In today's fast-paced financial markets, traders and investors are always seeking ways to automate their strategies and reduce the need for constant market monitoring. One popular tool for achieving this is the good till cancelled (GTC) order.

Whether you're aiming to buy at a specific low or sell at a desired high, understanding how a good till cancelled order works can help you act on opportunities—even when you're away from your screen.

What Is a Good Till Cancelled Order?

A good till cancelled (GTC) order is a directive to buy or sell a security at a specified price that remains active until it is either executed or manually cancelled by the trader.

Unlike a day order, which expires if not filled by the end of the trading session, a GTC order can remain open for days, weeks, or even months, depending on your broker's policies—typically up to 30, 60, or 90 days to prevent forgotten orders from being triggered unexpectedly.

How Does a GTC Order Work?

When you place a GTC order, you specify the security, the number of shares or contracts, and the price at which you wish to buy or sell. The order then sits in the broker's system, waiting for the market to reach your target price. If the market price hits your specified level before the order expires or is cancelled, the trade will be executed automatically.

For example, if a stock is trading at £100 and you want to buy it at £95, you can set a GTC buy order at £95. If the price drops to £95 within the order's active period, your order is filled—even if you're not actively monitoring the market at that moment.

GTC Orders vs Day Orders

The main difference between a GTC order and a day order lies in their duration:

Day Order: Expires at the end of the trading day if not executed.

GTC Order: Remains active until executed or manually cancelled, subject to broker-imposed time limits.

GTC orders are ideal for traders who want to set entry or exit points in advance and don't want to re-enter orders each day. Day orders, on the other hand, are better suited to those who trade actively and want to avoid overnight exposure.

Types of GTC Orders

GTC orders can be used as:

Limit Orders: Buy or sell at a specific price or better.

Stop Orders: Trigger a buy or sell when a security hits a certain price, often used to limit losses or lock in profits.

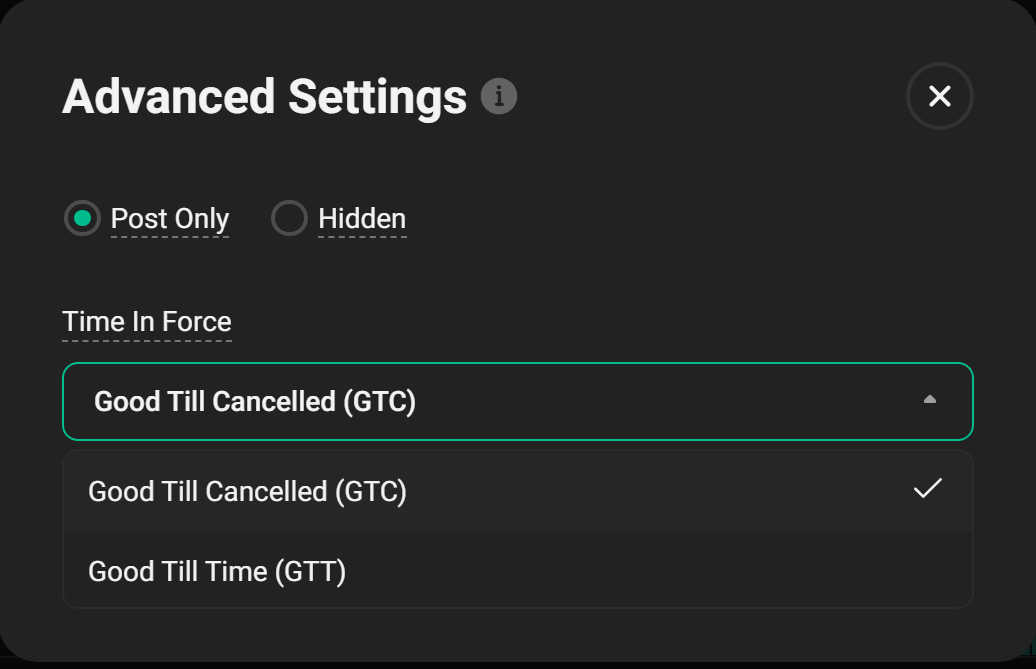

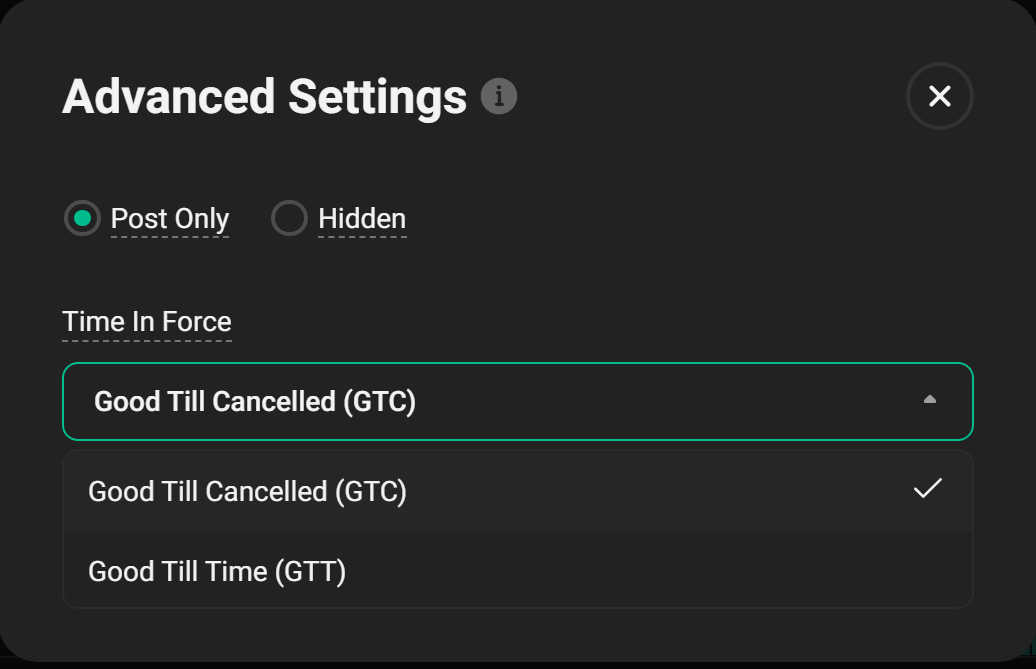

Some brokers may allow you to combine GTC with other order types, such as stop-limit or trailing stop orders, for greater flexibility.

Practical Scenarios for Using GTC Orders

1. Long-Term Price Targets

Suppose you believe a stock is overvalued at its current price but would be a good buy if it drops to a certain level. You can set a GTC buy order at your target price and wait for the market to come to you, rather than chasing the price or constantly watching the market.

2. Selling at a Desired Profit

If you own shares and want to sell if the price rises to a specific level, a GTC sell order lets you lock in your target without daily intervention. This is especially useful if you're aiming to sell near a 52-week high or after a planned rally.

3. Managing Trades While Away

Travelling or unable to monitor the markets daily? GTC orders automate your strategy, ensuring you don't miss out on opportunities due to time constraints or market hours.

Benefits of Good Till Cancelled Orders

Automation: No need to re-enter orders daily.

Precision: Set entry and exit points based on your analysis.

Convenience: Useful for those who can't monitor markets constantly.

Strategic Flexibility: Supports longer-term trading plans and reduces emotional decision-making.

Risks and Considerations

While GTC orders offer convenience, they come with specific risks:

Market Volatility: Sudden price swings can trigger your order at an inopportune time. For example, a brief price dip might fill your buy order, only for the price to rebound immediately, leaving you with a less favourable position.

Order Expiry: Most brokers set time limits (30–90 days) to prevent old orders from being executed unexpectedly. Always check your broker's policy.

Exchange Restrictions: Some exchanges, including the NYSE and Nasdaq, no longer accept GTC orders directly; instead, brokers manage them internally.

Forgotten Orders: If you forget about an open GTC order, it might execute after your strategy or market outlook has changed. Regularly review and update your orders as needed.

Best Practices for Using GTC Orders

Review Regularly: Check your open GTC orders to ensure they still align with your goals and market conditions.

Set Realistic Targets: Avoid setting prices too far from current levels, as your order may never be filled.

Use in Conjunction with Other Tools: Combine GTC orders with alerts or other risk management strategies.

Understand Broker Policies: Know your broker's rules regarding GTC order duration, fees, and execution.

Conclusion

A good till cancelled order is a valuable tool for traders and investors who want to automate their trading strategies and act on specific price targets without constant market supervision. By understanding how GTC orders work, their advantages, and their risks, you can use them to enhance your trading discipline and efficiency.

Always review your orders regularly and stay informed about your broker's policies to ensure your trading remains aligned with your objectives.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.