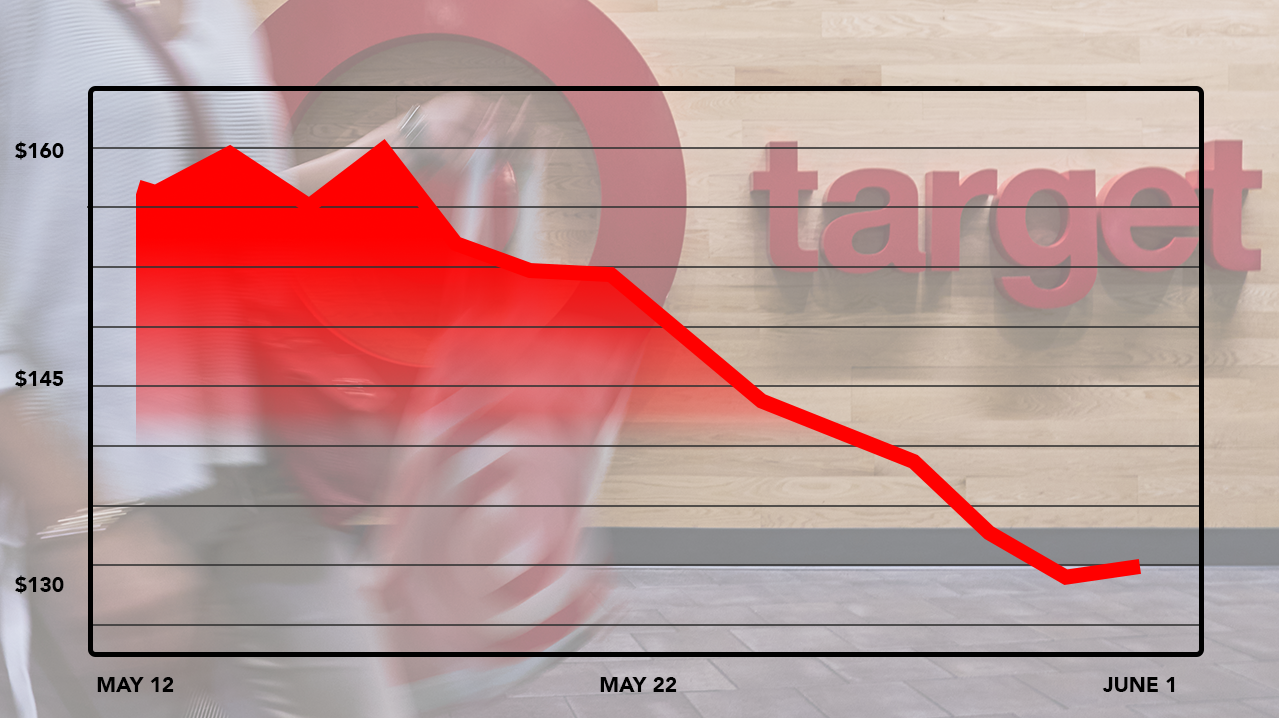

In 2021, Target reached its all-time high closing price of $243.34 on November 16, buoyed by strong consumer demand and effective pandemic-era strategies. However, subsequent years saw a decline:

2022: The stock closed at $139.02, marking a 34.24% decrease from the previous year.

2023: A slight recovery led to a closing price of $137.15, a 1.35% drop year-over-year.

2024: The stock ended at $134.04, down 2.27% from 2023.

As of April 2025, Target's stock is trading around $90.46, reflecting a 32.13% decline year-to-date. This downturn is attributed to various factors, including internal policy decisions, economic pressures, and shifts in consumer behaviour.

Why Is Target Stock Falling? 4 Factors Explored

1) DEI Rollback and Consumer Backlash

In early 2025, Target announced a rollback of its Diversity, Equity, and Inclusion (DEI) initiatives. This decision sparked widespread criticism and led to a 40-day consumer boycott. By the end of February, Target's stock had dropped by $27.27 per share, erasing approximately $12.4 billion in market value.

The backlash also resulted in a class-action lawsuit alleging Target misled investors about the risks of altering its DEI policies.

2) Declining Foot Traffic and Sales

The consumer boycott and negative sentiment towards Target's DEI policy changes have contributed to declining foot traffic and sales. Data shows that Target experienced a 7.9% year-over-year drop in foot traffic for the week beginning March 31, marking the tenth consecutive week of declines.

This sustained decrease in customer visits has raised concerns about the company's ability to maintain its market share and revenue streams.

3) Economic Pressures and Tariffs

Additionally, Target, like many retailers, faces challenges from broader economic pressures, including inflation and new tariffs. The Trump administration's tariffs on imports from China, Canada, and Mexico have increased costs for retailers reliant on international supply chains.

Target has warned that these tariffs could significantly impact its profits, as the company anticipates considerable profit pressure in the first quarter of 2025 due to tariff uncertainties and recent declines in net sales.

4) Competitive Retail Landscape

Lastly, the retail industry is highly competitive, with major players like Walmart, Amazon, and Costco continually innovating to capture market share. Target's recent challenges have been compounded by its struggle to keep pace with these competitors, particularly in areas such as e-commerce and grocery offerings.

Efforts to bolster private-label products and pursue collaborations have yet to yield significant performance improvements, leaving Target vulnerable in a rapidly evolving retail environment.

Future Outlook

In March 2025, Target announced strategic plans to drive more than $15 billion in sales growth by 2030. The company intends to reimagine key product categories, including gaming, sports, and toys, to build momentum in areas with growth potential. This multi-year initiative will enhance in-store experiences and strengthen Target's position in these markets.

Yet, Target's 2025 financial projections indicate modest growth, with anticipated sales growth of 1% and nearly flat comparable sales. Earnings per share are projected between $8.80 and $9.80.

Additionally, Marketbear's analyst's recommendations for Target's stock are mixed. Out of 33 analysts, 11 have issued a "Buy" rating, 21 have given a "Hold," and 1 has a "Sell" rating. This consensus suggests a cautious optimism about the company's future performance.

Conclusion

In conclusion, Target's stock decline in 2025 results from a combination of internal decisions and external factors. The rollback of DEI initiatives led to consumer backlash and legal challenges, while economic pressures, including tariffs and competition, have further strained the company's performance.

Analyst projections indicate potential upside for the stock, but the wide range of forecasts reflects uncertainty in the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.